Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching retirement age and wondering if your Medicare coverage is enough? You may be considering supplemental insurance to help cover the gaps in your healthcare costs. But do you really need it? In this article, we’ll explore the ins and outs of Medicare coverage and help you decide if supplemental insurance is right for you.

Medicare is a valuable resource for seniors, but it doesn’t cover everything. From deductibles and co-payments to services like dental and vision care, there are plenty of expenses that fall outside of traditional Medicare coverage. In this article, we’ll break down the different types of supplemental insurance available, what they cover, and how much they cost, so you can make an informed decision about whether or not to add it to your healthcare plan.

While Medicare covers many healthcare services, it doesn’t cover everything. That’s where supplemental insurance, also known as Medigap, comes in. Medigap plans are sold by private insurance companies and can help cover costs like deductibles, copayments, and coinsurance that Medicare doesn’t pay. While it’s not required to have supplemental insurance, it can help reduce out-of-pocket costs and provide more comprehensive coverage.

Do You Have to Have Supplemental Insurance With Medicare?

Medicare is a federal health insurance program that provides coverage for people 65 years of age or older, as well as younger people with certain disabilities. While Medicare can cover many healthcare expenses, there are still some gaps in coverage that can leave beneficiaries with out-of-pocket costs. This is where supplemental insurance comes in. In this article, we’ll explore whether or not you have to have supplemental insurance with Medicare.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also known as Medigap, is a type of policy that is sold by private insurance companies. These policies are designed to help cover some of the out-of-pocket costs that are not covered by Original Medicare, such as deductibles, copayments, and coinsurance.

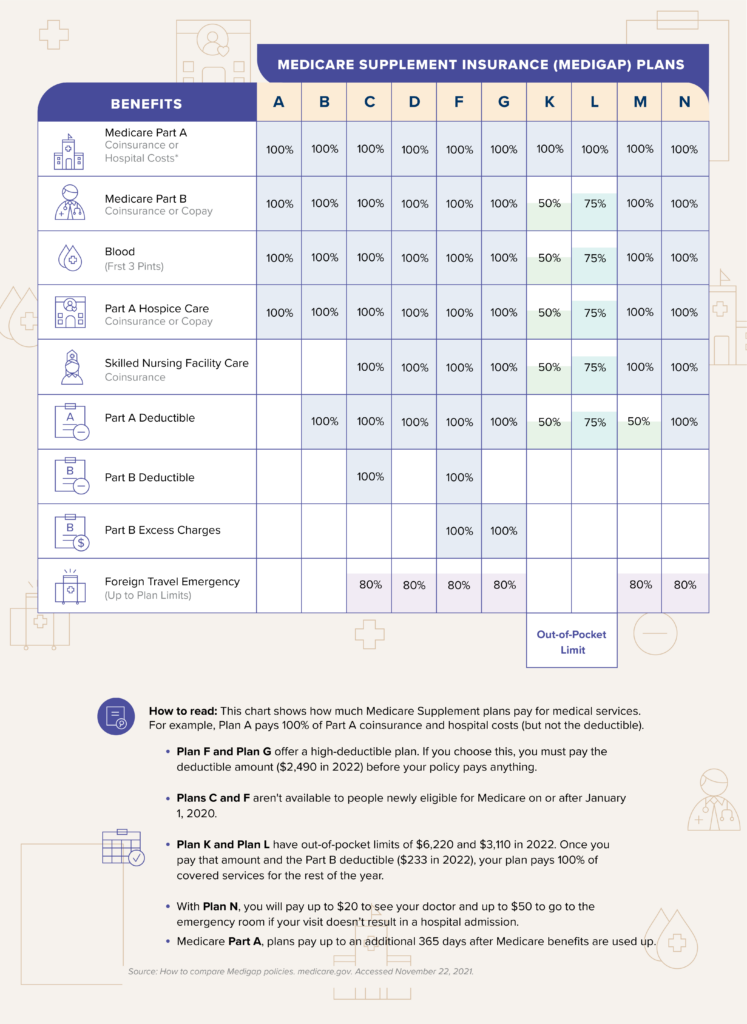

There are ten standardized Medigap plans available, each with a different level of coverage. These policies are labeled with letters, from A to N. The benefits of each plan are standardized across all insurance companies, so a Plan F from one company will have the same benefits as a Plan F from another company.

Is Supplemental Insurance Required with Medicare?

No, supplemental insurance is not required with Medicare. However, it can be a good idea to consider purchasing a Medigap policy to help cover the gaps in coverage that Original Medicare does not cover.

While Medicare covers a wide range of healthcare expenses, it does not cover everything. For example, Medicare Part A has a deductible for hospital stays, and Medicare Part B has a deductible for outpatient services. In addition, Medicare Part B only covers 80% of the cost of most outpatient services, leaving beneficiaries responsible for the remaining 20%.

Benefits of Supplemental Insurance

One of the biggest benefits of having supplemental insurance is the peace of mind it can provide. Knowing that you have coverage for the out-of-pocket costs that Medicare does not cover can help you feel more secure in your healthcare.

In addition, having a Medigap policy can help you save money in the long run. While the premiums for these policies can be expensive, they can also help you avoid unexpected healthcare costs that can be much higher than the monthly premiums.

Medicare Advantage vs. Supplemental Insurance

Another option for Medicare beneficiaries is Medicare Advantage, which is an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies and provide coverage for all the services that Original Medicare covers, as well as additional benefits such as prescription drug coverage, dental, and vision.

While Medicare Advantage plans can be a good choice for some people, they may not be the best option for everyone. For example, if you travel frequently, you may find that your Medicare Advantage plan has limited coverage outside of your home state.

Costs of Supplemental Insurance

The cost of a Medigap policy can vary depending on several factors, including your age, location, and health status. In addition, the premiums for these policies can increase over time.

It’s important to shop around and compare policies from different insurance companies to find the best coverage at the best price. Keep in mind that while the premiums for these policies can be expensive, the peace of mind and financial security they can provide may be worth the cost.

When to Purchase Supplemental Insurance

The best time to purchase a Medigap policy is during your open enrollment period. This is a six-month period that begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B.

During this time, you have guaranteed issue rights, which means that insurance companies cannot deny you coverage or charge you higher premiums based on your health status.

In Conclusion

While supplemental insurance is not required with Medicare, it can be a good idea to consider purchasing a Medigap policy to help cover the gaps in coverage that Original Medicare does not cover. These policies can provide peace of mind and help you avoid unexpected healthcare costs. When considering a Medigap policy, be sure to shop around and compare policies from different insurance companies to find the best coverage at the best price.

Frequently Asked Questions

What is Supplemental Insurance with Medicare?

Supplemental insurance, also known as Medigap, is a type of insurance policy that covers the gaps in Medicare coverage. Medicare only covers a portion of your medical expenses, and Medigap policies are designed to pay for the healthcare costs that Medicare doesn’t cover.

Medigap policies are sold by private insurance companies and are regulated by the government. These policies can help you pay for things like copayments, coinsurance, and deductibles that you may be responsible for under Medicare.

Do I Need Supplemental Insurance with Medicare?

While Medigap policies are not required by law, they can be a good idea for many people. If you have a lot of medical expenses, a Medigap policy can help you save money by paying for the costs that Medicare doesn’t cover.

Some people may also choose to purchase a Medigap policy because they want more control over their healthcare costs. With a Medigap policy, you can budget for your healthcare expenses and avoid unexpected bills.

How Do I Choose a Supplemental Insurance Policy?

Choosing a Medigap policy can be overwhelming, but there are a few things you can do to make the process easier. First, make a list of your healthcare needs and expenses. This will help you determine which policy will provide the most coverage for your needs.

You should also compare policies from different insurance companies and look at the premiums, deductibles, and benefits offered. Finally, make sure to read the policy carefully and ask any questions you may have before making a decision.

Can I Switch Supplemental Insurance Plans?

Yes, you can switch Medigap policies at any time. However, there are certain times when it may be easier to switch policies without being denied coverage or charged more because of pre-existing conditions.

The best time to switch policies is during your open enrollment period, which is the six-month period that starts the month you turn 65 and enroll in Medicare Part B. During this time, you have a guaranteed issue right to purchase any Medigap policy sold in your state.

How Much Does Supplemental Insurance with Medicare Cost?

The cost of Medigap policies can vary depending on the insurance company, the level of coverage, and your location. However, the premiums for Medigap policies are generally affordable and can be a good value for the coverage they provide.

It’s important to remember that you will still need to pay your Medicare Part B premium in addition to the Medigap premium. However, the peace of mind that comes with having comprehensive healthcare coverage can be worth the cost.

Do I need a Medicare Supplement Plan?

In conclusion, whether or not you need supplemental insurance with Medicare depends on your personal healthcare needs. While Medicare covers many medical expenses, it does not cover everything. Supplemental insurance can provide additional coverage for services such as dental, vision, and hearing care that are not covered by Medicare.

It’s important to carefully consider your healthcare needs and budget before deciding whether to purchase supplemental insurance. In some cases, it may be more cost-effective to pay for out-of-pocket expenses without supplemental insurance. However, for individuals with chronic health conditions or who require frequent medical care, supplemental insurance can provide valuable additional coverage and peace of mind.

Ultimately, the decision to purchase supplemental insurance with Medicare is a personal one that should be made after careful consideration of your individual healthcare needs and financial situation. Consulting with a trusted insurance agent or healthcare provider can help you make an informed decision about the best course of action for your unique situation.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts