Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

If you are living with a disability, you may be wondering if you qualify for Medicare benefits. This is an important question to ask, as Medicare can help cover the cost of necessary medical treatments and services. In this article, we’ll explore the requirements for Medicare eligibility for disabled individuals, and what steps you can take to apply for coverage.

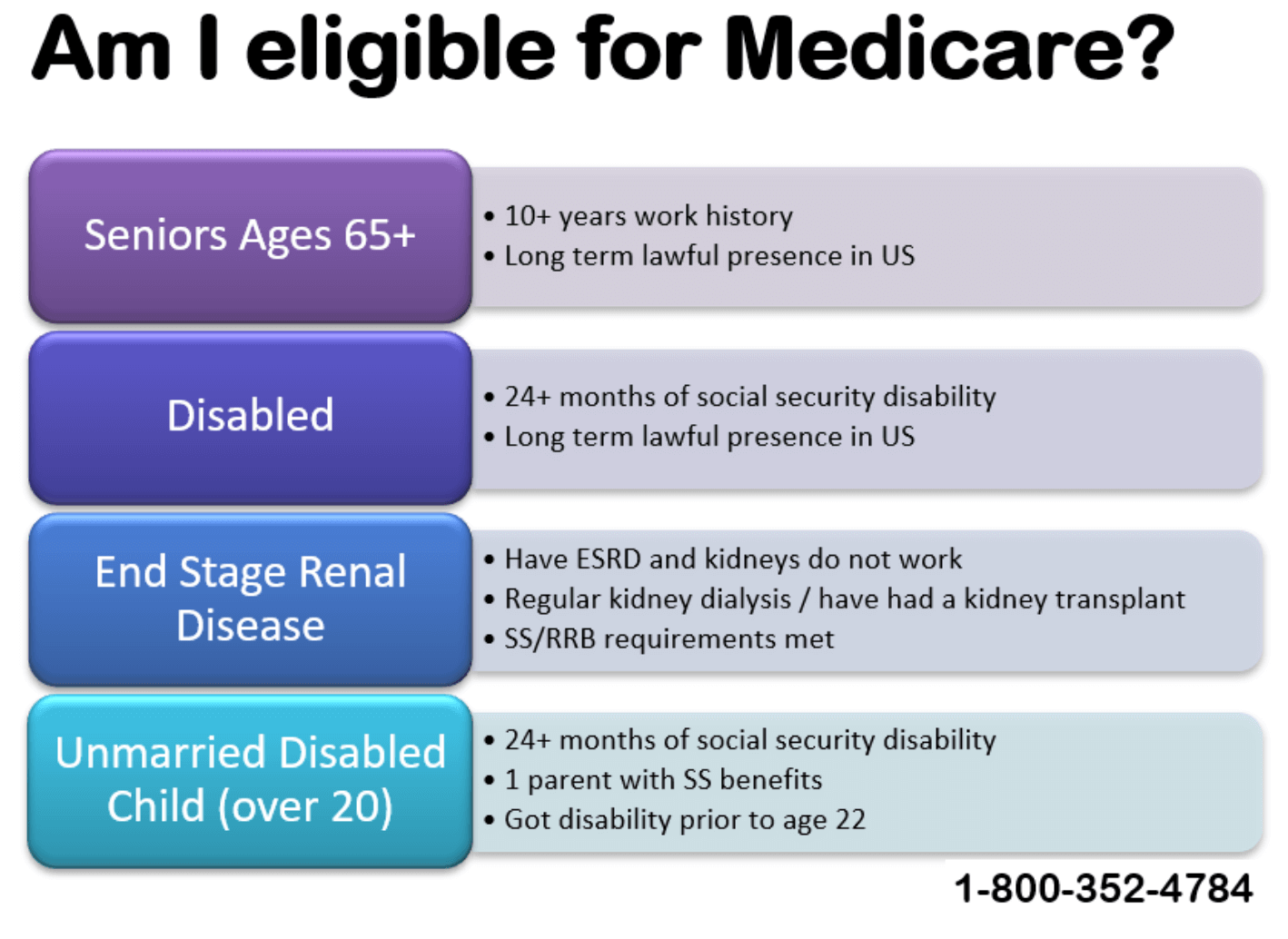

Yes, you may qualify for Medicare if you are under 65 and have a disability. You must have received Social Security Disability Insurance (SSDI) for at least 24 months or have End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS). You will automatically be enrolled in Medicare after receiving SSDI for 24 months. If you have ESRD or ALS, you can enroll in Medicare immediately.

Contents

- Do I Qualify for Medicare if I Am Disabled?

- Frequently Asked Questions

- Question 1: What is Medicare?

- Question 2: What are the requirements to qualify for Medicare if I am disabled?

- Question 3: Can I qualify for Medicare if I have a pre-existing condition?

- Question 4: What parts of Medicare am I eligible for if I am disabled?

- Question 5: How do I apply for Medicare if I am disabled?

Do I Qualify for Medicare if I Am Disabled?

If you are disabled, you may be wondering if you qualify for Medicare. The answer is yes, in most cases. Medicare is a federal health insurance program that provides coverage for people who are 65 years old or older, as well as for people with certain disabilities. In this article, we’ll go over the details of Medicare and how it applies to people with disabilities.

What is Medicare?

Medicare is a federal health insurance program that provides coverage for people who are 65 years old or older, as well as for people with certain disabilities. It is divided into several parts, which cover different types of medical expenses.

Medicare Part A

Medicare Part A covers inpatient hospital care, skilled nursing care, and hospice care. Most people do not have to pay a monthly premium for Part A, as long as they or their spouse have paid Medicare taxes for at least 10 years.

Medicare Part B

Medicare Part B covers doctor’s visits, outpatient care, and some preventive services. There is a monthly premium for Part B, which is based on your income.

Medicare Part C

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare. It is offered by private insurance companies, and includes all the benefits of Parts A and B, as well as additional benefits like dental and vision care.

Medicare Part D

Medicare Part D covers prescription drugs. It is also offered by private insurance companies, and has a monthly premium based on your income.

Who Qualifies for Medicare?

To qualify for Medicare, you must be 65 years old or older, or have a qualifying disability. Qualifying disabilities include:

- End-stage renal disease (ESRD)

- Lou Gehrig’s disease (ALS)

- Permanent kidney failure requiring dialysis or a kidney transplant

- Permanent disability

If you have one of these disabilities, you may be eligible for Medicare regardless of your age.

How Do I Apply for Medicare?

If you are receiving Social Security disability benefits, you will automatically be enrolled in Medicare after you have received disability benefits for two years. If you are not receiving Social Security disability benefits, you can apply for Medicare by visiting your local Social Security office or by applying online at the Social Security website.

What Are the Benefits of Medicare?

There are several benefits to having Medicare if you are disabled. Medicare can help cover the cost of medical expenses, including hospital stays, doctor’s visits, and prescription drugs. It can also provide access to preventive care, such as screenings for cancer and other diseases.

Medicare vs. Medicaid

It is important to note that Medicare and Medicaid are two different programs. Medicare is a federal health insurance program for people who are 65 years old or older, or who have certain disabilities. Medicaid is a joint federal and state program that provides health coverage for people with low incomes.

Conclusion

If you are disabled, you may be eligible for Medicare. Medicare is a federal health insurance program that provides coverage for people who are 65 years old or older, or who have certain disabilities. There are several parts to Medicare, which cover different types of medical expenses. To apply for Medicare, you can visit your local Social Security office or apply online. Medicare can help cover the cost of medical expenses, including hospital stays, doctor’s visits, and prescription drugs.

Frequently Asked Questions

Question 1: What is Medicare?

Medicare is a federal health insurance program that provides coverage to eligible individuals who are 65 years or older or have a qualifying disability.

If you are under 65 years of age and have a disability, then you may be eligible for Medicare benefits, but you must meet certain requirements to qualify.

Question 2: What are the requirements to qualify for Medicare if I am disabled?

To qualify for Medicare based on disability, you must have a disability that has lasted or is expected to last for at least 12 months and have paid into the Social Security system for a certain amount of time.

You must also be receiving either Social Security Disability Insurance (SSDI) or Railroad Retirement Board (RRB) disability benefits for at least two years before you become eligible for Medicare.

Question 3: Can I qualify for Medicare if I have a pre-existing condition?

Yes, you can still qualify for Medicare if you have a pre-existing condition. Medicare is not allowed to deny coverage based on a pre-existing condition.

However, if you are under 65 and have a pre-existing condition, you may have to wait up to two years before your Medicare coverage begins.

Question 4: What parts of Medicare am I eligible for if I am disabled?

If you are eligible for Medicare based on disability, you are eligible for all the same parts of Medicare as those who are 65 and older. This includes Medicare Part A (hospital insurance), Medicare Part B (medical insurance), and Medicare Part D (prescription drug coverage).

You may also be eligible for Medicare Advantage (Part C) plans, which provide additional benefits and may have lower out-of-pocket costs.

Question 5: How do I apply for Medicare if I am disabled?

If you are receiving Social Security Disability Insurance (SSDI) or Railroad Retirement Board (RRB) disability benefits, you will be automatically enrolled in Medicare after two years of receiving disability benefits.

If you are not receiving disability benefits but believe that you qualify for Medicare based on disability, you can apply for Medicare online at the Social Security Administration website or by visiting your local Social Security office.

In conclusion, if you are disabled and wondering if you qualify for Medicare, the answer is yes, you can. Medicare is a federal program that provides health insurance coverage for eligible individuals, regardless of their disability status. However, to be eligible for Medicare, you must meet specific criteria, such as your age, income, and disability status.

It is essential to understand that there are different types of Medicare coverage available for individuals with disabilities. For instance, if you have been receiving Social Security Disability Insurance (SSDI) benefits for at least two years, you may be eligible for Medicare Part A and Part B. Moreover, if you have a limited income and resources, you may also qualify for Medicare Extra Help, which can help you pay for Part D prescription drug coverage.

In summary, if you are disabled and wondering if you qualify for Medicare, the answer is not straightforward. Still, the good news is that there are different types of Medicare coverage available for individuals with disabilities. It is crucial to speak with a qualified healthcare professional or a Social Security Administration representative to understand your eligibility and the different coverage options available to you.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts