Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you struggling to keep up with your Medicare premiums? Do you find yourself sacrificing other necessities just to make ends meet? You’re not alone. Fortunately, there are options available to help you alleviate the financial burden of these costs.

Getting help with Medicare premiums can seem daunting, but it doesn’t have to be. In this article, we’ll explore various programs and resources that can assist you in paying for your premiums, so you can focus on what matters most: your health and well-being. So, let’s dive in and find the support you need.

- Contact Your State Health Insurance Assistance Program (SHIP): SHIPs provide free, one-on-one assistance to help you understand your Medicare benefits and options. They can also help you apply for financial assistance programs.

- Apply for Medicare Savings Programs (MSPs): MSPs help pay for Medicare premiums and, in some cases, deductibles, copayments, and coinsurance.

- Apply for Extra Help: Also known as the Low-Income Subsidy (LIS), Extra Help can assist with Medicare Part D prescription drug plan costs.

- Check with Your State Medicaid Program: If you have limited income and resources, you may qualify for Medicaid, which can help pay for Medicare premiums and other healthcare costs.

How to Get Help With Medicare Premiums?

Are you struggling to pay your Medicare premiums? If so, you’re not alone. Many people on Medicare find it challenging to cover the costs associated with their healthcare. Fortunately, there are several programs available that can help you get the assistance you need. Here are ten things to keep in mind when seeking help with your Medicare premiums.

1. Medicare Savings Programs

If you’re having trouble paying your Medicare premiums, you may qualify for a Medicare Savings Program. These programs are designed to help low-income individuals cover their healthcare costs. Depending on your income level, you may be eligible for assistance with your Medicare premiums, deductibles, and coinsurance.

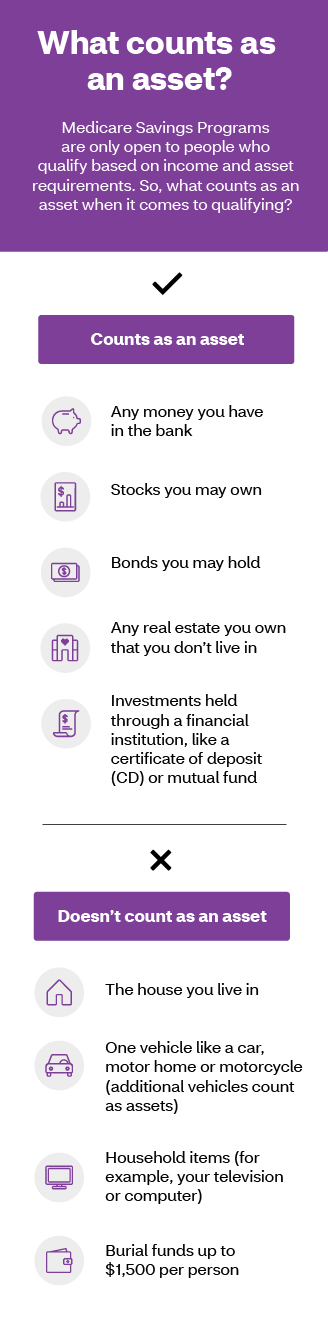

To qualify for a Medicare Savings Program, you must meet certain income and asset requirements. The exact requirements vary by state, so be sure to check with your local Medicaid office for more information.

2. Extra Help with Prescription Drug Costs

If you’re struggling to pay for your prescription drugs, you may be eligible for Extra Help. This program provides assistance with Medicare Part D costs, including premiums, deductibles, and coinsurance. To qualify for Extra Help, you must meet certain income and asset requirements.

If you qualify for Extra Help, you may also be eligible for a Special Enrollment Period. This allows you to change your Medicare Part D plan outside of the standard enrollment periods.

3. State Pharmaceutical Assistance Programs

In addition to Extra Help, many states offer their own Pharmaceutical Assistance Programs. These programs provide assistance with prescription drug costs to low-income individuals. To find out if your state offers a Pharmaceutical Assistance Program, check with your local Medicaid office.

4. Medicaid

If you’re having trouble paying for your healthcare costs, you may be eligible for Medicaid. This program provides assistance with a wide range of healthcare costs, including Medicare premiums. To qualify for Medicaid, you must meet certain income and asset requirements.

If you qualify for Medicaid, you may also be eligible for a Special Enrollment Period. This allows you to change your Medicare Advantage or Medicare Part D plan outside of the standard enrollment periods.

5. Medicare Advantage

If you’re looking for a way to save money on your healthcare costs, you may want to consider a Medicare Advantage plan. These plans are offered by private insurance companies and provide all the benefits of Original Medicare, plus additional benefits like prescription drug coverage.

To enroll in a Medicare Advantage plan, you must first be enrolled in Medicare Part A and Part B. You must also live in the plan’s service area.

6. Medicare Supplement

If you’re looking for additional coverage to help pay for your healthcare costs, you may want to consider a Medicare Supplement plan. These plans are offered by private insurance companies and provide additional coverage to help pay for things like deductibles, coinsurance, and copayments.

To enroll in a Medicare Supplement plan, you must first be enrolled in Medicare Part A and Part B.

7. Nonprofit Organizations

There are many nonprofit organizations that provide assistance to individuals with healthcare costs. These organizations may provide financial assistance to help cover Medicare premiums, copayments, and other healthcare costs.

To find a nonprofit organization that provides assistance in your area, check with your local Area Agency on Aging.

8. Social Security

If you’re having trouble paying for your Medicare premiums, you may be eligible for help from Social Security. Social Security provides assistance to individuals with low income and limited resources. To find out if you’re eligible for assistance from Social Security, contact your local Social Security office.

9. Veterans Benefits

If you’re a veteran, you may be eligible for assistance with your healthcare costs through the Department of Veterans Affairs. The VA provides a wide range of healthcare services to eligible veterans, including assistance with Medicare premiums.

To find out if you’re eligible for assistance through the VA, contact your local VA office.

10. Senior Community Centers

Many senior community centers offer assistance to individuals with healthcare costs. These centers may provide information on available programs and services, as well as assistance with completing applications for assistance.

To find a senior community center in your area, check with your local Area Agency on Aging.

In conclusion, there are many programs available to help you get the assistance you need with your Medicare premiums. Whether you qualify for a Medicare Savings Program, Extra Help, or another program, it’s important to explore all your options to find the best solution for your needs.

Contents

Frequently Asked Questions

What is Medicare Premium Assistance?

Medicare Premium Assistance is a program designed to help individuals with limited income and resources pay for their Medicare premiums. It is also known as Medicare Savings Programs (MSPs). MSPs are available to people with Medicare who have limited income and resources.

The program pays for Medicare Part A and Part B premiums, deductibles, coinsurance, and copayments. The amount of assistance you receive depends on your income and resources.

Who is eligible for Medicare Premium Assistance?

To be eligible for Medicare Premium Assistance, you must have Medicare Part A and meet the income and resource limits. The income limits vary by state, but generally, you must have an income below 135% of the Federal Poverty Level (FPL).

The resource limits also vary by state, but generally, you must have resources below $7,970 for an individual or $11,960 for a couple. Resources include savings, stocks, and bonds, but do not include your home, car, or personal belongings.

How do I apply for Medicare Premium Assistance?

You can apply for Medicare Premium Assistance at your local Medicaid office or Social Security office. You will need to fill out an application and provide proof of your income and resources.

If you are eligible for Medicare Premium Assistance, you will receive a letter explaining the program and the amount of assistance you will receive. The assistance will be paid directly to Medicare to cover your premiums, deductibles, coinsurance, and copayments.

What are the benefits of Medicare Premium Assistance?

The benefits of Medicare Premium Assistance include lower out-of-pocket costs for Medicare services. If you have limited income and resources, paying for Medicare premiums, deductibles, coinsurance, and copayments can be a challenge.

Medicare Premium Assistance can help you save money and ensure that you have access to the healthcare services you need. Additionally, some states offer additional benefits, such as coverage for vision, hearing, and dental services.

What other programs can help with Medicare costs?

In addition to Medicare Premium Assistance, there are other programs that can help with Medicare costs. These include the Medicare Extra Help program, which helps with prescription drug costs, and state prescription assistance programs.

You may also be eligible for Medicaid, which provides comprehensive healthcare coverage, including long-term care, for people with limited income and resources. Contact your local Medicaid office for more information about eligibility and benefits.

How to Lower Your Medicare Premiums

In conclusion, navigating the world of Medicare premiums can be overwhelming, but there are resources available to help you. From government programs to non-profit organizations, there are options to assist with the cost of your Medicare premiums.

One of the best places to start is with the Medicare Savings Programs. These programs are designed to help low-income individuals afford their Medicare premiums, deductibles, and copayments. Eligibility varies by state, so it’s important to research the program in your area.

Another option is to seek assistance from non-profit organizations. Many organizations offer financial assistance to seniors, including help with Medicare premiums. These organizations often have income restrictions, but can be a great resource for those who qualify.

Finally, don’t be afraid to reach out to your state’s Department of Aging or local Area Agency on Aging. These organizations exist to help seniors navigate the complex world of aging, including Medicare premiums. They may have additional resources or information to help you get the assistance you need.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts