Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Florida is a popular retirement destination for many Americans. It boasts of its sunny beaches, warm weather, and a low cost of living. With this in mind, it’s not surprising that many retirees wonder about their healthcare options, particularly Medicare. So, does Florida have Medicare? Let’s dive into this topic to help you make an informed decision regarding your healthcare needs in the Sunshine State.

Medicare is a federal health insurance program that covers millions of Americans aged 65 or older, as well as people with certain disabilities. While Medicare is a federal program, its implementation is done at the state level. This means that Medicare beneficiaries in Florida may have different options and benefits than those in other states. Let’s explore what this means for you as a Medicare beneficiary in Florida.

Yes, Florida has Medicare. Medicare is a federal health insurance program that is available to people who are 65 or older, as well as younger people with certain disabilities. In Florida, Medicare is administered by the Centers for Medicare & Medicaid Services (CMS), a federal agency. Medicare covers a wide range of medical services, including hospitalization, doctor visits, and prescription drugs.

Contents

- Does Florida Have Medicare?

- Frequently Asked Questions

- Does Florida Have Medicare?

- What Is the Difference Between Medicare and Medicaid in Florida?

- What Are the Medicare Advantage Plans Available in Florida?

- What Is the Medicare Savings Program in Florida?

- What Is the Medicare Part D Prescription Drug Program in Florida?

- Are Florida Medicare Advantage Plans Too Good to Pass Up?

Does Florida Have Medicare?

Medicare is a federal health insurance program for people who are 65 or older, have certain disabilities, or have end-stage renal disease. With its comprehensive coverage, it helps millions of Americans to access medical services. However, it is important to understand how Medicare works in different states, including Florida. In this article, we will discuss whether Florida has Medicare and how it works in the state.

Overview of Medicare in Florida

Florida is a state that has a large population of people aged 65 and over. According to the Census Bureau, in 2019, Florida had a population of over 21 million, and 20.9% of them were 65 or older. As such, Medicare is an essential program in the state. In Florida, Medicare is administered by the federal government through the Centers for Medicare & Medicaid Services (CMS).

Medicare in Florida is divided into four parts: Part A, Part B, Part C, and Part D. Part A covers hospital stays, hospice care, and some home health care services. Part B covers doctor’s visits, outpatient care, and some preventive services. Part C, also known as Medicare Advantage, is a private insurance option that provides all the benefits of Part A and Part B, and often includes prescription drug coverage and other services. Part D is a stand-alone prescription drug plan that helps pay for medications.

Benefits of Medicare in Florida

Medicare provides a range of benefits to Floridians, including:

- Coverage for hospital stays, doctor’s visits, and other medical services

- Access to preventive services, such as flu shots and cancer screenings

- Options for private insurance through Medicare Advantage plans

- Access to prescription drug coverage through Part D plans

- Financial protection from high medical costs

Medicare beneficiaries in Florida also have access to a range of health care providers, including doctors, hospitals, and other health care facilities. Medicare is widely accepted in the state, and most health care providers participate in the program.

How to Qualify for Medicare in Florida

To qualify for Medicare in Florida, you must meet certain eligibility criteria. Generally, you are eligible for Medicare if:

- You are 65 or older

- You have certain disabilities

- You have end-stage renal disease

If you are already receiving Social Security or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Parts A and B when you turn 65. If you are not receiving these benefits, you can sign up for Medicare during your Initial Enrollment Period.

Medicare vs. Medicaid in Florida

Medicaid is a joint federal and state program that provides health coverage to people with low income. In Florida, Medicaid is administered by the Florida Agency for Health Care Administration (AHCA). Unlike Medicare, which is available to people who are 65 or older, Medicaid is available to people of all ages who meet certain income and eligibility criteria.

Some people may be eligible for both Medicare and Medicaid, which is known as dual eligibility. If you are dual eligible in Florida, you may be able to access additional benefits, such as dental care, vision care, and transportation services.

Conclusion

In conclusion, Florida has Medicare, which is an essential program for the state’s large population of older adults. Medicare provides comprehensive health insurance coverage to Floridians, including hospital stays, doctor’s visits, and prescription drug coverage. To qualify for Medicare in Florida, you must meet certain eligibility criteria. If you are dual eligible for Medicare and Medicaid, you may be able to access additional benefits. Overall, Medicare is an important program in Florida that provides financial protection and access to essential health care services.

Frequently Asked Questions

Does Florida Have Medicare?

Yes, Florida has Medicare. Medicare is a federal health insurance program that provides coverage for people who are 65 years or older, people with certain disabilities, and people with end-stage renal disease. In Florida, Medicare is administered by the Centers for Medicare and Medicaid Services (CMS), a division of the Department of Health and Human Services.

Medicare in Florida covers a range of medical services, including hospital stays, doctor visits, and prescription drugs. Medicare also offers several different plans, such as Original Medicare, Medicare Advantage, and Medicare Supplement, which provide different levels of coverage and benefits. If you are a Florida resident and are eligible for Medicare, you can enroll in the program by contacting the Social Security Administration or visiting the Medicare website.

What Is the Difference Between Medicare and Medicaid in Florida?

While Medicare is a federal health insurance program, Medicaid is a joint federal-state program that provides health coverage for people with low income and limited resources. In Florida, the Medicaid program is administered by the Agency for Health Care Administration (AHCA).

The main difference between Medicare and Medicaid in Florida is that Medicare provides coverage for people who are 65 years or older, people with certain disabilities, and people with end-stage renal disease, while Medicaid provides coverage for people with low income and limited resources, regardless of their age or health status. Additionally, while Medicare is funded by the federal government, Medicaid is funded jointly by the federal government and the state of Florida.

What Are the Medicare Advantage Plans Available in Florida?

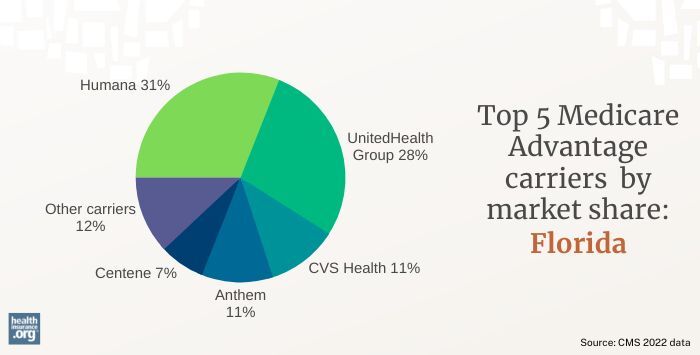

Medicare Advantage plans, also known as Medicare Part C, are a type of Medicare plan offered by private insurance companies in Florida. These plans provide all the benefits of Original Medicare, plus additional benefits such as vision, hearing, and dental coverage. In Florida, there are several Medicare Advantage plans available, including HMOs, PPOs, and Special Needs Plans (SNPs).

When choosing a Medicare Advantage plan in Florida, it is important to consider factors such as the plan’s network of providers, prescription drug coverage, and out-of-pocket costs. You can compare Medicare Advantage plans in Florida by using the Medicare Plan Finder tool on the Medicare website or by contacting a licensed insurance agent.

What Is the Medicare Savings Program in Florida?

The Medicare Savings Program is a program in Florida that helps people with limited income and resources pay for their Medicare premiums and other out-of-pocket costs. The program is funded by the federal government, but it is administered by the state of Florida through the Department of Children and Families (DCF).

To qualify for the Medicare Savings Program in Florida, you must meet certain income and asset requirements. There are several different levels of the program, each with different income and asset limits. If you qualify for the program, you may be eligible to receive assistance with your Medicare premiums, deductibles, coinsurance, and copayments.

What Is the Medicare Part D Prescription Drug Program in Florida?

The Medicare Part D prescription drug program is a federal program that provides coverage for prescription drugs to people who are enrolled in Medicare. In Florida, the program is administered by private insurance companies that have contracts with Medicare.

To enroll in the Medicare Part D prescription drug program in Florida, you must be enrolled in either Original Medicare or a Medicare Advantage plan that does not provide prescription drug coverage. Once enrolled, you can choose from a variety of prescription drug plans offered by different insurance companies. Each plan has a different list of covered drugs and different cost-sharing requirements, so it is important to compare plans carefully before choosing one.

Are Florida Medicare Advantage Plans Too Good to Pass Up?

In conclusion, Florida does offer Medicare as a healthcare option for its residents. This program provides coverage for individuals who are eligible due to their age, disability, or certain medical conditions. Beneficiaries can receive coverage for hospital stays, doctor visits, prescription drugs, and other necessary medical services.

It’s important to note that there are different types of Medicare plans available in Florida, including Original Medicare, Medicare Advantage, and Medicare Supplement plans. Each plan has its own benefits and costs, so it’s important to do your research and choose the option that best fits your needs and budget.

Overall, having access to Medicare in Florida can provide peace of mind and help ensure that individuals receive the necessary medical care they need. Whether you’re a retiree, disabled, or have certain medical conditions, Medicare can be a valuable resource for managing healthcare costs and improving your overall quality of life.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts