Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you confused about the difference between Medicare and Bupa? You’re not alone. It can be challenging to navigate the world of healthcare, especially when it comes to understanding insurance plans. In this article, we’ll break down the differences between Medicare and Bupa, so you can make an informed decision about which plan is right for you. So, grab a cup of coffee and let’s dive in.

Difference Between Medicare and Bupa: Which One is Right for You?

Medicare and Bupa are two healthcare options available to individuals looking for medical coverage. While both provide coverage for medical expenses, there are significant differences in the way they operate. In this article, we will explore the differences between Medicare and Bupa, and help you decide which one is right for your needs.

What is Medicare?

Medicare is a government-funded health insurance program that provides coverage to eligible individuals in Australia. It covers hospital treatment, medical treatment, and some allied health services. Medicare is available to all Australian citizens, permanent residents, and some overseas visitors who meet the eligibility criteria.

There are two main parts to Medicare: Medicare Part A and Medicare Part B. Medicare Part A covers hospital treatment, while Medicare Part B covers medical treatment. Both parts of Medicare have specific benefits and limitations, and there are out-of-pocket costs associated with some services.

Benefits of Medicare

– Access to a wide range of medical services

– Lower out-of-pocket costs for medical treatment

– Coverage for hospital treatment

– Access to allied health services such as physiotherapy and podiatry

Limitations of Medicare

– Limited coverage for dental, optical, and other healthcare services

– Waiting periods for some services

– Out-of-pocket costs for some services

– Limited coverage for medical treatment outside of Australia

What is Bupa?

Bupa is a private health insurance company that provides coverage for medical expenses. It offers a range of health insurance products, including hospital cover, extras cover, and packaged cover. Bupa is available to anyone who is eligible for private health insurance in Australia.

Bupa provides coverage for a wide range of medical services, including hospital treatment, medical treatment, and allied health services. It offers a range of different levels of coverage, from basic to comprehensive, to suit the needs of different individuals.

Benefits of Bupa

– Access to a wide range of medical services

– Lower out-of-pocket costs for medical treatment

– Coverage for hospital treatment

– Access to allied health services such as physiotherapy and podiatry

– Coverage for dental, optical, and other healthcare services

Limitations of Bupa

– Higher premiums than Medicare

– Waiting periods for some services

– Limited coverage for medical treatment outside of Australia

Medicare vs. Bupa

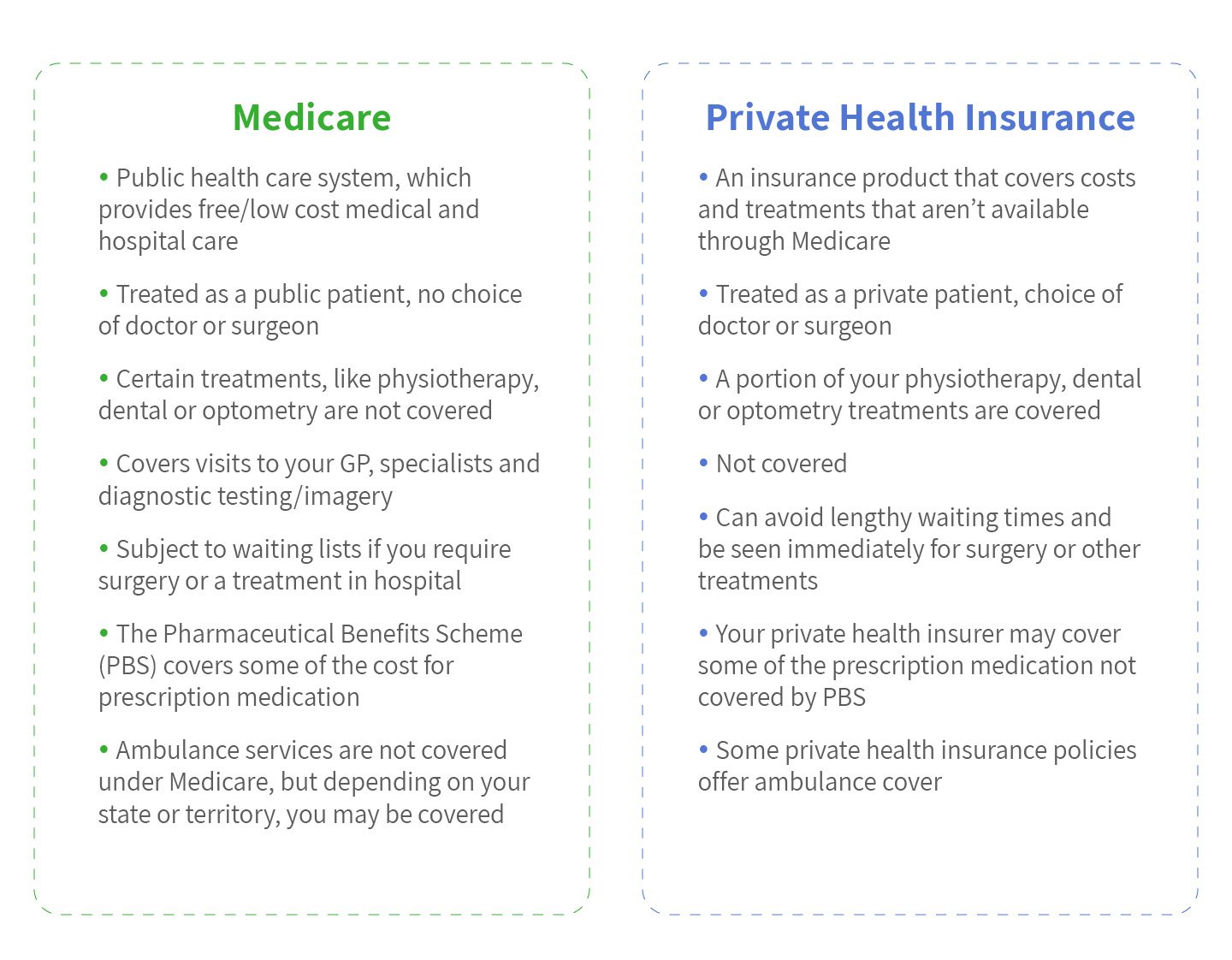

When deciding between Medicare and Bupa, there are several factors to consider. Here are some key differences between the two:

Coverage

Medicare provides coverage for hospital treatment, medical treatment, and some allied health services. Bupa provides coverage for a wider range of services, including hospital treatment, medical treatment, allied health services, and dental, optical, and other healthcare services.

Costs

Medicare has lower out-of-pocket costs for medical treatment, while Bupa has higher premiums but lower out-of-pocket costs overall. It’s important to consider your budget and healthcare needs when deciding which option is right for you.

Eligibility

Medicare is available to all Australian citizens, permanent residents, and some overseas visitors who meet the eligibility criteria. Bupa is available to anyone who is eligible for private health insurance in Australia.

Flexibility

Bupa offers a range of different levels of coverage, from basic to comprehensive, while Medicare has specific benefits and limitations. This means that Bupa may be a better option if you require more flexibility in your coverage.

Conclusion

Both Medicare and Bupa provide coverage for medical expenses, but there are significant differences in the way they operate. When deciding between the two, it’s important to consider your healthcare needs, budget, and eligibility. By understanding the differences between Medicare and Bupa, you can make an informed decision about which option is right for you.

Contents

- Frequently Asked Questions

- What is the difference between Medicare and Bupa?

- Can I have both Medicare and Bupa?

- How much does Bupa cost compared to Medicare?

- What are the benefits of having Bupa in addition to Medicare?

- Do I need Bupa if I already have Medicare?

- Private Health Insurance vs. Medicare: Who pays for what? – HCF Health Cover

Frequently Asked Questions

What is the difference between Medicare and Bupa?

Medicare is a government-funded health insurance program for Australian citizens and permanent residents. It covers essential medical services, including hospital treatments, doctor consultations, and certain medications. On the other hand, Bupa is a private health insurance provider that offers a range of health insurance plans. Bupa’s insurance plans cover a wider range of services, including hospital and extras cover, which includes dental, optical, and physiotherapy services.

While Medicare covers essential medical services, it does not cover all medical expenses. Medicare also has waiting periods for certain services and does not cover elective surgeries. Bupa’s insurance plans, on the other hand, provide more comprehensive coverage that includes elective surgeries and extras cover.

Can I have both Medicare and Bupa?

Yes, you can have both Medicare and Bupa. In fact, many Australians choose to have both to ensure they have comprehensive coverage for their healthcare needs. Medicare covers essential medical services, while Bupa’s insurance plans can cover additional services that Medicare does not.

If you have both Medicare and Bupa, Medicare will usually pay for your medical expenses first. Bupa will then cover any additional services that are not covered by Medicare.

How much does Bupa cost compared to Medicare?

The cost of Bupa depends on the level of coverage you choose. Bupa offers a range of health insurance plans with varying levels of coverage and premiums. The cost of Bupa’s insurance plans can be higher than the cost of Medicare, but they also provide more comprehensive coverage.

Medicare is funded by the government and is free for Australian citizens and permanent residents. However, Medicare does not cover all medical expenses, so many Australians choose to have private health insurance, such as Bupa, to ensure they have comprehensive coverage.

What are the benefits of having Bupa in addition to Medicare?

Having Bupa in addition to Medicare provides several benefits. Bupa’s insurance plans offer more comprehensive coverage than Medicare, including elective surgeries and extras cover, such as dental, optical, and physiotherapy services.

Bupa also offers more flexibility in terms of choosing your healthcare provider and accessing healthcare services. With Bupa, you can choose your doctor, hospital, and healthcare provider, giving you more control over your healthcare.

Do I need Bupa if I already have Medicare?

While Medicare covers essential medical services, it does not cover all medical expenses. Bupa’s insurance plans offer more comprehensive coverage, including elective surgeries and extras cover, such as dental, optical, and physiotherapy services.

If you want to have more control over your healthcare and ensure you have comprehensive coverage for your healthcare needs, it may be worth considering Bupa in addition to Medicare. However, whether you need Bupa or not depends on your individual healthcare needs and budget. It’s important to compare different health insurance plans and choose the one that best meets your needs.

Private Health Insurance vs. Medicare: Who pays for what? – HCF Health Cover

In conclusion, while both Medicare and Bupa offer healthcare coverage, they have distinct differences. Medicare is a government-funded program that provides coverage for eligible individuals aged 65 and above, while Bupa is a private health insurance provider that offers a range of healthcare plans for individuals and families.

One key difference between Medicare and Bupa is the level of coverage offered. Medicare provides basic coverage for hospital stays, doctor visits, and some medical procedures. In contrast, Bupa offers more comprehensive coverage that includes extras such as dental, optical, and physiotherapy services.

Another difference between the two is the cost. Medicare is funded by the government and is available to eligible individuals free of charge. In contrast, Bupa requires individuals to pay a premium for their healthcare coverage, with the cost varying depending on the level of coverage selected.

Ultimately, the choice between Medicare and Bupa will depend on an individual’s healthcare needs and personal circumstances. While Medicare may be a more cost-effective option for those aged 65 and above, Bupa may be a better choice for those seeking more comprehensive coverage and extras such as dental or optical services.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts