Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

If you’re approaching retirement age or already retired, you may be wondering if you need to have supplemental insurance with Medicare. Medicare is a government-run health insurance program, but it doesn’t cover all medical costs. That’s where supplemental insurance comes in. In this article, we’ll take a closer look at the role of supplemental insurance with Medicare and help you determine if it’s the right choice for you.

While Medicare covers a wide range of medical services, it doesn’t cover everything. Certain medical expenses, like deductibles, copayments, and coinsurance, can add up quickly. That’s why many people choose to get supplemental insurance, also known as Medigap, to help cover those costs. In the following sections, we’ll explore the ins and outs of supplemental insurance with Medicare, so you can make an informed decision about your healthcare coverage.

While it’s not mandatory, having a Medicare Supplement Insurance (Medigap) policy can help cover the gaps in Original Medicare coverage such as deductibles, copayments, and coinsurance. It can also cover services that Medicare doesn’t cover, such as medical care when traveling outside the U.S. and routine vision or dental care. It is advisable to enroll in Medigap during the open enrollment period for guaranteed issue rights.

Do I Have to Have Supplemental Insurance With Medicare?

If you are approaching the age of 65 or have been receiving Social Security Disability Insurance (SSDI) for more than two years, you may be eligible for Medicare. Medicare is a government-funded health insurance program that provides coverage for hospital stays, doctor visits, and other medical services. However, there are some gaps in Medicare coverage, which is where supplemental insurance, also known as Medigap, comes in. In this article, we will explore whether or not you need supplemental insurance with Medicare.

Understanding the Gaps in Medicare Coverage

While Medicare provides coverage for many healthcare services, it does not cover everything. For example, Medicare does not cover dental, vision, or hearing services. It also does not cover long-term care or custodial care. Additionally, Medicare has deductibles, copayments, and coinsurance that you are responsible for paying.

Medicare Part A covers hospital stays, but you are responsible for paying a deductible for each benefit period. After that, Medicare covers the cost of your hospital stay for up to 60 days. If you stay longer than 60 days, you will be responsible for paying a daily coinsurance amount. Medicare Part B covers doctor visits, but you are responsible for paying an annual deductible and 20% of the cost of your medical services.

What is Supplemental Insurance?

Supplemental insurance, also known as Medigap, is a type of insurance that helps fill in the gaps of Medicare coverage. Medigap policies are sold by private insurance companies and are designed to cover some or all of the costs that Medicare does not cover, such as deductibles, copayments, and coinsurance.

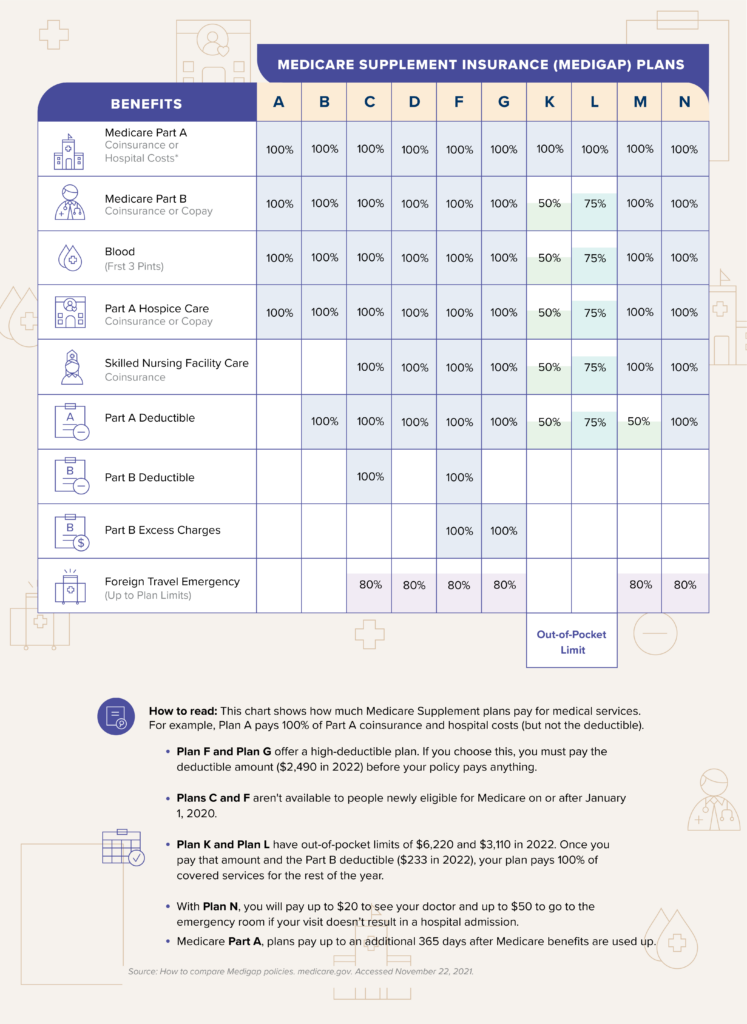

There are 10 standardized Medigap plans, each with a different level of coverage. Medigap Plan F is the most comprehensive and covers all of the gaps in Medicare coverage. However, it is also the most expensive. Medigap Plan G is a popular choice because it provides almost the same coverage as Plan F, but with a lower monthly premium.

Do I Need Supplemental Insurance?

Whether or not you need supplemental insurance with Medicare depends on your healthcare needs and budget. If you have a chronic condition or anticipate needing frequent medical care, supplemental insurance may be a good choice for you. Additionally, if you travel frequently, some Medigap plans provide coverage for emergency medical care outside of the United States.

On the other hand, if you are generally healthy and have a low income, you may not need supplemental insurance. If you cannot afford the monthly premium for supplemental insurance, you may be eligible for Medicaid, a government-funded healthcare program for low-income individuals and families.

Benefits of Supplemental Insurance

Supplemental insurance provides several benefits for Medicare beneficiaries. First, it helps protect against unexpected healthcare costs, such as hospital stays or surgeries. Second, it provides peace of mind knowing that you have coverage for the healthcare services that Medicare does not cover. Finally, it can help you save money on your healthcare expenses by covering deductibles, copayments, and coinsurance.

Medicare Advantage vs. Supplemental Insurance

Another option for Medicare beneficiaries is Medicare Advantage, also known as Medicare Part C. Medicare Advantage is a type of health insurance plan offered by private insurance companies that provides all of the benefits of Medicare Parts A and B, as well as additional benefits such as dental, vision, and hearing coverage. Some Medicare Advantage plans also include prescription drug coverage.

While Medicare Advantage may seem like a good choice, it is important to understand that you will be limited to the network of healthcare providers that the plan offers. Additionally, you may be responsible for paying deductibles, copayments, and coinsurance for the services that Medicare Advantage does not cover.

In contrast, supplemental insurance allows you to see any healthcare provider that accepts Medicare, giving you more flexibility in choosing your healthcare providers.

Conclusion

In conclusion, whether or not you need supplemental insurance with Medicare depends on your healthcare needs and budget. While Medicare provides coverage for many healthcare services, it does not cover everything. Supplemental insurance can help fill in the gaps of Medicare coverage and provide peace of mind knowing that you have coverage for unexpected healthcare costs. Additionally, it can help you save money on your healthcare expenses by covering deductibles, copayments, and coinsurance. Before making a decision about whether or not to purchase supplemental insurance, it is important to review your healthcare needs and budget and compare the costs and benefits of different Medigap plans.

Contents

Frequently Asked Questions

Do I Have to Have Supplemental Insurance With Medicare?

Many people wonder if they need to have supplemental insurance with Medicare. The answer is no, you do not have to have it, but it is highly recommended. Medicare only covers a portion of your healthcare costs, leaving you responsible for the rest. Supplemental insurance can help you cover those costs.

There are a few different types of supplemental insurance plans available, such as Medigap and Medicare Advantage. These plans can help cover the costs of deductibles, copayments, and coinsurance that Medicare does not cover. Without supplemental insurance, you could be left with significant out-of-pocket expenses.

What Are the Benefits of Having Supplemental Insurance With Medicare?

Supplemental insurance can provide a variety of benefits for those with Medicare. First and foremost, it can help cover the costs that Medicare does not cover, such as deductibles and copayments. This can help reduce your out-of-pocket expenses and provide peace of mind.

Additionally, some supplemental insurance plans offer additional benefits, such as vision, dental, and hearing coverage. These benefits can help improve your overall healthcare and quality of life. With the rising costs of healthcare, having supplemental insurance can help ensure that you can afford the care you need.

In conclusion, it is not mandatory to have supplemental insurance with Medicare, but it is highly recommended. Medicare does not cover all healthcare costs, and without supplemental insurance, you could be left with high out-of-pocket expenses. With supplemental insurance, you can have peace of mind knowing that you have additional coverage to help pay for the costs that Medicare does not cover.

Furthermore, supplemental insurance can provide additional benefits such as coverage for prescription drugs, dental, vision, and hearing services. These additional benefits can be extremely valuable, especially for those with chronic health conditions or who require frequent medical care.

In summary, while supplemental insurance is not required with Medicare, it is a wise investment for those who want to ensure they have comprehensive healthcare coverage. With the added benefits and protection, you can have peace of mind knowing that you are fully covered and prepared for any healthcare needs that may arise.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts