Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you confused about whether or not you have to pay Medicare tax? Well, you’re not alone. The rules and regulations surrounding Medicare tax can be complex, leaving many people unsure of their obligations. In this article, we’ll break down everything you need to know about Medicare tax, so you can understand what it is, who has to pay it, and how it affects your finances. Let’s dive in and get started!

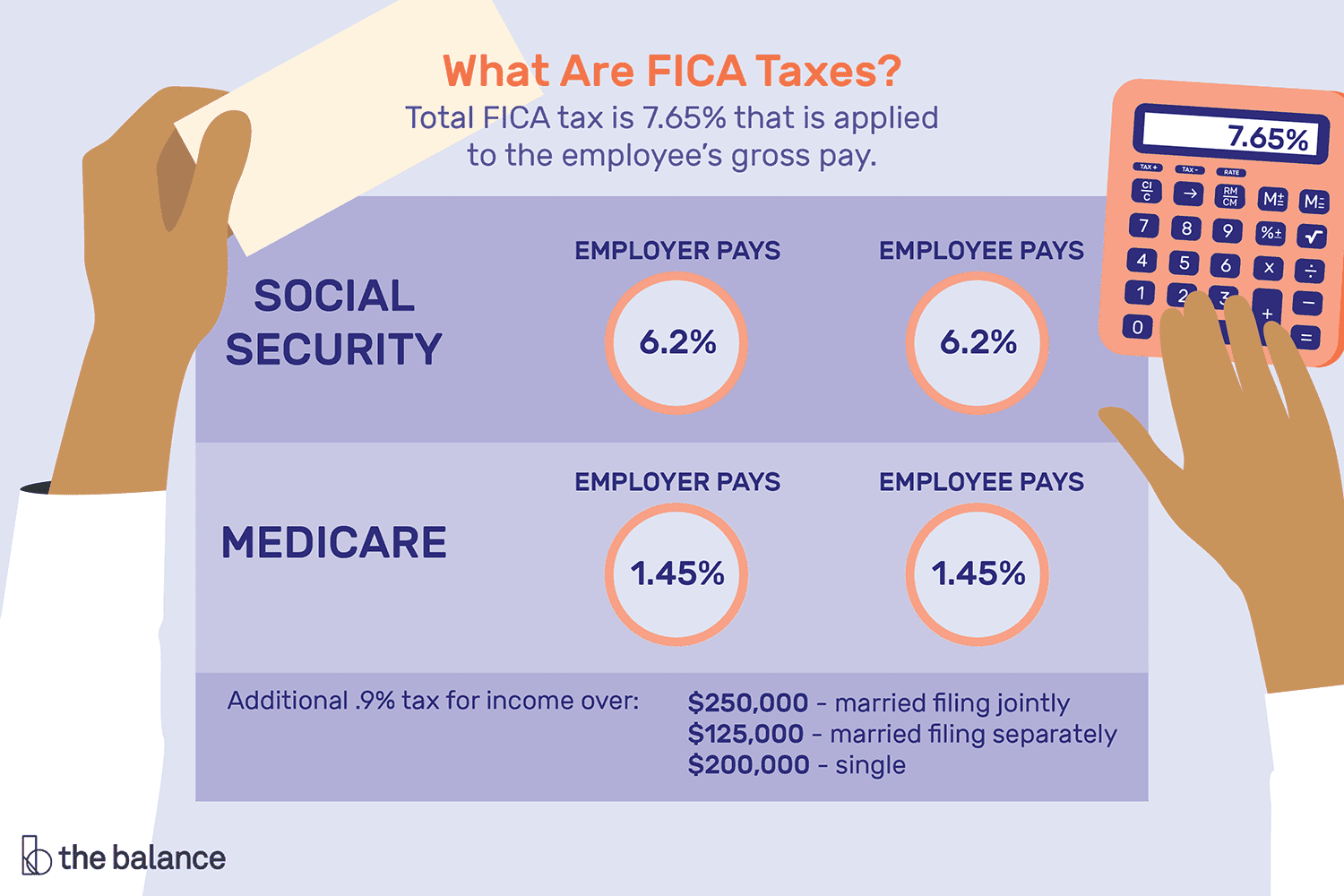

Yes, if you are an employee or self-employed, you are required to pay Medicare taxes. The tax rate is 1.45% of your wages, and your employer also pays 1.45% on your behalf. If you are self-employed, you are responsible for paying the full 2.9% Medicare tax. There is no income limit for Medicare taxes, so you will have to pay this tax on all of your earnings.

Do I Have to Pay Medicare Tax?

If you are an employee or self-employed individual in the United States, you may be wondering if you have to pay Medicare tax. Medicare is a federal health insurance program that provides coverage for people who are 65 years or older, as well as for certain younger people with disabilities. The Medicare tax is a payroll tax that funds this program. In this article, we will discuss whether or not you have to pay Medicare tax and what the tax entails.

What is Medicare Tax?

Medicare tax is a payroll tax that is used to fund the Medicare program. It is a percentage of an employee’s wages and is paid by both the employee and the employer. The current Medicare tax rate is 1.45% of an employee’s wages, and the employer must match this amount.

If you are self-employed, you are responsible for paying both the employee and employer portions of the Medicare tax, which is a total of 2.9% of your net earnings. Self-employed individuals also have to pay an additional 0.9% Medicare tax on wages that exceed a certain threshold.

Who Has to Pay Medicare Tax?

Most employees and self-employed individuals are required to pay Medicare tax. This includes full-time and part-time employees, as well as employees who receive tips or bonuses. However, there are some exceptions. For example, if you are a student who is enrolled full-time and working part-time at your school, you may be exempt from paying Medicare tax.

If you are self-employed, you are also required to pay Medicare tax. However, there are some exceptions for certain types of self-employment income. For example, if you are a farmer or fisherman, you may be exempt from paying Medicare tax on certain types of income.

Benefits of Paying Medicare Tax

While paying Medicare tax may seem like a burden, it is important to remember that the Medicare program provides important benefits to millions of Americans. Medicare provides coverage for hospital stays, doctor visits, and prescription drugs, among other things. By paying Medicare tax, you are helping to ensure that this program continues to provide these benefits to those who need them.

In addition, paying Medicare tax can also benefit you personally. If you are eligible for Medicare, you will be able to enroll in the program and receive coverage for your healthcare needs. This can help you save money on medical expenses and ensure that you receive the care you need.

Medicare Tax vs. Social Security Tax

It is important to note that Medicare tax is separate from Social Security tax, although both taxes are part of the payroll taxes that are deducted from your paycheck. Social Security tax is used to fund the Social Security program, which provides retirement and disability benefits to eligible individuals.

The current Social Security tax rate is 6.2% of an employee’s wages, up to a certain threshold. Like Medicare tax, the employer must match this amount. If you are self-employed, you are responsible for paying both the employee and employer portions of the Social Security tax, which is a total of 12.4% of your net earnings.

Conclusion

In conclusion, most employees and self-employed individuals are required to pay Medicare tax. This tax is used to fund the Medicare program, which provides important benefits to millions of Americans. While paying Medicare tax may seem like a burden, it is important to remember the benefits of the program and the role that the tax plays in ensuring that these benefits continue to be available.

If you have questions about your Medicare tax obligations, it is important to consult with a tax professional or financial advisor. They can help you understand your obligations and ensure that you are complying with all applicable tax laws.

Contents

Frequently Asked Questions

Here are some common questions and answers related to Medicare tax payment.

1. Do I have to pay Medicare tax?

Medicare tax is a payroll tax that is automatically deducted from your paycheck if you are an employee. If you are self-employed, you are responsible for paying both the employer and employee portions of the Medicare tax. The current rate for Medicare tax is 1.45% of your wages or self-employment income.

There is no income limit for Medicare tax, so you will continue to pay it on all of your earnings throughout the year. However, if you earn more than a certain amount, you may also be subject to an additional Medicare tax of 0.9%.

2. What if I don’t pay Medicare tax?

If you are an employee, your employer is required to withhold Medicare tax from your paycheck. If you are self-employed, you are responsible for paying the tax on your own. If you fail to pay Medicare tax, you may be subject to penalties and interest on the amount owed.

In addition, if you do not pay enough Medicare tax throughout the year, you may be subject to an underpayment penalty when you file your tax return. It is important to make sure you are paying the correct amount of Medicare tax to avoid these penalties.

3. Can I get a refund of Medicare tax?

Unlike income tax, you cannot get a refund of Medicare tax. This tax is used to fund the Medicare program, which provides health insurance to people over the age of 65 and those with certain disabilities. However, if you overpaid Medicare tax during the year, you may be able to apply the excess amount to your income tax liability.

It is also important to note that if you are a high-income earner, you may be subject to an additional Medicare tax of 0.9%. This tax is not refundable, even if you overpaid throughout the year.

4. Can I opt out of Medicare tax?

As an employee, you cannot opt out of Medicare tax. This tax is mandatory for all employees and is automatically deducted from your paycheck. If you are self-employed, you are also required to pay Medicare tax on your earnings.

However, if you are a member of a religious group that is opposed to receiving benefits from Social Security or Medicare, you may be eligible for an exemption from paying Medicare tax. You will need to file Form 4029 with the IRS to apply for this exemption.

5. What is the difference between Medicare tax and Social Security tax?

Medicare tax and Social Security tax are both payroll taxes that are deducted from your earnings. However, they fund different programs. Medicare tax funds the Medicare program, which provides health insurance to people over the age of 65 and those with certain disabilities.

Social Security tax funds the Social Security program, which provides retirement, disability, and survivor benefits to eligible workers and their families. The current rate for Social Security tax is 6.2% of your wages or self-employment income, up to a certain limit. Unlike Medicare tax, there is a cap on how much Social Security tax you can be required to pay each year.

Do You Pay Taxes on Social Security? Important Info!

In conclusion, understanding whether or not you need to pay Medicare tax can be a confusing and complicated topic. However, it is important to educate yourself on the subject in order to avoid any potential penalties or legal issues.

If you are an employee, you will likely have Medicare tax automatically deducted from your paycheck. If you are self-employed, you will need to calculate and pay the tax yourself.

While paying Medicare tax may seem like an added expense, it is important to remember that it helps fund important healthcare programs for millions of Americans. By contributing to Medicare, you are helping to ensure that everyone has access to necessary medical care.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts