Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Paragraph 1: Are you turning 65 soon and wondering how much Medicare Advantage costs? Or, are you already enrolled in Medicare Advantage and confused about the costs? Look no further! In this article, we will break down the costs of Medicare Advantage and help you make an informed decision.

Paragraph 2: Medicare Advantage offers additional benefits compared to Original Medicare, but it also comes with different costs. Understanding these costs can help you plan your healthcare expenses and avoid surprises. So, let’s dive into the world of Medicare Advantage costs and learn how much you can expect to pay.

Medicare Advantage plans have monthly premiums that vary depending on the specific plan you choose. In 2021, the average Medicare Advantage premium is $33 per month, but some plans have $0 premiums. Additionally, Medicare Advantage plans may have other costs such as deductibles, copayments, and coinsurance. These costs vary by plan, so it’s important to compare plans and understand the costs before enrolling.

Understanding the Cost of Medicare Advantage

Medicare Advantage is a health insurance program that offers an alternative to original Medicare. It provides additional benefits, such as vision, dental, and hearing, along with prescription drug coverage. However, as with any health insurance plan, Medicare Advantage has a cost associated with it. In this article, we will explore the various factors that determine the cost of Medicare Advantage.

Monthly Premiums

Medicare Advantage plans may charge a monthly premium in addition to the Medicare Part B premium. The amount of the premium varies depending on the plan, the location, and the insurance provider. Some plans may have a $0 premium, while others may have premiums that exceed $100 per month. It is important to compare plans and their costs before making a decision.

One way to save on monthly premiums is to choose a plan with a health savings account (HSA). An HSA is a tax-advantaged savings account that can be used to pay for medical expenses. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Deductibles and Copayments

Medicare Advantage plans may have deductibles and copayments for medical services. A deductible is the amount of money that must be paid before the insurance company starts paying for medical services. Copayments are a fixed amount that must be paid for each medical service. The amount of the deductible and copayments varies depending on the plan.

Some Medicare Advantage plans may have lower deductibles and copayments than original Medicare. However, it is important to compare the costs of each plan to determine which one is the best fit for your healthcare needs and budget.

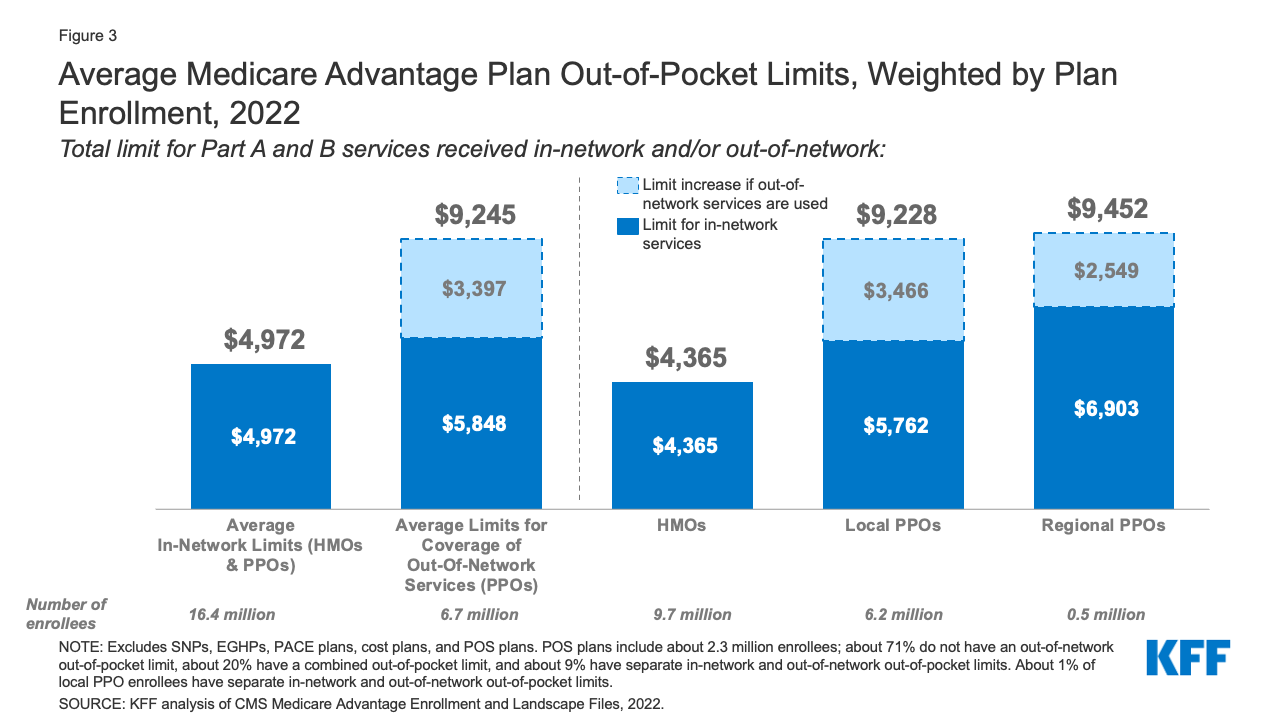

Out-of-Pocket Maximum

Medicare Advantage plans have an out-of-pocket maximum, which is the most you will have to pay for covered medical services in a year. Once you reach the out-of-pocket maximum, the plan will pay for all covered medical services for the rest of the year. The out-of-pocket maximum varies depending on the plan.

It is important to note that the out-of-pocket maximum does not include the monthly premium or the cost of services that are not covered by the plan. It is important to read the plan’s summary of benefits to understand what services are covered and what services are not covered.

Network Restrictions

Medicare Advantage plans may have network restrictions, which means that you must choose healthcare providers within the plan’s network to receive the lowest cost for medical services. Out-of-network providers may charge higher rates, which can result in higher out-of-pocket costs for you.

It is important to check the plan’s provider directory to ensure that your preferred healthcare providers are in the network. If your preferred healthcare providers are not in the network, you may need to switch to a different plan or pay higher out-of-network costs.

Prescription Drug Coverage

Medicare Advantage plans may include prescription drug coverage, which can help lower the cost of medications. The cost of prescription drug coverage varies depending on the plan and the medications that are covered.

It is important to review the plan’s formulary, which is a list of covered medications, to determine if your medications are covered and at what cost. If your medications are not covered, you may need to switch to a different plan or pay out-of-pocket for the medications.

Benefits of Medicare Advantage

Medicare Advantage plans offer several benefits that are not available with original Medicare. These benefits may include vision, dental, and hearing coverage, as well as wellness programs and health club memberships.

Some Medicare Advantage plans may also offer transportation to medical appointments and home-delivered meals for individuals with chronic conditions.

Medicare Advantage vs. Original Medicare

Medicare Advantage and original Medicare have different costs and benefits. Original Medicare does not include prescription drug coverage or additional benefits, such as vision, dental, and hearing.

However, original Medicare does not have network restrictions, which means that you can choose any healthcare provider that accepts Medicare. Original Medicare also does not have deductibles or out-of-pocket maximums for medical services.

It is important to compare the costs and benefits of each program to determine which one is the best fit for your healthcare needs and budget.

Conclusion

In summary, the cost of Medicare Advantage depends on several factors, including monthly premiums, deductibles and copayments, out-of-pocket maximums, network restrictions, and prescription drug coverage. It is important to compare the costs and benefits of each plan to determine which one is the best fit for your healthcare needs and budget.

Contents

- Frequently Asked Questions

- 1. How much does Medicare Advantage cost?

- 2. Are there any additional costs with Medicare Advantage?

- 3. Can I get financial assistance to pay for Medicare Advantage?

- 4. How do I enroll in a Medicare Advantage plan?

- 5. Can I switch from a Medicare Advantage plan to Original Medicare?

- 2023 Medicare Costs Comparison | Advantage vs Supplement

Frequently Asked Questions

Medicare Advantage is a popular healthcare plan that offers comprehensive medical coverage to seniors. However, many people are not aware of the cost associated with this plan. Here are some frequently asked questions about the cost of Medicare Advantage.

1. How much does Medicare Advantage cost?

The cost of Medicare Advantage varies depending on the plan you choose and your location. On average, Medicare Advantage plans cost around $30 to $50 per month in addition to your monthly Medicare Part B premium. Some plans may have a $0 premium, but they may have higher out-of-pocket costs such as deductibles, copayments, and coinsurance.

It is important to review each plan carefully and compare the costs and benefits before enrolling in a Medicare Advantage plan. You should also consider your healthcare needs and budget to determine the best plan for you.

2. Are there any additional costs with Medicare Advantage?

Yes, there may be additional costs with Medicare Advantage. In addition to your monthly premium, you may be responsible for copayments, coinsurance, and deductibles for medical services such as doctor visits, hospital stays, and prescription drugs. Some plans may also have a maximum out-of-pocket limit, which is the maximum amount you will pay for covered services in a year.

It is important to review the plan’s summary of benefits and coverage to understand the costs associated with each service. You should also check if your preferred doctors and hospitals are in the plan’s network to avoid additional out-of-pocket costs.

3. Can I get financial assistance to pay for Medicare Advantage?

Yes, you may be eligible for financial assistance to pay for Medicare Advantage. If you have a low income, you may qualify for the Medicare Savings Program, which can help pay for your premiums, deductibles, and coinsurance. You may also be eligible for Extra Help, which can help you pay for prescription drugs.

To determine if you qualify for financial assistance, you can contact your local State Health Insurance Assistance Program (SHIP) or visit Medicare.gov for more information.

4. How do I enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the Annual Enrollment Period (AEP) or during a Special Enrollment Period (SEP) if you have a qualifying event such as moving to a new location or losing your current coverage. To enroll, you can visit Medicare.gov or contact a licensed insurance agent who can help you compare plans and enroll in the plan of your choice.

It is important to enroll in a Medicare Advantage plan that meets your healthcare needs and budget. You should also review the plan’s network of doctors and hospitals to ensure that your preferred providers are included in the plan.

5. Can I switch from a Medicare Advantage plan to Original Medicare?

Yes, you can switch from a Medicare Advantage plan to Original Medicare during the Annual Enrollment Period (AEP) or during the Medicare Advantage Open Enrollment Period (OEP). The AEP runs from October 15 to December 7 each year, while the OEP runs from January 1 to March 31 each year.

If you decide to switch to Original Medicare, you should also enroll in a Medicare Part D plan to get prescription drug coverage. It is important to review your healthcare needs and budget before making any changes to your Medicare coverage.

2023 Medicare Costs Comparison | Advantage vs Supplement

In conclusion, the cost of Medicare Advantage varies depending on several factors such as your location, the plan you choose, and your health status. While some plans may have lower monthly premiums, they may come with higher out-of-pocket costs. On the other hand, plans with higher monthly premiums may offer more comprehensive coverage and lower out-of-pocket expenses.

It’s essential to carefully review and compare different Medicare Advantage plans before making a decision. You can use the Medicare Plan Finder tool to compare plans in your area and estimate your expected out-of-pocket costs.

Remember that enrolling in a Medicare Advantage plan can provide additional benefits and coverage beyond Original Medicare. By choosing a plan that suits your healthcare needs and budget, you can enjoy comprehensive coverage and peace of mind knowing that your healthcare costs are covered.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts