Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching retirement age and concerned about the potential impact of capital gains on your Medicare premiums? You’re not alone. Many Americans are unaware of the connection between their investment income and healthcare costs. In this article, we’ll explore how capital gains affect Medicare premiums and what steps you can take to mitigate any potential financial burden.

Do Capital Gains Affect Medicare Premiums?

Yes, your capital gains can affect your Medicare premiums. If your income, including capital gains, exceeds a certain threshold, you may be subject to higher Medicare premiums. In 2021, the threshold is $88,000 for individuals and $176,000 for couples filing jointly. If your income exceeds these thresholds, you may have to pay an Income Related Monthly Adjustment Amount (IRMAA) on top of your regular Medicare premiums.

Contents

- Do Capital Gains Affect Medicare Premiums?

- Frequently Asked Questions

- Do capital gains affect Medicare premiums?

- How do I calculate my MAGI for Medicare premiums?

- What are the income thresholds for Medicare premiums?

- Can I appeal my Medicare premiums if my income changes?

- Are there any strategies to reduce the impact of capital gains on Medicare premiums?

- Ways Capital Gains Can Affect Medicare Premiums and How to Fix That #shorts #medicare #retirement

Do Capital Gains Affect Medicare Premiums?

If you’re nearing retirement age, you might be wondering how your investment income will affect your Medicare premiums. Medicare is a federal health insurance program for people over 65 and those with certain disabilities. Medicare premiums are determined by a number of factors, including income. Capital gains are a type of investment income that can affect your Medicare premiums. Here’s what you need to know.

What are Capital Gains?

Capital gains are profits from the sale of a capital asset, such as stocks, bonds, or real estate. When you sell a capital asset for more than you paid for it, you have a capital gain. The amount of the gain is the difference between the purchase price and the selling price.

Short-term vs. Long-term Capital Gains

Capital gains are classified as either short-term or long-term, depending on how long you held the asset before selling it. If you held the asset for one year or less before selling it, it’s considered a short-term capital gain. If you held the asset for more than one year before selling it, it’s considered a long-term capital gain.

Capital Gains and Medicare Premiums

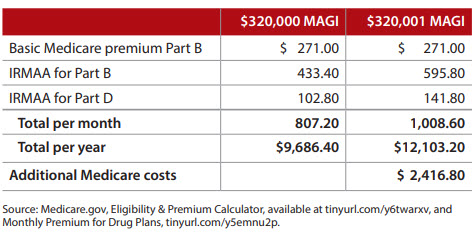

The amount of your capital gains can affect your Medicare premiums. If your income exceeds certain thresholds, you’ll pay higher premiums for Medicare Part B (which covers doctor visits and outpatient services) and Part D (which covers prescription drugs).

How are Medicare Premiums Calculated?

Medicare premiums are based on your modified adjusted gross income (MAGI). Your MAGI is your adjusted gross income (AGI) plus any tax-exempt interest you earned during the year. If you’re married and filing jointly, your MAGI includes your spouse’s income as well.

Medicare Part B Premiums

The standard Part B premium for 2021 is $148.50 per month. However, if your MAGI is above a certain amount, you’ll pay more. For individuals with a MAGI of $88,000 or less (or married couples with a MAGI of $176,000 or less), the standard premium applies. For those with a higher MAGI, the premium increases on a sliding scale.

Medicare Part D Premiums

The Part D premium is based on the plan you choose and your income. If your MAGI is above a certain amount, you’ll pay an additional amount on top of the plan premium. This additional amount is called the Income-Related Monthly Adjustment Amount (IRMAA).

Capital Gains and Premiums: How It Works

Income Thresholds for Medicare Premiums

The income thresholds for Medicare premiums are adjusted each year. For 2021, the income thresholds are:

– Single filers with a MAGI of $88,000 or less, or married couples filing jointly with a MAGI of $176,000 or less: Standard premium applies

– Single filers with a MAGI between $88,000 and $111,000, or married couples filing jointly with a MAGI between $176,000 and $222,000: Premium is $207.90 per month

– Single filers with a MAGI between $111,000 and $138,000, or married couples filing jointly with a MAGI between $222,000 and $276,000: Premium is $297.00 per month

– Single filers with a MAGI between $138,000 and $165,000, or married couples filing jointly with a MAGI between $276,000 and $330,000: Premium is $386.10 per month

– Single filers with a MAGI above $165,000, or married couples filing jointly with a MAGI above $330,000: Premium is $475.20 per month

Calculating the Impact of Capital Gains

To calculate the impact of your capital gains on your Medicare premiums, you’ll need to know your MAGI. You can calculate your MAGI by adding up your adjusted gross income and any tax-exempt interest you earned during the year. Then, add the amount of your capital gains to your MAGI.

If your MAGI is close to one of the income thresholds, your capital gains could push you over the edge into a higher premium bracket. For example, if you’re a single filer with a MAGI of $85,000 and you have $10,000 in capital gains, your MAGI would be $95,000. This would put you in the premium bracket for single filers with a MAGI between $88,000 and $111,000, which means you’d pay $207.90 per month instead of the standard premium.

Benefits of Capital Gains and Medicare Premiums

While capital gains can affect your Medicare premiums, they can also provide a source of income to help pay for healthcare costs. If you have a significant amount of investment income, you may be able to use it to offset the cost of higher premiums. Additionally, if you’re over 65 and have held your investments for more than a year, your capital gains will be taxed at a lower rate than short-term gains.

Capital Gains vs. Other Types of Income

It’s worth noting that capital gains aren’t the only type of income that can affect your Medicare premiums. Other types of income that count towards your MAGI include:

– Wages and salaries

– Self-employment income

– Rental income

– Pension income

– Social Security benefits (if you’re below full retirement age)

Bottom Line

Capital gains are a type of investment income that can affect your Medicare premiums. If your income exceeds certain thresholds, you’ll pay higher premiums for Medicare Part B and Part D. To calculate the impact of your capital gains on your premiums, you’ll need to know your MAGI. While capital gains can increase your premiums, they can also provide a source of income to help pay for healthcare costs.

Frequently Asked Questions

Below are some common questions and answers about whether capital gains affect Medicare premiums:

Capital gains from the sale of assets such as stocks, bonds, or real estate can affect your Medicare premiums. This is because Medicare uses your modified adjusted gross income (MAGI) to determine your premiums, and capital gains are included in your MAGI.

If your MAGI is above a certain threshold, you may have to pay a higher premium for Medicare Part B and Part D. However, the threshold amounts can change each year, so it’s important to stay up-to-date on the current income limits.

To calculate your MAGI for Medicare premiums, you’ll need to add up your adjusted gross income (AGI) plus any tax-exempt interest income you have and any excluded foreign income. Then, you’ll need to add back in any deductions you took for IRA contributions, student loan interest, or self-employment taxes. Finally, you’ll need to add any tax-exempt interest income from municipal bonds that you used to pay for Medicare premiums.

If you have capital gains, you’ll need to include those as well. You can use IRS Form 8962 to calculate your MAGI for Medicare purposes.

The income thresholds for Medicare premiums can change each year. For 2021, the thresholds are:

- $88,000 for individuals

- $176,000 for married couples filing jointly

If your MAGI is above these thresholds, you may have to pay a higher premium for Medicare Part B and Part D.

Yes, you can appeal your Medicare premiums if your income changes due to certain life-changing events, such as retirement or the death of a spouse. You’ll need to provide documentation of the event and your new income level to Medicare. If approved, your premiums will be adjusted based on your new income level.

It’s important to note that you can only appeal your premiums once per year, during the General Enrollment Period (January 1 – March 31).

There are a few strategies you can use to reduce the impact of capital gains on your Medicare premiums. One strategy is to sell assets with capital losses to offset the gains. Another strategy is to donate appreciated assets to charity instead of selling them, which can reduce your MAGI without triggering capital gains.

You may also want to consider working with a financial advisor or tax professional to develop a comprehensive plan for managing your income and assets in retirement to minimize the impact on your Medicare premiums.

Ways Capital Gains Can Affect Medicare Premiums and How to Fix That #shorts #medicare #retirement

In conclusion, it is clear that capital gains can impact Medicare premiums. As income increases, so does the cost of premiums. This means that if you have a significant increase in capital gains, you may see a corresponding increase in your Medicare premiums.

However, it is important to note that there are strategies you can use to minimize the impact of capital gains on your Medicare premiums. For example, you may be able to use a qualified charitable distribution or a donor-advised fund to reduce your taxable income and lower your premiums.

Ultimately, the best course of action will depend on your individual circumstances. If you are concerned about the impact of capital gains on your Medicare premiums, it may be helpful to speak with a financial advisor or tax professional who can provide guidance and help you develop a plan to minimize your costs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts