Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching the age of 65 and wondering when to join Medicare? With so many options and enrollment periods, it can be confusing to determine the right time to sign up for this crucial healthcare program. In this article, we’ll break down the different enrollment periods and factors to consider when deciding when to join Medicare.

From understanding the costs and benefits of each plan to knowing how your existing healthcare coverage may affect your decision, we’ll provide you with the information you need to make an informed decision about when to enroll in Medicare. Whether you’re approaching your 65th birthday or just starting to think about your future healthcare needs, this article is a must-read for anyone considering Medicare enrollment.

When to Join Medicare: A Comprehensive Guide

Are you nearing retirement age and wondering when to join Medicare? You’re not alone. Medicare can be a complex and confusing topic, but it’s crucial to understand the enrollment process and the various options available to you. In this article, we’ll cover everything you need to know about when to join Medicare.

Initial Enrollment Period: What You Need to Know

The initial enrollment period (IEP) is the first time you can enroll in Medicare. It’s a seven-month period that starts three months before your 65th birthday and ends three months after your birthday month. If you miss your IEP, you may have to pay a penalty and wait until the next general enrollment period to enroll.

During your IEP, you can enroll in Original Medicare (Part A and Part B), Medicare Advantage (Part C), and prescription drug coverage (Part D). It’s important to note that if you’re still working and have health coverage through your employer, you may be able to delay enrollment in Medicare without penalty.

If you’re not automatically enrolled in Medicare, you’ll need to sign up during your IEP. You can do this online, by phone, or in person at your local Social Security office.

General Enrollment Period: What You Need to Know

If you missed your IEP, you can still enroll in Medicare during the general enrollment period (GEP). The GEP runs from January 1 to March 31 each year. However, if you enroll during the GEP, your coverage won’t start until July 1 of that year. You may also have to pay a late enrollment penalty.

During the GEP, you can enroll in Original Medicare (Part A and Part B) and prescription drug coverage (Part D). You can’t enroll in Medicare Advantage during the GEP.

Special Enrollment Periods: What You Need to Know

In some cases, you may be eligible for a special enrollment period (SEP). SEPs allow you to enroll in Medicare outside of the IEP and GEP. There are several situations that may qualify you for an SEP, including:

– You move out of your Medicare Advantage plan’s service area

– You lose your health coverage through your employer

– You qualify for Medicaid

– You’re eligible for the Extra Help program for prescription drugs

If you think you may qualify for an SEP, contact Medicare or your State Health Insurance Assistance Program (SHIP) for more information.

Original Medicare vs. Medicare Advantage: What You Need to Know

When you enroll in Medicare, you have two main options: Original Medicare (Part A and Part B) or Medicare Advantage (Part C). Here’s a breakdown of the key differences between the two:

Original Medicare:

– Covers hospital stays (Part A) and doctor visits (Part B)

– Allows you to see any doctor who accepts Medicare

– May require you to pay deductibles and coinsurance

Medicare Advantage:

– Combines hospital stays and doctor visits into one plan

– May offer additional benefits, such as dental and vision coverage

– Generally requires you to see doctors within a specific network

When deciding between Original Medicare and Medicare Advantage, consider your health needs, budget, and preferred doctors.

Medicare Prescription Drug Coverage: What You Need to Know

If you enroll in Original Medicare, you’ll need to sign up for prescription drug coverage (Part D) separately. If you enroll in Medicare Advantage, prescription drug coverage may be included in your plan.

Part D plans vary in cost and coverage, so it’s important to compare plans and choose one that meets your needs. You can enroll in a Part D plan during your IEP or during the annual enrollment period (AEP), which runs from October 15 to December 7 each year.

Medicare Supplement Insurance: What You Need to Know

Original Medicare may not cover all of your healthcare costs. That’s where Medicare supplement insurance (Medigap) comes in. Medigap plans help cover deductibles, coinsurance, and other out-of-pocket costs.

You can enroll in a Medigap plan during your six-month Medigap open enrollment period, which starts the month you turn 65 and are enrolled in Part B. After your open enrollment period ends, you may still be able to enroll in a Medigap plan, but you may have to pay more or be subject to medical underwriting.

Conclusion

Enrolling in Medicare can be a daunting task, but understanding the enrollment process and your options can help you make informed decisions about your healthcare coverage. Whether you’re approaching your 65th birthday or have missed your initial enrollment period, it’s never too late to enroll in Medicare and get the coverage you need. Contact Medicare or your SHIP for more information about enrollment and coverage options.

Contents

Frequently Asked Questions

When it comes to Medicare, many people have questions about when they should enroll. Here are five common questions and answers to help you understand when to join Medicare.

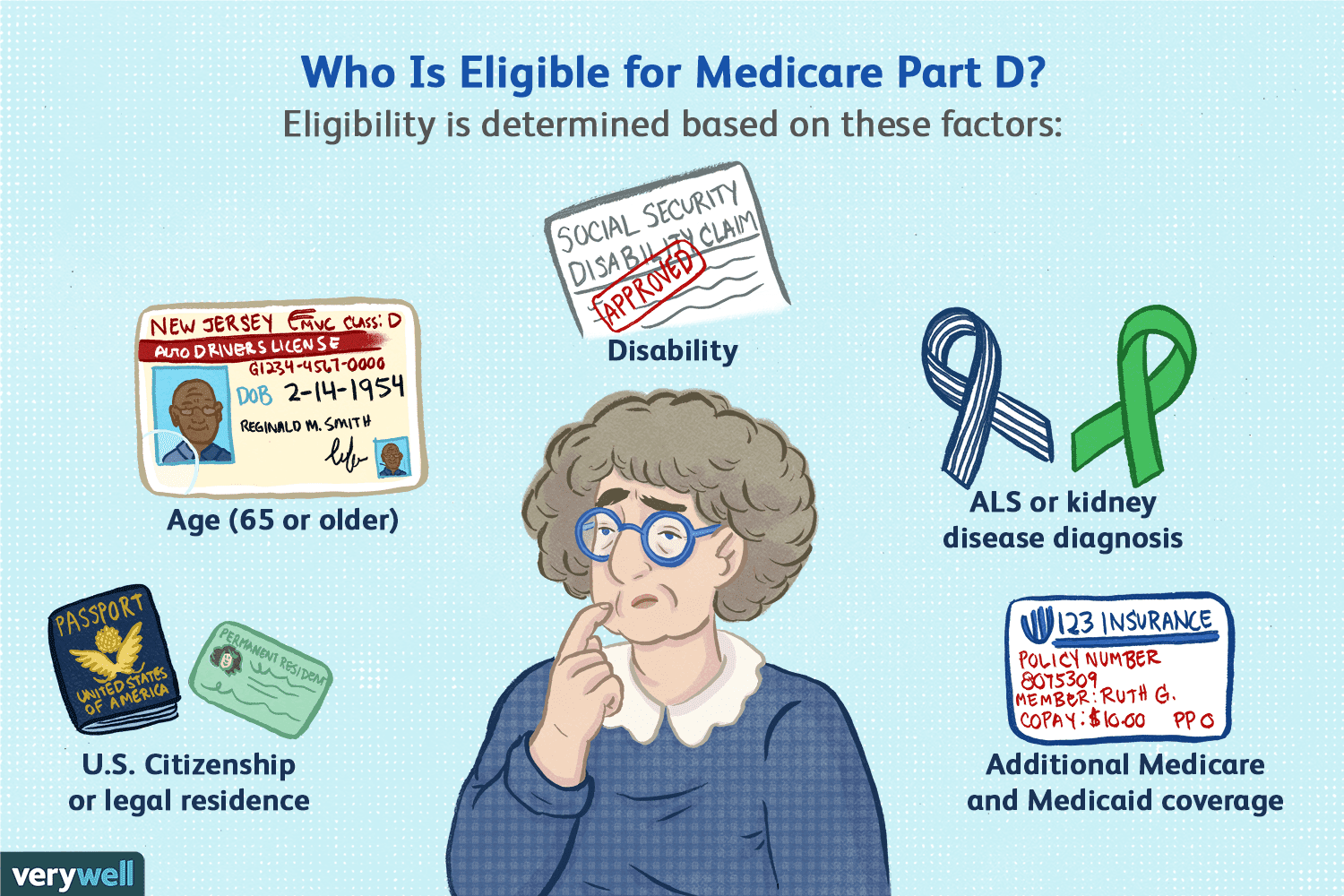

1. When am I eligible for Medicare?

You are eligible for Medicare when you turn 65 or if you have a qualifying disability. It is important to enroll in Medicare during your initial enrollment period, which is the seven-month period that begins three months before your 65th birthday month and ends three months after it. If you miss your initial enrollment period, you may have to pay a penalty when you enroll later.

If you have a qualifying disability, you can enroll in Medicare at any time, regardless of your age. You can also enroll in Medicare if you have end-stage renal disease or amyotrophic lateral sclerosis (ALS).

2. What are my Medicare enrollment options?

You have several enrollment options when it comes to Medicare. You can enroll in Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance). You can also enroll in a Medicare Advantage plan, which is a private insurance plan that provides the same coverage as Original Medicare, but may also include additional benefits like prescription drug coverage, dental, and vision coverage. You can also enroll in a Medicare Supplement plan, which helps pay for the out-of-pocket costs that Original Medicare doesn’t cover.

If you are still working and have health coverage through your employer, you may be able to delay enrollment in Medicare without penalty. However, it is important to talk to your employer and Medicare to understand your options.

3. What happens if I don’t enroll in Medicare?

If you don’t enroll in Medicare when you are first eligible, you may have to pay a penalty when you do enroll later. The penalty is calculated based on how long you went without coverage. Additionally, if you don’t have other creditable health coverage (like through an employer), you may have to pay a higher premium for Part B when you do enroll.

If you miss your initial enrollment period, you can enroll during the general enrollment period, which runs from January 1 to March 31 each year. However, your coverage won’t begin until July 1 of that year.

4. Can I change my Medicare coverage?

Yes, you can change your Medicare coverage during the annual enrollment period, which runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also switch from one Medicare Advantage plan to another, or from one Medicare Supplement plan to another.

Outside of the annual enrollment period, you can make changes to your coverage if you experience a qualifying life event, such as moving to a new state or losing your health coverage through your employer.

5. How do I enroll in Medicare?

You can enroll in Medicare online, by phone, or in person at your local Social Security office. To enroll online, visit the Social Security website and follow the prompts. To enroll by phone, call Social Security at 1-800-772-1213. If you prefer to enroll in person, visit your local Social Security office. It is important to have certain information ready when you enroll, such as your Social Security number, birth certificate, and proof of citizenship or legal residency.

Remember, it is important to enroll in Medicare during your initial enrollment period to avoid penalties and gaps in coverage.

When to Enroll In Medicare | Tips to Avoid Penalties

In conclusion, deciding when to join Medicare can be a complex decision, but it’s important to understand the options available to you. Whether you’re approaching retirement age or have a disability, understanding the benefits and costs of Medicare can help you make an informed decision.

It’s important to remember that delaying enrollment in Medicare can result in penalties and gaps in coverage. Therefore, it’s recommended that you enroll in Medicare during your initial enrollment period or special enrollment period to avoid these potential issues.

Ultimately, the decision to join Medicare should be based on your specific healthcare needs and financial situation. Consulting with a healthcare professional or financial advisor can also help you make the best decision for your individual circumstances.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts