Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that primarily covers people who are 65 years or older. But, did you know that it also provides coverage to those with disabilities? If you are under 65 and have a disability, you may qualify for Medicare.

Qualifying for Medicare can be a complicated process, especially if you are disabled and not sure where to start. In this article, we will explore the eligibility criteria for Medicare and outline the steps you need to take to enroll in the program. Let’s dive in!

Yes, if you have a disability and are under 65 years old, you may qualify for Medicare. You must have received Social Security Disability Insurance (SSDI) benefits for at least 24 months to be eligible for Medicare. If you have End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS), you may be eligible for Medicare immediately. Contact the Social Security Administration for more information on eligibility and enrollment.

Contents

- Do You Qualify for Medicare if You Are Disabled?

- Who is Eligible for Medicare if You Are Disabled?

- What Benefits Are Available for Medicare if You Are Disabled?

- Medicare vs. Medicaid: What’s the Difference?

- How to Apply for Medicare if You Are Disabled

- Medicare Advantage Plans for People with Disabilities

- Medicare Supplement Plans for People with Disabilities

- Conclusion

- Frequently Asked Questions

Do You Qualify for Medicare if You Are Disabled?

If you are disabled, you may have questions about whether or not you qualify for Medicare. Medicare is a federal health insurance program that provides coverage to people who are 65 years old and older or have certain disabilities. In this article, we will discuss the eligibility requirements for Medicare if you are disabled and what benefits are available to you.

Who is Eligible for Medicare if You Are Disabled?

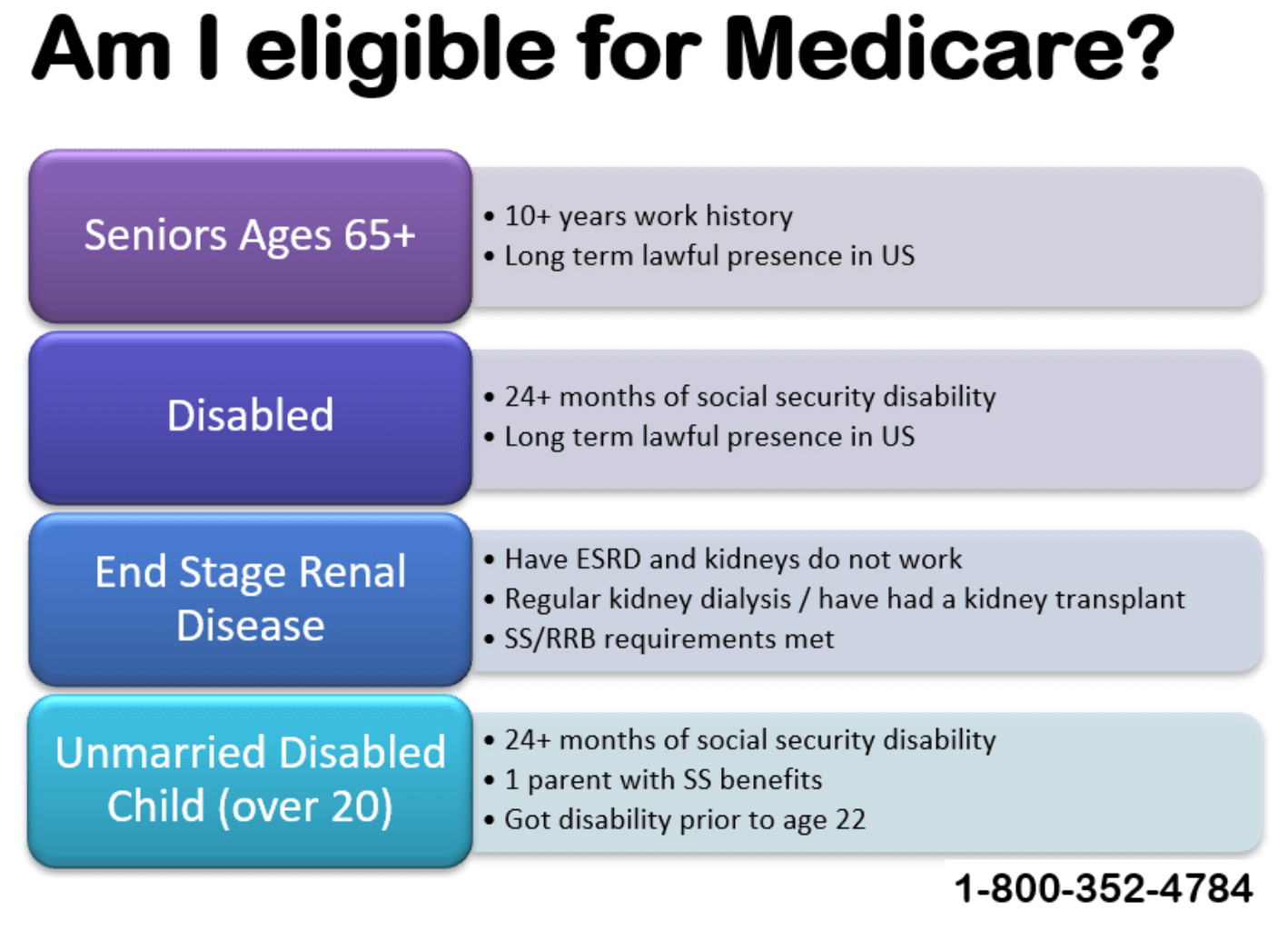

To be eligible for Medicare if you are disabled, you must meet one of the following criteria:

1. You have been receiving Social Security Disability Insurance (SSDI) benefits for at least 24 months.

2. You have a disability that is considered end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease.

If you meet one of these criteria, you are eligible for Medicare. It’s important to note that if you have ESRD or ALS, there is no waiting period for Medicare coverage.

What Benefits Are Available for Medicare if You Are Disabled?

If you are eligible for Medicare due to a disability, you will have access to the same benefits as those who are eligible due to age. These benefits include:

1. Part A: Hospital insurance that covers inpatient care, skilled nursing facility care, hospice care, and home health care.

2. Part B: Medical insurance that covers doctor’s visits, outpatient care, medical equipment, and preventive services.

3. Part C: Medicare Advantage plans that are offered by private insurance companies and provide all of the benefits of Parts A and B, as well as additional benefits such as vision, hearing, and dental.

4. Part D: Prescription drug coverage that helps pay for the cost of prescription medications.

Medicare vs. Medicaid: What’s the Difference?

It’s important to note the difference between Medicare and Medicaid. Medicare is a federal health insurance program that provides coverage to people who are 65 years old and older or have certain disabilities. Medicaid is a joint federal and state program that provides health coverage to people with low income.

If you are eligible for both Medicare and Medicaid, you will have access to more benefits and services. Medicaid can help pay for Medicare premiums, deductibles, and coinsurance.

How to Apply for Medicare if You Are Disabled

If you are receiving SSDI benefits, you will automatically be enrolled in Medicare after 24 months. If you have ESRD or ALS, you can apply for Medicare immediately.

To apply for Medicare, you can visit your local Social Security Administration office, call 1-800-772-1213, or apply online at www.ssa.gov.

Medicare Advantage Plans for People with Disabilities

Medicare Advantage plans are offered by private insurance companies and provide all of the benefits of Parts A and B, as well as additional benefits such as vision, hearing, and dental. These plans may be a good option for people with disabilities who want additional benefits that are not covered by traditional Medicare.

When choosing a Medicare Advantage plan, it’s important to consider the plan’s network of doctors and hospitals, the cost of premiums and copays, and the availability of additional benefits.

Medicare Supplement Plans for People with Disabilities

Medicare Supplement plans, also known as Medigap plans, are offered by private insurance companies and provide additional coverage for out-of-pocket costs that are not covered by traditional Medicare. These plans may be a good option for people with disabilities who have high medical expenses.

When choosing a Medicare Supplement plan, it’s important to consider the plan’s coverage options, the cost of premiums, and the availability of additional benefits.

Conclusion

If you are disabled, you may be eligible for Medicare. To be eligible, you must meet one of the criteria for disability and apply for coverage. Medicare provides coverage for hospital stays, doctor’s visits, prescription medications, and more. If you are eligible for both Medicare and Medicaid, you will have access to even more benefits and services. Consider your options carefully when choosing a Medicare plan to ensure that you have the coverage you need.

Frequently Asked Questions

1. Do You Qualify for Medicare if You Are Disabled?

Yes, you can qualify for Medicare if you are disabled. However, there are certain requirements that you must meet in order to be eligible.

To qualify for Medicare if you are disabled, you must have received Social Security disability benefits for at least 24 months. You must also be under the age of 65 and have a qualifying disability, which is determined by the Social Security Administration.

2. What is the Difference Between Medicare and Medicaid?

Medicare and Medicaid are both government-sponsored health insurance programs, but they serve different populations.

Medicare is a federal program that provides health insurance to people who are 65 or older, as well as to people with certain disabilities. Medicaid, on the other hand, is a joint federal and state program that provides health insurance to people with low incomes and limited resources.

3. What Does Medicare Cover?

Medicare covers a wide range of medical services and supplies, including hospitalization, doctor visits, preventive care, prescription drugs, and more.

Medicare is divided into four parts: Part A, which covers hospitalization and inpatient care; Part B, which covers doctor visits and outpatient care; Part C, which is also known as Medicare Advantage and provides additional benefits; and Part D, which covers prescription drugs.

4. How Much Does Medicare Cost?

The cost of Medicare varies depending on the specific plan you choose and your income level.

Most people do not have to pay a premium for Medicare Part A, but there is a monthly premium for Part B. The cost of Part B varies based on your income, but most people pay around $148.50 per month in 2021. There are also additional costs for Medicare Advantage and Part D plans.

5. Can You Have Other Insurance Alongside Medicare?

Yes, you can have other insurance alongside Medicare. Many people have additional coverage through a private insurance plan, such as a Medicare Supplement or a Medicare Advantage plan.

You can also have coverage through an employer-sponsored plan or through Medicaid. However, it is important to make sure that your other insurance does not conflict with Medicare and that you understand how the two policies work together.

In conclusion, if you are disabled and under the age of 65, you may qualify for Medicare benefits. It is important to note that you must have been receiving Social Security Disability Insurance (SSDI) for at least 24 months before you are eligible to enroll. However, those with end-stage renal disease or Amyotrophic Lateral Sclerosis (ALS) may be eligible for Medicare immediately upon diagnosis.

Medicare can provide important health care coverage for individuals with disabilities, including hospital stays, doctor visits, prescription drug coverage, and more. It is essential to understand the eligibility requirements and enrollment process to ensure that you receive the benefits you need.

If you have questions about Medicare and disability, you can visit the official Medicare website, speak with a healthcare provider, or contact a Medicare representative for assistance. Remember, Medicare can be a valuable resource for those with disabilities, providing access to essential healthcare services and treatments.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts