Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a government-funded health insurance program that provides coverage to people aged 65 or older, as well as those with certain disabilities. While Medicare covers a lot of medical costs, there are still out-of-pocket expenses that can add up. This is where Medigap and Medicare Advantage come in – both programs are designed to fill in the gaps left by Medicare. However, the difference between the two can be confusing, and it’s important to understand the pros and cons of each option before making a decision.

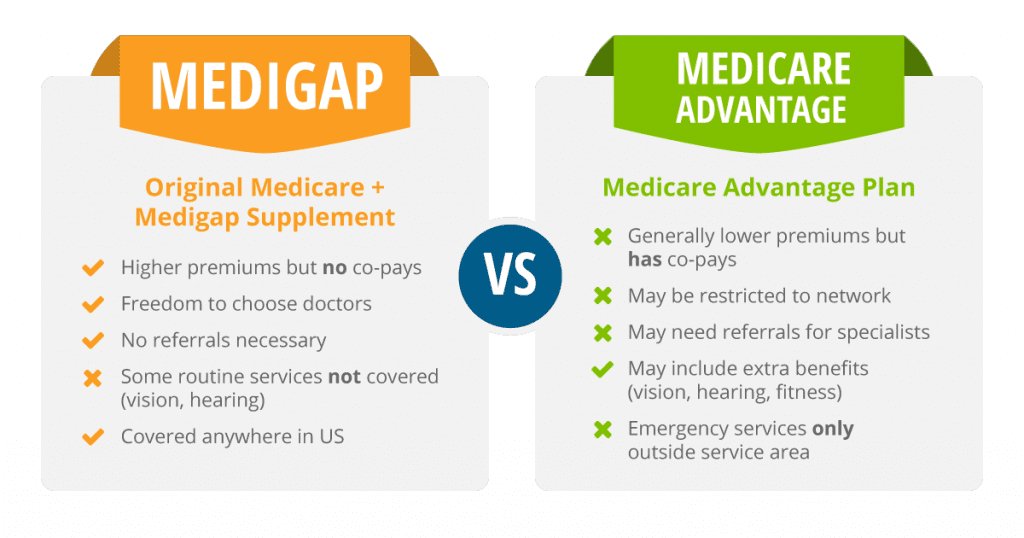

Medigap is a supplemental insurance policy that you can purchase from a private insurance company to help cover the costs that Medicare doesn’t. On the other hand, Medicare Advantage is an all-in-one alternative to traditional Medicare that is offered by private insurance companies. While both options have their benefits, they also have their drawbacks. Understanding the differences between Medigap and Medicare Advantage can help you make an informed decision about which option is right for you.

Medigap, also known as Medicare Supplement, is a private insurance policy that covers the “gaps” in Original Medicare, such as deductibles and coinsurance. On the other hand, Medicare Advantage, also known as Part C, is a comprehensive plan that replaces Original Medicare and often includes additional benefits like prescription drug coverage and dental care. While Medigap allows you to see any healthcare provider who accepts Medicare, Medicare Advantage requires you to use providers in the plan’s network.

Difference Between Medigap and Medicare Advantage

If you are a senior citizen or approaching retirement age, you may be wondering about the best way to manage your healthcare costs. Two popular options are Medigap and Medicare Advantage. While both programs are designed to cover healthcare expenses that Original Medicare does not cover, they differ in how they operate and the benefits they offer. In this article, we will explore the differences between Medigap and Medicare Advantage to help you decide which one is right for you.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, is a private insurance policy that you can purchase to supplement your Original Medicare coverage. Medigap policies cover the gaps in your healthcare costs that Original Medicare does not cover, such as deductibles, copayments, and coinsurance. Medigap policies are sold by private insurance companies and are standardized by the federal government, so each policy offers the same benefits regardless of the insurance company you purchase it from.

Medigap policies are designed to work with Original Medicare, so you must have both to enroll in Medigap. If you have a Medigap policy, it will pay its share of the Medicare-approved amount for covered healthcare costs, and then Medicare will pay its share. Medigap policies do not cover prescription drugs, so you will need to enroll in a separate Medicare Part D plan to get prescription drug coverage.

Benefits of Medigap

- Standardized benefits across all insurance companies

- Lower out-of-pocket costs for healthcare expenses

- No network restrictions

- Ability to see any doctor who accepts Medicare

Medigap VS Medicare Advantage

| Medigap | Medicare Advantage |

|---|---|

| Supplements Original Medicare | Replaces Original Medicare |

| No network restrictions | May have network restrictions |

| Standardized benefits across all insurance companies | Benefits vary by plan and insurance company |

| Higher premiums, but lower out-of-pocket costs | Lower premiums, but higher out-of-pocket costs |

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a private insurance plan that replaces Original Medicare. Medicare Advantage plans are offered by private insurance companies that contract with Medicare to provide all of your healthcare coverage, including hospital, medical, and prescription drug coverage. Medicare Advantage plans often include additional benefits that Original Medicare does not cover, such as vision, dental, and hearing care.

Medicare Advantage plans have network restrictions, meaning you must go to healthcare providers that are in the plan’s network to receive coverage. Some Medicare Advantage plans also require you to get a referral from your primary care physician to see a specialist. Medicare Advantage plans have different costs and benefits depending on the plan and insurance company you choose.

Benefits of Medicare Advantage

- All-in-one healthcare coverage

- Additional benefits not covered by Original Medicare

- Lower premiums than Medigap

- May include prescription drug coverage

Medicare Advantage VS Medigap

| Medicare Advantage | Medigap |

|---|---|

| Replaces Original Medicare | Supplements Original Medicare |

| May have network restrictions | No network restrictions |

| Benefits vary by plan and insurance company | Standardized benefits across all insurance companies |

| Lower premiums, but higher out-of-pocket costs | Higher premiums, but lower out-of-pocket costs |

Which one is right for you?

Choosing between Medigap and Medicare Advantage depends on your healthcare needs and preferences. If you prefer the flexibility of seeing any healthcare provider and want standardized benefits, Medigap may be the best option for you. If you want all-in-one healthcare coverage with additional benefits and lower premiums, Medicare Advantage may be the best option. Consider your healthcare needs and budget carefully before making a decision.

Conclusion

In conclusion, Medigap and Medicare Advantage are both great options for managing healthcare costs in retirement. While they both offer coverage for healthcare expenses that Original Medicare does not cover, they differ in how they operate and the benefits they offer. We hope this article has helped you understand the differences between Medigap and Medicare Advantage and choose the best option for your healthcare needs.

Contents

- Frequently Asked Questions

- What is the Difference Between Medigap and Medicare Advantage?

- What are the Benefits of Medigap?

- What are the Benefits of Medicare Advantage?

- Can I Have Both Medigap and Medicare Advantage?

- How Do I Decide Between Medigap and Medicare Advantage?

- Medicare Advantage vs Medicare Supplement Plans (Updated Review and Important Tips)

Frequently Asked Questions

What is the Difference Between Medigap and Medicare Advantage?

Medigap and Medicare Advantage are two different types of plans that provide coverage for healthcare costs. Medigap, also known as Medicare Supplement Insurance, is a private insurance policy that helps pay for costs not covered by Original Medicare. It covers things like deductibles, copays, and coinsurance. Medicare Advantage, on the other hand, is an all-in-one alternative to Original Medicare offered by private insurance companies. It includes all the benefits of Original Medicare, plus additional benefits such as prescription drug coverage.

Medigap plans work alongside Original Medicare, while Medicare Advantage plans replace Original Medicare. If you have Original Medicare and a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered healthcare costs, and then your Medigap policy will pay its share. If you have a Medicare Advantage plan, you’ll receive all your healthcare benefits through the plan, and the plan will pay for those benefits.

What are the Benefits of Medigap?

Medigap plans offer several benefits to Medicare beneficiaries. They provide coverage for costs that aren’t covered by Original Medicare, including deductibles, copays, and coinsurance. Some Medigap plans also offer coverage for healthcare services you might need while traveling outside the United States. By having a Medigap policy, you can have peace of mind knowing that you won’t be caught off guard by unexpected healthcare costs.

Another benefit of Medigap is that you get to choose your healthcare providers. There are no provider networks, which means you can see any doctor or healthcare provider who accepts Medicare. You don’t need a referral to see a specialist, and you can change healthcare providers at any time without needing to get prior approval from your insurance company.

What are the Benefits of Medicare Advantage?

Medicare Advantage plans have become increasingly popular in recent years, and for good reason. They offer a number of benefits that Original Medicare doesn’t provide, such as prescription drug coverage, vision and hearing services, and fitness programs. Many Medicare Advantage plans also offer additional benefits, such as transportation to medical appointments.

Another benefit of Medicare Advantage is that many plans have lower out-of-pocket costs than Original Medicare. Some plans also have a maximum out-of-pocket limit, which means that once you’ve reached that limit, you won’t have to pay anything for covered healthcare services for the rest of the year. This can provide peace of mind for those on a fixed income.

Can I Have Both Medigap and Medicare Advantage?

No, you cannot have both Medigap and Medicare Advantage at the same time. If you have a Medigap policy and decide to enroll in a Medicare Advantage plan, you will need to drop your Medigap policy. It’s important to note that you cannot use a Medigap policy to pay for out-of-pocket costs in a Medicare Advantage plan.

If you decide to leave a Medicare Advantage plan and return to Original Medicare, you may be able to purchase a Medigap policy. However, it’s important to do so during your Medigap Open Enrollment Period, which is a six-month period that begins the month you turn 65 and are enrolled in Medicare Part B.

How Do I Decide Between Medigap and Medicare Advantage?

Deciding between Medigap and Medicare Advantage can be a difficult choice, as both types of plans offer different benefits. It’s important to consider your healthcare needs and budget when making this decision.

If you want the flexibility to see any healthcare provider who accepts Medicare and don’t mind paying a higher monthly premium, a Medigap policy may be the right choice for you. If you’re looking for additional benefits, such as prescription drug coverage and vision services, and want to save money on out-of-pocket costs, a Medicare Advantage plan may be a better fit. It’s important to compare plans and costs before making a decision.

Medicare Advantage vs Medicare Supplement Plans (Updated Review and Important Tips)

In conclusion, understanding the difference between Medigap and Medicare Advantage is crucial for seniors who want to make the most out of their healthcare coverage. While both options offer additional benefits and coverage beyond Original Medicare, they operate differently. Medigap supplements your Original Medicare coverage, while Medicare Advantage replaces it with a private insurance plan.

When deciding which option is best for you, it’s important to consider factors such as your healthcare needs, budget, and preferred providers. Medigap plans typically offer more flexibility in terms of provider choice, while Medicare Advantage plans often have lower out-of-pocket costs.

Ultimately, the choice between Medigap and Medicare Advantage will depend on your individual circumstances and preferences. By carefully weighing the pros and cons of each option, you can choose the one that offers the most comprehensive and affordable coverage for your healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts