Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you someone who invests in stocks, bonds, or real estate? If so, you may be wondering if you need to pay Medicare taxes on your capital gains. It’s a valid question that many people have, especially those who are nearing retirement age or already retired.

The short answer is yes, you may need to pay Medicare taxes on your capital gains. However, the rules can be complex and vary depending on your income level and other factors. In this article, we’ll explore the ins and outs of Medicare taxes on capital gains and provide you with the information you need to understand your tax obligations. So, let’s dive in!

Yes, you may have to pay Medicare tax on capital gains. If your income exceeds a certain threshold, you will be subject to a 3.8% Medicare tax on your net investment income, which includes capital gains. The threshold is $200,000 for single filers and $250,000 for married couples filing jointly. However, if you are a self-employed individual, you may also owe an additional 2.9% Medicare tax on your self-employment income.

Do You Pay Medicare Tax on Capital Gains?

When it comes to taxes, there are many different types that individuals must pay. One of these taxes is Medicare tax, which is assessed on earned income. However, many people wonder whether they also need to pay Medicare tax on capital gains. In this article, we will explore this topic in depth and provide you with all the information you need to know.

What is Medicare Tax?

Medicare tax is a tax that is assessed on earned income to help fund Medicare, which is a federal health insurance program for individuals who are 65 years or older, as well as for certain individuals with disabilities. The current Medicare tax rate is 1.45% of all earned income, which is paid by both employers and employees.

Employer and Employee Responsibilities

For employees, the Medicare tax is automatically deducted from their paychecks, along with Social Security taxes. Employers are also required to match the amount of Medicare taxes paid by their employees. Self-employed individuals, on the other hand, are responsible for paying both the employer and employee portions of Medicare taxes themselves.

Do You Pay Medicare Tax on Capital Gains?

Capital gains are profits that individuals make from the sale of assets, such as stocks, real estate, and other investments. These gains are typically subject to capital gains tax, which is a separate tax from Medicare tax.

In general, Medicare tax only applies to earned income, which includes wages, salaries, and tips. Therefore, capital gains are not subject to Medicare tax.

Exceptions to the Rule

However, there are a few exceptions to this rule. For example, if you are a high-income earner, you may be subject to an additional Medicare tax of 0.9% on your earned income. This tax applies to individuals who earn more than $200,000 per year if they are single or $250,000 per year if they are married and filing jointly.

In addition, if you are a self-employed individual, you may be subject to the Medicare tax on your net investment income. This tax is also known as the Net Investment Income Tax (NIIT) and is assessed at a rate of 3.8% on the lesser of your net investment income or the amount by which your modified adjusted gross income exceeds $200,000 for single filers or $250,000 for married couples filing jointly.

Benefits of Medicare Tax

While paying taxes is never fun, there are several benefits to paying Medicare tax. First and foremost, Medicare provides health insurance coverage to millions of Americans who would otherwise be unable to afford it. In addition, Medicare helps to keep healthcare costs down by negotiating with healthcare providers to secure lower prices for medical services.

Medicare and Retirement

Finally, Medicare is an essential part of retirement planning. Once you turn 65, you are eligible for Medicare coverage, which can help to offset the high costs of medical care that often come with aging. By paying into Medicare throughout your career, you are ensuring that you will have access to affordable healthcare once you retire.

Conclusion

In conclusion, you do not need to pay Medicare tax on capital gains. However, there are a few exceptions to this rule, such as for high-income earners and self-employed individuals with net investment income. While paying taxes is never enjoyable, paying Medicare tax helps to ensure that millions of Americans have access to affordable healthcare and is an essential part of retirement planning.

Frequently Asked Questions

Do you pay Medicare tax on capital gains?

Yes, you may be required to pay Medicare tax on your capital gains depending on your income level. If your income exceeds certain thresholds, you will be subject to the Medicare surtax, also known as the Net Investment Income Tax (NIIT).

The NIIT is a 3.8% tax on certain types of investment income, including capital gains, dividends, and rental income. It applies to taxpayers with modified adjusted gross income (MAGI) above $200,000 for single filers and $250,000 for married filing jointly.

What is the Medicare surtax?

The Medicare surtax, also known as the Net Investment Income Tax (NIIT), is a 3.8% tax on certain types of investment income. This tax was introduced as part of the Affordable Care Act and is designed to help fund Medicare.

The NIIT applies to taxpayers with modified adjusted gross income (MAGI) above $200,000 for single filers and $250,000 for married filing jointly. It applies to investment income such as capital gains, dividends, and rental income.

How is the Medicare surtax calculated?

The Medicare surtax, also known as the Net Investment Income Tax (NIIT), is calculated as 3.8% of your net investment income. Net investment income includes capital gains, dividends, and rental income, among other types of investment income.

To determine if you are subject to the Medicare surtax, you must first calculate your modified adjusted gross income (MAGI). If your MAGI exceeds $200,000 for single filers or $250,000 for married filing jointly, you will be subject to the NIIT.

Can you avoid paying the Medicare surtax on capital gains?

There are several strategies that can be used to avoid or reduce the Medicare surtax on capital gains. One strategy is to hold investments in tax-deferred retirement accounts such as a 401(k) or IRA.

Another strategy is to time the sale of capital assets to minimize the impact of the surtax. For example, you may want to consider selling assets in a year when your income is below the threshold for the surtax.

Do non-residents pay Medicare tax on capital gains?

Non-residents are generally not subject to Medicare tax on capital gains. However, if you are a non-resident who is considered a resident for tax purposes under the substantial presence test, you may be subject to the Medicare surtax if your income exceeds the threshold. It is important to seek the advice of a tax professional if you are unsure about your tax residency status.

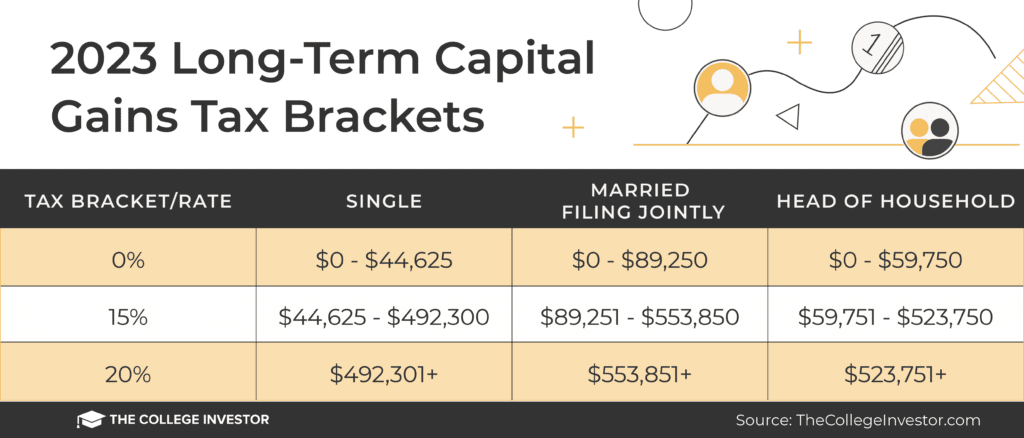

Here’s how to pay 0% tax on capital gains

In conclusion, it is important to understand that capital gains are subject to Medicare tax under certain circumstances. If you are an individual who earns more than $200,000 or a couple that earns more than $250,000 annually, you will be required to pay a Medicare tax of 3.8% on any capital gains earned. However, it’s important to note that not all capital gains are subject to this tax, and certain exemptions may apply. It’s advisable to consult with a tax professional to determine your specific tax obligations and minimize your tax liability.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts