Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage to individuals aged 65 years or older or those with certain disabilities. While Medicare covers a wide range of medical services, it does not cover all expenses, leaving beneficiaries with out-of-pocket costs. This is where Medicare Supplemental Insurance, also known as Medigap, comes in. But who is eligible for this additional coverage? Keep reading to find out.

To be eligible for Medicare Supplemental Insurance, you must be enrolled in Medicare Part A and Part B. You must also live in the state where the plan is offered and be 65 years old or older, or have a qualifying disability. Additionally, you must apply during the open enrollment period or during a special enrollment period if you have certain life changes, such as losing employer-sponsored coverage. Understanding the eligibility requirements for Medigap can help you make informed decisions about your healthcare coverage.

Who is Eligible for Medicare Supplemental Insurance?

Medicare supplemental insurance, also known as Medigap, is available to those who are enrolled in Medicare Part A and Part B. You must be 65 years or older or have a qualifying disability to be eligible for Medicare. You can enroll in a Medigap plan during your six-month open enrollment period, which begins on the first day of the month in which you turn 65 and are enrolled in Part B. It’s important to note that Medigap policies don’t cover prescription drugs, so you’ll need to enroll in a separate Medicare Part D plan for that coverage.

Contents

- Who is Eligible for Medicare Supplemental Insurance?

- Frequently Asked Questions

- Question 1: Who is eligible for Medicare Supplemental Insurance?

- Question 2: Can I enroll in Medigap if I have a pre-existing condition?

- Question 3: What does Medigap cover?

- Question 4: How much does Medigap cost?

- Question 5: When can I enroll in Medigap?

- What is Medigap? (Medicare Supplement Insurance Explained)

Who is Eligible for Medicare Supplemental Insurance?

Medicare is the federal health insurance program for people who are 65 years old or older, as well as for people under 65 with certain disabilities. While Medicare covers many medical expenses, there are still some out-of-pocket costs that can add up. This is where Medicare supplemental insurance, also known as Medigap, comes in.

Eligibility for Medicare Supplemental Insurance

To be eligible for Medicare supplemental insurance, you must be enrolled in Original Medicare, which consists of Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). You cannot enroll in a Medicare Advantage plan and a Medigap plan at the same time.

Once you are enrolled in Original Medicare, you can apply for Medigap during your Medigap Open Enrollment Period, which is the six-month period that starts the month you turn 65 and are enrolled in Medicare Part B. During this period, insurance companies cannot deny you coverage or charge you more due to pre-existing conditions.

Benefits of Medicare Supplemental Insurance

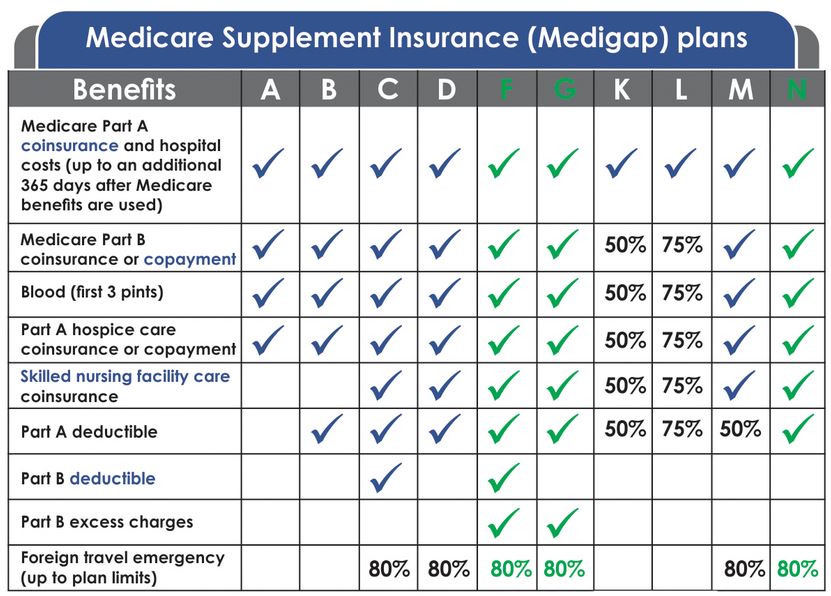

Medigap plans are designed to help pay for the out-of-pocket costs that Original Medicare does not cover, such as deductibles, coinsurance, and copayments. There are 10 standardized Medigap plans available in most states, each with its own set of benefits. These benefits can include coverage for skilled nursing facility care, foreign travel emergencies, and excess charges from providers who do not accept Medicare assignment.

Medigap Vs. Medicare Advantage

Medicare Advantage plans, also known as Medicare Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies and may include additional benefits such as prescription drug coverage, dental, vision, and hearing benefits. However, Medicare Advantage plans typically have networks of providers and may require prior authorization for certain services.

While Medigap plans do not include additional benefits, they do offer more flexibility in terms of choosing providers, as long as they accept Medicare assignment. Medigap plans also do not require prior authorization for services.

How to Choose a Medigap Plan

When choosing a Medigap plan, it is important to consider your individual healthcare needs and budget. Each Medigap plan has its own monthly premium, and some plans may offer more comprehensive coverage than others.

You can compare Medigap plans and their benefits using the Medicare.gov website or by speaking with a licensed insurance agent. Keep in mind that Medigap plans are standardized, meaning that each plan with the same letter designation will offer the same benefits, regardless of the insurance company.

Costs of Medicare Supplemental Insurance

The cost of Medigap plans varies depending on the plan you choose and where you live. In addition to the monthly premium, some Medigap plans may also require you to pay a deductible before coverage kicks in.

It is important to note that Medigap plans do not include prescription drug coverage. If you need prescription drug coverage, you will need to enroll in a separate Medicare Part D plan.

When to Enroll in Medicare Supplemental Insurance

The best time to enroll in a Medigap plan is during your Medigap Open Enrollment Period, as mentioned earlier. During this period, insurance companies cannot deny you coverage or charge you more due to pre-existing conditions.

If you miss your Medigap Open Enrollment Period, you may still be able to enroll in a Medigap plan, but the insurance company may be able to deny you coverage or charge you more based on your health status.

Conclusion

Medicare supplemental insurance can be a valuable tool in helping to pay for the out-of-pocket costs of healthcare. To be eligible for Medigap, you must be enrolled in Original Medicare and apply during your Medigap Open Enrollment Period. It is important to consider your individual healthcare needs and budget when choosing a Medigap plan, and to enroll in a separate Medicare Part D plan if you need prescription drug coverage.

Frequently Asked Questions

Question 1: Who is eligible for Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also known as Medigap, is available for individuals who are 65 years or older and have enrolled in Medicare Part A and Part B. Additionally, individuals under the age of 65 may be eligible for Medigap if they have a disability or certain medical conditions.

If you are already enrolled in a Medicare Advantage plan, you will not be eligible for Medigap. It is important to note that Medigap policies are sold by private insurance companies and eligibility requirements may vary.

Question 2: Can I enroll in Medigap if I have a pre-existing condition?

Yes, you can enroll in Medigap if you have a pre-existing condition. However, it is important to note that if you apply for Medigap outside of your open enrollment period, you may be subject to medical underwriting and could be denied coverage or charged a higher premium based on your health status.

During your open enrollment period, which is the six-month period that begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B, insurance companies cannot deny you coverage or charge you a higher premium due to a pre-existing condition.

Question 3: What does Medigap cover?

Medigap policies are designed to cover some or all of the out-of-pocket costs associated with Original Medicare, including deductibles, copayments, and coinsurance. Medigap policies may also cover certain benefits that are not covered by Original Medicare, such as emergency medical care when traveling outside of the United States.

It is important to note that Medigap policies do not cover prescription drugs. If you need prescription drug coverage, you will need to enroll in a Medicare Part D plan.

Question 4: How much does Medigap cost?

The cost of Medigap policies varies depending on a number of factors, including your age, location, and the type of Medigap policy you choose. In general, Medigap policies with more comprehensive coverage will have higher premiums.

It is important to shop around and compare prices from different insurance companies before choosing a Medigap policy. You may also want to consider working with a licensed insurance agent who can help you find the right policy for your needs and budget.

Question 5: When can I enroll in Medigap?

You can enroll in a Medigap policy during your open enrollment period, which is the six-month period that begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During this time, insurance companies cannot deny you coverage or charge you a higher premium based on your health status.

If you miss your open enrollment period, you may still be able to enroll in a Medigap policy, but you may be subject to medical underwriting and could be denied coverage or charged a higher premium based on your health status. Additionally, you may only be able to enroll in a Medigap policy during certain times of the year, such as during the annual Medicare Open Enrollment Period.

What is Medigap? (Medicare Supplement Insurance Explained)

In conclusion, Medicare Supplemental Insurance is a valuable resource for those who qualify. Eligibility is based on a few key factors, including age, citizenship, and enrollment in Original Medicare. It is important to note that not everyone will be eligible for all types of Medicare Supplemental Insurance plans, so it is crucial to do your research and assess your individual needs before making a decision.

If you are eligible for Medicare Supplemental Insurance, it can provide peace of mind and financial security. It can help cover costs that Original Medicare does not, such as deductibles, copayments, and coinsurance. By enrolling in a Medicare Supplemental Insurance plan, you can ensure that you have comprehensive coverage and are not left with unexpected medical bills.

Ultimately, the decision to enroll in Medicare Supplemental Insurance is a personal one that should be made after careful consideration of your individual needs and circumstances. With the right plan, you can enjoy the benefits of additional coverage and the peace of mind that comes with knowing you are protected against unexpected medical expenses.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts