Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, our healthcare needs tend to increase, along with the cost of medical care. While Medicare can provide valuable coverage for many seniors, some may find that it doesn’t cover all of their expenses. This is where Medicare supplemental insurance, also known as Medigap, can come in handy.

Medigap policies are designed to fill in the gaps left by Medicare, covering things like deductibles, copayments, and coinsurance. But do you really need this extra coverage? In this article, we’ll explore the ins and outs of Medicare supplemental insurance to help you make an informed decision about whether it’s right for you.

Do I Need Medicare Supplemental Insurance?

If you are nearing the age of 65, or already enrolled in Medicare, you may be wondering whether you need Medicare supplemental insurance, also known as Medigap. While Medicare does cover many healthcare expenses, it does not cover everything. Medigap policies are designed to fill in the gaps in Medicare coverage, providing additional benefits that can help you pay for out-of-pocket costs like deductibles, coinsurance, and copayments. In this article, we will explore whether you need Medicare supplemental insurance and what factors you should consider when making this decision.

Understanding Medicare Coverage

Before we dive into whether you need Medigap, it’s important to understand what Medicare covers. Medicare is a federal health insurance program that provides coverage for people who are 65 or older, as well as people with certain disabilities and chronic conditions. There are four parts to Medicare:

- Part A: Hospital insurance that covers inpatient care, hospice care, and skilled nursing facility care.

- Part B: Medical insurance that covers doctor visits, outpatient care, and preventive services.

- Part C: Also known as Medicare Advantage, these are private insurance plans that provide all the benefits of Parts A and B, as well as additional benefits like dental and vision care.

- Part D: Prescription drug coverage that helps pay for the cost of prescription medications.

While Medicare covers many healthcare expenses, there are still some costs that you will be responsible for. For example, Medicare Part A has a deductible of $1,484 per benefit period, and Part B has a deductible of $203 per year. You will also be responsible for paying coinsurance and copayments for certain services.

What is Medicare Supplemental Insurance?

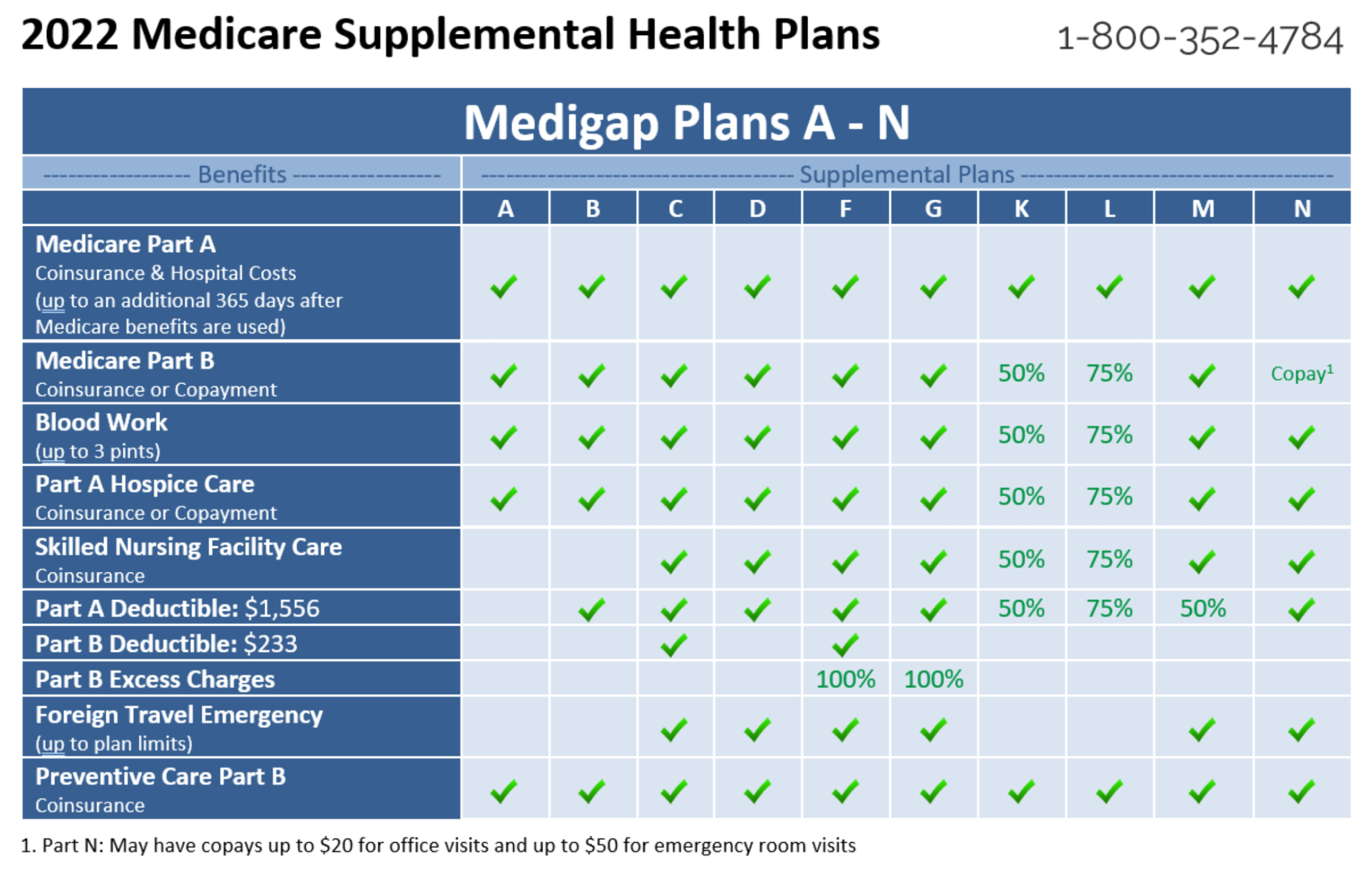

Medicare supplemental insurance, or Medigap, is a type of private insurance policy that helps cover some of the out-of-pocket costs associated with Medicare. Medigap policies are sold by private insurance companies, and they are designed to complement Medicare coverage. There are 10 standardized Medigap plans available in most states, each labeled with a letter (A, B, C, D, F, G, K, L, M, and N). Each plan offers a different set of benefits, and the benefits covered by each plan are standardized across all insurance companies.

Factors to Consider

Whether or not you need Medigap will depend on your individual situation. Here are some factors to consider when making this decision:

Your Healthcare Needs

Consider your current and anticipated healthcare needs. If you have a chronic condition or require frequent medical care, you may be more likely to require Medigap coverage. Additionally, if you travel frequently or live in a rural area, you may benefit from Medigap coverage that provides emergency medical care when you are away from home.

Your Budget

Medigap policies can vary in cost depending on the plan you choose and the insurance company you buy it from. Consider whether you can afford the monthly premiums, and whether the benefits you receive outweigh the costs of the policy.

Your Existing Coverage

If you have other health insurance coverage, like through an employer or a union, you may not need Medigap coverage. Additionally, if you enroll in a Medicare Advantage plan, you may not need Medigap coverage since Medicare Advantage plans often provide additional benefits that are not covered by traditional Medicare.

Enrollment Period

The best time to enroll in Medigap coverage is during your initial enrollment period, which is the six-month period that begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this period, insurance companies cannot deny you coverage or charge you more because of pre-existing conditions.

Benefits of Medigap

Here are some of the benefits of Medigap coverage:

- Covers out-of-pocket costs: Medigap policies can help cover out-of-pocket costs like deductibles, coinsurance, and copayments.

- Freedom to choose providers: With Medigap, you can see any healthcare provider who accepts Medicare.

- Standardized benefits: The benefits covered by each Medigap plan are standardized across all insurance companies, so you know exactly what you are getting.

- Peace of mind: Medigap can provide peace of mind knowing that you are covered for unexpected healthcare costs.

Medigap vs. Medicare Advantage

While Medigap and Medicare Advantage are both designed to provide additional healthcare coverage, they are different in several ways. Here are some of the key differences between the two:

| Medigap | Medicare Advantage |

|---|---|

| Works with traditional Medicare | Replaces traditional Medicare |

| No network restrictions | May have network restrictions |

| Covers out-of-pocket costs | May have lower out-of-pocket costs, but may have higher premiums |

| No additional benefits | May offer additional benefits like dental, vision, and hearing care |

Ultimately, whether you choose Medigap or Medicare Advantage will depend on your individual healthcare needs and budget.

Conclusion

In conclusion, Medicare supplemental insurance can be a valuable addition to traditional Medicare coverage for some people. When deciding whether you need Medigap coverage, consider your healthcare needs, budget, existing coverage, and enrollment period. Medigap policies can provide peace of mind knowing that you are covered for unexpected healthcare costs, and they can help fill in the gaps in Medicare coverage.

Frequently Asked Questions

Here are some commonly asked questions to help you understand if you need Medicare Supplemental Insurance:

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also known as Medigap, is private health insurance that helps pay for some of the healthcare costs that Medicare doesn’t cover, such as deductibles, copayments, and coinsurance. It’s meant to supplement your Original Medicare coverage.

Medicare Supplemental Insurance is sold by private insurance companies and comes in different levels of coverage. Each level of coverage is identified by a letter (A, B, C, D, F, G, K, L, M, and N) and has a different set of benefits. You’ll pay a monthly premium for your Medigap policy in addition to your Medicare Part B premium.

Do I Need Medicare Supplemental Insurance?

Whether or not you need Medicare Supplemental Insurance depends on your individual healthcare needs and financial situation. If you have Original Medicare and you’re happy with your coverage, you may not need Medigap. However, if you anticipate needing a lot of healthcare services or have a chronic condition, you may want to consider Medigap to help cover your out-of-pocket costs.

If you travel frequently or live in a state where Medicare Advantage plans aren’t widely available, you may also benefit from Medigap. It’s important to consider your healthcare needs and budget when deciding if Medigap is right for you.

When Can I Enroll in Medicare Supplemental Insurance?

The best time to enroll in Medicare Supplemental Insurance is during your Medigap Open Enrollment Period, which lasts for six months and begins on the first day of the month in which you’re 65 or older and enrolled in Medicare Part B. During this time, you have guaranteed issue rights, which means that insurance companies can’t deny you coverage or charge you higher premiums based on your health status.

If you miss your Medigap Open Enrollment Period, you may still be able to enroll in Medigap, but you may be subject to medical underwriting, which means that insurance companies can consider your health status when determining your premiums or whether to offer you coverage.

How Much Does Medicare Supplemental Insurance Cost?

The cost of Medicare Supplemental Insurance varies depending on the level of coverage you choose, the insurance company you buy your policy from, and your location. Generally, the more comprehensive the coverage, the higher the monthly premium.

It’s important to shop around and compare prices from different insurance companies to find the best deal. Keep in mind that the cheapest policy may not always be the best option for your healthcare needs.

Can I Switch Medicare Supplemental Insurance Plans?

Yes, you can switch Medicare Supplemental Insurance plans at any time, but you may be subject to medical underwriting if you switch outside of your Medigap Open Enrollment Period. If you’re considering switching plans, it’s important to compare the benefits and costs of each plan and make sure that the new plan meets your healthcare needs.

Keep in mind that if you switch plans, you may lose some of the benefits you had with your previous plan, such as coverage for pre-existing conditions. It’s important to understand the terms of your new policy before you switch.

Do I need a Medicare Supplement Plan?

In conclusion, the decision to purchase Medicare supplemental insurance ultimately depends on your individual healthcare needs and financial situation. If you have significant medical expenses and want to limit your out-of-pocket costs, a Medigap plan may be a wise investment. On the other hand, if you are relatively healthy and can afford to pay for unexpected medical expenses, you may not need this additional coverage.

It is important to carefully consider all of your options and compare Medicare supplemental insurance plans before making a decision. You can speak with a licensed insurance agent or use online resources to research and compare plans. Don’t wait until you need medical care to make this important decision – take the time to evaluate your options now and ensure that you have the coverage you need to protect your health and finances in the years to come.

Overall, Medicare supplemental insurance can provide valuable benefits and peace of mind for those who need it. While it may not be necessary for everyone, it’s important to understand your options and make an informed decision about your healthcare coverage. Make sure to review your options and carefully consider your needs before making a final decision on whether or not to purchase Medicare supplemental insurance.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts