Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you feeling confused about whether you can have both Medicare Part A and private insurance? Well, you’re not alone! Many people wonder if they can have both types of coverage and how it would work. The good news is that in most cases, it is possible to have both Medicare Part A and private insurance.

In this article, we’ll explore the ins and outs of having both types of coverage. We’ll take a look at the different scenarios where it might be beneficial, as well as some potential drawbacks to consider. So, if you’re wondering if you can have Medicare Part A and private insurance, keep reading to find out more!

Yes, you can have both Medicare Part A and private insurance. In fact, it’s common for people to have both. Medicare Part A is hospital insurance and may not cover all of your medical expenses. Private insurance can help cover those additional costs. However, if you have a Medicare Advantage plan, you cannot have another health insurance plan. It’s important to review your coverage options and choose the plan that best fits your needs and budget.

Can I Have Medicare Part A and Private Insurance?

Understanding Medicare Part A

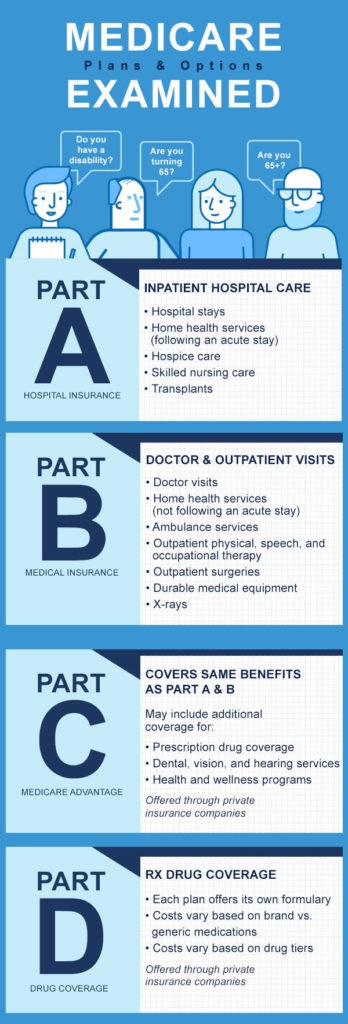

Medicare Part A is the hospital insurance program provided by the federal government in the United States. It is available to individuals who are 65 years of age or older, as well as those with certain disabilities. Medicare Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and home health care. Most individuals are automatically enrolled in Medicare Part A when they turn 65 or become eligible for Social Security disability benefits.

Benefits of Medicare Part A

Medicare Part A covers many of the expenses associated with hospitalization and other types of medical care. This can include hospital stays, skilled nursing facility care, and hospice care. The program also covers some home health care services, such as physical therapy, occupational therapy, and speech-language pathology services. Additionally, Medicare Part A includes coverage for some preventive services, such as flu shots and mammograms.

Limitations of Medicare Part A

While Medicare Part A provides comprehensive coverage for many types of medical care, there are some limitations to the program. For example, it does not cover most outpatient services, such as doctor visits or prescription drugs. Additionally, there are limits on the amount of time an individual can spend in a hospital or skilled nursing facility under Medicare Part A. Finally, some services may be subject to deductibles, copayments, or coinsurance.

Understanding Private Insurance

Private insurance is any type of insurance that is provided by a private company, rather than by the government. In the United States, private insurance is often provided by employers as a benefit to their employees. However, individuals can also purchase private insurance policies on their own.

Benefits of Private Insurance

Private insurance can provide many different types of coverage, depending on the policy. Some policies cover only basic medical care, while others provide more comprehensive coverage for things like dental care, vision care, and prescription drugs. Additionally, private insurance may offer more flexibility in terms of choosing doctors and hospitals, and may provide access to services that are not covered by Medicare.

Limitations of Private Insurance

Like Medicare Part A, private insurance policies also have limitations. For example, some policies may have deductibles, copayments, or coinsurance that must be paid by the individual before certain services are covered. Additionally, private insurance policies may not cover all types of medical care, and may exclude coverage for pre-existing conditions. Finally, private insurance can be expensive, especially for individuals who do not receive it as a benefit from their employer.

Can I Have Both Medicare Part A and Private Insurance?

Yes, it is possible to have both Medicare Part A and private insurance. This is known as having dual coverage. In fact, many individuals choose to have both types of coverage in order to maximize their benefits and minimize their out-of-pocket costs.

Benefits of Having Dual Coverage

By having both Medicare Part A and private insurance, individuals can often access a wider range of medical services, and may have more flexibility in choosing doctors and hospitals. Additionally, having dual coverage can help to cover the costs of services that are not covered by Medicare, such as dental care, vision care, and prescription drugs. Finally, having dual coverage can help to minimize out-of-pocket costs by covering deductibles, copayments, and coinsurance.

Limitations of Having Dual Coverage

While having dual coverage can be beneficial, it can also be complicated. For example, individuals with dual coverage may need to coordinate their benefits between their Medicare and private insurance policies. Additionally, some private insurance policies may require individuals to use certain doctors or hospitals in order to receive coverage, which can limit their options. Finally, having dual coverage can be expensive, as individuals may need to pay premiums for both Medicare and their private insurance policy.

The Bottom Line

In conclusion, it is possible to have both Medicare Part A and private insurance. This can provide individuals with access to a wider range of medical services, and can help to minimize out-of-pocket costs. However, having dual coverage can also be complicated and expensive. Individuals should carefully consider their options and weigh the benefits and limitations of each type of coverage before making a decision.

Contents

- Frequently Asked Questions

- Can I have Medicare Part A and private insurance?

- Will my private insurance pay for services that Medicare doesn’t cover?

- Do I have to pay for both Medicare Part A and my private insurance?

- Can I drop my private insurance if I have Medicare Part A?

- What happens if my private insurance doesn’t cover a service that Medicare does?

- Do I Need Medicare If I Have Private Insurance? 🤔

Frequently Asked Questions

Many people wonder if they can have both Medicare Part A and private insurance. Here are some frequently asked questions about this topic:

Can I have Medicare Part A and private insurance?

Yes, you can have both Medicare Part A and private insurance. Medicare Part A is the hospital insurance portion of Medicare, and it is usually free for people who have worked and paid Medicare taxes for at least 10 years. Private insurance can supplement your Medicare coverage and provide additional benefits.

However, if you have private insurance, it is important to make sure that your providers accept both your private insurance and Medicare. You should also check with your private insurance provider to see if they require you to enroll in Medicare Part A in order to keep your private insurance coverage.

Will my private insurance pay for services that Medicare doesn’t cover?

It depends on the type of private insurance you have. Some private insurance plans, such as Medicare Advantage plans, cover the same services as Medicare Part A and Part B, as well as additional benefits like vision, dental, and hearing coverage. Other private insurance plans may only cover services that Medicare doesn’t cover, such as prescription drugs.

It’s important to review the details of your private insurance plan to understand what services are covered and how they work with Medicare. You can also contact your insurance company or a licensed insurance agent for help understanding your coverage options.

Do I have to pay for both Medicare Part A and my private insurance?

Yes, you will usually have to pay for both Medicare Part A and your private insurance. Medicare Part A is usually free for people who have worked and paid Medicare taxes for at least 10 years, but you may still have to pay a deductible and coinsurance for hospital stays and other services. Private insurance premiums, deductibles, and other costs vary depending on the plan you choose.

However, having both Medicare Part A and private insurance can help you minimize your out-of-pocket costs for medical care by covering services that Medicare doesn’t cover or providing additional benefits.

Can I drop my private insurance if I have Medicare Part A?

Yes, you can drop your private insurance if you have Medicare Part A. However, it’s important to carefully review the details of your private insurance policy before making any changes to your coverage. Some private insurance plans may require you to have Medicare Part A in order to keep your coverage, while others may offer additional benefits that you may not want to lose.

If you decide to drop your private insurance, you may want to consider enrolling in a Medicare Advantage plan or a Medicare Supplement plan to help fill the gaps in your Medicare coverage. You can also contact a licensed insurance agent for help understanding your coverage options.

What happens if my private insurance doesn’t cover a service that Medicare does?

If your private insurance doesn’t cover a service that Medicare does, you may still be able to receive the service through Medicare. Medicare will pay for services that are medically necessary and covered by Medicare, even if your private insurance won’t cover them.

However, you may still be responsible for paying any deductibles, coinsurance, or other costs associated with the service. It’s important to review the details of your private insurance policy and Medicare coverage to understand how they work together and what your out-of-pocket costs may be.

Do I Need Medicare If I Have Private Insurance? 🤔

In conclusion, it is possible to have Medicare Part A and private insurance at the same time. This can be beneficial for those who need additional coverage beyond what Medicare offers, such as prescription drug coverage or more extensive hospital stays. However, it is important to carefully consider the costs and benefits of each plan and ensure that they work together seamlessly to provide comprehensive coverage.

Before enrolling in both Medicare Part A and private insurance, it is important to do your research and compare different plans. This will help you find the best options that meet your individual needs and budget. Additionally, it is important to understand how your plans will work together and what costs you may be responsible for.

Overall, having both Medicare Part A and private insurance can provide additional peace of mind and coverage for your healthcare needs. By taking the time to carefully evaluate your options and choose the right plans, you can ensure that you have the best possible coverage for your unique needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts