Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you confused about the different Medicare enrollment periods? You’re not alone. The Annual Enrollment Period (AEP) and Open Enrollment Period (OEP) are two of the most important times of the year for Medicare beneficiaries. In this article, we’ll explore the differences between these two enrollment periods, so you can make informed decisions when it comes to your healthcare coverage.

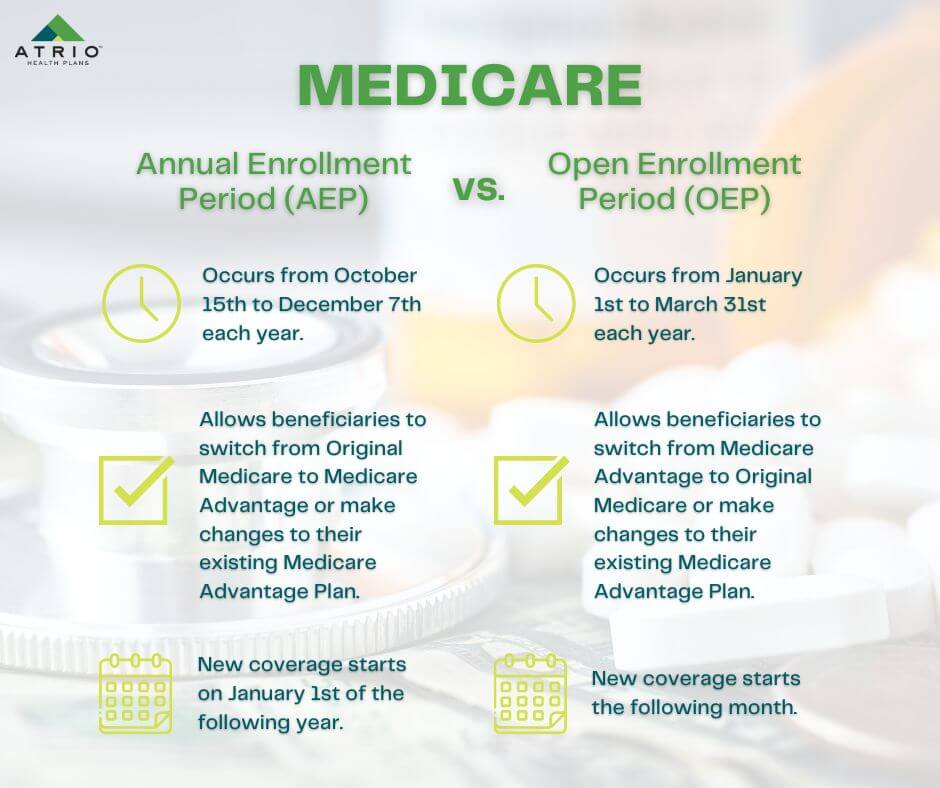

Medicare Annual Enrollment Period (AEP) occurs every year between October 15th and December 7th. During this period, you can make changes to your Medicare coverage, including switching from Original Medicare to a Medicare Advantage plan. On the other hand, Medicare Open Enrollment Period (OEP) runs from January 1st to March 31st. During OEP, you can make a one-time change to your Medicare Advantage plan or switch back to Original Medicare.

Understanding the Difference Between Medicare AEP and OEP

When it comes to Medicare, there are two important enrollment periods that you need to know about – Annual Enrollment Period (AEP) and Open Enrollment Period (OEP). These two enrollment periods have different rules and guidelines, and it’s important to understand the differences between them to make the most out of your Medicare coverage.

What is Medicare AEP?

Medicare Annual Enrollment Period (AEP) is the time of the year when Medicare beneficiaries can make changes to their Medicare coverage. The AEP runs from October 15 to December 7 every year, and during this period, you can:

- Switch from Original Medicare to a Medicare Advantage plan

- Switch from a Medicare Advantage plan back to Original Medicare

- Switch from one Medicare Advantage plan to another

- Switch from one Medicare Part D plan to another

- Enroll in a Medicare Part D plan if you didn’t enroll during your Initial Enrollment Period

It’s important to note that any changes you make during the AEP will take effect on January 1 of the following year.

What is Medicare OEP?

Medicare Open Enrollment Period (OEP) is different from the Annual Enrollment Period (AEP). The OEP runs from January 1 to March 31 every year, and during this period, you can:

- Switch from a Medicare Advantage plan to another Medicare Advantage plan

- Switch from a Medicare Advantage plan back to Original Medicare

- Enroll in a Medicare Part D plan if you didn’t enroll during your Initial Enrollment Period

- Switch from one Medicare Part D plan to another

It’s important to note that you cannot switch from Original Medicare to a Medicare Advantage plan during the OEP.

Benefits of Medicare AEP

The Medicare AEP is a great opportunity for beneficiaries to review and make changes to their Medicare coverage. It allows you to ensure that your coverage is up to date and meets your current health needs. The AEP also gives you the chance to switch to a Medicare Advantage plan if you feel that it would better suit your needs. Additionally, you can enroll in a Medicare Part D plan during the AEP if you didn’t enroll during your Initial Enrollment Period.

Benefits of Medicare OEP

The Medicare OEP is a great time to make changes to your Medicare Advantage or Medicare Part D plan. If you’ve had a change in health needs or lifestyle, you may find that a different plan would better suit your needs. The OEP gives you the chance to make that change. Additionally, if you didn’t enroll in a Medicare Part D plan during your Initial Enrollment Period, the OEP gives you a second chance to enroll.

Medicare AEP vs OEP

While the Medicare AEP and OEP have some similarities, there are also some key differences between the two enrollment periods. Here are some of the main differences:

| Medicare AEP | Medicare OEP |

|---|---|

| Runs from October 15 to December 7 | Runs from January 1 to March 31 |

| You can switch from Original Medicare to a Medicare Advantage plan | You cannot switch from Original Medicare to a Medicare Advantage plan |

| You can switch from one Medicare Advantage plan to another | You can switch from one Medicare Advantage plan to another |

| You can switch from one Medicare Part D plan to another | You can switch from one Medicare Part D plan to another |

| You can enroll in a Medicare Part D plan if you didn’t enroll during your Initial Enrollment Period | You can enroll in a Medicare Part D plan if you didn’t enroll during your Initial Enrollment Period |

| Changes take effect on January 1 of the following year | Changes take effect on the first day of the following month |

Conclusion

Understanding the difference between Medicare AEP and OEP is important to ensure that you make the most out of your Medicare coverage. The AEP and OEP have different rules and guidelines, and knowing what you can and cannot do during these periods can help you make informed decisions about your health care. Whether you’re looking to switch to a Medicare Advantage plan, change your Medicare Part D plan, or enroll in a plan for the first time, the AEP and OEP give you the opportunity to do so.

Frequently Asked Questions

What is Medicare AEP?

Medicare Annual Enrollment Period (AEP) is a period that runs from October 15 to December 7 every year. During this time, Medicare beneficiaries can review and make changes to their existing Medicare coverage, such as switching from Original Medicare to a Medicare Advantage plan or changing their Medicare Advantage plan. Any changes made during AEP take effect on January 1 of the following year.

AEP is an opportunity for Medicare beneficiaries to assess their healthcare needs and make changes to their coverage accordingly. It is important for beneficiaries to review their coverage annually to ensure that their healthcare needs are being met and that they are enrolled in the most cost-effective plan.

What is Medicare OEP?

Medicare Open Enrollment Period (OEP) is a period that runs from January 1 to March 31 every year. During this time, Medicare beneficiaries who are enrolled in a Medicare Advantage plan can make a one-time change to their coverage. They can switch to a different Medicare Advantage plan, or they can drop their Medicare Advantage plan and return to Original Medicare.

OEP is a limited opportunity for Medicare beneficiaries to make a change to their coverage if they are not satisfied with their current plan. It is important to note that beneficiaries who switch to a new Medicare Advantage plan during OEP cannot switch to another plan or return to Original Medicare until the following AEP.

What is the difference between Medicare AEP and OEP?

The main difference between Medicare AEP and OEP is the window of time during which beneficiaries can make changes to their coverage. AEP runs from October 15 to December 7, while OEP runs from January 1 to March 31.

During AEP, beneficiaries can make changes to all aspects of their Medicare coverage, such as switching from Original Medicare to a Medicare Advantage plan or changing their Medicare Advantage plan. During OEP, beneficiaries who are enrolled in a Medicare Advantage plan can make a one-time change to their coverage, such as switching to a different Medicare Advantage plan or returning to Original Medicare.

What are the benefits of reviewing Medicare coverage during AEP and OEP?

Reviewing Medicare coverage during AEP and OEP can help beneficiaries ensure that their healthcare needs are being met and that they are enrolled in the most cost-effective plan. By reviewing their coverage annually, beneficiaries can assess whether their current plan is still meeting their needs and whether there are other plans available that may provide better coverage or lower costs.

Additionally, reviewing coverage during AEP and OEP can help beneficiaries avoid any coverage gaps or penalties. For example, if a beneficiary fails to enroll in a Medicare prescription drug plan when they are first eligible, they may incur a penalty if they enroll later. By reviewing coverage annually, beneficiaries can ensure that they are enrolled in all necessary plans and are not subject to any penalties.

Can I make changes to my Medicare coverage outside of AEP and OEP?

In most cases, changes to Medicare coverage can only be made during AEP and OEP. However, there are certain circumstances that may allow beneficiaries to make changes to their coverage outside of these periods. For example, beneficiaries may be able to make changes to their coverage if they move to a new area that is not covered by their current plan, or if they experience a qualifying life event such as marriage or divorce.

It is important to note that making changes to Medicare coverage outside of AEP and OEP may be subject to certain restrictions and limitations. Beneficiaries should consult with a Medicare representative or healthcare professional to determine whether they are eligible to make changes to their coverage outside of these periods.

The 2 Medicare Advantage Enrollment Periods – AEP and OEP!

In conclusion, it is important to understand the differences between Medicare Annual Enrollment Period (AEP) and Medicare Open Enrollment Period (OEP). AEP occurs once a year, and it allows individuals to make changes to their Medicare Advantage and Medicare Part D plans. OEP, on the other hand, occurs annually and allows individuals to make changes to their Medicare Advantage plan only.

During AEP, individuals can enroll in a new Medicare Advantage plan, switch from Original Medicare to a Medicare Advantage plan, switch from one Medicare Advantage plan to another, and enroll in or make changes to their Medicare Part D prescription drug coverage. During OEP, individuals can switch from one Medicare Advantage plan to another or return to Original Medicare.

It is important to note that missing these enrollment periods can result in limited options and higher costs. Therefore, it is recommended that individuals review their Medicare coverage annually and take advantage of these enrollment periods to ensure they have the best coverage for their healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts