Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program for people aged 65 and over, as well as for certain younger people with disabilities. The question of when you can enroll in Medicare is an important one, and it’s essential to understand the eligibility requirements and when you can sign up.

Many people assume that you automatically qualify for Medicare when you turn 65, but that’s not necessarily the case. In this article, we’ll explore the age requirements for Medicare and what you need to know to ensure you’re covered when you need it most. So, let’s dive in and explore the ins and outs of Medicare eligibility!

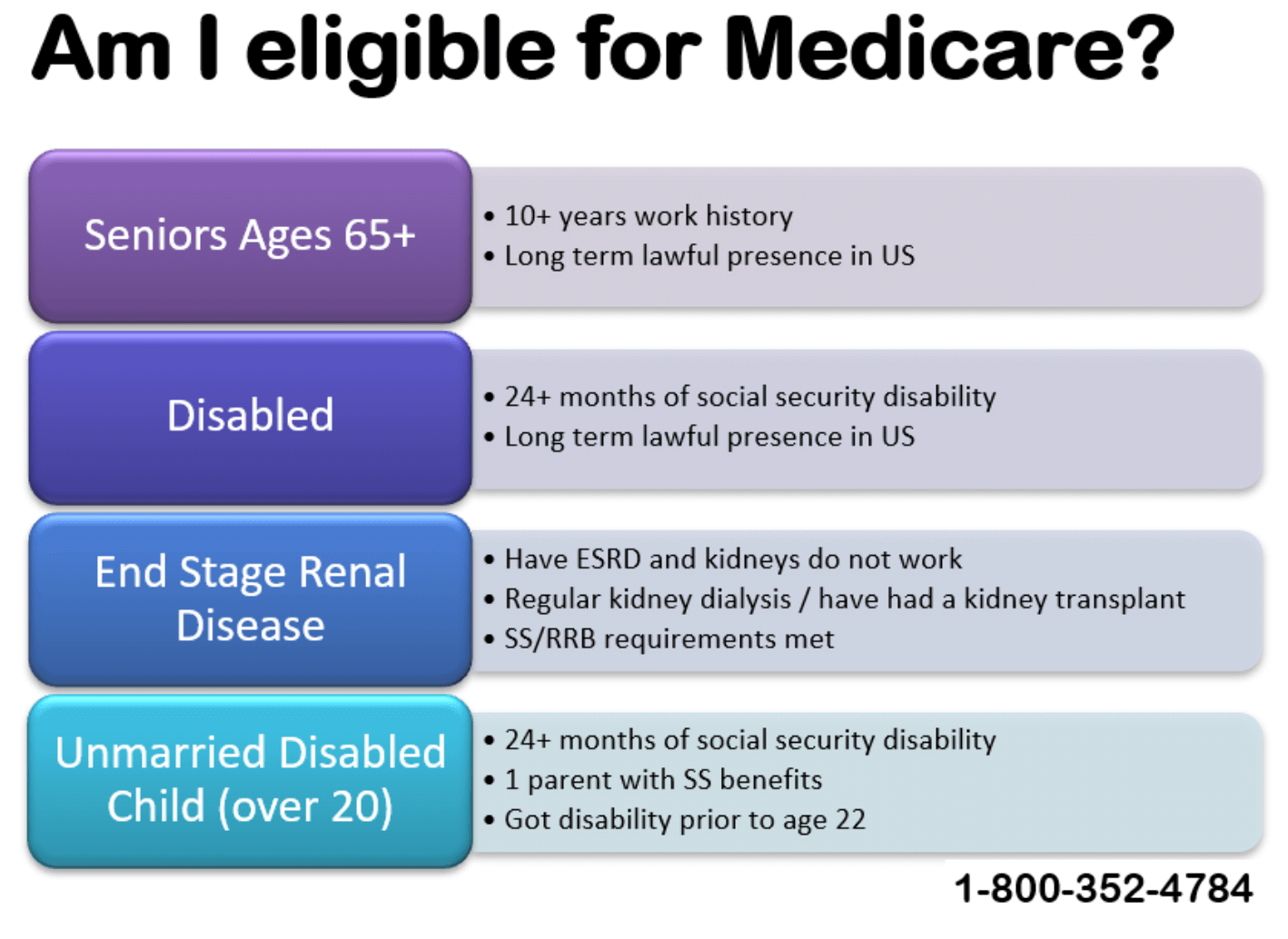

To qualify for Medicare, you must be at least 65 years old or have a qualifying disability or medical condition, such as end-stage renal disease. You may also qualify if you have amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s disease. If you are approaching Medicare eligibility, start researching your options to ensure you have the coverage you need.

How Old Do You Have to Be for Medicare Insurance?

Medicare insurance is a government-run health insurance program that helps people with their medical expenses. It covers a wide range of healthcare services, including hospital stays, doctor visits, and prescription drugs. But one question that many people have is, “How old do you have to be for Medicare insurance?” In this article, we’ll answer that question and provide some additional information about Medicare.

What is Medicare?

Medicare is a federal health insurance program for people who are 65 or older, as well as for younger people with certain disabilities and people with end-stage renal disease. The program is divided into four parts: Part A, Part B, Part C, and Part D.

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Part B covers doctor visits, outpatient care, and some preventive services. Part C, also known as Medicare Advantage, is an alternative to original Medicare and includes Parts A and B, as well as additional benefits like prescription drug coverage. Part D is prescription drug coverage.

When Can You Enroll in Medicare?

Most people become eligible for Medicare when they turn 65. You can enroll in Medicare during your Initial Enrollment Period, which is a seven-month period that begins three months before the month you turn 65 and ends three months after the month you turn 65. If you miss your Initial Enrollment Period, you may be subject to a late enrollment penalty.

If you’re still working and have health insurance through your employer, you may be able to delay enrolling in Medicare without penalty. However, you’ll need to enroll in Medicare once you retire or lose your employer coverage.

What are the Benefits of Medicare?

There are many benefits to enrolling in Medicare. For one, it can help you save money on your healthcare expenses. Without insurance, medical bills can quickly add up and become overwhelming. Medicare can help you avoid those high costs.

Another benefit of Medicare is that it provides access to a wide range of healthcare services. From doctor visits to hospital stays to prescription drugs, Medicare covers many different types of medical care.

Original Medicare vs Medicare Advantage

As mentioned earlier, there are two different types of Medicare: original Medicare and Medicare Advantage. Original Medicare includes Parts A and B and is run by the federal government. Medicare Advantage, on the other hand, is run by private insurance companies and includes Parts A, B, and usually Part D.

The main difference between the two is that original Medicare allows you to see any doctor who accepts Medicare, while Medicare Advantage requires you to use doctors within the plan’s network.

What is the Cost of Medicare?

The cost of Medicare can vary depending on a few different factors, such as your income and which parts of Medicare you enroll in. Part A is usually free for most people, but you’ll need to pay a premium for Part B. The cost of Part B is based on your income and can range from $148.50 to $504.90 per month in 2021.

If you enroll in Medicare Advantage, the cost will depend on the plan you choose. Some plans may have low or no premiums, but they may also have higher out-of-pocket costs.

What Does Medicare Cover?

Medicare covers a wide range of healthcare services, including:

- Inpatient hospital stays

- Doctor visits

- Outpatient care

- Prescription drugs (if enrolled in Part D)

- Preventive services

- Home health care

- Hospice care

- Skilled nursing facility care

It’s important to note that not all services are covered at 100%, and you may still be responsible for some out-of-pocket costs.

What is Not Covered by Medicare?

While Medicare covers many different healthcare services, there are some things that it does not cover. Some examples include:

- Dental care

- Vision care

- Hearing aids

- Cosmetic surgery

- Long-term care

If you need any of these services, you’ll need to pay for them out of pocket or enroll in a separate insurance plan that covers them.

Conclusion

Medicare is a valuable resource for people who need help paying for their healthcare expenses. Most people become eligible for Medicare when they turn 65, but younger people with certain disabilities may also qualify. There are different parts of Medicare, including original Medicare and Medicare Advantage, and each has its own benefits and costs. If you’re nearing retirement age or have a disability, it’s important to understand your options for Medicare coverage.

Frequently Asked Questions

Medicare is a federal health insurance program for those who are 65 years old or older, as well as for those who have certain disabilities or end-stage renal disease. Here are some commonly asked questions about the age requirements for Medicare insurance.

1. When can I sign up for Medicare?

Generally, you can sign up for Medicare during your Initial Enrollment Period (IEP), which is the seven-month period that begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65. If you are under 65 and have certain disabilities or end-stage renal disease, you may also be eligible for Medicare.

If you do not sign up for Medicare during your IEP, you may face a late enrollment penalty and may have to wait until the General Enrollment Period (GEP) to sign up. The GEP is from January 1 to March 31 of each year, and coverage starts on July 1 of that year.

2. Can I get Medicare before I turn 65?

If you have certain disabilities or end-stage renal disease, you may be eligible for Medicare before you turn 65. However, the rules for eligibility are different than for those who are 65 or older.

If you have been receiving Social Security Disability Insurance (SSDI) for at least 24 months, you will automatically be enrolled in Medicare. If you have end-stage renal disease, you may be eligible for Medicare regardless of your age or work history.

3. What if I am still working when I turn 65?

If you are still working when you turn 65 and have health coverage through your employer or union, you may not need to sign up for Medicare right away. However, it is important to check with your employer to see if they require you to enroll in Medicare.

If you do not enroll in Medicare when you are first eligible and you do not have health coverage through your employer or union, you may face a late enrollment penalty when you do sign up for Medicare.

4. Do I need to pay for Medicare?

Most people do not have to pay a premium for Medicare Part A, which covers hospital stays, skilled nursing facilities, and some home health care. However, there may be a premium for Medicare Part B, which covers doctor visits, outpatient care, and some preventive services.

The amount of the premium for Medicare Part B varies depending on your income. If you have a higher income, you may pay more for your Part B premium.

5. What if I have other insurance?

If you have other health insurance, such as through your employer or union, you may still be eligible for Medicare. However, it is important to check with your insurance provider to see how Medicare will work with your other insurance.

If you have other insurance that is considered creditable coverage, which means it is at least as good as Medicare’s coverage, you may not need to enroll in Medicare Part B right away. However, if your other insurance ends or changes, you may need to enroll in Medicare Part B to avoid a late enrollment penalty.

How to Qualify For Medicare (You Don’t Have to Be 65)

In conclusion, the age requirement for Medicare insurance is a crucial factor for many Americans. Individuals who are 65 years or older are eligible for Medicare insurance, but those who have certain disabilities or illnesses may also qualify before turning 65. It’s important to understand the eligibility criteria to ensure that you or your loved ones receive the necessary medical coverage.

If you’re nearing the age of 65, it’s important to start researching and understanding Medicare insurance options to make informed decisions about your healthcare. With Medicare, you can access a range of medical services and treatments without facing significant financial burdens. Whether you’re looking for preventative care or specialized treatments, Medicare insurance can help you manage your health needs.

Ultimately, the age requirement for Medicare insurance is an important consideration for anyone who wants to protect their health and well-being as they age. By understanding the eligibility criteria and exploring the available options, you can make informed decisions about your healthcare and ensure that you receive the medical coverage you need to live a healthy and fulfilling life.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts