Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you looking for your 1095-B form from Medicare? This important document is essential for filing your taxes and proving that you had health insurance coverage for the year. While it may seem daunting to navigate the Medicare system and obtain this form, the process is actually quite simple.

In this article, we’ll guide you through the steps to get your 1095-B from Medicare. We’ll explain what the form is, why it’s important, and provide tips and resources to make the process as easy as possible. Whether you’re a Medicare beneficiary or a caregiver helping a loved one, we’ve got you covered.

How Do I Get My 1095-B From Medicare?

To get your 1095-B form from Medicare, you can either wait for it to arrive in the mail or download it from your online Medicare account. If you choose to download it online, log in to your account and look for the “View and print your 1095-B” option. If you haven’t received your form in the mail by mid-February, you can call the Medicare customer service number at 1-800-MEDICARE to request a copy.

How Do I Get My 1095 B From Medicare?

When it comes to filing your taxes, it’s important to have all the necessary documents in order. One of these documents is the 1095 B form, which shows proof of health insurance coverage. If you are a Medicare beneficiary, you may be wondering how to obtain this form. In this article, we will go over the steps you need to take to get your 1095 B from Medicare.

What is the 1095 B form?

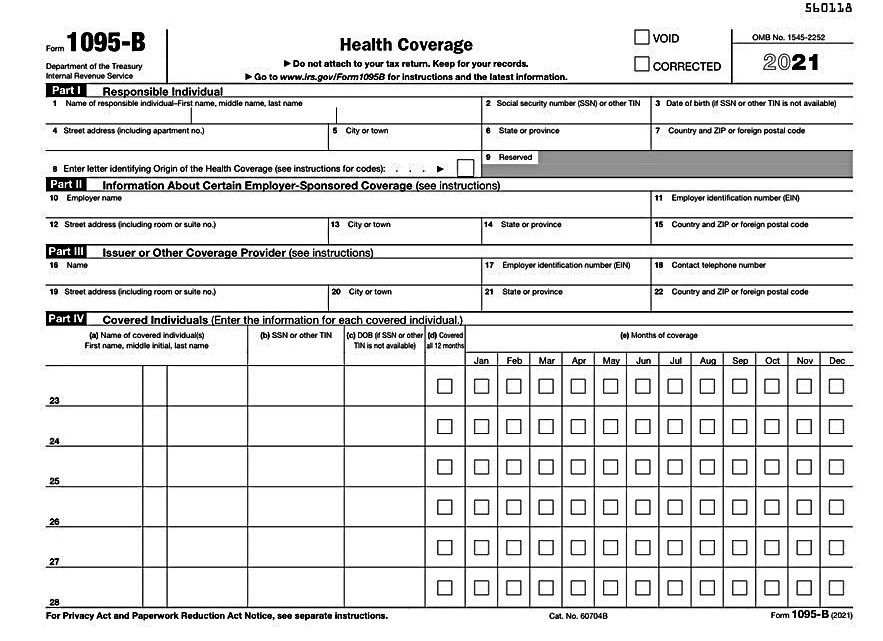

The 1095 B form is an IRS tax form that shows proof of health insurance coverage. This form is used to report information about your health insurance coverage to the IRS. It includes information about the months you had coverage, the type of coverage you had, and the individuals covered under your plan.

To be clear, not all individuals will receive a 1095 B form. This form is only required for individuals who had coverage through certain types of health insurance plans, including Medicare. If you received coverage through Medicare, you will need to obtain your 1095 B form from Medicare.

How to get your 1095 B form from Medicare

Getting your 1095 B form from Medicare is a simple process. Here are the steps you need to take:

- Contact Medicare

- Check your myMedicare.gov account

- Wait for the form to arrive by mail

If you are a current Medicare beneficiary, you can contact Medicare directly to request your 1095 B form. You can call Medicare at 1-800-MEDICARE (1-800-633-4227) or visit your local Medicare office. Be sure to have your Medicare number handy when you call or visit.

If you have a myMedicare.gov account, you may be able to access your 1095 B form online. Log into your account and look for the “View All Claims and Statements” section. If your form is available online, you will be able to download and print it from this section.

If neither of the above options work for you, don’t worry. Medicare will automatically mail your 1095 B form to you by March 2nd of each year. Make sure your address is up-to-date with Medicare to ensure you receive your form.

Benefits of having a 1095 B form

Having a 1095 B form can be beneficial for several reasons. First and foremost, it provides proof of health insurance coverage, which is required when filing your taxes. This can help you avoid any penalties or fees for not having coverage. Additionally, the form can provide you with important information about your health insurance coverage, such as the individuals covered under your plan and the months you had coverage.

1095 B form vs 1095 A form

It’s important to note that the 1095 B form is different from the 1095 A form. The 1095 A form is used by individuals who purchased health insurance through the Health Insurance Marketplace. This form is used to reconcile any premium tax credits you received with the IRS. If you purchased insurance through the Marketplace, you will receive a 1095 A form from the Marketplace, not from Medicare.

In conclusion, obtaining your 1095 B form from Medicare is a simple process that can be done by contacting Medicare directly, checking your myMedicare.gov account, or waiting for the form to arrive by mail. Having this form can be beneficial when filing your taxes and can provide you with important information about your health insurance coverage. Be sure to keep your 1095 B form in a safe place for future reference.

Contents

Frequently Asked Questions

What is 1095 B Form from Medicare?

Form 1095-B is a tax form that provides information about your health care coverage. It shows the months you had qualifying health coverage (referred to as minimum essential coverage) during the previous year. If you had Medicare coverage for all of the previous year, you will receive a 1095-B form from Medicare.

It is important to keep this form as it will help you to file your taxes correctly. The information on this form will also be used by the IRS to determine if you owe a penalty for not having health insurance.

When will I receive my 1095 B from Medicare?

You should receive your 1095-B form from Medicare by the end of January. If you have not received it by then, you should contact Medicare to request a copy. You can call the Medicare hotline at 1-800-MEDICARE (1-800-633-4227) or visit your local Medicare office.

If you have changed your address recently, make sure to update your information with Medicare to ensure that the form is sent to the correct address.

Can I access my 1095 B form online?

Yes, you can access your 1095-B form online through your Medicare account. To access it, log in to your account and navigate to the “My Health” section. From there, click on “View all my plans and coverage” and then select “View my Medicare Summary.” You should see a link to your 1095-B form on that page.

If you are having trouble accessing your account or your form is not available online, you can still request a copy from Medicare by calling the Medicare hotline or visiting your local Medicare office.

What should I do if there is an error on my 1095 B?

If you notice an error on your 1095-B form, you should contact Medicare as soon as possible to have it corrected. You can call the Medicare hotline or visit your local Medicare office to request a correction.

It is important to ensure that the information on your form is accurate, as it will be used to determine if you owe a penalty for not having health insurance. If you do not correct any errors, you may end up owing more in taxes than you should.

Do I need to attach my 1095 B form to my tax return?

No, you do not need to attach your 1095-B form to your tax return. However, you should keep it with your tax records in case you need to refer to it in the future.

If you used the Marketplace to purchase health insurance, you will also receive a 1095-A form. If you received advanced premium tax credits to help pay for your insurance, you will need to fill out Form 8962 with your tax return. The information on your 1095-A form will be used to complete this form.

How to find & download your 1095-A Tax Form

In conclusion, obtaining your 1095-B form from Medicare is a straightforward process. By logging in to your online account, contacting Medicare directly, or waiting for the form to arrive in the mail, you can ensure that you have the necessary documentation to file your taxes accurately.

Remember, the 1095-B form is important because it shows that you had health insurance coverage for the previous year. This information is required by the government to verify that you met the Affordable Care Act’s minimum coverage requirements.

If you have any questions or concerns about your 1095-B form or your health insurance coverage, don’t hesitate to reach out to Medicare or your insurance provider. They will be happy to assist you and guide you through the process.

In conclusion, taking the time to obtain your 1095-B form can save you headaches and potential penalties down the line. It’s an essential part of the tax-filing process, so don’t forget to include it when you file your taxes this year.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts