Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a government-funded health insurance program that covers millions of Americans aged 65 and older, as well as those with specific disabilities or chronic conditions. However, many people are unaware that they may still be responsible for paying additional out-of-pocket expenses known as Medicare excess charges. In this article, we will explore how common these excess charges are and what you need to know to avoid them.

Whether you are currently enrolled in Medicare or are planning to become eligible soon, understanding the potential costs associated with excess charges is essential to protect your financial well-being. We will delve into the details of Medicare excess charges, including what they are, how they work, and what you can do to minimize their impact on your healthcare expenses. So, let’s get started and learn more about this important aspect of Medicare coverage.

Medicare excess charges are not very common. Only a small percentage of doctors and healthcare providers charge these excess fees. In fact, less than 5% of doctors who accept Medicare charge these fees. However, it is important to be aware of these charges and to understand how they can affect your out-of-pocket costs.

How Common Are Medicare Excess Charges?

Medicare excess charges are additional fees that doctors and other healthcare providers can charge above the Medicare-approved amount. These charges can be an unpleasant surprise for Medicare beneficiaries who thought they were fully covered. But how common are these excess charges? Let’s explore.

Understanding Excess Charges

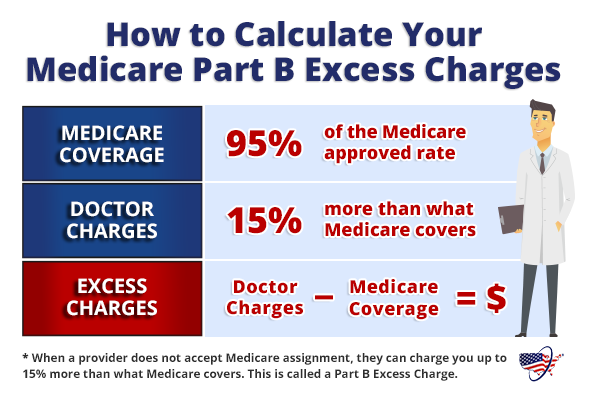

Medicare excess charges happen when healthcare providers do not accept Medicare assignment. In other words, they do not agree to accept the Medicare-approved amount as full payment for their services. Instead, they can charge up to 15% more than the Medicare-approved amount as an excess charge.

Not all healthcare providers can charge excess fees. Only non-participating providers, those who do not accept Medicare assignment, can charge excess fees. Participating providers, those who agree to accept the Medicare-approved amount as full payment, cannot charge excess fees.

How Common Are Excess Charges?

Excess charges are not very common, but they do happen. According to the Centers for Medicare and Medicaid Services (CMS), only about 5% of Medicare beneficiaries in traditional Medicare faced excess charges in 2016. This means that the vast majority of Medicare beneficiaries did not face excess charges.

However, the likelihood of facing excess charges varies by state and by healthcare provider. Some states have higher rates of excess charges than others, and some healthcare providers are more likely to charge excess fees than others. It’s important to check with your healthcare provider to see if they accept Medicare assignment and if they charge excess fees.

What Are the Costs of Excess Charges?

Excess charges can be costly for Medicare beneficiaries who face them. If a healthcare provider charges an excess fee, the beneficiary is responsible for paying the excess amount out of pocket. This can add up quickly, especially for expensive procedures or treatments.

For example, if the Medicare-approved amount for a service is $100, and the healthcare provider charges a 15% excess fee, the total cost would be $115. If Medicare covers 80% of the approved amount, the beneficiary would be responsible for paying $23 out of pocket – the $15 excess fee plus the 20% coinsurance on the approved amount.

How to Avoid Excess Charges

There are a few ways to avoid excess charges. One way is to choose healthcare providers who accept Medicare assignment. Participating providers agree to accept the Medicare-approved amount as full payment, so they cannot charge excess fees.

Another way to avoid excess charges is to enroll in a Medicare Advantage plan. These plans have provider networks, and healthcare providers in the network agree to accept the plan’s payment terms. This means that Medicare Advantage beneficiaries generally do not face excess charges.

The Benefits of Medicare Advantage

In addition to avoiding excess charges, Medicare Advantage plans offer other benefits. These plans often include additional benefits, such as dental, vision, and hearing coverage, that are not covered by traditional Medicare. They may also offer lower out-of-pocket costs and more coordinated care.

However, Medicare Advantage plans also have some drawbacks. They have provider networks, so beneficiaries may have to switch healthcare providers if their current provider is not in the network. They also may have more restrictions on coverage than traditional Medicare.

Medicare Advantage vs. Traditional Medicare

When deciding between Medicare Advantage and traditional Medicare, it’s important to consider the benefits and drawbacks of each. Traditional Medicare offers more flexibility in choosing healthcare providers, but Medicare Advantage may offer additional benefits and lower out-of-pocket costs.

Ultimately, the decision depends on individual healthcare needs and preferences. It’s important to review all options and choose the plan that best meets your needs.

In Conclusion

Medicare excess charges are not very common, but they can be costly for Medicare beneficiaries who face them. The best way to avoid excess charges is to choose healthcare providers who accept Medicare assignment or enroll in a Medicare Advantage plan. When deciding between traditional Medicare and Medicare Advantage, consider the benefits and drawbacks of each and choose the plan that best meets your needs.

Frequently Asked Questions

Medicare excess charges can be a confusing topic for many people. Here are some common questions and answers to help you understand how common they are.

What are Medicare excess charges?

Medicare excess charges are additional fees that doctors and other health care providers may charge you for services that Medicare covers. These fees are above the Medicare-approved amount for the service, and they can add up quickly if you’re not careful. Medicare excess charges are not allowed for doctors who accept Medicare assignment, but they can be charged by doctors who do not accept assignment.

It’s important to note that Medicare excess charges are not the same as out-of-pocket costs, which are the expenses you pay for health care services that Medicare does not cover. Excess charges are additional fees that some doctors can charge you if they do not agree to accept Medicare’s payment as full payment for their services.

How common are Medicare excess charges?

Medicare excess charges are not very common, but they can be a concern for people who visit doctors who do not accept assignment. According to the Centers for Medicare & Medicaid Services (CMS), only about 5% of doctors who treat Medicare patients charge excess fees. However, in some geographic areas, the percentage of doctors who charge excess fees can be much higher.

It’s important to check with your doctor before you receive any services to make sure they accept Medicare assignment. If they do not accept assignment, you may be responsible for paying any excess charges out of your own pocket.

How can I avoid Medicare excess charges?

The best way to avoid Medicare excess charges is to choose a doctor who accepts Medicare assignment. This means that the doctor agrees to accept Medicare’s payment as full payment for their services. If your doctor does not accept assignment, you may be responsible for paying any excess charges out of your own pocket.

You can also check with your doctor before you receive any services to make sure they accept Medicare assignment. If they do not accept assignment, you may want to consider finding another doctor who does.

How much can Medicare excess charges cost?

Medicare excess charges can vary depending on the doctor and the service being provided. However, the maximum amount that a doctor can charge for excess fees is 15% above the Medicare-approved amount for the service. This means that if Medicare approves $100 for a service, the most that a doctor can charge for excess fees is $15.

It’s important to keep track of any excess charges you may have to pay so that you can budget for them accordingly. If you have any questions about the cost of your health care services, you can contact Medicare or your doctor’s office for more information.

Does Medicare supplement insurance cover excess charges?

Some Medicare supplement insurance plans, also known as Medigap plans, may cover excess charges. However, not all Medigap plans offer this coverage, so it’s important to check with your plan to see if it’s included. If your plan does not cover excess charges, you may be responsible for paying them out of your own pocket.

It’s also important to note that Medigap plans are not the same as Medicare Advantage plans, which are a different type of Medicare coverage. If you have a Medicare Advantage plan, you may be subject to different rules and costs related to excess charges.

Medicare Part B Excess Charges – Should You Worry?

In conclusion, Medicare excess charges are not as common as some may think. According to recent studies, only a small percentage of healthcare providers actually charge excess fees. However, it is important for Medicare beneficiaries to be aware of these charges and take necessary precautions to avoid them.

One way to avoid excess charges is to choose healthcare providers who accept Medicare assignment. This means that the provider agrees to accept the Medicare-approved amount as payment in full for their services. Another option is to purchase a Medigap policy, which can help cover excess charges.

Overall, while excess charges may not be widespread, it is still essential for Medicare beneficiaries to stay informed and educated about their healthcare options. By doing so, they can make informed decisions about their healthcare and avoid any unexpected financial burdens.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts