Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you planning to travel abroad but worrying about your Medicare coverage? You’re not alone. Many people are confused about the extent of their Medicare coverage when they leave the country. In this article, we’ll explore the ins and outs of Medicare coverage abroad and what you need to know before you pack your bags. So, sit back, relax, and let’s dive in!

Medicare is a vital program that provides health insurance coverage to millions of Americans. However, it’s important to understand that Medicare coverage is limited when you travel outside of the United States. In this article, we’ll help you understand what is and isn’t covered by Medicare when you travel abroad. We’ll also give you some tips to help you stay healthy and safe while you’re away from home. Let’s get started!

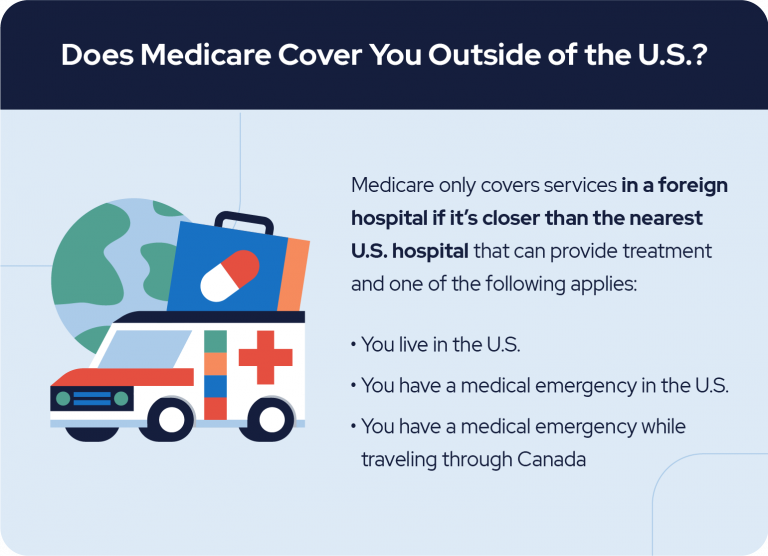

Medicare generally does not cover healthcare services outside of the United States. However, there are some exceptions such as emergency medical services received in Canada or Mexico, or in rare cases, when a Medicare beneficiary experiences a medical emergency while traveling abroad and the nearest hospital is outside of the United States. It is recommended that Medicare beneficiaries consider purchasing travel insurance to cover their healthcare needs while traveling outside of the country.

Contents

- Does Medicare Cover Abroad?

- Frequently Asked Questions

- 1. Does Medicare cover medical expenses incurred overseas?

- 2. What types of medical expenses are covered by Medicare abroad?

- 3. Can I purchase additional insurance to cover medical expenses abroad?

- 4. Are there any Medicare Advantage plans that offer coverage for medical expenses abroad?

- 5. What should I do if I need medical attention while traveling abroad?

- Does Medicare Cover International Travel?

Does Medicare Cover Abroad?

When it comes to healthcare, it’s important to have coverage that extends beyond your home country. If you’re a Medicare beneficiary, you may be wondering if your coverage extends to healthcare services received abroad. In this article, we’ll explore the question of whether or not Medicare covers healthcare services outside of the United States.

Original Medicare Coverage Outside of the U.S.

Original Medicare, which includes Medicare Part A and Part B, does not typically cover healthcare services received outside of the United States. However, there are some limited circumstances where Medicare may cover healthcare services received abroad.

If you’re traveling outside of the United States and have a medical emergency, Medicare may cover the cost of emergency services that are needed to diagnose or treat your emergency medical condition. These services may include ambulance services, emergency room visits, and inpatient hospital care.

It’s important to note that Medicare will only cover emergency services that are needed to diagnose or treat your emergency medical condition. Any follow-up care that may be necessary will not be covered by Medicare.

Medigap Coverage Outside of the U.S.

If you have a Medicare Supplement Insurance (Medigap) policy, your policy may provide some coverage for healthcare services received outside of the United States. Medigap plans C, D, F, G, M and N provide coverage for emergency healthcare services received outside of the United States, up to a certain limit.

It’s important to note that Medigap coverage for healthcare services received outside of the United States is limited to emergency services that are needed to diagnose or treat your emergency medical condition. Any follow-up care that may be necessary will not be covered by your Medigap policy.

Medicare Advantage Coverage Outside of the U.S.

If you have a Medicare Advantage (MA) plan, your plan may provide some coverage for healthcare services received outside of the United States. MA plans are required to provide emergency healthcare services to their members when they are outside of the United States.

Some MA plans may also offer additional coverage for non-emergency healthcare services received outside of the United States. If your MA plan offers this additional coverage, it may be subject to certain limitations and restrictions.

Other Options for Coverage Outside of the U.S.

If you’re planning to travel outside of the United States and want to ensure that you have coverage for healthcare services received abroad, there are other options available to you.

One option is to purchase travel medical insurance. Travel medical insurance can provide coverage for emergency and non-emergency healthcare services received outside of the United States. Coverage under travel medical insurance policies can vary, so it’s important to carefully review any policy before purchasing.

Another option is to purchase an international health insurance policy. International health insurance policies are designed to provide coverage for healthcare services received outside of your home country. These policies can provide comprehensive coverage, including coverage for preventive care, routine care, and emergency care.

Benefits of Coverage Outside of the U.S.

Having coverage for healthcare services received outside of the United States can provide peace of mind when traveling abroad. It can also help ensure that you receive the care you need in the event of a medical emergency.

Some Medicare beneficiaries may choose to purchase travel medical insurance or an international health insurance policy to supplement their existing coverage. This can provide additional coverage and may help minimize out-of-pocket costs.

Conclusion

In conclusion, Original Medicare typically does not cover healthcare services received outside of the United States. However, there are some limited circumstances where Medicare may cover emergency services received abroad.

If you have a Medigap policy or a Medicare Advantage plan, your policy may provide some coverage for healthcare services received outside of the United States. Additionally, there are other options available, such as travel medical insurance or international health insurance.

If you’re planning to travel outside of the United States, it’s important to carefully review your coverage options and ensure that you have the coverage you need to protect your health and well-being while abroad.

Frequently Asked Questions

Medicare is a federal health insurance program in the United States that provides coverage for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD). One common question asked by many Medicare beneficiaries is whether Medicare covers medical expenses abroad. Below are some frequently asked questions and answers about Medicare coverage abroad.

1. Does Medicare cover medical expenses incurred overseas?

Generally, Medicare does not cover medical expenses incurred overseas. This means that if you need medical attention while traveling outside the United States, you will be responsible for paying all the costs out of your pocket. However, there are some exceptions to this rule, such as if you are on a cruise ship within the United States territorial waters or if you are traveling through Canada to get to Alaska.

If you are planning to travel abroad, it is recommended that you purchase travel medical insurance to cover any unexpected medical expenses that may arise. Some Medicare Advantage plans may also offer limited coverage for emergency medical care when traveling outside the United States, so it’s important to check with your plan provider before you travel.

2. What types of medical expenses are covered by Medicare abroad?

As mentioned earlier, Medicare generally does not cover medical expenses incurred overseas. However, there are a few situations where Medicare may provide coverage, such as if you are in the United States territory or if you are traveling through Canada to get to Alaska. In these situations, Medicare will cover the same types of medical expenses that it covers within the United States.

If you need medical attention while traveling abroad, you will likely have to pay for all the costs out of your pocket. This includes hospitalization, doctor’s visits, prescription drugs, and medical procedures. It is important to note that the cost of medical care can be much higher in other countries, so it is recommended that you purchase travel medical insurance to cover any unexpected expenses.

3. Can I purchase additional insurance to cover medical expenses abroad?

Yes, you can purchase additional insurance to cover medical expenses incurred overseas. This is commonly known as travel medical insurance. Travel medical insurance is designed to cover unexpected medical expenses, such as emergency medical care, hospitalization, and medical evacuation, while traveling outside your home country.

Travel medical insurance can be purchased from a variety of sources, including travel agencies, insurance companies, and online providers. It is important to read the policy carefully and understand the coverage limits and exclusions before purchasing any travel insurance.

4. Are there any Medicare Advantage plans that offer coverage for medical expenses abroad?

Yes, some Medicare Advantage plans offer limited coverage for emergency medical care when traveling outside the United States. The specific coverage and limits vary depending on the plan, so it’s important to check with your plan provider before you travel.

It is important to note that Medicare Advantage plans are offered by private insurance companies and are not part of the original Medicare program. If you have a Medicare Advantage plan, your coverage may differ from the coverage provided by original Medicare.

5. What should I do if I need medical attention while traveling abroad?

If you need medical attention while traveling abroad, you should first seek medical care from a local healthcare provider. It is important to keep all receipts and records of any medical expenses incurred, as you may need to submit them to your travel medical insurance provider for reimbursement.

If you have a Medicare Advantage plan that offers coverage for emergency medical care outside the United States, you should contact your plan provider as soon as possible to inform them of your situation. They can provide guidance on the next steps to take and help you find an appropriate healthcare provider in the area.

Does Medicare Cover International Travel?

In conclusion, Medicare coverage abroad can be a complicated issue that requires careful consideration. While Medicare does not typically cover healthcare services outside of the United States, there are some exceptions to this rule. For example, if you experience a medical emergency while traveling abroad, Medicare may cover some of your healthcare expenses.

It’s important to note that Medicare coverage abroad is not a substitute for travel insurance. If you plan to travel internationally, it’s a good idea to purchase a travel insurance policy that includes medical coverage. This will ensure that you are fully protected in the event of a medical emergency while traveling.

Overall, while Medicare coverage abroad may be limited, there are still options available to ensure that you are fully protected while traveling. By understanding your options and taking the necessary precautions, you can enjoy your travels abroad with peace of mind knowing that you are fully covered in the event of a medical emergency.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts