Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Social Security and Medicare taxes are two important deductions that every American worker has to pay. These taxes are generally referred to as FICA (Federal Insurance Contributions Act) taxes and are automatically deducted from an employee’s paycheck. The question that arises here is, what percentage of your paycheck actually goes towards Social Security and Medicare taxes?

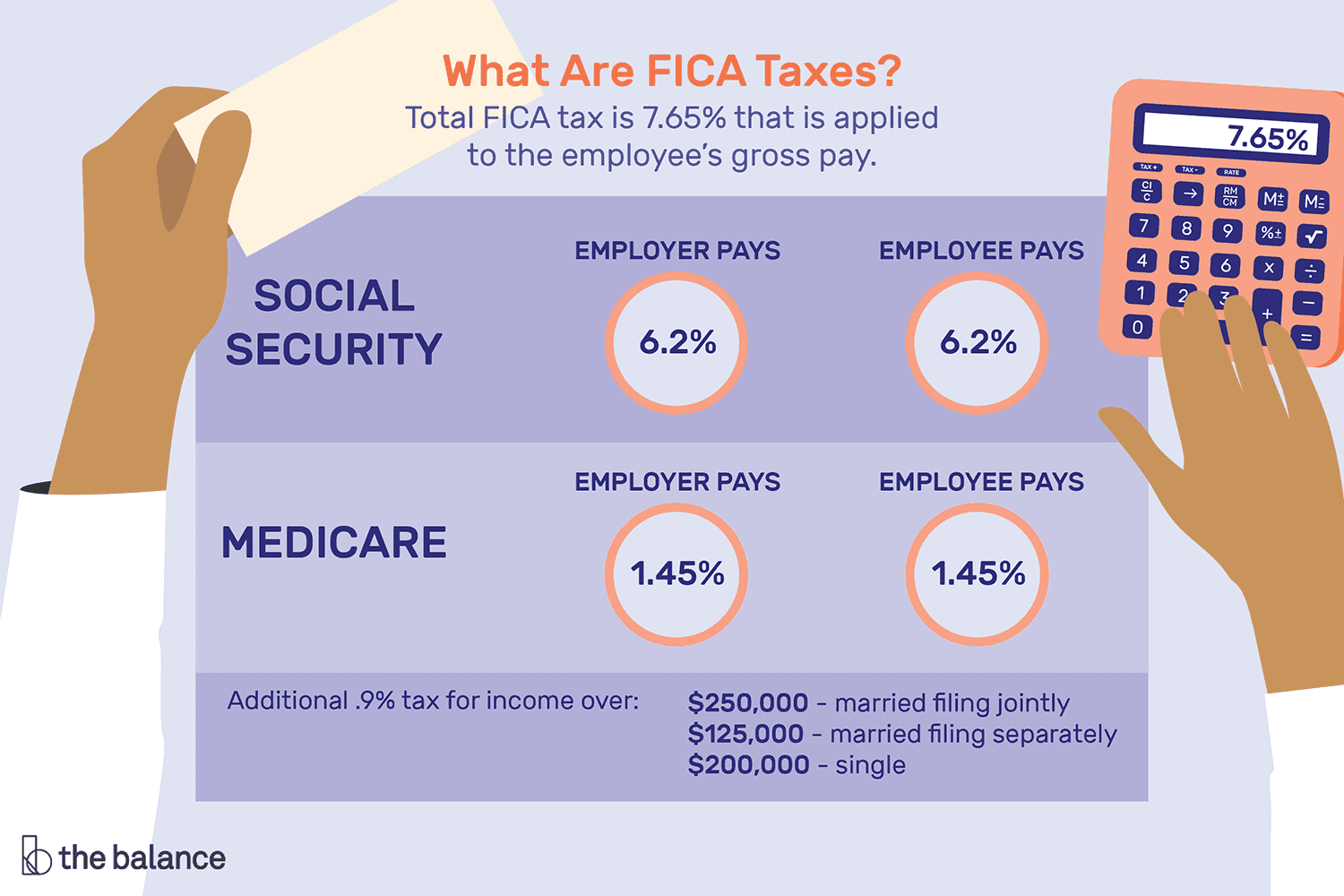

The answer is not a straightforward one. The Social Security tax rate is currently 6.2% for both employers and employees, while the Medicare tax rate is 1.45% for both employers and employees. However, for high-income earners, there is an additional Medicare tax of 0.9% that applies to wages over a certain threshold. In this article, we will take a closer look at how the Social Security and Medicare tax percentages are calculated, and how they impact your take-home pay.

Contents

- Understanding Social Security and Medicare Tax Percentages

- What is Social Security Tax?

- What is Medicare Tax?

- Combined Social Security and Medicare Tax Rate

- Benefits of Social Security and Medicare

- Differences Between Social Security and Medicare

- How to Calculate Your Social Security and Medicare Tax

- Other Payroll Taxes to Consider

- How to Reduce Your Social Security and Medicare Tax

- Conclusion

- Frequently Asked Questions:

- What Percentage is Social Security and Medicare Tax?

- How are Social Security and Medicare Tax Calculated?

- Are Social Security and Medicare Taxes Deductible?

- What is the Maximum Social Security Tax I Can Pay?

- What Happens to the Money Collected from Social Security and Medicare Taxes?

- What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

Understanding Social Security and Medicare Tax Percentages

What is Social Security Tax?

Social Security is a government program that provides retirement, disability, and survivor benefits to eligible individuals. The Social Security tax is a payroll tax that funds the program. Employees and employers both contribute to Social Security tax, with the employee portion taken out of their paycheck and the employer portion paid separately.

Currently, the Social Security tax rate for employees is 6.2% on earnings up to $142,800 per year. Employers also pay a 6.2% tax on their employees’ earnings up to the same limit. Self-employed individuals pay both the employee and employer portions, totaling 12.4%.

What is Medicare Tax?

Medicare is a government healthcare program for people aged 65 and older and those with certain disabilities or medical conditions. The Medicare tax is another payroll tax that helps fund the program. Similar to Social Security tax, both employees and employers contribute to Medicare tax.

The Medicare tax rate for employees is 1.45% on all earnings with no limit. Employers also pay a 1.45% tax on their employees’ earnings. Self-employed individuals pay both the employee and employer portions, totaling 2.9%.

Combined Social Security and Medicare Tax Rate

When calculating your total payroll taxes, you’ll need to consider both Social Security and Medicare taxes. For employees, the combined rate is 7.65% on earnings up to $142,800 per year. For employers, the combined rate is also 7.65% on their employees’ earnings up to the same limit. Self-employed individuals pay a combined rate of 15.3% on all earnings.

Benefits of Social Security and Medicare

Although payroll taxes may seem like a burden, they fund important government programs that provide benefits to millions of Americans. Social Security provides retirement, disability, and survivor benefits to eligible individuals and their families. Medicare helps cover the cost of healthcare for people aged 65 and older and those with certain disabilities or medical conditions.

Differences Between Social Security and Medicare

While both Social Security and Medicare are government programs that help Americans, there are some key differences. Social Security provides retirement and disability benefits, while Medicare provides healthcare benefits. Additionally, Social Security is funded by payroll taxes, while Medicare is funded by a combination of payroll taxes, premiums, and government funding.

How to Calculate Your Social Security and Medicare Tax

Calculating your payroll taxes can be tricky, but fortunately, most payroll software or payroll services will do it for you. If you’re self-employed, you’ll need to calculate your own payroll taxes and make quarterly estimated payments. The IRS provides a self-employment tax calculator to help you estimate your taxes.

Other Payroll Taxes to Consider

In addition to Social Security and Medicare taxes, there are other payroll taxes that employers and employees may need to pay. These include federal income tax, state and local income tax, and unemployment taxes.

How to Reduce Your Social Security and Medicare Tax

While you can’t avoid paying Social Security and Medicare taxes entirely, there are some ways to reduce your tax liability. For example, self-employed individuals can deduct half of their self-employment tax on their income tax return. Additionally, some employers offer retirement plans that can reduce your taxable income.

Conclusion

In summary, Social Security and Medicare taxes are important payroll taxes that fund government programs that provide retirement, disability, survivor, and healthcare benefits to millions of Americans. Understanding how these taxes work and how to calculate them can help you better manage your finances and plan for the future. While you can’t avoid paying these taxes entirely, there are ways to reduce your tax liability and maximize your benefits.

Frequently Asked Questions:

What Percentage is Social Security and Medicare Tax?

Social Security and Medicare taxes are commonly referred to as FICA taxes. FICA stands for Federal Insurance Contributions Act. The FICA tax rate for social security is 6.2% and the FICA tax rate for Medicare is 1.45%. These rates are applicable for both employees and employers.

It is important to note that the social security tax has a wage base limit, which means that once an employee’s earnings reach a certain amount, they no longer have to pay social security tax. As of 2021, the wage base limit is $142,800. However, there is no wage base limit for Medicare tax, and it must be paid on all earnings.

How are Social Security and Medicare Tax Calculated?

Social Security and Medicare taxes are calculated based on an employee’s earnings. The FICA tax rate for social security is 6.2% of an employee’s earnings up to the wage base limit. Any earnings above the wage base limit are not subject to social security tax. The FICA tax rate for Medicare is 1.45% of an employee’s total earnings, with no wage base limit.

Employers are also required to pay FICA taxes on behalf of their employees. Employers pay an additional 6.2% of their employees’ earnings up to the wage base limit for social security tax and 1.45% of their employees’ total earnings for Medicare tax.

Are Social Security and Medicare Taxes Deductible?

Yes, social security and Medicare taxes are deductible on an individual’s federal income tax return. Self-employed individuals can also deduct half of their FICA taxes as an adjustment to income. However, it is important to note that social security and Medicare taxes are not deductible for state and local income tax purposes.

What is the Maximum Social Security Tax I Can Pay?

As of 2021, the maximum social security tax an employee can pay is $8,853.60, which is 6.2% of the wage base limit of $142,800. Employers also pay a maximum social security tax of $8,853.60 on behalf of each employee.

If an individual has multiple jobs or is self-employed, they may pay more than the maximum social security tax. However, any excess social security tax paid will be credited towards the individual’s future social security benefits.

What Happens to the Money Collected from Social Security and Medicare Taxes?

The money collected from social security and Medicare taxes is used to fund social security and Medicare programs. Social security provides retirement, disability, and survivor benefits to eligible individuals and their families. Medicare provides healthcare coverage to individuals who are 65 years and older, as well as to individuals with certain disabilities and medical conditions. The money collected from FICA taxes is placed in a trust fund and used to pay benefits to eligible individuals.

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

In conclusion, understanding the percentage of Social Security and Medicare tax is crucial for all taxpayers. With Social Security tax, employees are required to pay 6.2% of their earnings, while employers are required to match that amount. For Medicare tax, employees are required to pay 1.45% of their earnings, and employers must also match that amount.

It is important to note that there is a wage base limit for Social Security tax, which means that once an employee’s earnings reach a certain amount, they will no longer be required to pay the tax. However, there is no wage base limit for Medicare tax.

Knowing the percentage of Social Security and Medicare tax can help individuals better plan for their finances and ensure they are properly withholding the correct amount from their paychecks. It is also important to stay informed about any changes or updates to these percentages, as they can impact your overall tax liability.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts