Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that covers the medical expenses of people aged 65 or older, as well as younger people with disabilities and those with end-stage renal disease. Hospital stays are often a necessary part of medical treatment, but many people are unsure of how long Medicare will cover their stay. In this article, we will explore the answer to the question, “How many days will Medicare pay for a hospital stay?” and provide helpful information to guide you through the process of understanding your coverage.

Hospital stays can be stressful and overwhelming, especially when it comes to navigating insurance coverage. Understanding Medicare’s policy on hospital stays can help ease some of that stress. In this article, we will break down the basics of Medicare coverage for hospital stays, including how long Medicare will cover your stay and what you can expect in terms of out-of-pocket costs. Whether you are a Medicare beneficiary or are caring for someone who is, this article will provide valuable information to help you make informed decisions about medical treatment.

Medicare Part A pays for inpatient hospital stays up to 90 days per benefit period. If you need to stay longer, you may be eligible for additional days. However, if you stay longer than 90 days, you will have to pay a daily coinsurance amount. After 150 days, Medicare coverage ends. It’s important to note that these rules can vary based on your individual situation and the specific hospital services you receive.

How Many Days Will Medicare Pay for Hospital Stay?

When it comes to hospital stays, it’s important to know how many days Medicare will pay for. Understanding this can help you plan ahead and avoid unexpected medical bills. In this article, we will discuss how many days Medicare covers for hospital stays.

Medicare Part A Coverage

Medicare Part A is the part of Medicare that covers hospital stays. For each benefit period, Medicare will cover up to 90 days of hospitalization. A benefit period begins the day you are admitted to the hospital and ends when you haven’t received any hospital care for 60 days in a row. If you are readmitted to the hospital after 60 days, a new benefit period will begin.

During the first 60 days of a benefit period, Medicare will cover all of your hospital costs, except for the Part A deductible. As of 2021, the Part A deductible is $1,484. After the first 60 days, you will be responsible for a daily coinsurance amount. The coinsurance amount for 2021 is $371 per day for days 61-90 of hospitalization.

It’s important to note that the 90-day limit is per benefit period. If you need to be hospitalized again within the same benefit period, Medicare will cover up to an additional 90 days of hospitalization.

Medicare Advantage Coverage

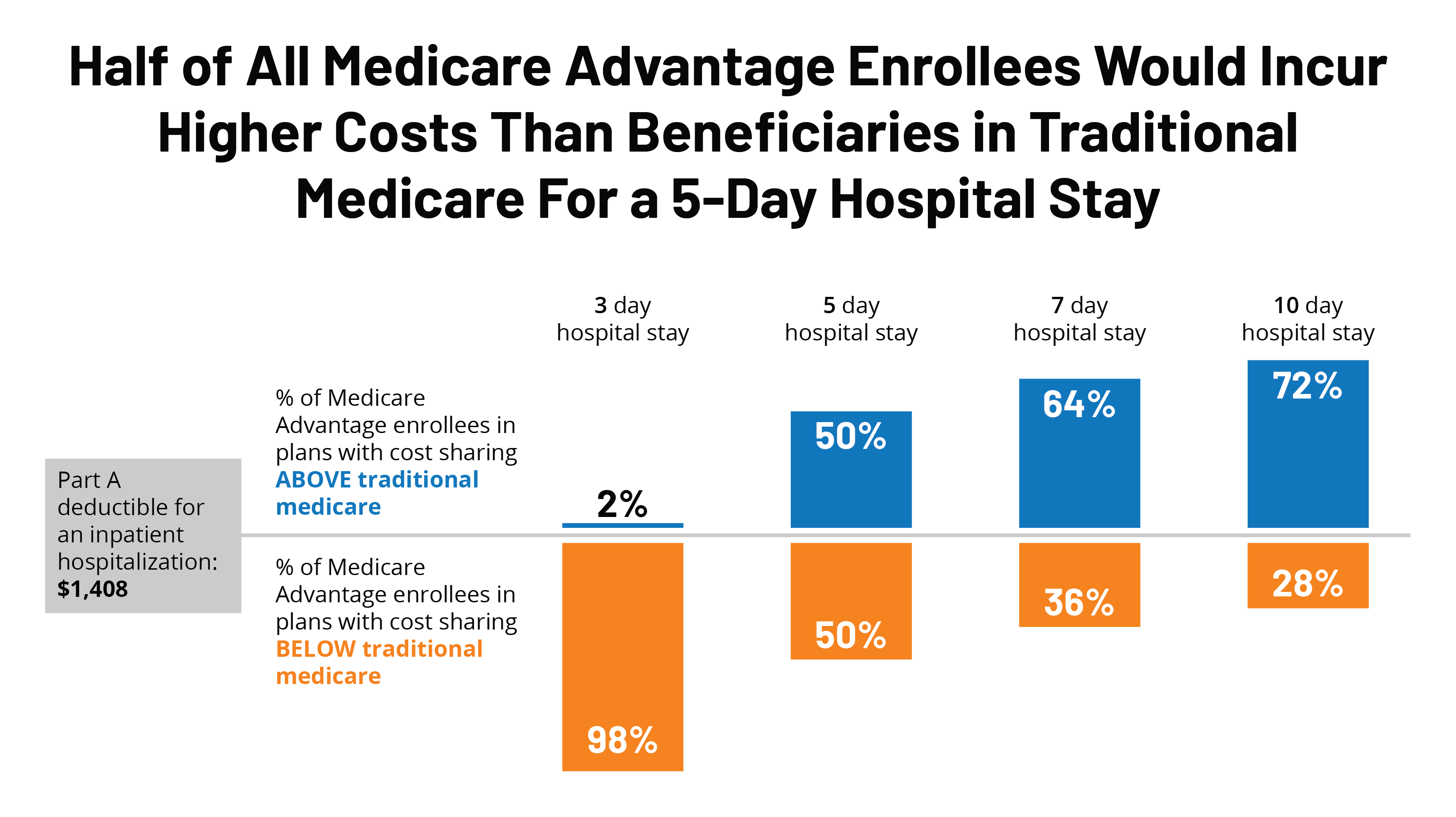

Medicare Advantage plans are offered by private insurance companies and provide an alternative way to receive Medicare benefits. If you have a Medicare Advantage plan, your hospital coverage may differ from traditional Medicare.

Many Medicare Advantage plans offer additional benefits, such as coverage for prescription drugs or routine dental and vision care. However, the hospital coverage may have different limitations. Some Medicare Advantage plans may have shorter hospital stays, higher out-of-pocket costs, or require prior authorization for hospitalization.

It’s important to review your Medicare Advantage plan’s coverage before you need hospitalization to understand the limitations and costs.

Benefit of Choosing a Medicare Supplement Plan

Medicare Supplement plans, also known as Medigap policies, can help cover the out-of-pocket costs that Medicare Part A doesn’t cover. This can include the Part A deductible and coinsurance amounts.

If you choose a Medicare Supplement plan, you can have peace of mind knowing that you won’t be responsible for unexpected medical bills. However, it’s important to note that Medicare Supplement plans do not provide additional hospital coverage beyond what Medicare covers.

When Medicare Will Not Cover Hospital Stays

There are some situations where Medicare will not cover hospital stays, such as if the hospitalization is for custodial care or for a procedure that is not deemed medically necessary. Additionally, if you leave the hospital against medical advice, Medicare may not cover the costs of your hospitalization.

It’s important to understand the situations where Medicare will not cover hospital stays to avoid unexpected medical bills.

Comparing Traditional Medicare and Medicare Advantage

When choosing between traditional Medicare and a Medicare Advantage plan, it’s important to weigh the pros and cons of each. Traditional Medicare offers more flexibility in choosing healthcare providers and typically has broader hospital coverage. However, Medicare Advantage plans may offer additional benefits and can have lower out-of-pocket costs.

It’s important to review your healthcare needs and budget to determine which option is best for you.

Conclusion

Understanding how long Medicare will cover hospital stays is an important part of planning for your healthcare needs. Medicare Part A covers up to 90 days of hospitalization per benefit period, while Medicare Advantage plans may have different limitations. Choosing a Medicare Supplement plan can help cover out-of-pocket costs, but it’s important to understand the limitations of each plan before choosing. By understanding your options, you can make informed decisions about your healthcare coverage.

Contents

- Frequently Asked Questions

- How many days will Medicare pay for a hospital stay?

- What happens if I leave the hospital before Medicare’s coverage ends?

- What if I need to go back to the hospital after my benefit period has ended?

- What if I have a Medicare Advantage plan?

- What if I have other insurance in addition to Medicare?

- Legal Standard for Obtaining 100 days of Medicare | Medicare Coverage After Hospital Discharge

Frequently Asked Questions

Medicare is a federal health insurance program for people who are 65 or older, as well as some younger people with disabilities. One of the benefits of Medicare is the coverage of hospital stays. Here are some frequently asked questions about how many days Medicare will pay for a hospital stay.

How many days will Medicare pay for a hospital stay?

Medicare Part A covers up to 90 days of hospitalization per benefit period. A benefit period starts the day you’re admitted to a hospital and ends when you haven’t received any hospital care for 60 days. If you need to go back into the hospital after the benefit period has ended, a new benefit period begins, and the 90-day limit starts over again.

If you need to stay in the hospital for more than 90 days in a benefit period, you can use your lifetime reserve days. You have 60 lifetime reserve days that can be used over your lifetime. Once you’ve used your lifetime reserve days, you’re responsible for all hospital costs.

What happens if I leave the hospital before Medicare’s coverage ends?

If you leave the hospital before Medicare’s coverage ends, you may be able to continue receiving care in a skilled nursing facility. Medicare covers up to 100 days of skilled nursing facility care per benefit period. To qualify for this coverage, you must have a qualifying hospital stay of at least three days and need skilled nursing care.

If you don’t need skilled nursing care but still require additional hospital care, you may be able to receive outpatient hospital services. Medicare Part B covers many outpatient hospital services, including doctor visits, lab tests, and X-rays.

What if I need to go back to the hospital after my benefit period has ended?

If you need to go back to the hospital after your benefit period has ended, you’ll start a new benefit period, and the 90-day limit will start over again. If you’re still in the hospital when the new benefit period starts, you won’t have to pay the deductible again. However, if you’ve been out of the hospital for more than 60 days, you’ll have to pay the deductible again.

If you need to stay in the hospital for more than 90 days in a benefit period, you can use your lifetime reserve days. You have 60 lifetime reserve days that can be used over your lifetime. Once you’ve used your lifetime reserve days, you’re responsible for all hospital costs.

What if I have a Medicare Advantage plan?

If you have a Medicare Advantage plan, your coverage for a hospital stay may be different. Some Medicare Advantage plans have different costs and coverage rules than Original Medicare. You should check with your plan to see what your coverage is for hospital stays.

Most Medicare Advantage plans are required to provide at least the same level of coverage as Original Medicare, but some plans may offer additional benefits or have different cost-sharing requirements. Make sure you understand your plan’s coverage and costs before you go to the hospital.

What if I have other insurance in addition to Medicare?

If you have other insurance in addition to Medicare, such as employer-sponsored insurance or a Medigap policy, your coverage for a hospital stay may be different. Your other insurance may pay for some of the costs that Medicare doesn’t cover, or it may have different coverage rules.

Make sure you understand your other insurance’s coverage and costs before you go to the hospital. You should also let the hospital and your doctors know about your other insurance so they can bill the right insurance first.

Legal Standard for Obtaining 100 days of Medicare | Medicare Coverage After Hospital Discharge

In conclusion, Medicare provides coverage for hospital stays, but the number of days can vary depending on several factors. These factors include the type of Medicare plan you have, the reason for hospitalization, and the medical assessment by your healthcare provider.

It is important to note that while Medicare provides coverage for hospital stays, it may not cover all expenses. Patients may still be responsible for co-payments, deductibles, and other out-of-pocket expenses. Therefore, it is essential to review your Medicare plan carefully and talk to your healthcare provider about any potential costs.

Ultimately, understanding the details of Medicare coverage for hospital stays can help you make informed decisions about your healthcare needs. By working closely with your healthcare provider and reviewing your Medicare benefits, you can ensure that you receive the care you need without incurring unexpected expenses.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts