Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you wondering whether you need Personal Injury Protection (PIP) insurance if you already have Medicare? It’s a valid question, and one that many people have. PIP insurance and Medicare are both types of insurance that can help with medical expenses, but they serve different purposes. In this article, we’ll explore whether you need PIP insurance if you have Medicare and what the benefits of having both types of insurance might be.

If you have Medicare, you may still need Personal Injury Protection (PIP) insurance. PIP covers medical expenses, lost wages, and other costs related to a car accident, regardless of who was at fault. Medicare may not cover all of these costs, and PIP can fill in the gaps. Check your state’s requirements, as some states require PIP as part of your car insurance policy.

Contents

- Do I Need Pip Insurance if I Have Medicare?

- Frequently Asked Questions

- Do I Need Pip Insurance if I Have Medicare?

- What Does Medicare Cover in Case of an Accident?

- What Are the Benefits of Having PIP Insurance with Medicare?

- How Much Does PIP Insurance Cost?

- Where Can I Buy PIP Insurance?

- Michigan PIP Coverage: Should I Opt Out If I Have Medicare? | Attorney Christopher Hunter

Do I Need Pip Insurance if I Have Medicare?

If you are a Medicare beneficiary, you may be wondering whether you need to purchase Personal Injury Protection (PIP) insurance. PIP insurance is an additional type of insurance that covers medical expenses and lost wages in the event of an accident, regardless of who is at fault. While PIP insurance may be a good option for some people, it is not always necessary if you have Medicare. In this article, we will explore whether you need PIP insurance if you have Medicare.

What is PIP Insurance?

Personal Injury Protection (PIP) insurance is an additional type of insurance that is available in some states. PIP insurance covers medical expenses and lost wages in the event of an accident, regardless of who is at fault. PIP insurance is designed to provide quick and easy access to medical care and lost wages, without having to wait for a lawsuit to be settled.

Benefits of PIP Insurance

One of the benefits of PIP insurance is that it provides coverage regardless of who is at fault. This means that if you are injured in an accident, you can receive medical treatment and lost wages immediately, without having to wait for a lawsuit to be settled. Additionally, PIP insurance can cover a wide range of expenses, including medical bills, rehabilitation costs, and lost wages.

Drawbacks of PIP Insurance

One of the drawbacks of PIP insurance is that it can be expensive, especially if you live in a state where it is mandatory. Additionally, PIP insurance may duplicate coverage that you already have, such as Medicare. Furthermore, PIP insurance may not cover all of your expenses, such as pain and suffering, emotional distress, or future medical expenses.

Does Medicare Cover the Same Things as PIP Insurance?

Medicare is a federal health insurance program that is available to people over the age of 65, people with certain disabilities, and people with end-stage renal disease. Medicare covers a wide range of medical expenses, including hospital stays, doctor visits, and prescription drugs. However, Medicare may not cover all of the expenses that are covered by PIP insurance.

Benefits of Medicare

One of the benefits of Medicare is that it is a comprehensive health insurance program that covers a wide range of medical expenses. Additionally, Medicare is available to people over the age of 65, people with certain disabilities, and people with end-stage renal disease. Furthermore, Medicare is a federal program, which means that it is available in all states.

Drawbacks of Medicare

One of the drawbacks of Medicare is that it may not cover all of the expenses that are covered by PIP insurance. For example, Medicare may not cover lost wages or rehabilitation costs. Additionally, Medicare may not cover all of your medical expenses, such as dental or vision care.

Do You Need PIP Insurance if You Have Medicare?

Whether you need PIP insurance if you have Medicare depends on a number of factors, including where you live, your health status, and your financial situation. If you live in a state where PIP insurance is mandatory, you may need to purchase it regardless of whether you have Medicare. Additionally, if you are in poor health, you may want to consider purchasing PIP insurance to ensure that you have adequate coverage. Finally, if you have a high income, you may want to consider purchasing PIP insurance to protect your assets.

Benefits of Having Both PIP Insurance and Medicare

One of the benefits of having both PIP insurance and Medicare is that you may have more comprehensive coverage. Additionally, having both types of insurance may provide you with greater peace of mind, knowing that you are fully covered in the event of an accident.

Drawbacks of Having Both PIP Insurance and Medicare

One of the drawbacks of having both PIP insurance and Medicare is that it can be expensive. Additionally, having both types of insurance may duplicate coverage that you already have, which means that you may be paying for coverage that you do not need.

Conclusion

In conclusion, whether you need PIP insurance if you have Medicare depends on a number of factors, including where you live, your health status, and your financial situation. While PIP insurance can be a good option for some people, it may not be necessary if you have Medicare. If you are unsure whether you need PIP insurance, it is recommended that you speak with an insurance agent or financial advisor to discuss your options.

Frequently Asked Questions

Do I Need Pip Insurance if I Have Medicare?

Personal Injury Protection (PIP) insurance is a type of coverage that pays for medical expenses, lost wages, and other related costs in case of an accident. On the other hand, Medicare is a federal health insurance program for people over 65 and those with certain disabilities or chronic conditions. So, do you need PIP insurance if you have Medicare? The answer is, it depends.

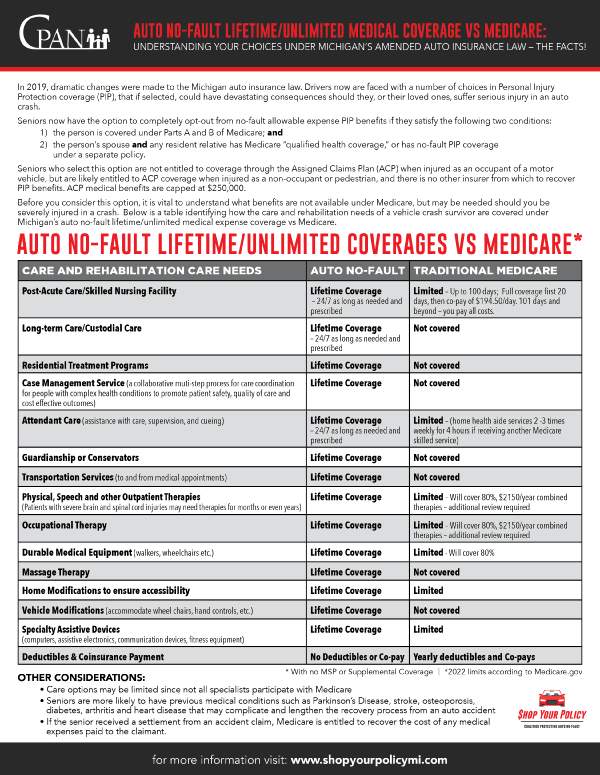

If you have Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance), then you may not need PIP insurance because it already covers some of the costs associated with an accident. However, if you have a Medicare Advantage plan (Part C), which is offered by private insurance companies, then you may need PIP insurance to cover the gaps in your coverage.

What Does Medicare Cover in Case of an Accident?

Medicare Part A covers hospital stays, hospice care, and some home health services. If you are admitted to the hospital as an inpatient due to an accident, then Part A will cover your hospital stay, including room and board, meals, and some medical services. Medicare Part B covers doctor visits, outpatient services, and medical equipment. If you need medical treatment or supplies due to an accident, then Part B will cover these expenses.

However, Medicare has limitations and may not cover all the costs associated with an accident. For example, Medicare does not cover long-term care or personal care services, which may be necessary after an accident. That’s why having additional insurance, such as PIP insurance, can help you cover these costs and provide additional protection.

What Are the Benefits of Having PIP Insurance with Medicare?

Having PIP insurance with Medicare can provide several benefits, including:

- Additional coverage: PIP insurance can cover the costs that Medicare may not cover, such as lost wages, rehabilitation expenses, and personal care services.

- No deductibles or copayments: PIP insurance does not require deductibles or copayments, which means you can receive the full benefit amount without any out-of-pocket expenses.

- Flexibility: PIP insurance can be used to cover a wide range of expenses, including medical bills, transportation costs, and even household services.

Overall, PIP insurance can provide additional protection and peace of mind in case of an accident, especially if you have a Medicare Advantage plan or if you want to have more comprehensive coverage than what Medicare provides.

How Much Does PIP Insurance Cost?

The cost of PIP insurance varies depending on several factors, such as your age, location, driving record, and the level of coverage you choose. In general, PIP insurance is relatively affordable and can cost anywhere from $100 to $300 per year.

However, the cost of PIP insurance may be higher if you live in a state with high insurance rates or if you have a poor driving record. It’s important to compare different insurance companies and policies to find the best coverage and price for your needs.

Where Can I Buy PIP Insurance?

PIP insurance is typically offered by auto insurance companies and is mandatory in some states. If you live in a state that requires PIP insurance, then you can purchase it as part of your auto insurance policy. If you live in a state where PIP insurance is optional, then you can still purchase it as a separate policy or as part of your Medicare Advantage plan.

It’s important to shop around and compare different insurance companies and policies to find the best coverage and price for your needs. You can also consult with an insurance agent or broker to help you navigate the options and make an informed decision.

Michigan PIP Coverage: Should I Opt Out If I Have Medicare? | Attorney Christopher Hunter

In conclusion, while Medicare provides comprehensive health insurance coverage for seniors, it does not cover all medical expenses. Therefore, it may be worth considering purchasing Personal Injury Protection (PIP) insurance to cover any gaps in coverage. PIP insurance can provide additional benefits such as coverage for lost wages, rehabilitation, and other expenses that may not be covered by Medicare.

It is also important to note that PIP insurance is not required in all states, so it is important to check with your state’s insurance regulations to determine whether or not it is necessary. However, even if PIP insurance is not mandatory in your state, it may still be a wise investment to ensure that you are fully protected in the event of an accident.

Ultimately, the decision to purchase PIP insurance alongside Medicare coverage is a personal one that will depend on your individual needs and circumstances. It is important to weigh the costs and benefits of both options carefully before making a decision, and to consult with a licensed insurance professional for guidance.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts