Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, medical expenses can pile up and getting the right Medicare plan is crucial. While Medicare Advantage plans offer a comprehensive package, there are different types to choose from. AARP Medicare Advantage 1 and 2 are two options, and it’s important to understand how they differ to find the plan that suits your needs best.

If you’re looking for a Medicare Advantage plan that offers more than the standard coverage, AARP Medicare Advantage plans may be a great option for you. However, with two different types to choose from, it can be confusing. In this article, we’ll break down the differences between AARP Medicare Advantage 1 and 2 to help you make an informed decision about your health insurance.

AARP Medicare Advantage plans offer comprehensive coverage for medical expenses. Medicare Advantage 1 provides additional benefits beyond Original Medicare, while Medicare Advantage 2 offers even more comprehensive coverage, including vision, hearing, and dental benefits. Both plans also offer prescription drug coverage. The main difference between the two plans is the extent of coverage they provide.

Contents

- Difference Between AARP Medicare Advantage 1 and 2

- Frequently Asked Questions

- What is the difference between AARP Medicare Advantage 1 and 2?

- What benefits do AARP Medicare Advantage 1 and 2 offer?

- How do I enroll in AARP Medicare Advantage 1 or 2?

- What is the cost of AARP Medicare Advantage 1 and 2?

- Can I switch between AARP Medicare Advantage 1 and 2?

- Comparing AARP Medicare Supplement Insurance Plans

Difference Between AARP Medicare Advantage 1 and 2

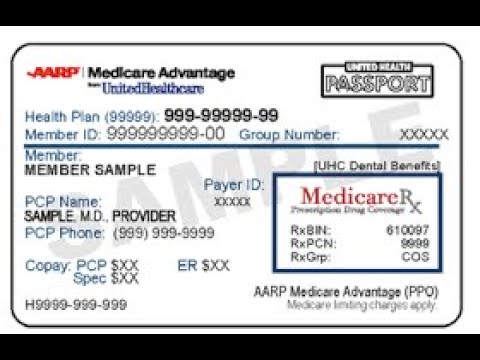

If you are looking for a Medicare Advantage plan, you may have come across AARP Medicare Advantage 1 and 2. These plans are offered by UnitedHealthcare and designed for people who are 65 years or older and eligible for Medicare. While both plans have many similarities, they also have some differences that you should be aware of before making a decision.

Plan Benefits

AARP Medicare Advantage 1 and 2 both offer a range of benefits that can help you manage your healthcare costs. These benefits can include coverage for doctor visits, hospital stays, prescription drugs, and more. However, there are some differences in the benefits offered by these plans.

AARP Medicare Advantage 1 may offer more benefits than AARP Medicare Advantage 2. For example, AARP Medicare Advantage 1 may cover hearing aids, routine vision care, and fitness programs, while AARP Medicare Advantage 2 may not. If these benefits are important to you, it may be worth considering AARP Medicare Advantage 1.

Costs

When choosing a Medicare Advantage plan, it’s important to consider the costs associated with the plan. Both AARP Medicare Advantage 1 and 2 have monthly premiums, deductibles, and out-of-pocket costs. However, there are some differences in the costs associated with these plans.

AARP Medicare Advantage 1 may have a higher monthly premium than AARP Medicare Advantage 2. However, you may also have lower out-of-pocket costs with AARP Medicare Advantage 1. If you are willing to pay a higher monthly premium to have lower out-of-pocket costs, AARP Medicare Advantage 1 may be the right choice for you.

Network

Another important consideration when choosing a Medicare Advantage plan is the network of providers that are available to you. Both AARP Medicare Advantage 1 and 2 have networks of providers that you can choose from. However, these networks may differ between the two plans.

AARP Medicare Advantage 1 may have a larger network of providers than AARP Medicare Advantage 2. If having a wide range of providers to choose from is important to you, AARP Medicare Advantage 1 may be the better choice.

Additional Benefits

In addition to the benefits that are included in the plan, both AARP Medicare Advantage 1 and 2 may offer additional benefits that can help you stay healthy and save money. These benefits can include wellness programs, discounts on health-related products and services, and more.

AARP Medicare Advantage 1 may offer more additional benefits than AARP Medicare Advantage 2. If you are looking for a plan that offers additional benefits, AARP Medicare Advantage 1 may be the right choice for you.

Enrollment

Enrolling in a Medicare Advantage plan can be a confusing process. Both AARP Medicare Advantage 1 and 2 have specific enrollment periods that you should be aware of.

AARP Medicare Advantage 1 and 2 both have an Annual Enrollment Period that runs from October 15th to December 7th each year. During this time, you can enroll in or make changes to your Medicare Advantage plan. However, AARP Medicare Advantage 1 may also have special enrollment periods that allow you to enroll at other times of the year.

Customer Service

When choosing a Medicare Advantage plan, it’s important to consider the level of customer service that you will receive. AARP Medicare Advantage 1 and 2 both offer customer service that can help you with any questions or concerns that you may have.

However, AARP Medicare Advantage 1 may offer better customer service than AARP Medicare Advantage 2. If having access to excellent customer service is important to you, AARP Medicare Advantage 1 may be the better choice.

Pros and Cons

Before making a decision about which Medicare Advantage plan to choose, it’s important to consider the pros and cons of each plan.

AARP Medicare Advantage 1 may offer more benefits and a larger network of providers, but it may also have a higher monthly premium. AARP Medicare Advantage 2 may have a lower monthly premium, but it may not offer as many benefits or a wide range of providers.

Conclusion

Choosing the right Medicare Advantage plan can be a difficult decision. AARP Medicare Advantage 1 and 2 both have many similarities, but they also have some important differences that you should be aware of. By considering the benefits, costs, network, additional benefits, enrollment, customer service, and pros and cons of each plan, you can make an informed decision about which plan is right for you.

Frequently Asked Questions

What is the difference between AARP Medicare Advantage 1 and 2?

AARP Medicare Advantage 1 and 2 are two different types of insurance plans offered by United Healthcare. The main difference between the two is the benefits and coverage they offer. AARP Medicare Advantage 1 is a Health Maintenance Organization (HMO) plan, while AARP Medicare Advantage 2 is a Preferred Provider Organization (PPO) plan.

With AARP Medicare Advantage 1, you are required to choose a primary care physician (PCP) and receive referrals from them for specialist care. The plan typically has lower out-of-pocket costs, but you may have a more limited provider network. AARP Medicare Advantage 2, on the other hand, allows you to see any doctor or specialist in the plan’s network without a referral. The plan may have higher out-of-pocket costs, but you have more flexibility in choosing your healthcare providers.

What benefits do AARP Medicare Advantage 1 and 2 offer?

Both AARP Medicare Advantage 1 and 2 offer a range of benefits, including coverage for hospital stays, doctor visits, prescription drugs, and preventive care services. However, the specific benefits and coverage can vary depending on the plan you choose.

In general, AARP Medicare Advantage 1 may offer more comprehensive benefits for preventive care and wellness services, such as vision, dental, and hearing coverage. AARP Medicare Advantage 2 may offer more flexibility in terms of provider choice and coverage for out-of-network care. It’s important to carefully review the benefits and coverage of each plan before choosing one that is right for you.

How do I enroll in AARP Medicare Advantage 1 or 2?

To enroll in AARP Medicare Advantage 1 or 2, you must first be eligible for Medicare Part A and Part B. You can then enroll during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. You can also enroll during a Special Enrollment Period (SEP) if you experience certain life events, such as moving to a new area or losing your employer-sponsored health insurance.

To enroll, you can visit the United Healthcare website or call their customer service hotline. You will need to provide your Medicare information, including your Medicare number and the date your coverage started, as well as personal information such as your name, address, and phone number.

What is the cost of AARP Medicare Advantage 1 and 2?

The cost of AARP Medicare Advantage 1 and 2 can vary depending on a number of factors, including the specific plan you choose, your location, and your income. In general, both plans have premiums, deductibles, copayments, and coinsurance.

AARP Medicare Advantage 1 typically has lower out-of-pocket costs, but may have a more limited provider network. AARP Medicare Advantage 2 may have higher out-of-pocket costs, but offers more flexibility in choosing healthcare providers. It’s important to carefully review the costs and coverage of each plan before enrolling.

Can I switch between AARP Medicare Advantage 1 and 2?

Yes, you can switch between AARP Medicare Advantage 1 and 2 during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. You can also switch during a Special Enrollment Period (SEP) if you experience certain life events, such as moving to a new area or losing your employer-sponsored health insurance.

To switch plans, you can visit the United Healthcare website or call their customer service hotline. You will need to provide your Medicare information, including your Medicare number and the date your coverage started, as well as personal information such as your name, address, and phone number. It’s important to carefully review the benefits and costs of each plan before making a switch.

Comparing AARP Medicare Supplement Insurance Plans

In conclusion, understanding the difference between AARP Medicare Advantage 1 and 2 is important when making healthcare decisions. While both plans offer comprehensive coverage, AARP Medicare Advantage 2 has additional benefits such as dental, vision, and hearing coverage. It’s important to evaluate individual healthcare needs and consider factors such as budget and location when choosing a plan.

Ultimately, enrolling in either AARP Medicare Advantage 1 or 2 can provide peace of mind and access to quality healthcare. With the opportunity to receive additional benefits, AARP Medicare Advantage 2 may be the better choice for those looking for more comprehensive coverage. However, it’s important to carefully review all plan details and consult with a healthcare professional before making a decision.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts