Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare and FICA are two terms that are often used in the world of finance and healthcare. While they may sound similar, they are actually quite different. In this article, we will explore the differences between Medicare and FICA, and what they mean for you.

First, let’s start with Medicare. Medicare is a federal program that provides health insurance to people who are 65 or older, as well as to those with certain disabilities or illnesses. It is funded through payroll taxes, premiums, and general government revenue. FICA, on the other hand, stands for the Federal Insurance Contributions Act, which is a payroll tax that funds both Social Security and Medicare. Understanding the differences between these two terms is crucial for anyone who wants to make informed decisions about their healthcare and finances.

Difference Between Medicare and FICA

Medicare and FICA are two terms that are often used interchangeably, but they have different meanings and functions. Understanding the differences between Medicare and FICA is important, especially for those who are approaching retirement age. In this article, we will explore the differences between Medicare and FICA.

What is FICA?

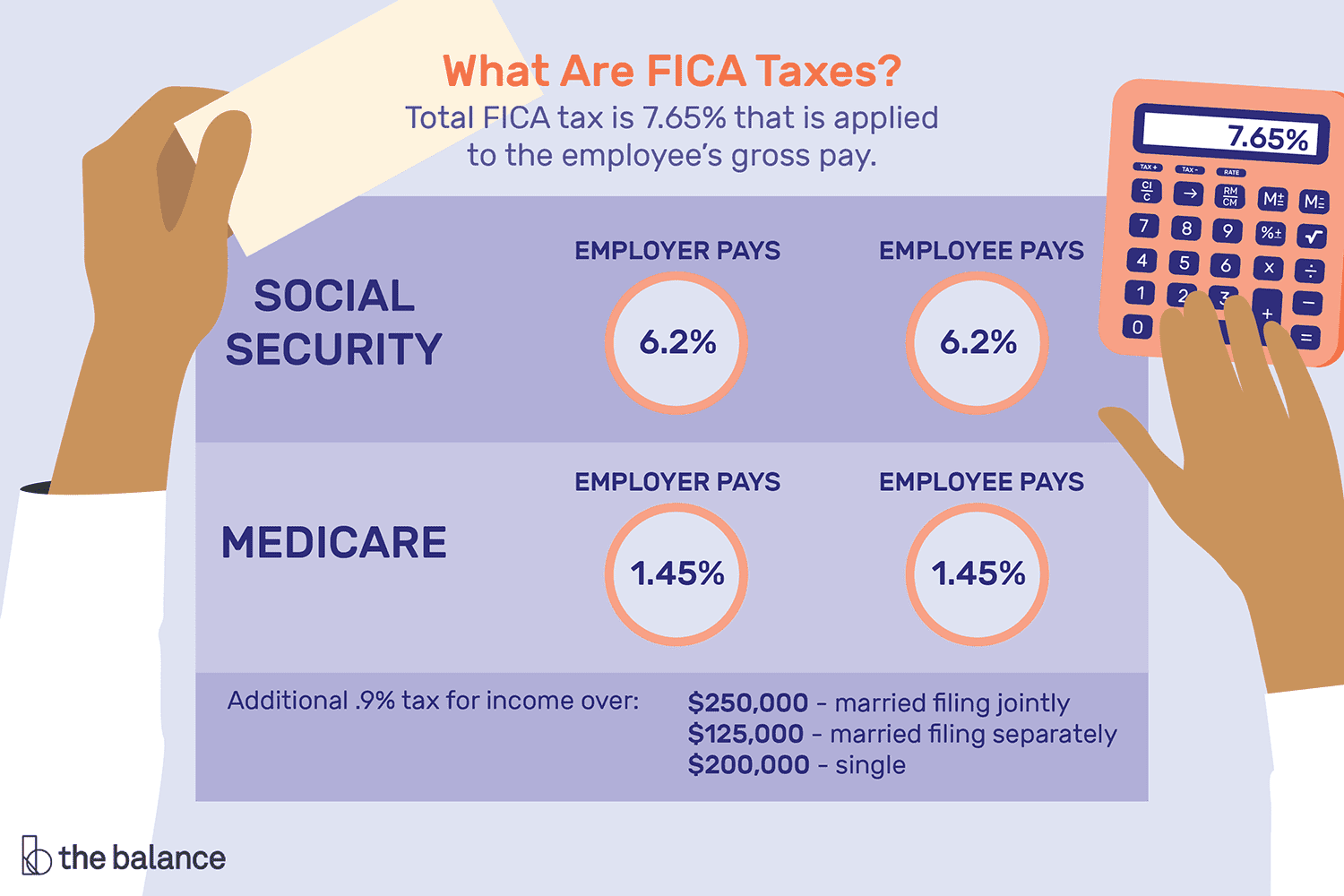

FICA stands for Federal Insurance Contributions Act. It is a federal payroll tax that is withheld from an employee’s paycheck to fund Social Security and Medicare programs. The FICA tax is split between the employee and the employer, with both parties contributing an equal amount. The FICA tax rate is currently set at 7.65% of an employee’s gross earnings, with 6.2% going towards Social Security and 1.45% going towards Medicare.

The funds collected from FICA taxes go towards providing benefits to retired or disabled individuals and their families. Social Security benefits are designed to provide financial support to individuals who have retired or are unable to work due to a disability. Medicare benefits, on the other hand, provide health insurance coverage to individuals who are 65 years or older, or those who have certain disabilities.

What is Medicare?

Medicare is a federal health insurance program that provides coverage to individuals who are 65 years or older, or those who have certain disabilities. The program is funded through payroll taxes, premiums, and general revenue. Medicare is divided into four parts: Part A, Part B, Part C, and Part D.

Part A provides coverage for hospital stays, skilled nursing facilities, and hospice care. Part B provides coverage for doctor visits, outpatient services, and medical equipment. Part C, also known as Medicare Advantage, is an alternative to traditional Medicare that allows individuals to receive coverage through private insurance companies. Part D provides coverage for prescription drugs.

How Do Medicare and FICA Differ?

While both Medicare and FICA are payroll taxes, they serve different purposes. FICA taxes are used to fund Social Security and Medicare programs, while Medicare taxes are used exclusively to fund the Medicare program. Additionally, while FICA taxes are split between the employee and the employer, Medicare taxes are solely the responsibility of the employee.

Another key difference between Medicare and FICA is that Medicare is a health insurance program, while FICA is a payroll tax. Medicare provides coverage for medical expenses, while FICA taxes fund retirement and disability benefits.

Benefits of FICA and Medicare

The benefits of FICA taxes are that they provide financial support for individuals who have retired or are unable to work due to a disability. Social Security benefits are designed to provide a safety net for individuals who may not have saved enough for retirement or who are unable to work due to a disability.

The benefits of Medicare are that it provides health insurance coverage to individuals who are 65 years or older, or those who have certain disabilities. Medicare helps to cover the costs of medical expenses, which can be particularly important for seniors who may have limited income.

Medicare vs. FICA

While both Medicare and FICA are important programs, they serve different purposes. Medicare provides health insurance coverage, while FICA taxes fund retirement and disability benefits. Additionally, while FICA taxes are split between the employee and the employer, Medicare taxes are solely the responsibility of the employee.

In terms of benefits, Medicare provides coverage for medical expenses, while FICA taxes provide financial support for retired or disabled individuals. It is important to understand the differences between Medicare and FICA, especially as you approach retirement age. By understanding these programs, you can make informed decisions about your healthcare and retirement needs.

Conclusion

In conclusion, Medicare and FICA are two important programs that serve different purposes. FICA taxes fund retirement and disability benefits, while Medicare provides health insurance coverage. While both programs are funded through payroll taxes, they have different tax rates and are split between the employee and the employer in different ways. Understanding the differences between Medicare and FICA is important for anyone approaching retirement age.

Frequently Asked Questions

What is Medicare?

Medicare is a federal health insurance program that helps cover the healthcare needs of people who are 65 or older and some younger people with certain disabilities or illnesses. Medicare is funded by payroll taxes, premiums paid by beneficiaries, and general revenue from the government.

Medicare is divided into four parts, A, B, C, and D. Part A covers inpatient hospital stays, skilled nursing care, and hospice care. Part B covers doctor visits, outpatient services, and some preventative care. Part C, also known as Medicare Advantage, allows beneficiaries to receive their benefits through a private insurance company. Part D covers prescription drugs.

What is FICA?

FICA stands for Federal Insurance Contributions Act. It is a federal payroll tax that is used to fund Social Security and Medicare. Both employers and employees are required to pay FICA taxes.

The FICA tax is divided into two parts. The Social Security portion is 12.4% of an employee’s wages, with half paid by the employer and half by the employee. The Medicare portion is 2.9% of an employee’s wages, with half paid by the employer and half by the employee.

What is the difference between Medicare and FICA?

The main difference between Medicare and FICA is that Medicare is a federal health insurance program that helps cover healthcare costs for eligible individuals, while FICA is a federal payroll tax that funds Social Security and Medicare.

Medicare is specifically designed to provide health insurance coverage, while FICA is a tax that helps fund Social Security and Medicare. Medicare is paid for by a combination of payroll taxes, beneficiary premiums, and general revenue, while FICA taxes are paid by both employers and employees.

Who is eligible for Medicare?

Eligibility for Medicare is based on age and certain disabilities or illnesses. Individuals who are 65 or older and have paid into the Medicare system through payroll taxes are generally eligible for Medicare. Individuals who are younger than 65 may also be eligible if they have certain disabilities or illnesses.

It’s important to note that eligibility for Medicare does not guarantee free healthcare. Beneficiaries may still be responsible for premiums, deductibles, and other out-of-pocket costs.

What happens if I don’t pay FICA taxes?

If you don’t pay FICA taxes, you may be subject to penalties and interest charges. Additionally, your Social Security and Medicare benefits may be reduced or delayed. Employers who do not pay FICA taxes may also be subject to penalties and fines.

It’s important to pay FICA taxes in full and on time to avoid any potential consequences. If you’re having trouble paying your FICA taxes, you may be able to work out a payment plan with the IRS or seek assistance from a tax professional.

Who Is FICA And Why Is He Getting All My Money?

In conclusion, understanding the difference between Medicare and FICA is crucial for every taxpayer. Medicare is a federal health insurance program that covers individuals aged 65 or older, while FICA is a payroll tax that funds Social Security and Medicare. Although both programs are related to healthcare, they serve different purposes and have different requirements.

If you are an employee, FICA taxes will be automatically deducted from your paycheck, while Medicare is a voluntary program that requires enrollment. On the other hand, Medicare is available to all eligible individuals, regardless of their employment status. Additionally, while FICA taxes have a maximum income limit, Medicare does not, meaning that higher-income earners may pay more in Medicare taxes.

Overall, it is essential to understand the difference between these two programs to ensure that you are paying the appropriate taxes and receiving the benefits you are entitled to. By educating yourself on the intricacies of Medicare and FICA, you can make informed decisions about your healthcare and finances.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts