Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare and bundled payment are two healthcare terms that often confuse people. While both are related to healthcare, they differ greatly in their structure and purpose. Understanding the difference between these two terms is crucial, especially for those who depend on healthcare services.

Medicare is a federal health insurance program that is primarily designed for people aged 65 and above. It offers coverage for hospitalization, medical care, prescription drugs, and other healthcare services. On the other hand, bundled payment is a payment model that focuses on paying healthcare providers a fixed amount for all the services they provide to a patient during a specified period.

Medicare is a federal health insurance program that provides coverage for people above 65 years of age, people with disabilities, and those with end-stage renal disease. On the other hand, bundled payment is a healthcare payment model that pays a fixed amount for all the services required for a specific condition or treatment. The key difference between Medicare and bundled payment is that Medicare is an insurance program, while bundled payment is a payment model. Medicare covers a wide range of healthcare services, while bundled payment covers a specific set of services for a particular condition or treatment.

Difference Between Medicare and Bundled Payments Explained

What Is Medicare?

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, younger people with disabilities, and people with end-stage renal disease. The program is funded by taxes and premiums paid by beneficiaries, and it covers a range of medical services and treatments, including hospital stays, doctor visits, and prescription drugs.

Benefits of Medicare

Medicare provides a range of benefits, including:

- Coverage for hospital stays

- Coverage for doctor visits and preventive care

- Coverage for prescription drugs

- Coverage for durable medical equipment

- Coverage for home health care

Medicare Vs. Private Health Insurance

One of the main differences between Medicare and private health insurance is that Medicare is a federal program, while private health insurance is offered by private companies. Medicare also has a standard set of benefits that are available to all beneficiaries, while private health insurance plans can vary in terms of coverage and cost.

What Are Bundled Payments?

Bundled payments are a type of payment model where healthcare providers are paid a fixed amount for a group of related services and treatments, rather than being paid for each individual service. The goal of bundled payments is to reduce healthcare costs and improve the quality of care by incentivizing providers to work together to provide more efficient and effective care.

Benefits of Bundled Payments

Some of the benefits of bundled payments include:

- Reduced healthcare costs

- Improved care coordination and communication between providers

- Increased focus on quality of care

- Greater transparency in pricing and billing

- Incentives for providers to work together and reduce unnecessary services

Bundled Payments Vs. Fee-for-Service

Bundled payments are often compared to fee-for-service payment models, where providers are paid for each individual service they provide. One of the main differences is that fee-for-service models can incentivize providers to perform more services, even if they are unnecessary, while bundled payments incentivize providers to work together to provide more efficient and effective care.

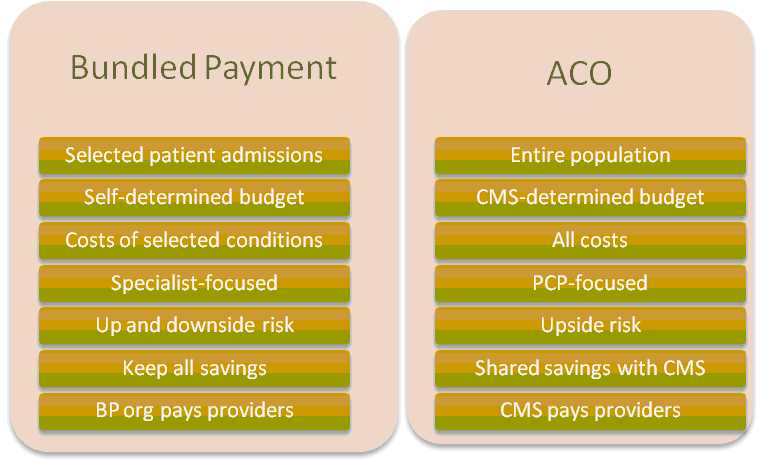

Key Differences Between Medicare and Bundled Payments

While Medicare and bundled payments are both related to healthcare payments, they are different in a number of ways. Some of the key differences include:

Payment Model

Medicare is a fee-for-service payment model, while bundled payments are a type of alternative payment model.

Covered Services

Medicare covers a broad range of medical services and treatments, while bundled payments typically only cover a specific set of related services.

Provider Incentives

In fee-for-service models like Medicare, providers are often incentivized to perform more services, while bundled payments incentivize providers to work together to provide more efficient and effective care.

Costs

The costs of Medicare are typically covered by taxes and premiums paid by beneficiaries, while the costs of bundled payments are typically covered by a fixed payment from the payer.

Quality of Care

Both Medicare and bundled payments are focused on improving the quality of care, but bundled payments may be more effective in incentivizing providers to work together to achieve that goal.

Conclusion

In conclusion, Medicare and bundled payments are two different types of healthcare payment models that have different goals and incentives. While Medicare is a fee-for-service model that covers a broad range of services, bundled payments are a type of alternative payment model that focuses on improving the quality of care by incentivizing providers to work together to provide more efficient and effective care. Understanding the differences between these two payment models is important for healthcare providers, payers, and patients alike.

Frequently Asked Questions

Here are some common questions about the difference between Medicare and Bundled Payment:

What is Medicare?

Medicare is a federal health insurance program for people who are 65 or older, as well as for some younger people with disabilities or certain medical conditions. It is funded by taxes and premiums and covers a range of medical services, including hospital care, doctor visits, and prescription drugs.

Medicare is divided into several parts, including Part A, which covers hospital stays and some skilled nursing care, and Part B, which covers doctor visits and other outpatient services. Medicare also offers Part C, or Medicare Advantage, which is a private health insurance option, and Part D, which covers prescription drugs.

What is Bundled Payment?

Bundled Payment is a payment model in which healthcare providers are paid a set amount for all the services needed to treat a patient for a particular condition or medical event, such as a hip replacement or a heart attack. This includes all the services provided by hospitals, doctors, and other healthcare professionals involved in the patient’s care.

The goal of Bundled Payment is to encourage collaboration among healthcare providers and to reduce costs by incentivizing them to work together to provide high-quality care in an efficient and effective way.

What is the difference between Medicare and Bundled Payment?

The main difference between Medicare and Bundled Payment is that Medicare is an insurance program that pays for individual medical services, while Bundled Payment is a payment model that pays for all the services needed to treat a patient for a specific medical event or condition.

While Medicare covers a wide range of medical services, Bundled Payment is focused on specific conditions or medical events, such as joint replacements or heart attacks. Medicare is funded by taxes and premiums, while Bundled Payment is typically funded by private insurers or healthcare providers.

Which healthcare providers participate in Bundled Payment?

A wide range of healthcare providers can participate in Bundled Payment, including hospitals, doctors, and other healthcare professionals. These providers work together to provide high-quality care for a specific medical event or condition, and are paid a set amount for all the services needed to treat the patient.

Bundled Payment is often used for common procedures, such as joint replacements or heart attacks, and can also be used for chronic conditions, such as diabetes or kidney disease.

What are the benefits of Bundled Payment?

Bundled Payment has several benefits, including improved collaboration among healthcare providers, reduced costs, and better outcomes for patients. By incentivizing healthcare providers to work together to provide high-quality care in an efficient and effective way, Bundled Payment can help improve the overall quality of care and reduce healthcare costs.

It can also help reduce the number of hospital readmissions and complications, which can further reduce costs and improve patient outcomes. Additionally, Bundled Payment can help healthcare providers better understand the true cost of care and identify areas where they can improve efficiency and reduce waste.

What is the difference between Medicare and Medicaid?

In conclusion, understanding the difference between Medicare and bundled payment is crucial for anyone who wants to make informed decisions about their healthcare. While Medicare is a government-funded program that offers healthcare coverage to seniors and those with certain disabilities, bundled payment is a payment model that rewards healthcare providers for providing high-quality care at a lower cost.

One of the key benefits of Medicare is that it provides comprehensive coverage for a wide range of healthcare services. However, it can also be complex and difficult to navigate, with different rules and regulations depending on the specific plan. On the other hand, bundled payment offers a more streamlined and simplified approach to payment, which can lead to more efficient and effective care.

Ultimately, both Medicare and bundled payment have their pros and cons, and it’s important to carefully consider your options before making any decisions about your healthcare. By doing your research and consulting with healthcare professionals, you can make the best choice for your individual needs and preferences.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts