Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a government-sponsored health insurance program for senior citizens and qualifying individuals with disabilities. While Medicare covers many medical services, there are gaps in coverage that require additional insurance. This is where Medicare Advantage and Medicare Supplement come into play. Both offer additional coverage, but they differ in significant ways. In this article, we’ll explore the differences between Medicare Advantage and Medicare Supplement to help you make the best decision for your healthcare needs.

Contents

- Difference Between Medicare Advantage and Medicare Supplement

- Frequently Asked Questions

- What is Medicare Advantage?

- What is Medicare Supplement?

- What are the key differences between Medicare Advantage and Medicare Supplement?

- How do I choose between Medicare Advantage and Medicare Supplement?

- Can I switch between Medicare Advantage and Medicare Supplement?

- Medicare Advantage vs Medicare Supplement Plans (Updated Review and Important Tips)

Difference Between Medicare Advantage and Medicare Supplement

Medicare Advantage and Medicare Supplement are two different types of health insurance plans available to seniors in the United States. Both options have their benefits and drawbacks, and it is important to understand the differences between these two plans before making a decision.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of health insurance plan offered by private insurance companies. This plan provides all the benefits of Original Medicare, including hospital and medical coverage, but may also include additional benefits such as vision, hearing, and dental services. Medicare Advantage plans typically have lower out-of-pocket costs than Original Medicare, but may also have more restrictions on which doctors and hospitals you can see.

If you choose a Medicare Advantage plan, you will still need to pay your monthly Medicare Part B premium, as well as any additional premium for the Medicare Advantage plan. Some Medicare Advantage plans also require you to use doctors and hospitals within a specific network, so it is important to check if your preferred providers are covered by the plan.

What is Medicare Supplement?

Medicare Supplement, also known as Medigap, is a type of health insurance plan that is designed to cover the gaps in Original Medicare coverage. This plan is offered by private insurance companies and can help pay for things like deductibles, copayments, and coinsurance that are not covered by Original Medicare. Medicare Supplement plans do not provide additional benefits like vision, hearing, or dental coverage.

If you choose a Medicare Supplement plan, you will need to pay a monthly premium in addition to your Medicare Part B premium. Medicare Supplement plans are standardized by the government, which means that the benefits are the same across all plans, regardless of which insurance company you choose.

Benefits of Medicare Advantage

One of the main benefits of Medicare Advantage is that it often has lower out-of-pocket costs than Original Medicare. This can be especially beneficial for seniors who require a lot of medical care. Medicare Advantage plans may also include additional benefits like vision, hearing, and dental coverage, which are not covered by Original Medicare.

Another benefit of Medicare Advantage is that many plans include prescription drug coverage. This can be especially helpful for seniors who take a lot of medications, as it can help reduce the cost of their prescriptions.

Benefits of Medicare Supplement

One of the main benefits of Medicare Supplement is that it provides more comprehensive coverage than Original Medicare alone. This can be especially beneficial for seniors who require a lot of medical care and want to avoid high out-of-pocket costs.

Another benefit of Medicare Supplement is that the plans are standardized, which means that you can compare plans across different insurance companies and choose the one that best meets your needs.

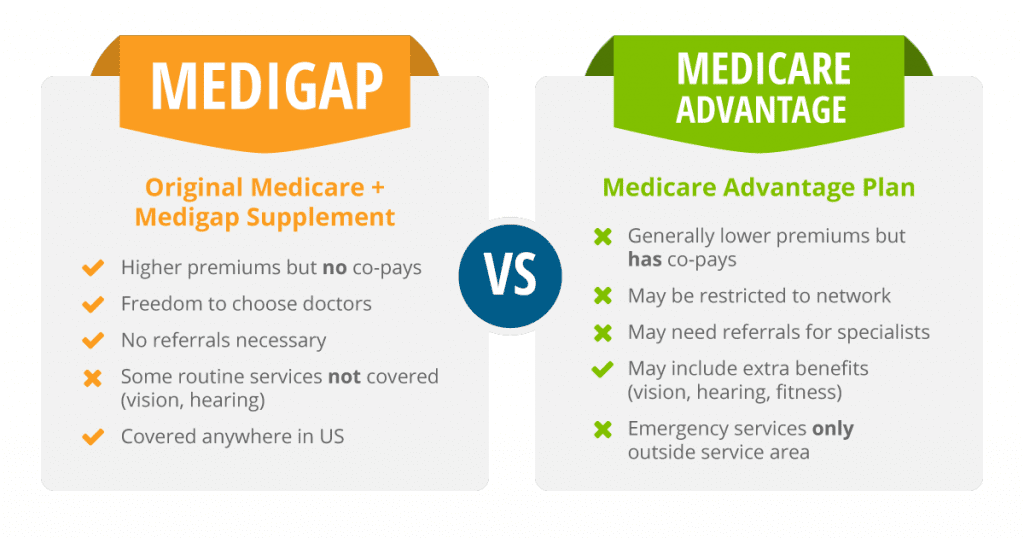

Medicare Advantage vs. Medicare Supplement

When deciding between Medicare Advantage and Medicare Supplement, it is important to consider your individual needs and preferences. Here are some key differences to keep in mind:

– Medicare Advantage plans often have lower out-of-pocket costs than Medicare Supplement plans, but may have more restrictions on which doctors and hospitals you can see.

– Medicare Supplement plans provide more comprehensive coverage than Medicare Advantage, but do not include additional benefits like vision, hearing, or dental coverage.

– Medicare Advantage plans may include prescription drug coverage, while Medicare Supplement plans do not.

How to Choose Between Medicare Advantage and Medicare Supplement

When choosing between Medicare Advantage and Medicare Supplement, it is important to consider your individual needs and preferences. Here are some factors to consider:

– Your health and medical needs: If you require a lot of medical care, Medicare Supplement may be a better option as it provides more comprehensive coverage. If you are generally healthy and do not require a lot of medical care, Medicare Advantage may be a more affordable option.

– Your budget: Medicare Advantage plans often have lower out-of-pocket costs than Medicare Supplement plans, but may also have higher premiums. It is important to consider both the monthly premiums and the potential out-of-pocket costs when making a decision.

– Your preferred doctors and hospitals: If you have a preferred doctor or hospital that is not covered by a Medicare Advantage plan, you may want to consider Medicare Supplement instead.

Conclusion

Medicare Advantage and Medicare Supplement are two different types of health insurance plans available to seniors in the United States. Both options have their benefits and drawbacks, and it is important to carefully consider your individual needs and preferences when making a decision. By understanding the differences between these two plans, you can make an informed decision about which option is right for you.

Frequently Asked Questions

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare that is offered by private insurance companies. Medicare Advantage plans are required to cover everything that Original Medicare covers, but they may also offer additional benefits such as vision, dental, and prescription drug coverage. Medicare Advantage plans often have lower out-of-pocket costs than Original Medicare, but they may also have more restrictive provider networks.

One potential advantage of Medicare Advantage is that it may offer more comprehensive coverage than Original Medicare. However, it is important to carefully review the details of any Medicare Advantage plan before enrolling to ensure that it meets your specific healthcare needs.

What is Medicare Supplement?

Medicare Supplement, also known as Medigap, is a type of insurance policy that is designed to help cover the out-of-pocket costs associated with Original Medicare. Medicare Supplement plans are offered by private insurance companies and are designed to work alongside Original Medicare to cover things like deductibles, copayments, and coinsurance.

Unlike Medicare Advantage plans, Medicare Supplement plans do not offer additional benefits beyond what is covered by Original Medicare. However, they may offer more flexibility in terms of provider choice, as you can typically see any doctor who accepts Medicare.

What are the key differences between Medicare Advantage and Medicare Supplement?

The key differences between Medicare Advantage and Medicare Supplement are the types of coverage they offer and the way they work with Original Medicare. Medicare Advantage plans offer comprehensive coverage that may include additional benefits beyond what is covered by Original Medicare, while Medicare Supplement plans are designed to help cover the out-of-pocket costs associated with Original Medicare.

Medicare Advantage plans often have lower out-of-pocket costs than Original Medicare, but they may also have more restrictive provider networks. Medicare Supplement plans offer more flexibility in terms of provider choice, but they may also have higher premiums.

How do I choose between Medicare Advantage and Medicare Supplement?

Choosing between Medicare Advantage and Medicare Supplement depends on your individual healthcare needs and preferences. If you are looking for comprehensive coverage that includes additional benefits beyond what is covered by Original Medicare, a Medicare Advantage plan may be a good option. If you prefer to stick with Original Medicare but want help with out-of-pocket costs, a Medicare Supplement plan may be a better choice.

When evaluating your options, it is important to consider factors such as premiums, deductibles, copayments, and provider networks. You should also review the specific benefits offered by each plan to ensure that they align with your healthcare needs.

Can I switch between Medicare Advantage and Medicare Supplement?

In most cases, you can switch between Medicare Advantage and Medicare Supplement during certain enrollment periods. The Annual Enrollment Period (AEP) occurs every year from October 15 to December 7, during which time you can switch from one Medicare Advantage plan to another, switch from Medicare Advantage to Original Medicare with a Medicare Supplement plan, or switch from Original Medicare with a Medicare Supplement plan to a Medicare Advantage plan.

There are also special enrollment periods (SEPs) that allow you to make changes outside of the AEP if you meet certain criteria, such as moving to a new service area or losing other health coverage. It is important to carefully review the rules and restrictions associated with each enrollment period to ensure that you are eligible to make changes to your coverage.

Medicare Advantage vs Medicare Supplement Plans (Updated Review and Important Tips)

In conclusion, understanding the difference between Medicare Advantage and Medicare Supplement is crucial for anyone looking to enroll in Medicare. While both plans offer additional benefits beyond Original Medicare, they differ in how they provide coverage and what they cover. It’s important to carefully evaluate your healthcare needs and budget to determine which plan is right for you.

Medicare Advantage plans often have lower out-of-pocket costs and may offer additional benefits such as dental and vision coverage. However, they also typically have more restrictive provider networks and may require referrals to see specialists. Medicare Supplement plans, on the other hand, allow you to see any provider who accepts Medicare and often offer more comprehensive coverage, but may come with higher monthly premiums.

Ultimately, choosing between Medicare Advantage and Medicare Supplement depends on your individual healthcare needs and financial situation. It’s important to review all available options and consult with a licensed insurance agent or Medicare counselor before making a decision.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts