Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a government-funded health insurance program that provides coverage for Americans aged 65 and older, as well as younger individuals with certain disabilities or medical conditions. There are several different types of Medicare plans available, each with its own set of benefits and costs. In this article, we will be exploring the difference between two of the most popular types of Medicare plans – Medicare Parts G and N.

Medicare Part G and Part N are both comprehensive health insurance plans that cover a wide range of medical services and treatments. However, there are some key differences between the two plans, including their cost, coverage, and eligibility requirements. If you are considering enrolling in Medicare or are looking to switch to a different plan, it is important to understand the differences between these two options so that you can make an informed decision about which plan is right for you.

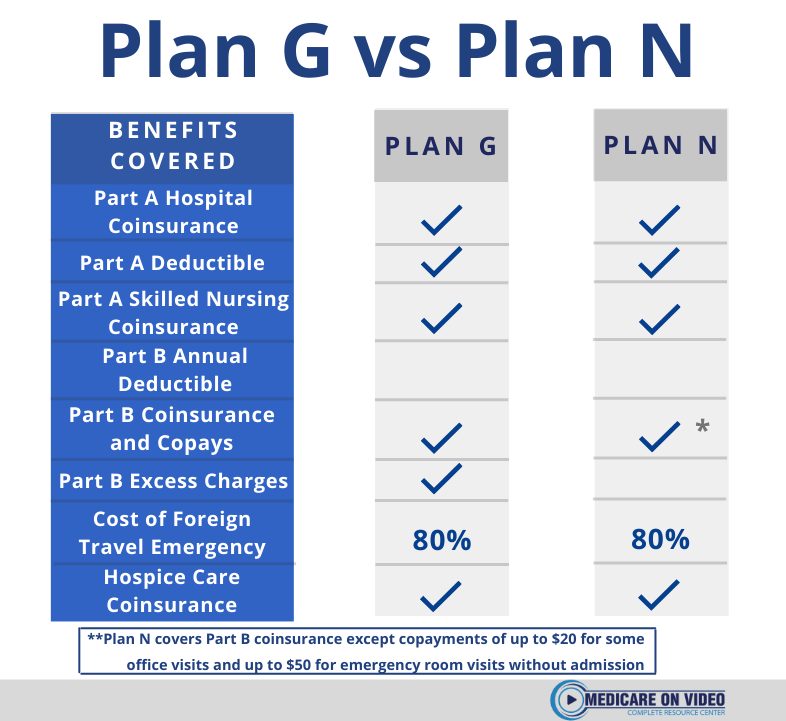

Medicare Supplement plans G and N are two of the ten standardized plans available to Medicare beneficiaries. Plan G offers more comprehensive coverage than Plan N, including coverage for Part B excess charges. However, Plan N has lower premiums and requires copayments for some services. Ultimately, the choice between the two plans will depend on an individual’s specific healthcare needs and budget.

Contents

Difference Between Medicare G and N

Medicare is a federal health insurance program for Americans aged 65 and over, as well as those with certain disabilities and chronic conditions. Medicare covers a range of medical services, including hospital stays, doctor visits, and prescription drugs. Two of the most popular Medicare plans are Medicare Supplement Plans G and N. Here are the key differences between the two plans.

Cost

Medicare Supplement Plan G is generally more expensive than Plan N. Plan G covers more medical costs than Plan N, so it tends to have higher monthly premiums. However, Plan G also has lower out-of-pocket costs than Plan N, which can save you money in the long run.

Plan N has lower monthly premiums than Plan G, but it also has higher out-of-pocket costs. You’ll need to pay a copayment for each doctor’s visit and emergency room visit with Plan N. However, if you don’t visit the doctor frequently, Plan N might be a good option for you.

Coverage

Both Plan G and Plan N cover a range of medical services, including hospital stays, doctor visits, and prescription drugs. However, Plan G covers more medical costs than Plan N. Plan G covers the Medicare Part B deductible, which is $203 in 2021. Plan N does not cover the Medicare Part B deductible, but it does cover most other medical costs.

Plan G also covers excess charges, which are additional charges that some doctors and hospitals may charge above the Medicare-approved amount. Plan N does not cover excess charges, so you’ll need to pay those out of pocket if your doctor or hospital charges them.

Benefits

One of the benefits of both Plan G and Plan N is that they allow you to see any doctor who accepts Medicare. You don’t need to choose a primary care physician or get referrals to see a specialist.

Plan G also has a few additional benefits that Plan N does not have. For example, Plan G covers the cost of blood transfusions, which can be expensive. Plan G also covers skilled nursing facility care, which is not covered by some other Medicare Supplement plans.

Enrollment

You can enroll in both Plan G and Plan N during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this time, you can switch from one Medicare Supplement plan to another without penalty.

If you’re new to Medicare, you can enroll in a Medicare Supplement plan during your initial enrollment period, which is the seven-month period that starts three months before your 65th birthday. If you miss your initial enrollment period, you may have to pay a higher premium when you do enroll.

Conclusion

In conclusion, Medicare Supplement Plan G and Plan N are both good options for seniors who want additional medical coverage beyond what Medicare provides. Plan G covers more medical costs than Plan N, but it also has higher monthly premiums. Plan N has lower monthly premiums, but it also has higher out-of-pocket costs. Ultimately, the plan you choose will depend on your individual healthcare needs and budget.

Frequently Asked Questions

What is the difference between Medicare G and N?

Medicare Supplement Plan G and Plan N are both popular options for beneficiaries who want additional coverage beyond Original Medicare. Plan G provides more comprehensive coverage than Plan N, but it also has a higher monthly premium. Plan N offers a lower premium but requires beneficiaries to pay a small copayment for some services.

Plan G covers all of the gaps in Original Medicare, including Part A and Part B deductibles, coinsurance, and excess charges. It also covers foreign travel emergency medical care. Plan N covers everything that Plan G covers, except for the Part B deductible and some copayments for doctor visits and emergency room visits.

Which plan offers the most coverage?

Medicare Supplement Plan G offers the most comprehensive coverage of any of the standardized Medigap plans. It covers all of the gaps in Original Medicare, including Part A and Part B deductibles, coinsurance, and excess charges. It also covers foreign travel emergency medical care.

Plan N is a close second in terms of coverage, but it does require beneficiaries to pay a small copayment for some services. However, Plan N does have a lower monthly premium than Plan G, so it may be a more affordable option for some beneficiaries.

Which plan is more affordable?

Medicare Supplement Plan N typically has a lower monthly premium than Plan G, but it does require beneficiaries to pay a small copayment for some services. However, the copayments are generally small and may be more affordable than the higher monthly premium for Plan G.

Ultimately, the cost of each plan will depend on a variety of factors, including where you live, your age, and your health status. It’s important to compare the costs and benefits of each plan carefully to determine which one is the most affordable option for you.

Can I switch from one plan to another?

Yes, you can switch from one Medicare Supplement plan to another at any time. However, if you want to switch to a plan with more comprehensive coverage, you may be subject to medical underwriting and could be denied coverage or charged a higher premium based on your health status.

If you want to switch to a plan with less coverage, you may be able to do so without medical underwriting. However, it’s important to carefully consider the costs and benefits of each plan before making a decision.

Which plan should I choose?

The best Medicare Supplement plan for you will depend on your individual needs and preferences. If you value comprehensive coverage and are willing to pay a higher monthly premium, Plan G may be the best option for you. If you’re looking for a more affordable plan and don’t mind paying a small copayment for some services, Plan N may be a better choice.

It’s important to compare the costs and benefits of each plan carefully and consider factors like your health status, budget, and travel plans before making a decision. You may also want to consult with a licensed insurance agent or financial advisor to help you make an informed decision.

In conclusion, when it comes to choosing between Medicare G and N, it all comes down to your individual needs. Medicare G offers more comprehensive coverage, including coverage for excess charges, foreign travel emergencies, and more. However, it also comes with a higher monthly premium. On the other hand, Medicare N offers lower monthly premiums and covers most of the same benefits as Medicare G, with the exception of excess charges and some copayments.

It is important to carefully consider your healthcare needs and budget when choosing between Medicare G and N. Consulting with a licensed insurance agent can help you better understand the specifics of each plan and make an informed decision. Remember, the right Medicare plan for you may not be the same as someone else’s, so take the time to evaluate your options and choose wisely.

Ultimately, whether you choose Medicare G or N, both plans offer valuable coverage options for seniors. With the peace of mind that comes from knowing you have adequate healthcare coverage, you can focus on enjoying your golden years and living life to the fullest.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts