Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

If you’re lucky enough to have employer-provided health insurance, you might be wondering if you really need to sign up for Medicare. After all, you’re already covered, right? Well, not necessarily. While employer-provided health insurance can certainly be a valuable benefit, it doesn’t always provide the same level of coverage as Medicare.

In this article, we’ll take a closer look at whether or not you need Medicare if you have employer health insurance. We’ll explore the differences between the two types of coverage, and help you determine whether or not you should enroll in Medicare. So if you’re feeling a bit confused about your health insurance options, read on!

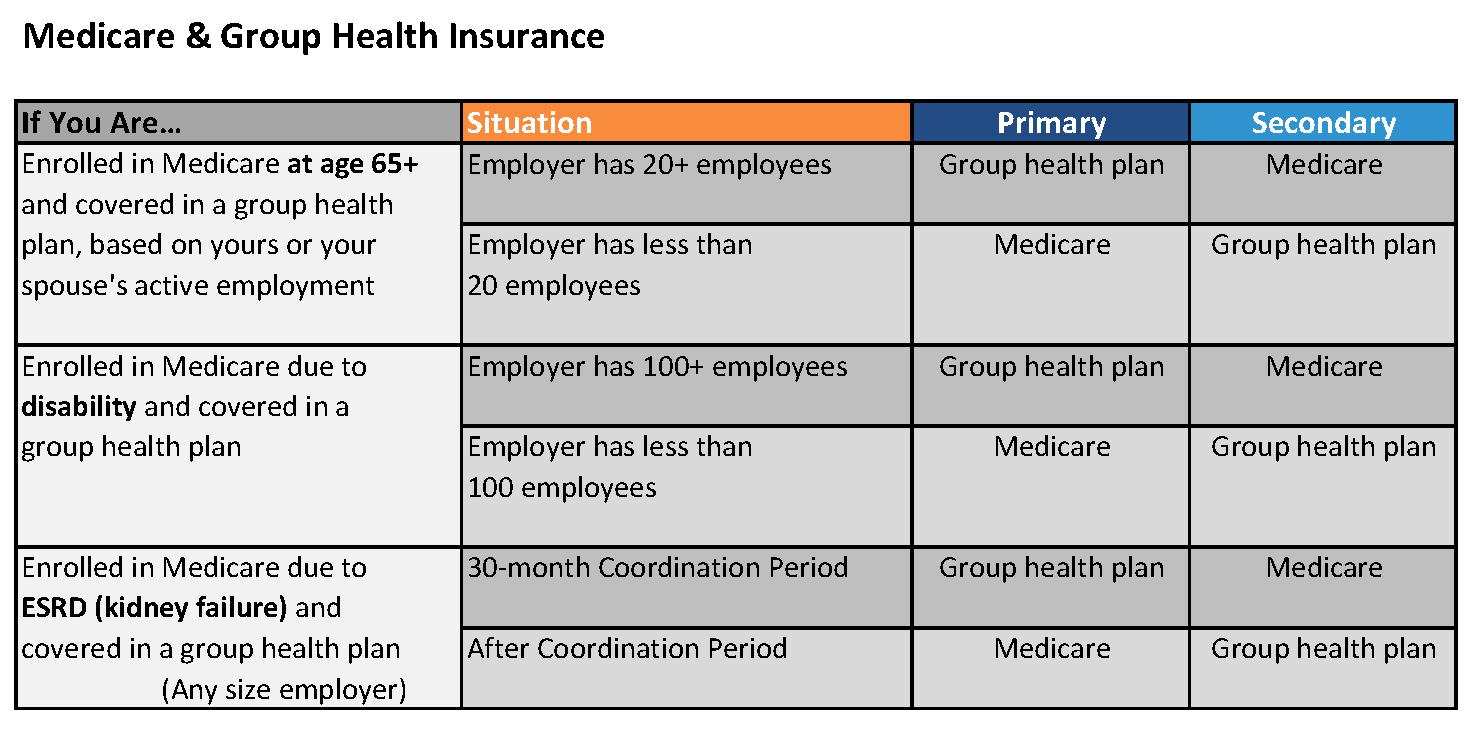

If you have health insurance through your employer and you are nearing the age of 65, you may be wondering if you need to sign up for Medicare. The answer depends on the size of your employer. If your employer has fewer than 20 employees, Medicare becomes your primary insurance. If your employer has more than 20 employees, your employer insurance will remain your primary insurance and Medicare will become secondary.

Contents

- Do I Need Medicare if I Have Employer Health Insurance?

- Frequently Asked Questions

- Do I Need Medicare if I Have Employer Health Insurance?

- What Happens if I Don’t Enroll in Medicare Part B?

- Can I Delay Enrolling in Medicare Part B if I Have Employer Health Insurance?

- Does Medicare Affect My Employer Health Insurance Premiums?

- Do I Need to Notify My Employer if I Enroll in Medicare?

- Medicare & Employer Health Insurance

Do I Need Medicare if I Have Employer Health Insurance?

If you are currently covered by employer health insurance, you may be wondering if you need to enroll in Medicare when you become eligible at age 65. While employer health insurance can be a great benefit, it’s important to understand how it works with Medicare and what your options are. In this article, we’ll explore whether or not you need Medicare if you have employer health insurance.

Understanding Medicare and Employer Health Insurance

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, as well as some younger people with disabilities. Medicare has four parts: Part A, which covers hospital stays and some skilled nursing care; Part B, which covers doctor visits, outpatient services, and medical equipment; Part C, also known as Medicare Advantage, which is an alternative to traditional Medicare that is offered by private insurance companies; and Part D, which covers prescription drugs.

Employer health insurance, on the other hand, is a type of group health insurance that is offered by an employer to its employees. This coverage can vary widely depending on the employer and the plan, but typically includes coverage for doctor visits, hospital stays, and prescription drugs.

Do You Need Medicare if You Have Employer Health Insurance?

The answer to this question depends on a few factors. If you are still working and covered by employer health insurance, you may not need to enroll in Medicare right away. However, if you are no longer working or your employer health insurance is not considered “credible coverage” by Medicare, you will need to enroll in Medicare in order to avoid paying penalties.

It’s important to note that even if you have employer health insurance, you may still want to enroll in Medicare Part A when you become eligible. Part A is typically free for most people, and it can provide additional coverage that your employer health insurance may not cover. For example, if you need to be hospitalized and your employer health insurance has high out-of-pocket costs, Medicare Part A can help cover those costs.

Benefits of Enrolling in Medicare if You Have Employer Health Insurance

There are several benefits to enrolling in Medicare if you have employer health insurance. First and foremost, it can provide additional coverage that your employer health insurance may not cover. This can include coverage for hospital stays, skilled nursing care, and other healthcare services.

In addition, enrolling in Medicare can provide peace of mind knowing that you have comprehensive coverage for all of your healthcare needs. Medicare is a well-established program that has been providing healthcare coverage to millions of Americans for decades, so you can be confident in the quality of care you will receive.

How Medicare Works with Employer Health Insurance

If you have both Medicare and employer health insurance, your employer health insurance will typically be your primary insurance. This means that it will pay for your healthcare services first, and then Medicare will pay for any remaining costs. However, there are some exceptions to this rule, so it’s important to understand how your specific coverage works.

If you have Medicare Part D prescription drug coverage and employer health insurance that includes prescription drug coverage, you may need to choose one or the other. You cannot have both types of coverage at the same time.

Medicare vs Employer Health Insurance

When it comes to choosing between Medicare and employer health insurance, there is no one-size-fits-all answer. It depends on your specific needs and circumstances. However, there are some general considerations to keep in mind.

Medicare typically provides more comprehensive coverage than employer health insurance, especially when it comes to hospital stays and skilled nursing care. However, employer health insurance may offer more flexibility in terms of doctor and hospital networks.

Conclusion

In conclusion, whether or not you need Medicare if you have employer health insurance depends on your specific situation. If you are still working and covered by employer health insurance, you may not need to enroll in Medicare right away. However, if you are no longer working or your employer health insurance is not considered “credible coverage” by Medicare, you will need to enroll in Medicare in order to avoid paying penalties. It’s important to understand how Medicare works with employer health insurance and to consider the benefits of enrolling in Medicare even if you have employer health insurance.

Frequently Asked Questions

Do I Need Medicare if I Have Employer Health Insurance?

It depends on the size of your employer. If you work for a large employer with more than 20 employees, your employer’s group health plan will be your primary insurance. Medicare will act as a secondary payer and will only cover costs that your employer’s plan doesn’t cover. In this case, you don’t need to enroll in Medicare Part B immediately when you turn 65 and could wait until you retire to avoid late enrollment penalties.

However, if you work for a small employer with fewer than 20 employees, Medicare becomes your primary insurance when you turn 65. In this case, you should enroll in Medicare Part B during your Initial Enrollment Period to avoid late enrollment penalties. Your employer’s plan will act as a secondary payer and will only cover costs that Medicare doesn’t cover.

What Happens if I Don’t Enroll in Medicare Part B?

If you don’t enroll in Medicare Part B when you turn 65 and don’t have primary insurance from an employer with more than 20 employees, you may face a late enrollment penalty. The penalty is calculated by multiplying 10% of the Part B premium for each 12-month period you were eligible but didn’t enroll. The penalty lasts as long as you have Part B. Additionally, you’ll have to wait until the General Enrollment Period, which runs from January 1 to March 31 each year, to enroll in Part B. Coverage won’t begin until July 1 of that year.

It’s important to note that if you have primary insurance from an employer with fewer than 20 employees, you don’t have to enroll in Medicare Part B when you turn 65 to avoid a late enrollment penalty. However, you should enroll in Part B when you retire and lose your employer’s coverage to avoid a gap in coverage and late enrollment penalties.

Can I Delay Enrolling in Medicare Part B if I Have Employer Health Insurance?

If you have primary insurance from an employer with more than 20 employees, you can delay enrolling in Medicare Part B without facing late enrollment penalties. You can enroll in Part B during a Special Enrollment Period when you retire or lose your employer’s coverage. However, if you have primary insurance from an employer with fewer than 20 employees, you should enroll in Part B during your Initial Enrollment Period to avoid late enrollment penalties.

It’s important to note that if you delay enrolling in Medicare Part B, you may face gaps in coverage and may have to pay out-of-pocket for medical expenses that Medicare would have covered. Additionally, if you delay enrolling in Part B and don’t have primary insurance from an employer with more than 20 employees, you may face late enrollment penalties.

Does Medicare Affect My Employer Health Insurance Premiums?

Medicare won’t affect your employer health insurance premiums if you have primary insurance from an employer with more than 20 employees. Your employer pays for your health insurance premiums, and Medicare acts as a secondary payer. However, if you have primary insurance from an employer with fewer than 20 employees, your employer’s health insurance premiums may be affected by Medicare. Employers with fewer than 20 employees may receive a tax credit for providing health insurance to employees who are eligible for Medicare. This tax credit can help offset the cost of providing health insurance.

It’s important to note that if you have primary insurance from an employer with fewer than 20 employees, Medicare may affect your out-of-pocket costs. In this case, your employer’s health insurance plan will act as a secondary payer and will only cover costs that Medicare doesn’t cover. You may have to pay more for your health care expenses.

Do I Need to Notify My Employer if I Enroll in Medicare?

Yes, you should notify your employer if you enroll in Medicare. This is important because your employer’s health insurance plan will act as a secondary payer to Medicare. Your employer needs to know that you have enrolled in Medicare so that they can adjust their coverage and costs accordingly. Additionally, if you have primary insurance from an employer with fewer than 20 employees, your employer may be eligible for a tax credit for providing health insurance to Medicare-eligible employees. Your employer needs to know that you have enrolled in Medicare so that they can claim this tax credit.

It’s important to note that if you don’t notify your employer that you have enrolled in Medicare, you may face gaps in coverage and may have to pay out-of-pocket for medical expenses that Medicare would have covered. Additionally, if you delay notifying your employer and don’t have primary insurance from an employer with more than 20 employees, you may face late enrollment penalties.

Medicare & Employer Health Insurance

In conclusion, whether or not you need Medicare if you have employer health insurance depends on your individual situation. While having employer health insurance can provide you with coverage, Medicare can offer additional benefits and security. It’s important to weigh the costs and benefits of both options and determine which one is best for you.

If you are nearing retirement age and are no longer covered by employer health insurance, signing up for Medicare can be a smart decision. Medicare can help cover medical costs and provide peace of mind. Additionally, if your employer has fewer than 20 employees, Medicare may become your primary insurance provider.

It’s important to do your research and talk to a healthcare professional to determine the best course of action for your individual situation. Whether you choose to stick with employer health insurance or enroll in Medicare, make sure you have the coverage you need to stay healthy and secure.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts