Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As you approach retirement age, it’s essential to understand your healthcare options. One of the most common questions people have is, “When can I get Medicare health insurance?” The answer to this question depends on several factors, including your age, employment status, and eligibility for other healthcare programs.

If you’re approaching age 65, you’re likely eligible for Medicare. However, if you’re younger than 65, you may still be able to qualify for Medicare if you have certain disabilities or medical conditions. Understanding the timing and requirements for Medicare enrollment can help you make informed decisions about your healthcare coverage as you enter your golden years.

When Can I Get Medicare Health Insurance?

Medicare is a federal health insurance program that provides coverage to eligible individuals who are aged 65 or older, as well as those with certain disabilities or chronic conditions. If you are wondering when you can get Medicare health insurance, this article will provide you with all the information you need to know.

Turning 65

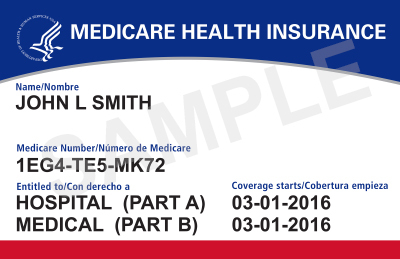

If you are turning 65, you are eligible to enroll in Medicare during the Initial Enrollment Period (IEP), which begins three months before your 65th birthday and ends three months after your birthday month. During this period, you can enroll in Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance). You can also enroll in a Medicare Advantage plan or a Part D prescription drug plan.

To enroll in Medicare, you need to contact the Social Security Administration (SSA) or apply online through the SSA website. If you are already receiving Social Security benefits, you will automatically be enrolled in Original Medicare.

Disability

If you have a disability and are under the age of 65, you may be eligible for Medicare if you have been receiving Social Security Disability Insurance (SSDI) for at least 24 months. You will be automatically enrolled in Medicare during the 25th month of receiving SSDI.

If you have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), you may be eligible for Medicare regardless of your age.

Chronic Conditions

If you have a chronic condition such as diabetes, heart disease, or cancer, you may be eligible for Medicare if you meet certain criteria. Medicare covers services and treatments related to these chronic conditions, including doctor visits, hospital stays, and prescription drugs.

If you have a chronic condition, it is important to understand your Medicare coverage options and how to enroll in the appropriate plans.

Enrollment Periods

In addition to the IEP, there are other enrollment periods for Medicare. The Annual Enrollment Period (AEP) runs from October 15 to December 7 each year. During this period, you can make changes to your Medicare Advantage or Part D plan.

There is also a Special Enrollment Period (SEP) that allows you to enroll in or make changes to your Medicare coverage outside of the IEP and AEP. You may qualify for an SEP if you move, lose your health insurance coverage, or experience certain other life events.

Benefits of Medicare

Medicare provides a range of benefits to eligible individuals, including:

– Coverage for hospital stays, doctor visits, and other medical services

– Access to preventive care services such as mammograms and annual wellness visits

– Coverage for prescription drugs through Part D plans

– Flexibility to choose between Original Medicare and Medicare Advantage plans

– Protection against high out-of-pocket costs through Medicare Supplement plans

Original Medicare vs. Medicare Advantage

Original Medicare consists of Part A and Part B and is provided by the federal government. It allows you to see any doctor or healthcare provider that accepts Medicare and covers a range of medical services.

Medicare Advantage, on the other hand, is provided by private insurance companies and offers additional benefits such as vision, dental, and hearing coverage. Medicare Advantage plans may also have lower out-of-pocket costs than Original Medicare.

Costs of Medicare

There are several costs associated with Medicare, including premiums, deductibles, and coinsurance. The amount you pay will depend on the type of coverage you have and your income level.

Medicare Part A is generally free for most people, while Part B requires a monthly premium. Medicare Advantage and Part D plans also have monthly premiums, deductibles, and copayments.

Conclusion

In conclusion, Medicare provides important health insurance coverage to eligible individuals who are aged 65 or older, have certain disabilities, or have chronic conditions. It is important to understand the enrollment periods, benefits, and costs of Medicare in order to make informed decisions about your healthcare coverage.

Frequently Asked Questions

When Can I Get Medicare Health Insurance?

Medicare health insurance is available for individuals who are 65 years of age or older, as well as those with certain disabilities or end-stage renal disease. You can enroll in Medicare during the initial enrollment period, which begins three months before your 65th birthday and ends three months after your 65th birthday. If you miss your initial enrollment period, you can still enroll during the general enrollment period, which occurs from January 1st to March 31st of each year.

If you are under 65 and have a disability, you may be eligible for Medicare health insurance after receiving Social Security Disability Insurance (SSDI) for 24 months. If you have end-stage renal disease, you may be eligible for Medicare health insurance immediately, regardless of your age or other health conditions.

What Parts of Medicare Should I Enroll In?

There are four parts of Medicare: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Most individuals enroll in Parts A and B, which together are known as Original Medicare. If you prefer to receive your Medicare benefits through a private insurance company, you may choose to enroll in a Medicare Advantage plan (Part C) instead. If you need prescription drug coverage, you can also enroll in a Part D plan.

It is important to carefully review your healthcare needs and budget when choosing which parts of Medicare to enroll in. You can also speak with a licensed insurance agent or Medicare representative to help you make an informed decision.

How Much Will Medicare Health Insurance Cost?

The cost of Medicare health insurance varies depending on which parts you enroll in and your income level. Most individuals do not pay a premium for Part A, but there is a monthly premium for Part B. The standard Part B premium in 2021 is $148.50 per month, but this amount may be higher depending on your income. If you choose to enroll in a Medicare Advantage plan, you will likely pay a monthly premium in addition to your Part B premium.

If you need prescription drug coverage, you will also pay a monthly premium for a Part D plan. The cost of your prescription drugs may vary depending on the plan you choose and which medications you take. It is important to review all costs associated with Medicare health insurance before enrolling.

What Does Medicare Health Insurance Cover?

Medicare health insurance covers a wide range of healthcare services, including hospital stays, doctor visits, preventative care, and certain medical equipment and supplies. Part A covers hospital stays, hospice care, and skilled nursing facility care. Part B covers doctor visits, outpatient care, and preventative services. Medicare Advantage plans may offer additional benefits, such as dental, vision, and hearing coverage.

It is important to note that Medicare health insurance does not cover all healthcare services, such as long-term care or most dental and vision care. You may need to purchase additional insurance or pay out-of-pocket for these services.

How Do I Enroll in Medicare Health Insurance?

You can enroll in Medicare health insurance online, by phone, or in person at your local Social Security office. If you are already receiving Social Security benefits, you will be automatically enrolled in Parts A and B when you turn 65. If you are not receiving Social Security benefits, you will need to enroll during your initial enrollment period or general enrollment period.

It is important to enroll in Medicare health insurance during the appropriate enrollment period to avoid late enrollment penalties. You can also change your Medicare coverage during certain times of the year, such as the annual enrollment period from October 15th to December 7th.

How to Qualify For Medicare (You Don’t Have to Be 65)

In conclusion, Medicare health insurance is a valuable resource for those who are eligible. If you’re 65 or older, have certain disabilities, or have end-stage renal disease, you may qualify for this program.

It’s important to note that enrollment periods exist, so it’s crucial to be aware of these times and take advantage of them. In most cases, individuals can enroll during the initial enrollment period, which begins three months before the month they turn 65 and ends three months after their birthday month.

If you miss this enrollment period, don’t worry. There are other opportunities to enroll, such as the annual open enrollment period. By taking the time to understand the eligibility requirements and enrollment periods, you can ensure that you receive the benefits of Medicare health insurance.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts