Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As the United States continues to honor and support its veterans, it’s important to consider the healthcare options available to those who have become disabled during their service. One question that arises is whether disabled veterans need Medicare, and if so, what benefits they can receive from the program.

While disabled veterans are eligible for healthcare through the Department of Veterans Affairs (VA), Medicare can provide additional benefits and coverage. In this article, we’ll explore the reasons why disabled veterans may need Medicare, the benefits they can receive, and the potential challenges they may face in accessing healthcare.

Yes, disabled veterans may need Medicare coverage in addition to their VA benefits. While VA benefits cover some medical expenses, they may not cover everything. Medicare can provide additional coverage for services such as hospitalization, skilled nursing care, and prescription drugs. Disabled veterans may also be eligible for both Medicare and VA benefits, allowing them to receive care from both programs.

Contents

- Do Disabled Veterans Need Medicare?

- Frequently Asked Questions

- 1. Do all disabled veterans need Medicare?

- 2. What healthcare benefits do disabled veterans receive?

- 3. Can disabled veterans enroll in Medicare Advantage plans?

- 4. Can disabled veterans receive both VA disability compensation and Medicare benefits?

- 5. How can disabled veterans enroll in Medicare?

- VA and Medicare (what Veterans need to know)

Do Disabled Veterans Need Medicare?

As a disabled veteran, you have served your country with honor and have undergone sacrifices that most people cannot even imagine. You have put your life on the line, and you have earned the gratitude and respect of your fellow citizens. However, many disabled veterans still face challenges when it comes to accessing quality healthcare. Medicare is a federal health insurance program that provides coverage to seniors aged 65 and over, but the question remains: do disabled veterans need Medicare?

What is Medicare?

Medicare is a federal health insurance program that provides coverage for people aged 65 and over, as well as people with certain disabilities. Medicare is divided into four parts: Part A, Part B, Part C, and Part D. Each part provides coverage for different types of healthcare services, including hospital stays, doctor visits, prescription drugs, and more.

What Does Medicare Cover?

Medicare Part A covers hospital stays, skilled nursing care, hospice care, and some home health care. Medicare Part B covers doctor visits, outpatient care, preventive services, and medical equipment. Medicare Part C, also known as Medicare Advantage, is an alternative to traditional Medicare that provides coverage through private insurance companies. Medicare Part D provides coverage for prescription drugs.

What are the Benefits of Medicare?

There are several benefits to Medicare, including:

- Access to a wide range of healthcare services

- Protection against high healthcare costs

- Preventive care services that can help you stay healthy

- Prescription drug coverage

Do Disabled Veterans Qualify for Medicare?

As a disabled veteran, you may be eligible for both Medicare and VA healthcare benefits. If you are eligible for Medicare, you can choose to enroll in Medicare Part A and/or Part B. However, if you are already receiving VA healthcare benefits, you may not need to enroll in Medicare.

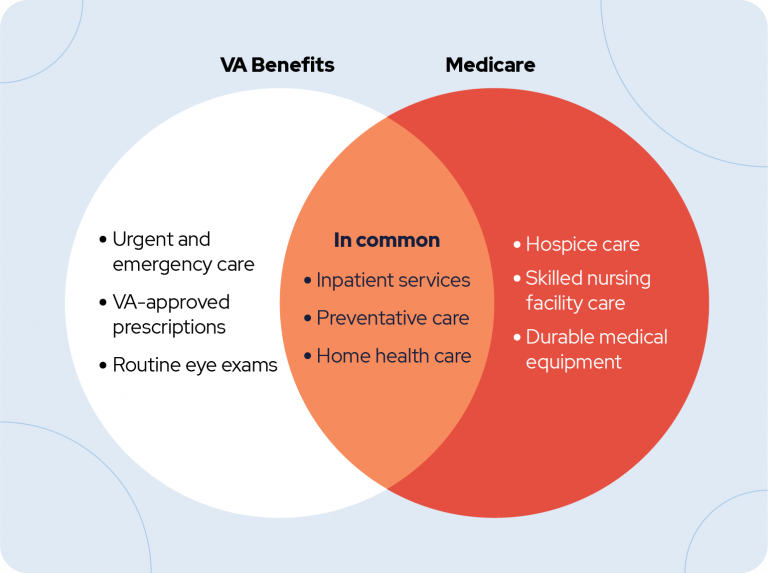

What are the Differences Between VA Healthcare and Medicare?

There are some differences between VA healthcare and Medicare. VA healthcare is designed specifically for veterans and provides comprehensive care for both service-related and non-service-related conditions. Medicare, on the other hand, is available to all Americans aged 65 and over and provides coverage for a wide range of healthcare services.

- VA healthcare is free for veterans who meet certain eligibility requirements, while Medicare requires premiums, deductibles, and copayments.

- VA healthcare provides care at VA facilities, while Medicare allows you to choose from a wide range of healthcare providers.

- VA healthcare may be more specialized in certain areas, such as mental health or prosthetics, while Medicare provides more general healthcare coverage.

Should Disabled Veterans Enroll in Medicare?

Whether or not disabled veterans should enroll in Medicare depends on their individual circumstances. If you are already receiving VA healthcare benefits, you may not need to enroll in Medicare. However, if you are not receiving VA healthcare benefits or if you need additional coverage beyond what VA healthcare provides, Medicare may be a good option for you.

What are the Pros and Cons of Enrolling in Medicare?

Some pros of enrolling in Medicare include:

- Access to a wider range of healthcare services and providers

- Protection against high healthcare costs

- Prescription drug coverage

Some cons of enrolling in Medicare include:

- Premiums, deductibles, and copayments

- Need to navigate the complex Medicare system

- May not be necessary if you are already receiving VA healthcare benefits

Conclusion

In conclusion, disabled veterans may or may not need Medicare, depending on their individual circumstances. If you are already receiving VA healthcare benefits, you may not need to enroll in Medicare. However, if you need additional coverage beyond what VA healthcare provides, Medicare may be a good option for you. It is important to carefully consider your options and consult with a healthcare professional to determine what is best for you.

Frequently Asked Questions

In this section, we will address some common questions regarding whether disabled veterans need Medicare.

1. Do all disabled veterans need Medicare?

Not all disabled veterans need Medicare. However, if a veteran is eligible for Medicare due to age or disability, they may choose to enroll in the program. Medicare can provide additional coverage to veterans who may have limited access to healthcare through the VA system or who require services that are not covered by the VA.

It is important for veterans to consider their individual healthcare needs and evaluate whether Medicare may be beneficial for them. Veterans who have other healthcare coverage may also choose to delay enrolling in Medicare until they retire or lose their other coverage.

2. What healthcare benefits do disabled veterans receive?

Disabled veterans may be eligible for a range of healthcare benefits through the VA, including medical, dental, and vision care. The VA also provides mental health services, rehabilitation and prosthetic services, and caregiver support. These benefits are designed to support veterans with service-connected disabilities and may be available to veterans regardless of their income or other healthcare coverage.

While the VA offers comprehensive healthcare coverage, some veterans may choose to enroll in Medicare to access additional benefits or to have a wider choice of healthcare providers. Veterans who are eligible for both VA healthcare and Medicare may use both programs to receive the care they need.

3. Can disabled veterans enroll in Medicare Advantage plans?

Yes, disabled veterans who are eligible for Medicare can enroll in Medicare Advantage plans if they choose. Medicare Advantage plans are offered by private insurance companies and provide an alternative to traditional Medicare coverage. These plans may offer additional benefits, such as prescription drug coverage or dental and vision care, and may have lower out-of-pocket costs than traditional Medicare.

However, before enrolling in a Medicare Advantage plan, veterans should carefully review the plan’s benefits and coverage options to ensure that it meets their healthcare needs. Veterans who are enrolled in Medicare Advantage plans may also need to continue receiving care through the VA system, depending on their individual circumstances.

4. Can disabled veterans receive both VA disability compensation and Medicare benefits?

Yes, disabled veterans can receive both VA disability compensation and Medicare benefits. VA disability compensation is a tax-free benefit paid to veterans with service-connected disabilities, while Medicare is a federal health insurance program that provides coverage to eligible individuals. The two programs are separate and do not affect each other.

However, veterans who receive VA disability compensation may also be eligible for other healthcare benefits through the VA, which could affect their decision to enroll in Medicare. Veterans should carefully consider their healthcare needs and the benefits provided by each program before making a decision.

5. How can disabled veterans enroll in Medicare?

Disabled veterans who are eligible for Medicare can enroll in the program online, by mail, or in person at a Social Security office. To enroll online, veterans can visit the Medicare website and complete the online application. Veterans can also enroll by mail by completing a paper application and mailing it to the Social Security Administration.

Additionally, veterans can enroll in Medicare in person at a Social Security office. Veterans should bring their military discharge papers (DD-214), Social Security card, and any other applicable documentation when enrolling in person. Veterans who are unsure if they are eligible for Medicare or who have questions about the enrollment process can contact Social Security for assistance.

VA and Medicare (what Veterans need to know)

In conclusion, disabled veterans require Medicare to receive adequate medical care. These brave individuals have sacrificed their physical and mental health for the safety and protection of their country. It’s our responsibility to provide them with the support they need to live a fulfilling life after service.

Without Medicare, disabled veterans may not have access to necessary medical treatments, medications, and devices. It could lead to financial hardships and worsen their health conditions. The government needs to prioritize the healthcare needs of disabled veterans and ensure they have access to the best medical care possible.

In summary, disabled veterans have served their country with pride and honor, and they deserve access to quality healthcare. Medicare can provide them with the support they need to live a fulfilling life after service. Let’s show our gratitude by supporting policies that prioritize the healthcare needs of disabled veterans.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts