Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program for people who are 65 years or older or have certain disabilities. It covers a wide range of medical services, including hospital stays, doctor visits, and prescription drugs. But what prescriptions are covered by Medicare?

Understanding which prescriptions are covered by Medicare can be confusing, especially with the different parts and plans. It’s important to know what drugs are covered to avoid unexpected costs and ensure you’re getting the care you need. In this article, we’ll break down the basics of Medicare prescription coverage and help you navigate the complex world of healthcare.

Medicare covers prescription drugs that are medically necessary to treat a health condition. The specific drugs covered depend on the Medicare plan you have, as well as the formulary of the plan. Each plan has its own list of covered drugs, known as a formulary, which can change from year to year. Before enrolling in a Medicare plan, make sure to check the formulary to see if your prescriptions are covered.

What Prescriptions Are Covered by Medicare?

Medicare is a government-run health insurance program that provides coverage to millions of Americans. If you are eligible for Medicare, you may be wondering what prescriptions are covered by the program. In this article, we’ll take a closer look at the types of prescription drugs that are covered by Medicare, as well as what you need to know about getting coverage for your medications.

Original Medicare Coverage

If you are enrolled in Original Medicare (Part A and Part B), you may be wondering what prescription drug coverage is available to you. Unfortunately, Original Medicare does not cover most prescription drugs. However, there are some exceptions. For example, Medicare Part B may cover certain medications that are administered by a doctor or other healthcare provider. These medications may include things like chemotherapy drugs, immunosuppressive drugs, and certain vaccines.

If you require prescription drug coverage beyond what is offered by Original Medicare, you may want to consider enrolling in a Medicare Part D plan. Medicare Part D is a prescription drug plan that is offered by private insurance companies. These plans can help you pay for your medications, but you will need to pay a monthly premium and meet certain deductibles and copayments.

Medicare Part D Coverage

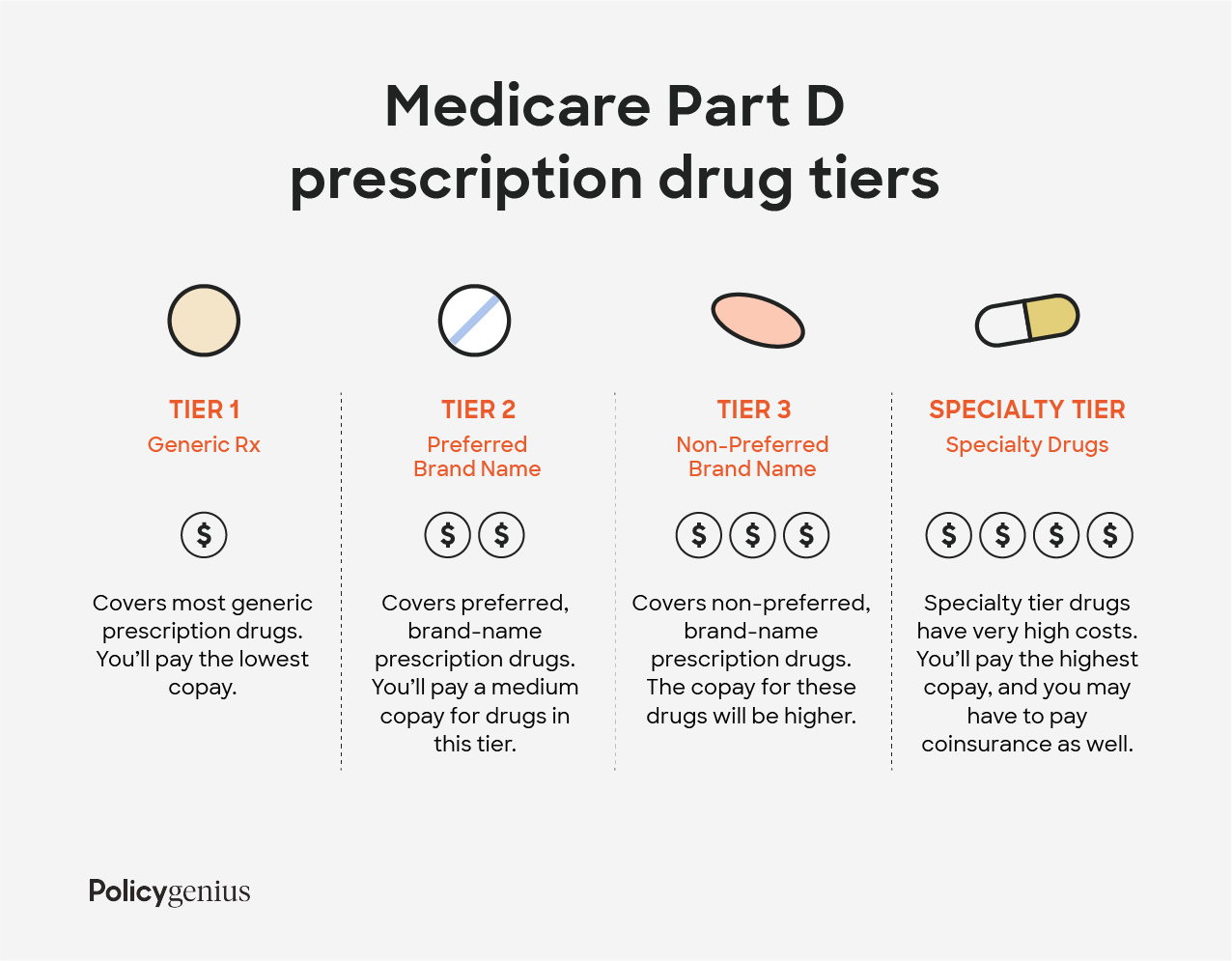

Medicare Part D plans are designed to help Medicare beneficiaries pay for their prescription drugs. These plans are offered by private insurance companies and are available to anyone who is eligible for Medicare. There are a variety of different Medicare Part D plans to choose from, each with its own list of covered medications, copayments, and deductibles.

If you are considering enrolling in a Medicare Part D plan, it’s important to do your research and compare different plans before making a decision. Some plans may have lower premiums but higher copayments, while others may have higher premiums but lower copayments. You’ll want to find a plan that fits your budget and covers the medications you need.

Medicare Advantage Coverage

Medicare Advantage plans are another option for Medicare beneficiaries who are looking for prescription drug coverage. These plans are offered by private insurance companies and provide all of the benefits of Original Medicare (Part A and Part B), as well as additional benefits like prescription drug coverage, vision and dental care, and wellness programs.

If you choose to enroll in a Medicare Advantage plan, your prescription drug coverage will be included in your plan’s benefits. However, it’s important to remember that not all Medicare Advantage plans offer the same level of coverage. Some plans may have more comprehensive prescription drug coverage than others, so it’s important to compare different plans before making a decision.

What Drugs Are Covered by Medicare?

The types of prescription drugs that are covered by Medicare can vary depending on your specific plan. However, there are some general guidelines that can help you understand what medications are covered. Generally, Medicare Part D plans must cover at least two drugs in each therapeutic category and class, although there are some exceptions.

In addition to this, Medicare Part D plans must also cover all drugs that are used to treat certain medical conditions. These conditions include cancer, HIV/AIDS, and depression, among others. However, there may be restrictions on the types of medications that are covered, so it’s important to check your plan’s formulary to see if your medications are covered.

Benefits of Medicare Prescription Drug Coverage

There are many benefits to having prescription drug coverage through Medicare. First and foremost, it can help you save money on your medications. Many prescription drugs can be expensive, and having coverage can help you avoid paying full price out of pocket. Additionally, having prescription drug coverage can make it easier to manage your health conditions and stay healthy.

Medicare Prescription Drug Coverage vs. Other Options

If you are considering Medicare prescription drug coverage, you may be wondering how it compares to other options. For example, you may be considering purchasing medications from Canada or using a discount drug card.

While there are certainly other options available, Medicare prescription drug coverage can offer a number of advantages. For example, Medicare Part D plans are required to cover certain medications, which can provide you with peace of mind knowing that your medications are covered. Additionally, Medicare Part D plans can be customized to fit your specific needs, which can make it easier to get the coverage you need at a price you can afford.

Conclusion

In conclusion, Medicare prescription drug coverage can be an important part of your healthcare coverage. Whether you are enrolled in Original Medicare or a Medicare Advantage plan, there are options available to help you pay for your medications. By understanding the types of medications that are covered by Medicare and comparing different plans, you can find the coverage that’s right for you and your healthcare needs.

Contents

- Frequently Asked Questions

- What prescription drugs does Medicare cover?

- How do I know if my prescription drugs are covered?

- Can I switch Part D plans if my prescription drugs are not covered?

- Are there any restrictions on the amount of prescription drugs I can get through Medicare?

- What if I need a prescription drug that is not covered by Medicare?

- Does Original Medicare Cover Prescriptions?

Frequently Asked Questions

Medicare covers a range of prescription drugs, but it can be confusing to know exactly what is covered. Here are some frequently asked questions about what prescriptions are covered by Medicare:

What prescription drugs does Medicare cover?

Medicare Part D covers a range of prescription drugs, including those used to treat both acute and chronic conditions. This includes drugs such as antidepressants, blood pressure medications, and insulin. However, not all drugs are covered, so it’s important to check with your plan provider to see if the specific drugs you need are covered.

It’s worth noting that Medicare does not cover prescription drugs through its original program (Parts A and B) unless they are administered in a hospital or doctor’s office. To get coverage for outpatient prescription drugs, you’ll need to enroll in Medicare Part D.

How do I know if my prescription drugs are covered?

The easiest way to find out if your prescription drugs are covered by Medicare is to check the formulary for your specific Part D plan. A formulary is a list of drugs that are covered by a given plan. You can typically find this information on the plan’s website or by calling the plan provider directly.

If your drug is not covered by your plan, you may be able to get an exception if you can show that the drug is medically necessary. Your doctor can help you with this process.

Can I switch Part D plans if my prescription drugs are not covered?

Yes, you can switch Part D plans if your prescription drugs are not covered or if you find a plan with better coverage. However, you can only switch plans during certain times of the year, such as during the annual enrollment period (October 15 to December 7) or during a special enrollment period if you experience a qualifying life event.

It’s important to review your plan’s formulary each year during the annual enrollment period to ensure that your drugs will still be covered for the following year.

Are there any restrictions on the amount of prescription drugs I can get through Medicare?

Yes, there are some restrictions on the amount of prescription drugs you can get through Medicare. This is known as the “quantity limit.” The quantity limit is the maximum amount of a drug that a plan will cover in a certain period of time.

The quantity limits vary depending on the drug and the plan, so it’s important to check with your plan provider to see what the limits are for your specific drugs. Your doctor can also help you with this process.

What if I need a prescription drug that is not covered by Medicare?

If you need a prescription drug that is not covered by Medicare, you may be able to get assistance through other programs, such as the Extra Help program or by getting help from a patient assistance program offered by the drug manufacturer.

It’s also worth talking to your doctor to see if there are any alternative drugs that are covered by Medicare that could work for your condition.

Does Original Medicare Cover Prescriptions?

In conclusion, understanding what prescriptions are covered by Medicare can be confusing, but it’s essential to ensure you receive the necessary medications without breaking the bank. With Medicare Part D, you have access to a variety of prescription drug plans, each with its list of covered medications. It’s important to review each plan’s formulary to see if your medications are covered before enrolling in a plan.

Additionally, if you have a chronic condition that requires expensive medications, you may qualify for Medicare’s Extra Help program, which can help lower your out-of-pocket costs. Finally, if you still have questions about Medicare’s prescription drug coverage, you can seek help from a licensed Medicare agent or counselor who can guide you through the process and help you choose the best plan for your needs.

Overall, taking the time to understand Medicare’s prescription drug coverage can help you save money and receive the medications you need to stay healthy. Don’t hesitate to reach out for help and guidance to ensure you’re making the best decisions for your healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts