Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a government-run health insurance program for people who are 65 or older, as well as for younger individuals with certain disabilities. While Medicare Part A and Part B cover many healthcare expenses, some costs are left uncovered. This is why many people opt for additional coverage through Medicare Part C and Medigap. However, it can be confusing to understand the difference between the two. In this article, we will break down the difference between Medicare Part C and Medigap, and help you determine which option is right for you.

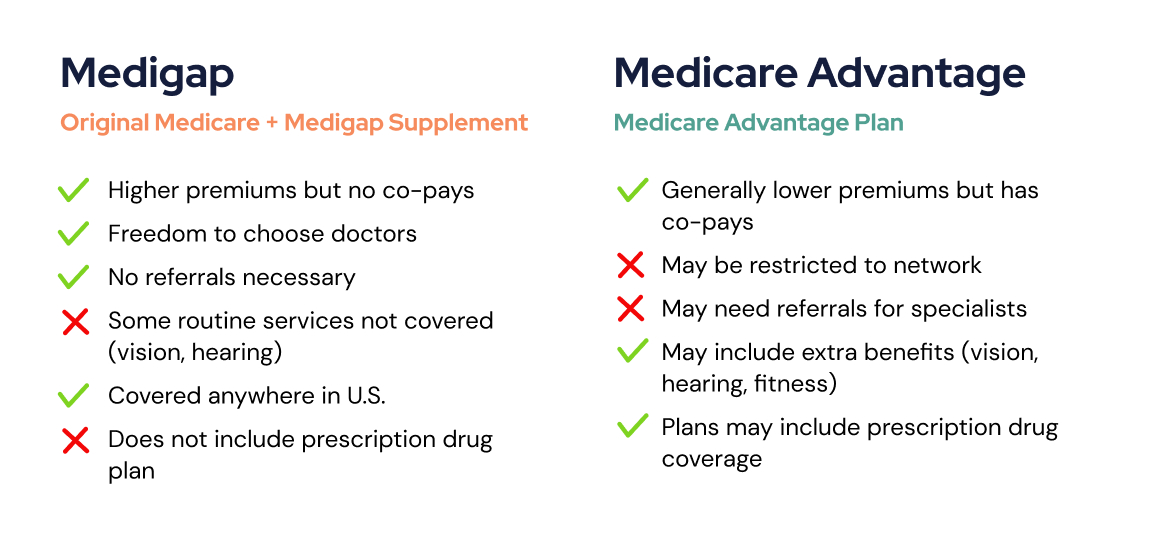

Medicare Part C, also known as Medicare Advantage, is a private insurance plan that provides all the benefits of Medicare Part A and Part B, along with additional coverage such as prescription drug benefits, dental care, and vision care. On the other hand, Medigap, also known as Medicare Supplement Insurance, is a private insurance plan that is designed to fill in the gaps left by Original Medicare. It covers costs such as deductibles, copayments, and coinsurance, which are not covered by Medicare Part A and Part B.

What is the Difference Between Medicare Part C and Medigap?

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare. It’s offered by private insurance companies, and it includes all the benefits of Part A and Part B, as well as additional benefits like prescription drug coverage and vision and dental services. Medigap, on the other hand, is a supplemental insurance policy that covers the gaps in Original Medicare coverage, such as copayments and deductibles. Unlike Medicare Advantage, you can keep your Original Medicare coverage if you have Medigap.

Understanding the Difference Between Medicare Part C and Medigap

Medicare Part C

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare. Medicare Advantage plans are offered by private insurance companies that have been approved by Medicare. These plans provide all the benefits of Original Medicare and often include additional benefits such as prescription drug coverage, vision, dental, and hearing services, and wellness programs. Medicare Advantage plans typically have lower out-of-pocket costs than Original Medicare, but they often have more restrictions on which healthcare providers you can see.

Medicare Part C plans are required to cover all the same services as Original Medicare, except for hospice care, which continues to be covered by Medicare Part A. However, Medicare Advantage plans can choose to cover additional benefits that Original Medicare does not cover, such as routine dental and vision services. Some Medicare Advantage plans also offer prescription drug coverage, which is not covered by Original Medicare.

Benefits of Medicare Part C

- Lower out-of-pocket costs

- Additional benefits not covered by Original Medicare

- Potentially lower costs for prescription drugs

- May offer more comprehensive coverage for certain services

Drawbacks of Medicare Part C

- May have more restrictions on which healthcare providers you can see

- May require referrals to see specialists

- May have higher costs if you see out-of-network healthcare providers

- May have more limited coverage if you travel frequently

Medigap

Medigap, also known as Medicare Supplement, is a type of insurance policy that helps fill in the gaps in coverage left by Original Medicare. Medigap policies are offered by private insurance companies and are designed to cover out-of-pocket costs like deductibles, copayments, and coinsurance. Medigap policies do not provide additional benefits beyond what is covered by Original Medicare.

There are ten standardized Medigap plans, each labeled with a letter. Each plan offers a different level of coverage, with Plan F being the most comprehensive. However, as of January 1, 2020, Plan F is no longer available to new Medicare beneficiaries. If you already have Plan F, you can keep it, but if you are new to Medicare, you will need to choose a different plan.

Benefits of Medigap

- Covers out-of-pocket costs like deductibles, copayments, and coinsurance

- Allows you to see any healthcare provider who accepts Medicare patients

- No referrals needed to see specialists

- Covers some healthcare costs when you travel outside the United States

Drawbacks of Medigap

- Does not cover additional benefits beyond what is covered by Original Medicare

- May have higher monthly premiums than Medicare Advantage plans

- May not be available in all states

Medicare Part C vs. Medigap

When deciding between Medicare Part C and Medigap, it is important to consider your healthcare needs and budget. Medicare Advantage plans may be a good choice if you want additional benefits beyond what is covered by Original Medicare and are willing to accept more restrictions on which healthcare providers you can see. Medigap policies may be a good choice if you want to keep the freedom to see any healthcare provider who accepts Medicare patients and want to avoid unexpected out-of-pocket costs.

Ultimately, the choice between Medicare Part C and Medigap comes down to personal preference. It is important to review all your options and compare the benefits and costs of each plan before making a decision.

Factors to Consider When Choosing Between Medicare Part C and Medigap

| Factor | Medicare Part C | Medigap |

|---|---|---|

| Monthly Premiums | May be lower | May be higher |

| Out-of-Pocket Costs | May be lower | May be higher |

| Additional Benefits | May be included | Not included |

| Healthcare Provider Restrictions | May be more restrictive | Can see any provider who accepts Medicare patients |

| Referrals for Specialists | May be required | Not required |

| Coverage When Traveling | May be limited | Covers some healthcare costs when traveling outside the United States |

Conclusion

Medicare Part C and Medigap are both options for Medicare beneficiaries who want to supplement or replace their Original Medicare coverage. Medicare Advantage plans offer additional benefits beyond what is covered by Original Medicare, while Medigap policies help cover out-of-pocket costs. It is important to review all your options and compare the benefits and costs of each plan before making a decision.

Frequently Asked Questions

Medicare Part C and Medigap are two different types of Medicare plans. It’s important to understand the differences so you can choose the right plan for your healthcare needs. Here are some frequently asked questions to help you understand the differences between Medicare Part C and Medigap:

What is Medicare Part C?

Medicare Part C is also known as Medicare Advantage. It’s a type of Medicare plan that is offered by private insurance companies. Medicare Advantage plans provide the same coverage as Original Medicare (Part A and Part B), but they often include additional benefits like vision, dental, and prescription drug coverage. Medicare Advantage plans may also have lower out-of-pocket costs than Original Medicare.

When you enroll in a Medicare Advantage plan, you still have Medicare coverage, but you receive your benefits through the private insurance company. You pay a monthly premium for your Medicare Advantage plan, and you may also have to pay copays and deductibles for your healthcare services.

What is Medigap?

Medigap, also known as Medicare Supplement Insurance, is a type of Medicare plan that is offered by private insurance companies. Medigap plans help pay for the out-of-pocket costs that come with Original Medicare, such as copays, deductibles, and coinsurance. Medigap plans do not provide additional benefits beyond what is covered by Original Medicare.

When you enroll in a Medigap plan, you still have Original Medicare coverage. You pay a monthly premium for your Medigap plan, in addition to the premium you pay for Part B. Medigap plans may provide you with more predictable healthcare costs, as you won’t have to worry about unexpected expenses.

What is the difference between Medicare Part C and Medigap?

The main difference between Medicare Part C and Medigap is that Medicare Part C is a replacement for Original Medicare, while Medigap is a supplement to Original Medicare. Medicare Advantage plans provide the same coverage as Original Medicare (Part A and Part B) as well as additional benefits, while Medigap plans only pay for the out-of-pocket costs associated with Original Medicare. Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, while Medigap plans provide more predictable healthcare costs.

Another difference is how you receive your healthcare benefits. With Medicare Advantage, you receive your benefits through a private insurance company, while with Medigap, you still receive your benefits through Original Medicare.

Can I have both Medicare Part C and Medigap?

No, you cannot have both Medicare Part C and Medigap. Medicare Advantage plans cannot be combined with Medigap plans. If you enroll in a Medicare Advantage plan, you cannot also have a Medigap plan. However, if you have a Medigap plan and you decide to switch to a Medicare Advantage plan, you can drop your Medigap plan.

It’s important to carefully consider your healthcare needs and choose the Medicare plan that is right for you. If you are considering switching from a Medigap plan to a Medicare Advantage plan, make sure you understand the differences in coverage and costs.

How do I choose between Medicare Part C and Medigap?

Choosing between Medicare Part C and Medigap depends on your individual healthcare needs and preferences. Consider factors like your healthcare costs, the doctors and hospitals you prefer, and the benefits you need. Make sure you understand the differences in coverage and costs between the two types of plans.

You can compare Medicare Advantage plans and Medigap plans using the Medicare Plan Finder tool on the Medicare website. You can also speak with a licensed insurance agent who can help you understand your options and choose the Medicare plan that is right for you.

Medicare Advantage vs Medicare Supplement Plans (Updated Review and Important Tips)

In conclusion, understanding the difference between Medicare Part C and Medigap is essential for anyone who is eligible for Medicare coverage. While both options can provide additional benefits beyond original Medicare, they operate in different ways. Medicare Part C, also known as Medicare Advantage, is an all-in-one plan that replaces original Medicare and may include additional benefits like prescription drug coverage. On the other hand, Medigap plans are designed to supplement original Medicare by covering some of the costs that Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

It’s important to note that not everyone is eligible for Medicare Part C, and the availability and cost of Medigap plans may vary depending on your location and health needs. It’s crucial to compare your options carefully and choose the plan that best fits your individual needs and budget. Consider working with a licensed insurance agent or a financial advisor who can help you navigate the complexities of Medicare and make informed decisions about your healthcare coverage.

Ultimately, whether you choose Medicare Part C or Medigap, you can rest assured that you’ll have access to high-quality healthcare coverage that can help protect your health and financial well-being in your golden years.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts