Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching retirement age and wondering if you’ll have to pay for Medicare? The answer is not a simple one, as it depends on a variety of factors. In this article, we’ll explore the different scenarios that may impact whether or not you’ll need to pay for Medicare when you retire.

From income thresholds to work history, there are several key factors that can determine your Medicare coverage and costs in retirement. Understanding these factors can help you plan and prepare for your retirement healthcare expenses. So, let’s dive in and explore the question: do you have to pay for Medicare when you retire?

Yes, you will need to pay for Medicare when you retire. Most people qualify for premium-free Part A, but you’ll still need to pay for Part B, which covers doctor visits and other outpatient services. The cost of Part B varies depending on your income, but most people pay the standard premium amount. You may also want to consider a Medicare Supplement plan or a Medicare Advantage plan to cover additional healthcare costs.

Do You Have to Pay for Medicare When You Retire?

Medicare is a federal health insurance program that provides coverage to people who meet certain criteria. If you are approaching retirement age, you may be wondering whether you will have to pay for Medicare when you retire. The answer is not straightforward, as it depends on a number of factors. In this article, we will explore the question in depth and help you understand what you need to know.

What is Medicare?

Medicare is a federal health insurance program that provides coverage for people who are 65 years or older, as well as those who have certain disabilities or medical conditions. The program is divided into several parts, each of which covers different types of medical expenses.

Part A: Hospital Insurance

Medicare Part A covers hospital stays, skilled nursing care, hospice care, and some home health care. Most people do not have to pay a premium for Part A, as they have paid into the system through payroll taxes during their working years.

Part B: Medical Insurance

Medicare Part B covers doctor visits, outpatient care, preventive services, and medical equipment. Most people who enroll in Part B have to pay a monthly premium, which is based on their income.

Part C: Medicare Advantage

Medicare Advantage plans are offered by private insurance companies and provide the same coverage as Parts A and B, as well as additional benefits such as vision, dental, and prescription drug coverage. These plans may have different costs and rules than original Medicare.

Part D: Prescription Drug Coverage

Medicare Part D provides coverage for prescription drugs. Like Part B, most people who enroll in Part D have to pay a monthly premium.

How Does Medicare Work When You Retire?

If you are still working and have employer-sponsored health insurance, you may be able to delay enrolling in Medicare without penalty. However, once you retire, you will need to enroll in Medicare to avoid gaps in coverage.

Enrolling in Medicare

You can enroll in Medicare during your initial enrollment period, which starts three months before your 65th birthday and ends three months after. If you miss this window, you may have to pay a penalty when you enroll later.

Costs of Medicare

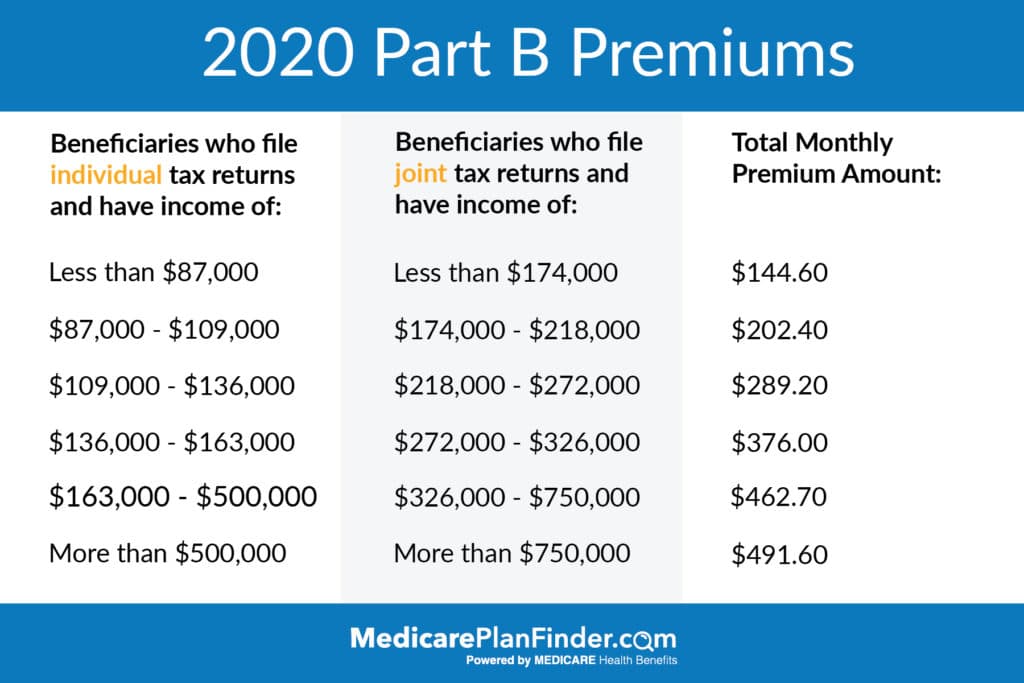

The cost of Medicare varies depending on the parts you enroll in and your income. Most people do not have to pay a premium for Part A, but they will have to pay a premium for Part B and Part D. The cost of these premiums is based on a sliding scale, so people with higher incomes pay more.

Benefits of Medicare

Medicare provides comprehensive health insurance coverage that can help you stay healthy and manage medical expenses in retirement. Some of the benefits of Medicare include:

Preventive Services

Medicare covers a wide range of preventive services, such as annual wellness visits, flu shots, and cancer screenings. These services can help you stay healthy and catch health problems early.

Flexibility

Medicare gives you the flexibility to choose your doctors and hospitals, as long as they accept Medicare. You can also choose between original Medicare and Medicare Advantage plans, depending on your needs.

Financial Protection

Medicare can help protect you from high medical expenses in retirement. While you will still have to pay some costs out of pocket, Medicare can help cover the majority of your medical expenses.

Medicare vs. Private Insurance

While Medicare provides comprehensive health insurance coverage, some people choose to supplement their coverage with private insurance. Here are some of the key differences between Medicare and private insurance:

Cost

Private insurance can be more expensive than Medicare, especially if you have a pre-existing condition. However, some people may be able to find more affordable coverage through private insurance.

Coverage

Medicare provides comprehensive coverage for most medical expenses, while private insurance may have more limited coverage or exclude certain types of medical care.

Flexibility

Private insurance plans may have more flexibility than Medicare when it comes to choosing doctors and hospitals. However, you may have to pay more out of pocket if you go out of network.

Conclusion

If you are approaching retirement age, it is important to understand how Medicare works and what your options are. While you will have to pay for some parts of Medicare, the program provides comprehensive health insurance coverage that can help you stay healthy and manage medical expenses in retirement. By understanding your options and choosing the right coverage for your needs, you can enjoy a happy and healthy retirement.

Frequently Asked Questions

Medicare is a federal health insurance program that provides coverage to people aged 65 and older, as well as those with certain disabilities or medical conditions. If you plan to retire soon, you may be wondering whether you’ll have to pay for Medicare. Here are some common questions and answers to help you understand how Medicare works in retirement.

Do I have to pay for Medicare when I retire?

Yes, most people do need to pay for Medicare when they retire. Medicare Part A, which covers hospital stays, is usually free if you or your spouse paid Medicare taxes while working. However, you’ll need to pay a premium for Medicare Part B, which covers doctor visits and other outpatient services. The Part B premium is based on your income and can change each year.

Additionally, you may want to enroll in a Medicare Part D prescription drug plan, which also has a monthly premium. There are also supplemental insurance plans, known as Medigap, that can help cover some of the out-of-pocket costs that Medicare doesn’t pay for.

How much will I have to pay for Medicare?

The cost of Medicare depends on several factors, including your income, the type of Medicare coverage you choose, and any additional insurance you have. For most people, the Part B premium is around $148.50 per month in 2021. However, if your income is above a certain level, you may have to pay more. The cost of Medigap plans varies depending on the level of coverage you choose and where you live.

It’s important to budget for these costs when planning for retirement, as they can add up quickly. You may also want to explore options for lowering your Medicare costs, such as enrolling in a Medicare Advantage plan or applying for assistance programs.

When should I enroll in Medicare?

You can enroll in Medicare during a seven-month period that starts three months before your 65th birthday and ends three months after your birthday month. If you’re already receiving Social Security benefits, you’ll be automatically enrolled in Medicare Parts A and B. However, if you’re not yet receiving benefits, you’ll need to sign up yourself.

It’s important to enroll in Medicare on time to avoid late enrollment penalties and gaps in coverage. If you miss your initial enrollment period, you may have to pay higher premiums for Part B and may have to wait to enroll in certain types of coverage.

What if I have other insurance besides Medicare?

If you have other health insurance, such as through an employer or a spouse’s plan, you may be able to delay enrolling in Medicare without penalty. However, it’s important to understand how your other insurance works with Medicare and whether it’s worth keeping both types of coverage.

For example, if you have retiree health benefits through an employer, you may be able to use them to supplement Medicare. However, if you have a high-deductible health plan, you may want to enroll in Medicare to avoid paying large out-of-pocket costs. It’s a good idea to talk to a benefits counselor or financial planner to help you make the best decision.

Can I change my Medicare coverage after I retire?

Yes, you can make changes to your Medicare coverage during certain times of the year, such as during the annual open enrollment period from October 15th to December 7th. During this time, you can switch between Medicare Advantage and Original Medicare, add or drop prescription drug coverage, and make other changes to your plan.

You may also be able to make changes to your coverage outside of the annual enrollment period if you experience a qualifying life event, such as a move or loss of other insurance. It’s a good idea to review your Medicare coverage each year and make changes as needed to ensure that you have the best possible coverage for your needs.

Working Past Age 65, How (And When) to Enroll in Medicare When You Retire

In conclusion, Medicare is a valuable resource for seniors in the United States. It provides access to affordable healthcare services, including doctor visits, hospital stays, and prescription drugs. However, many people wonder whether they will have to pay for Medicare when they retire.

The answer depends on several factors, including your income and the type of Medicare coverage you choose. Most people will pay some amount for their Medicare coverage, but the cost can vary widely depending on your circumstances.

Fortunately, there are resources available to help you understand your Medicare options and make the best choices for your needs. Whether you are nearing retirement or are already retired, it is important to explore your Medicare options and make informed decisions about your healthcare coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts