Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, retirement becomes a significant milestone. With it comes a host of financial changes, including pension income. However, many retirees are left wondering if they will have to pay Medicare taxes on their pension income. The answer is not as straightforward as one might think. In this article, we will explore what Medicare taxes are, how they relate to pension income, and what retirees can expect come tax season. So, let’s dive in and learn more about this important topic.

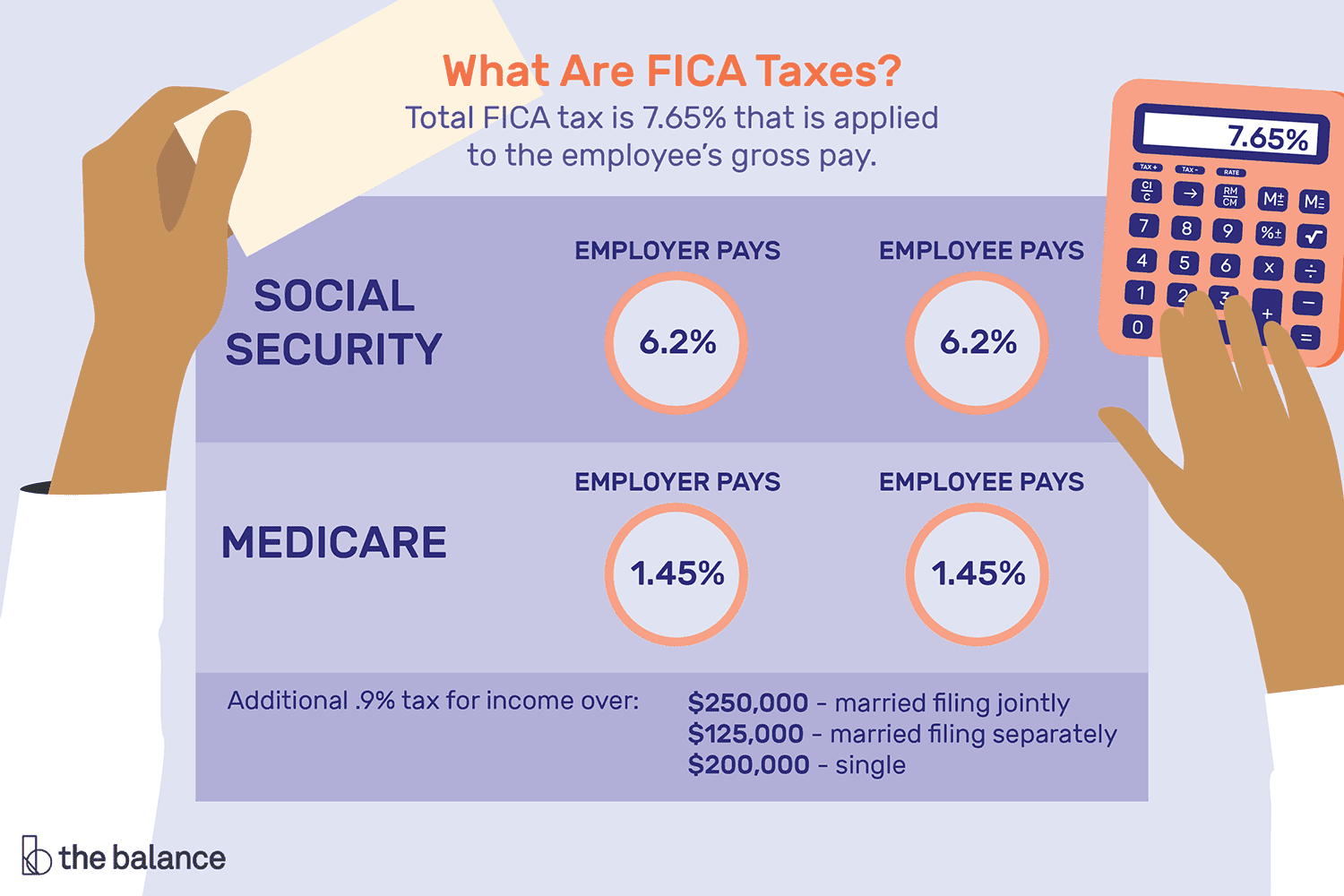

Yes, you may have to pay Medicare tax on your pension income. If your income from pensions and other sources exceeds certain thresholds, you will have to pay a 1.45% Medicare tax on the excess amount. However, if you are self-employed and receiving pension income, you may have to pay an additional 0.9% Medicare tax. It is always best to consult with a tax professional to determine how Medicare tax applies to your specific situation.

Contents

- Do You Pay Medicare Tax on Pension Income?

- Frequently Asked Questions

- Do you pay Medicare tax on pension income?

- Can you avoid paying Medicare tax on pension income?

- How is Medicare tax on pension income calculated?

- When do you have to pay Medicare tax on pension income?

- What other taxes do you have to pay on pension income?

- Do you have to pay income tax on retirement pension?

Do You Pay Medicare Tax on Pension Income?

If you receive pension income, you may be wondering if you are required to pay Medicare taxes on that income. The answer to this question depends on several factors, including the type of pension income you receive and your age. In this article, we’ll explore these factors in detail to help you understand your Medicare tax obligations.

Types of Pension Income

There are two main types of pension income: taxable and non-taxable. Taxable pension income includes any income you receive from a pension plan that you or your employer contributed to before taxes were taken out. Non-taxable pension income, on the other hand, includes any income you receive from a pension plan that you or your employer contributed to after taxes were taken out.

If you receive taxable pension income, you may be required to pay Medicare taxes on that income. However, if you receive non-taxable pension income, you are not required to pay Medicare taxes on that income.

Age and Medicare Tax Obligations

If you are under the age of 65 and receive taxable pension income, you are required to pay Medicare taxes on that income. The current Medicare tax rate is 1.45% of your taxable income, and your employer is required to withhold this amount from your paycheck.

If you are over the age of 65 and receive taxable pension income, you are not required to pay Medicare taxes on that income. However, if you continue to work and receive wages, you may be required to pay Medicare taxes on those wages.

Benefits of Paying Medicare Taxes on Pension Income

While it may seem like an additional expense, paying Medicare taxes on your pension income can actually provide you with several benefits. For one, it helps ensure that you are eligible for Medicare coverage when you turn 65. It also helps fund the Medicare program, which provides healthcare coverage to millions of Americans.

Additionally, paying Medicare taxes on your pension income can help you avoid potential penalties. If you fail to pay Medicare taxes when you are required to do so, you may be subject to penalties and interest charges.

Non-Taxable Pension Income and Medicare Coverage

While you are not required to pay Medicare taxes on non-taxable pension income, it’s important to note that this income may still impact your Medicare coverage. Specifically, if you receive non-taxable pension income that exceeds certain limits, you may be subject to higher Medicare premiums.

To determine if your non-taxable pension income will impact your Medicare premiums, you should speak with a qualified financial advisor or Medicare expert.

Comparing Pension Income vs Wages

It’s important to note that pension income and wages are treated differently when it comes to Medicare taxes. If you receive wages, your employer is required to withhold Medicare taxes from your paycheck, regardless of your age. However, if you receive pension income, your Medicare tax obligations may vary based on your age and the type of income you receive.

Calculating Medicare Taxes on Pension Income

Calculating your Medicare taxes on pension income can be a bit tricky, as it depends on several factors. To determine your Medicare tax obligations, you should speak with a qualified tax professional or financial advisor.

In general, however, you can expect to pay 1.45% of your taxable pension income in Medicare taxes if you are under the age of 65. If you are over the age of 65, you are not required to pay Medicare taxes on your pension income.

Conclusion

In summary, whether or not you are required to pay Medicare taxes on your pension income depends on several factors, including the type of income you receive and your age. If you receive taxable pension income and are under the age of 65, you are required to pay Medicare taxes on that income. If you receive non-taxable pension income or are over the age of 65, you are not required to pay Medicare taxes on that income.

While paying Medicare taxes on pension income may seem like an additional expense, it can provide you with several benefits, including eligibility for Medicare coverage and the knowledge that you are helping fund a program that provides healthcare coverage to millions of Americans.

Frequently Asked Questions

Do you pay Medicare tax on pension income?

Yes, you may have to pay Medicare tax on your pension income. If you are receiving a pension from an employer who did not withhold Social Security or Medicare taxes from your pay, you may be subject to the Medicare tax on your pension income.

The Medicare tax rate is currently 1.45% of your income, and there is no income limit for this tax. This means that you will pay Medicare tax on all of your pension income, regardless of how much you receive.

Can you avoid paying Medicare tax on pension income?

Unfortunately, there is no way to avoid paying Medicare tax on your pension income. Unlike Social Security taxes, which have an income limit, Medicare taxes are assessed on all income, regardless of how much you earn.

However, you may be able to reduce your Medicare tax liability by taking advantage of certain deductions and credits. For example, if you have high medical expenses, you may be able to deduct some of these expenses on your tax return, which could lower your taxable income and reduce your Medicare tax liability.

How is Medicare tax on pension income calculated?

Medicare tax on pension income is calculated at a rate of 1.45% of your income. This tax is assessed on all pension income, including distributions from qualified retirement plans, annuities, and other types of retirement income.

If you receive a pension from an employer who did not withhold Social Security or Medicare taxes from your pay, you may be subject to an additional 0.9% Medicare tax on your pension income. This tax is only assessed on income above certain thresholds, which vary depending on your filing status.

When do you have to pay Medicare tax on pension income?

If you are receiving a pension from an employer who did not withhold Social Security or Medicare taxes from your pay, you may have to pay Medicare tax on your pension income. This tax is typically due when you file your federal income tax return for the year.

If you are receiving a pension from an employer who did withhold Social Security and Medicare taxes from your pay, you should not have to pay Medicare tax on your pension income. However, if you have other sources of income that are not subject to Social Security or Medicare taxes, you may still be subject to the Medicare tax on these sources of income.

What other taxes do you have to pay on pension income?

In addition to Medicare tax, you may have to pay federal and state income tax on your pension income. The amount of tax you owe will depend on your total income, deductions, and credits.

If you receive a pension from an employer who did withhold Social Security and Medicare taxes from your pay, you should only have to pay income tax on your pension income. However, if you have other sources of income that are not subject to Social Security or Medicare taxes, you may have to pay additional taxes on these sources of income.

Do you have to pay income tax on retirement pension?

In conclusion, it is important to understand whether you are required to pay Medicare tax on your pension income. If you are receiving Social Security benefits, your Medicare tax will automatically be deducted from your payments. However, if you are receiving pension income from a private employer or retirement account, you may be required to pay Medicare tax on that income.

It is important to check with your tax advisor or the Social Security Administration to determine your specific tax obligations. Failure to pay Medicare tax on your pension income could result in penalties and interest charges. By staying informed about your tax obligations, you can avoid potential problems and ensure that you are fulfilling your responsibilities as a taxpayer.

Ultimately, it is up to you to ensure that you are complying with all tax laws and regulations. By understanding the rules and regulations regarding Medicare tax on pension income, you can make informed decisions and avoid any unnecessary penalties or fees. Remember, paying your fair share of taxes helps fund important programs and services that benefit all Americans.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts