Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you nearing retirement age or have already retired? If so, one of the most pressing concerns on your mind may be healthcare costs. Medicare is a federal health insurance program for people over 65 and those with certain disabilities. However, a common question among many seniors is whether Medicare covers all hospital costs.

The short answer is no, Medicare does not cover all hospital costs. While it does cover a significant portion of hospital expenses, there are still out-of-pocket costs that beneficiaries must be prepared for. In this article, we will explore what Medicare covers and what it does not, as well as ways to mitigate the financial burden of healthcare costs in retirement.

Medicare Part A covers most hospital costs, but not all. You may still be responsible for deductibles, copayments, and coinsurance. Some services, such as private rooms or a television, may also not be covered. Medicare Part B may cover certain hospital outpatient services, but again, you may still be responsible for some costs. It’s important to review your specific plan and coverage to fully understand your costs and benefits.

Does Medicare Cover All Hospital Costs?

Medicare is a federal health insurance program that provides coverage for certain medical expenses, including hospital stays. However, not all hospital costs are covered under Medicare. In this article, we will explore what hospital costs Medicare covers and what expenses may not be covered.

What Hospital Costs Are Covered by Medicare?

Medicare Part A is the portion of the program that covers hospital costs. This includes inpatient hospital care, skilled nursing facility care, and hospice care. Inpatient hospital care includes a semi-private room, meals, general nursing care, and other hospital services and supplies.

Skilled nursing facility care is covered under Medicare Part A for up to 100 days following a hospital stay. Hospice care is also covered under Medicare Part A for patients who are terminally ill and have a life expectancy of six months or less.

In addition to these services, Medicare Part A also covers some outpatient hospital services, such as emergency room visits, outpatient surgery, and diagnostic tests.

It is important to note that while Medicare Part A covers these hospital costs, beneficiaries may still be responsible for certain out-of-pocket expenses, such as deductibles, copayments, and coinsurance.

What Hospital Costs Are Not Covered by Medicare?

While Medicare Part A covers many hospital costs, there are some expenses that may not be covered. For example, Medicare does not typically cover private-duty nursing, which is care provided by a nurse who is not associated with a hospital or skilled nursing facility.

Medicare also does not cover most dental care, including routine cleanings, fillings, and extractions. Additionally, Medicare does not cover cosmetic surgery, hearing aids, or acupuncture.

It is important to note that while Medicare may not cover certain hospital costs, beneficiaries may still have options for coverage through other insurance plans or programs.

Benefits of Medicare Coverage for Hospital Costs

One of the main benefits of Medicare coverage for hospital costs is that it can provide financial protection in the event of a serious illness or injury. With Medicare coverage, beneficiaries can receive the care they need without worrying about the high cost of hospital bills.

In addition, Medicare coverage can provide peace of mind for beneficiaries and their families, knowing that they have access to quality medical care when they need it most.

Medicare Coverage for Hospital Costs vs. Other Insurance Options

While Medicare provides coverage for many hospital costs, there may be other insurance options available that provide additional benefits. For example, some Medicare Advantage plans may offer additional coverage for dental, vision, or hearing care.

In addition, some individuals may choose to purchase supplemental insurance, such as a Medigap policy, to cover out-of-pocket expenses associated with Medicare coverage.

It is important for beneficiaries to carefully review their options and choose the coverage that best meets their individual needs and budget.

Conclusion

In summary, Medicare provides coverage for many hospital costs, including inpatient hospital care, skilled nursing facility care, and hospice care. However, there are some hospital expenses that may not be covered under Medicare.

Beneficiaries should carefully review their options and choose the coverage that best meets their individual needs and budget. With the right coverage, beneficiaries can receive the care they need without worrying about the high cost of hospital bills.

Contents

- Frequently Asked Questions

- Does Medicare cover all hospital costs?

- What hospital costs does Medicare Part A cover?

- What hospital costs does Medicare Part B cover?

- Can I purchase additional coverage to help with hospital costs?

- What should I do if I receive a bill for hospital costs that I thought Medicare would cover?

- Medicare Part A: Hospital Coverage Explained!

Frequently Asked Questions

Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. However, many people are still unsure about what Medicare covers. One of the biggest questions is whether Medicare covers all hospital costs. Here are the answers to some of the most frequently asked questions about that.

Does Medicare cover all hospital costs?

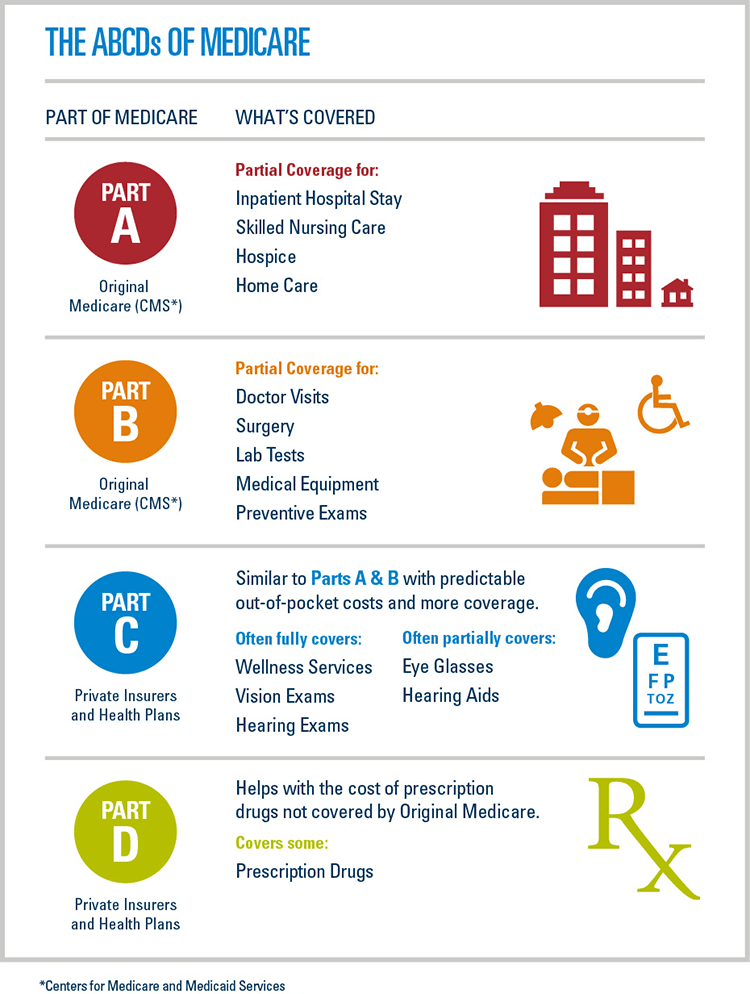

No, Medicare does not cover all hospital costs. Part A of Medicare covers inpatient hospital care, but you may still be responsible for certain costs such as deductibles, copayments, and coinsurance. Part B of Medicare covers outpatient hospital care, but you may still be responsible for some costs such as copayments and coinsurance.

Additionally, Medicare does not cover certain services such as private-duty nursing, a private room (unless medically necessary), and personal care items such as a phone or television in your room. It’s important to review your Medicare coverage and understand your costs before receiving hospital care.

What hospital costs does Medicare Part A cover?

Medicare Part A covers inpatient hospital care, including a semi-private room, meals, general nursing, drugs, and other hospital services and supplies. Part A also covers care in a skilled nursing facility, hospice care, and some home health care.

However, you may be responsible for certain costs such as a deductible for each benefit period, coinsurance for stays longer than 60 days, and copayments for stays longer than 90 days. It’s important to review your Medicare coverage and understand your costs before receiving hospital care.

What hospital costs does Medicare Part B cover?

Medicare Part B covers outpatient hospital care, including doctor services, outpatient therapy, and other hospital services and supplies that are medically necessary. Part B also covers preventive services such as flu shots and cancer screenings.

However, you may be responsible for certain costs such as a deductible, copayments, and coinsurance. It’s important to review your Medicare coverage and understand your costs before receiving hospital care.

Can I purchase additional coverage to help with hospital costs?

Yes, you can purchase additional coverage to help with hospital costs. Medicare Supplement Insurance, also known as Medigap, can help cover some of the costs that Medicare doesn’t cover such as deductibles, copayments, and coinsurance. Medicare Advantage plans, also known as Part C, offer additional benefits and may cover some costs that Original Medicare doesn’t cover.

It’s important to review your options and understand the costs and benefits of each plan before purchasing additional coverage.

What should I do if I receive a bill for hospital costs that I thought Medicare would cover?

If you receive a bill for hospital costs that you thought Medicare would cover, you should review your Medicare Summary Notice or Explanation of Benefits to make sure the charges were processed correctly. If you still have questions, you can contact your healthcare provider or Medicare directly for assistance.

If you believe the charges were billed incorrectly, you can request a Medicare claim review or file an appeal. It’s important to address any billing issues promptly to avoid late fees or collection actions.

Medicare Part A: Hospital Coverage Explained!

In conclusion, Medicare provides coverage for many hospital costs but not all. It’s important to understand the different parts of Medicare and what they cover. Part A covers inpatient hospital care, while Part B covers outpatient services. However, there may still be out-of-pocket costs, such as deductibles and copayments, depending on the specific services received. It’s crucial to review your Medicare plan and understand your coverage to avoid any unexpected expenses.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts