Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage to millions of Americans. However, many people are still confused about what exactly Medicare is and how it differs from other types of health insurance.

In this article, we’ll explore the basics of Medicare and answer the question: Is Medicare health insurance? Whether you’re approaching retirement age or simply looking to better understand your healthcare options, this guide will provide valuable insights into one of the most important programs in the U.S. healthcare system.

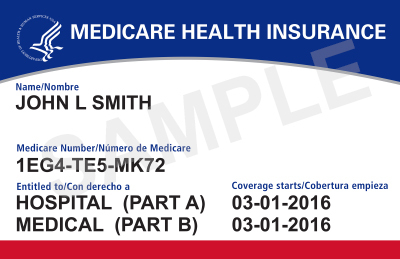

Yes, Medicare is a federal health insurance program that provides coverage to people who are 65 or older, as well as those with certain disabilities or chronic conditions. Medicare is divided into different parts, including Part A, which covers hospital stays, and Part B, which covers doctor visits and other outpatient services. There are also additional plans, such as Medicare Advantage and Part D, which provide additional coverage options.

Is Medicare Health Insurance?

Medicare is a government health insurance program in the United States that primarily serves people who are aged 65 years and above. But is Medicare a health insurance program? In short, the answer is yes. However, Medicare is not just any health insurance program. It is a unique program that has its own rules, regulations, and benefits. This article will provide you with a detailed overview of Medicare and explain why it is considered a health insurance program.

What is Medicare?

Medicare is a health insurance program run by the federal government that covers the cost of healthcare services for eligible individuals. The program was established in 1965 under the Social Security Act and has since become one of the most important social welfare programs in the United States. Medicare is funded through payroll taxes, premiums, and general revenue.

The program is divided into several parts, each of which covers different healthcare services. Part A covers inpatient hospital care, skilled nursing facility care, hospice, and home health services. Part B covers outpatient medical services, including doctor visits, preventive care, and medical equipment. Part C, also known as Medicare Advantage, is a comprehensive plan that combines parts A and B and often includes additional benefits such as prescription drug coverage. Part D covers prescription drugs.

Medicare Benefits

One of the biggest advantages of Medicare is that it provides affordable healthcare coverage to millions of older Americans. Medicare covers a wide range of healthcare services, including hospital stays, doctor visits, and prescription drugs. The program also offers preventive care services such as mammograms, flu shots, and diabetes screenings.

Another benefit of Medicare is that it provides financial protection against unexpected medical expenses. Without Medicare, many older Americans would be unable to access healthcare services due to the high cost of medical care. Medicare ensures that eligible individuals can receive the care they need without worrying about the financial burden.

Medicare Vs. Private Insurance

While Medicare is a health insurance program, it is different from private insurance in several ways. First, Medicare is a government-run program, while private insurance is typically provided by for-profit companies. Second, Medicare is available to all eligible individuals, regardless of their health status. Private insurance companies can deny coverage to individuals with pre-existing conditions.

Another difference between Medicare and private insurance is the cost. Medicare is generally less expensive than private insurance, especially for older Americans who are more likely to have health problems. Medicare also offers more comprehensive coverage than many private insurance plans.

How to Enroll in Medicare

Enrolling in Medicare is a straightforward process. Most people are automatically enrolled in Medicare Part A when they turn 65, as long as they have paid into the Social Security system for at least ten years. However, you must actively enroll in Medicare Part B and Part D.

To enroll in Medicare Part B, you need to contact the Social Security Administration and complete an application. You can enroll in Medicare Part D either by signing up for a standalone prescription drug plan or by enrolling in a Medicare Advantage plan that includes drug coverage.

Medicare Eligibility Requirements

To be eligible for Medicare, you must be a US citizen or a legal permanent resident who has lived in the United States for at least five years. You must also meet certain age and work history requirements. Most people become eligible for Medicare when they turn 65. However, younger people with certain disabilities or chronic conditions may also be eligible for Medicare.

Medicare Coverage Limitations

While Medicare provides comprehensive coverage for many healthcare services, there are some limitations to the program. For example, Medicare does not cover long-term care services such as nursing home care. The program also has limits on the amount of coverage it provides for certain services, such as physical therapy and mental health services.

Additionally, Medicare does not cover all prescription drugs. If you need a medication that is not covered under Medicare Part D, you may need to pay for it out of pocket or enroll in a supplemental insurance plan.

Medicare and Medicaid

Medicare is often confused with Medicaid, another government-run healthcare program. While both programs provide healthcare coverage to eligible individuals, they are different in several ways. Medicaid is a means-tested program that provides healthcare coverage to low-income individuals and families. Medicare, on the other hand, is available to all eligible individuals, regardless of their income.

Conclusion

In conclusion, Medicare is a health insurance program that provides affordable healthcare coverage to millions of older Americans. The program is funded by payroll taxes, premiums, and general revenue and covers a wide range of healthcare services. While there are some limitations to the program, Medicare is an essential program that provides financial protection against unexpected medical expenses. If you are eligible for Medicare, it is important to enroll in the program to ensure that you have access to the healthcare services you need.

Frequently Asked Questions

Is Medicare Health Insurance?

Medicare is a federal health insurance program in the United States that provides coverage for people who are 65 years or older, those with certain disabilities, and those with End-Stage Renal Disease (ESRD). It is a form of health insurance, but it is not the same as private health insurance that is purchased through an employer or on the individual market.

Medicare has four parts: Part A, Part B, Part C, and Part D. Part A covers hospital stays and some skilled nursing care, while Part B covers doctor visits and outpatient care. Part C, also known as Medicare Advantage, is an alternative to traditional Medicare and is offered through private insurance companies. Part D covers prescription drugs. Medicare is funded through payroll taxes, premiums, and general revenue.

Overall, Medicare is a form of health insurance that provides coverage for certain groups of people in the United States. It is an important program that helps millions of Americans access healthcare services they need.

Who is eligible for Medicare?

In general, people who are 65 years or older and have worked and paid into the Social Security system for at least 10 years are eligible for Medicare. People with certain disabilities or ESRD may also be eligible. There are different enrollment periods depending on a person’s circumstances, and it’s important to enroll during the appropriate time to avoid penalties.

It’s important to note that Medicare may not cover all healthcare costs, and there may be out-of-pocket expenses like deductibles, copayments, and coinsurance. Some people choose to enroll in additional insurance plans to help cover these costs, such as Medicare Supplement plans or Medicare Advantage plans.

What does Medicare cover?

Medicare covers a range of healthcare services, including hospital stays, doctor visits, preventive care, and prescription drugs. Part A covers hospital stays, hospice care, and some skilled nursing care. Part B covers doctor visits, outpatient care, and some preventive services. Part C, or Medicare Advantage, covers all the services that Parts A and B cover, plus additional benefits like vision, dental, and hearing. Part D covers prescription drugs.

It’s important to note that Medicare may not cover all healthcare costs, and there may be out-of-pocket expenses like deductibles, copayments, and coinsurance. Some people choose to enroll in additional insurance plans to help cover these costs, such as Medicare Supplement plans or Medicare Advantage plans.

How much does Medicare cost?

The cost of Medicare varies depending on a person’s circumstances. Part A is typically free for people who have worked and paid into the Social Security system for at least 10 years. Part B has a monthly premium, which is based on a person’s income. Part C and Part D are offered through private insurance companies, and the costs vary depending on the plan.

It’s important to note that Medicare may not cover all healthcare costs, and there may be out-of-pocket expenses like deductibles, copayments, and coinsurance. Some people choose to enroll in additional insurance plans to help cover these costs, such as Medicare Supplement plans or Medicare Advantage plans.

Can I have other health insurance with Medicare?

Yes, it’s possible to have other health insurance with Medicare. Some people choose to enroll in additional insurance plans to help cover costs that Medicare doesn’t cover, such as deductibles, copayments, and coinsurance. These plans include Medicare Supplement plans and Medicare Advantage plans.

It’s important to note that if a person has other health insurance, such as through an employer or union, that insurance may be primary to Medicare. This means that the other insurance pays first, and Medicare pays second. It’s important to understand how the different insurance plans work together to ensure that a person is getting the most coverage possible.

Medicare Basics: Parts A, B, C & D

In conclusion, Medicare is undoubtedly a form of health insurance that provides coverage for millions of Americans. However, it is important to understand that Medicare is not the same as private health insurance plans. Medicare is a federally-funded program that is specifically designed to help seniors and individuals with disabilities access the medical care they need.

While Medicare has some similarities to private health insurance plans, it also has many unique features that set it apart. For example, Medicare is available to all eligible individuals regardless of their health status or income level. Additionally, Medicare provides benefits that are not typically covered by private health insurance plans, such as prescription drug coverage and preventative care services.

Overall, Medicare is an essential resource for millions of Americans who rely on it to access the medical care they need. While it may not be the same as private health insurance plans, it is an important tool that provides critical support to seniors, individuals with disabilities, and others who need it most.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts