Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you wondering if it’s possible to have both Medicare and private insurance? The answer is yes, but there are certain rules and regulations you should be aware of. Many people have both types of insurance to ensure they have comprehensive coverage for their healthcare needs.

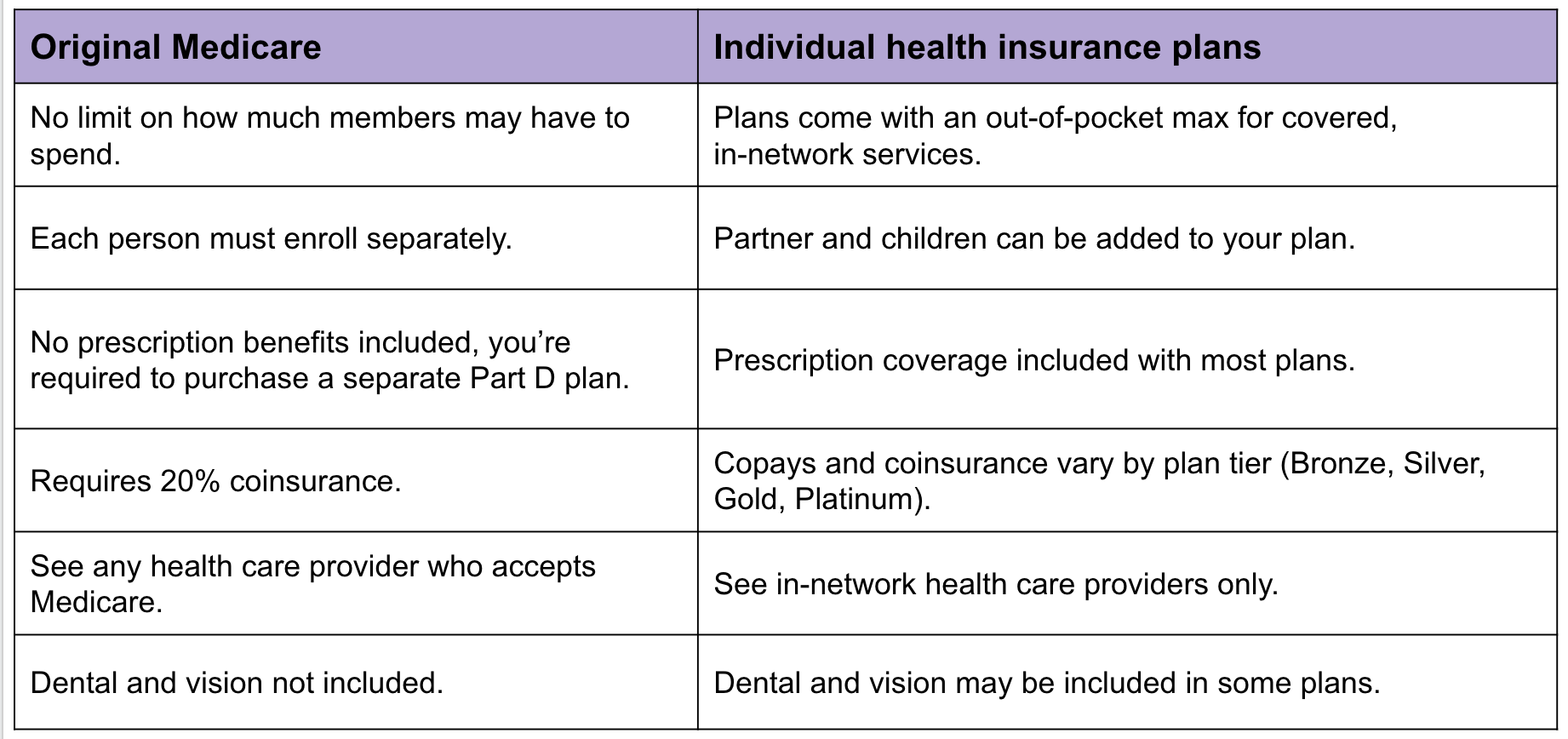

Medicare is a federal health insurance program for people who are 65 or older, as well as certain younger people with disabilities. Private insurance, on the other hand, is offered by private companies and can provide additional coverage beyond what Medicare offers. Keep reading to learn more about the pros and cons of having both types of insurance and how to navigate the process.

Yes, you can have both Medicare and private insurance. However, it is important to understand how both plans will work together. Medicare will be your primary insurance, while your private insurance will be secondary. This means that Medicare will pay for its share of covered services first, and then your private insurance will pay for any remaining costs. It is important to review your coverage options and speak with your healthcare providers to ensure you have the best coverage for your needs.

Contents

- Can I Have Medicare and Private Insurance?

- Frequently Asked Questions

- Can I Have Medicare and Private Insurance?

- What are the Different Types of Private Insurance that I Can Have with Medicare?

- Do I Need Private Insurance if I Have Medicare?

- How can I Determine if I Need Private Insurance with Medicare?

- What Happens if I Have Both Medicare and Private Insurance and I Need Medical Services?

- Medicare vs Private Insurance – What makes more sense in 2022?

Can I Have Medicare and Private Insurance?

Medicare is a federal health insurance program for people who are 65 years or older, and for younger people with certain disabilities. Private insurance, on the other hand, is provided by private companies and can be purchased by anyone who wants coverage. But can you have both?

Medicare Advantage vs. Private Insurance

Medicare Advantage plans are a type of Medicare plan that is offered by private insurance companies. These plans provide all of the benefits of Original Medicare, but may also include additional benefits like dental, vision, and prescription drug coverage. Many Medicare Advantage plans also have lower out-of-pocket costs than Original Medicare.

Private insurance, on the other hand, is not part of the Medicare program. These plans are offered by private companies and can provide coverage for a variety of medical services, including hospital stays, doctor visits, and prescription drugs. Private insurance plans may also offer additional benefits like wellness programs, gym memberships, and alternative therapies.

The Benefits of Having Both

Having both Medicare and private insurance can be beneficial for some people. For example, if you have a Medicare Advantage plan and also have private insurance, you may have access to even more benefits. Private insurance may cover services that are not covered by your Medicare Advantage plan, such as chiropractic care or acupuncture.

Having both types of insurance can also help you save money on out-of-pocket costs. If you have a Medicare Advantage plan with a high deductible, for example, your private insurance may be able to cover some or all of the costs until you reach your deductible.

The Drawbacks of Having Both

While there are benefits to having both Medicare and private insurance, there are also some drawbacks to consider. One potential downside is that you may end up paying more in premiums and fees. Private insurance plans can be expensive, and adding a second insurance plan on top of Medicare can be even more costly.

Another potential issue is that having both types of insurance can be confusing. You may need to keep track of multiple deductibles, co-pays, and coverage limits, which can be difficult to manage.

How to Decide If You Should Have Both

Deciding whether to have both Medicare and private insurance will depend on your individual needs and circumstances. If you have a chronic medical condition that requires frequent medical care, having both types of insurance may be beneficial.

On the other hand, if you are generally healthy and do not require a lot of medical care, having both types of insurance may not be necessary. It may be more cost-effective to stick with one type of insurance and pay out-of-pocket for any services that are not covered.

Final Thoughts

In summary, you can have both Medicare and private insurance. There are benefits and drawbacks to having both, so it is important to carefully consider your options and choose what is best for your individual situation. If you are unsure whether to have both types of insurance, talk to a licensed insurance agent or financial advisor who can help guide you through the decision-making process.

References:

- Medicare.gov: What’s Medicare?

- Healthcare.gov: Types of Health Insurance

Frequently Asked Questions

Can I Have Medicare and Private Insurance?

Yes, you can have both Medicare and private insurance. This is known as dual coverage. Dual coverage can be beneficial as it can cover some of the expenses that Medicare may not cover, such as dental, vision, and prescription drug costs. However, you should be aware that having dual coverage may also mean paying two separate premiums.

It is important to note that when you have both Medicare and private insurance, you must inform your healthcare providers which insurance you want to use for each service. Medicare is the primary payer, which means it will pay for the services first, and then private insurance will cover any remaining costs.

What are the Different Types of Private Insurance that I Can Have with Medicare?

There are several types of private insurance that you can have with Medicare. These include Medicare Advantage plans, Medicare Supplement Insurance (Medigap) policies, and employer-sponsored health plans. Medicare Advantage plans (Part C) are offered by private insurance companies and provide additional coverage such as dental, vision, and hearing services. Medigap policies are also offered by private insurance companies and help pay for some of the costs that Medicare doesn’t cover. Employer-sponsored health plans are provided by employers to their employees and can include both medical and prescription drug coverage.

It is important to research and compare the different types of private insurance available to you to determine which one best meets your healthcare needs and budget.

Do I Need Private Insurance if I Have Medicare?

While it is not required to have private insurance if you have Medicare, it can be beneficial. Medicare only covers certain healthcare services and may not cover all of your medical expenses. Private insurance can provide additional coverage for services such as dental, vision, and prescription drugs. Additionally, private insurance can help cover the costs that Medicare doesn’t cover, such as deductibles, copayments, and coinsurance.

It is important to note that if you decide to enroll in a Medicare Advantage plan, you will need to have both Medicare Part A and Part B to be eligible.

How can I Determine if I Need Private Insurance with Medicare?

Determining if you need private insurance with Medicare depends on your healthcare needs and budget. If you have high medical expenses or require services that are not covered by Medicare, private insurance may be beneficial. Additionally, if you want to have more control over your healthcare options, private insurance can provide additional coverage and benefits.

It is recommended that you research and compare the different types of private insurance available to you to determine which one best meets your healthcare needs and budget. Additionally, you can speak with a licensed insurance agent to help guide you through the decision-making process.

What Happens if I Have Both Medicare and Private Insurance and I Need Medical Services?

If you have both Medicare and private insurance and need medical services, you must inform your healthcare providers which insurance you want to use for each service. Medicare is the primary payer, which means it will pay for the services first, and then private insurance will cover any remaining costs.

It is important to note that if you have a Medicare Advantage plan, you may be limited to using healthcare providers within the plan’s network. If you receive healthcare services outside of the plan’s network, you may be responsible for paying additional costs. It is recommended that you review your plan’s network and coverage options before receiving medical services.

Medicare vs Private Insurance – What makes more sense in 2022?

In conclusion, the answer to the question of whether you can have both Medicare and private insurance is a resounding yes. It is entirely possible to have both forms of coverage and is, in fact, a popular option for many seniors. Having both Medicare and private insurance can provide a range of benefits, including more extensive coverage, lower out-of-pocket costs, and access to a broader network of healthcare providers.

However, it is important to note that having both forms of coverage can also be more complicated and may require additional effort to manage. It is essential to carefully review your policies and ensure that the coverage you receive from each plan does not overlap or leave gaps in your healthcare coverage. Additionally, you may need to coordinate with both your Medicare and private insurance providers to ensure that your claims are processed correctly and your benefits are maximized.

In the end, the decision of whether to have both Medicare and private insurance ultimately comes down to your individual needs and preferences. If you are looking for comprehensive coverage and are willing to put in the extra effort to manage multiple plans, having both forms of insurance may be the right choice for you. However, if you prefer to keep things simple and streamlined, sticking with one type of coverage may be the better option.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts