Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you a senior citizen who is wondering if AARP covers Medicare deductible expenses? You’re not alone. Many people in their golden years are trying to figure out what their insurance covers and what they are responsible for. In this article, we will explore whether AARP covers Medicare deductibles and what you should know about this topic.

Medicare can be a confusing topic, especially when it comes to deductibles. AARP is one of the most popular insurance providers for seniors, but many individuals still wonder if their plans cover certain expenses. We’ll dive into the specifics of AARP’s coverage and what kind of Medicare deductibles you can expect to pay.

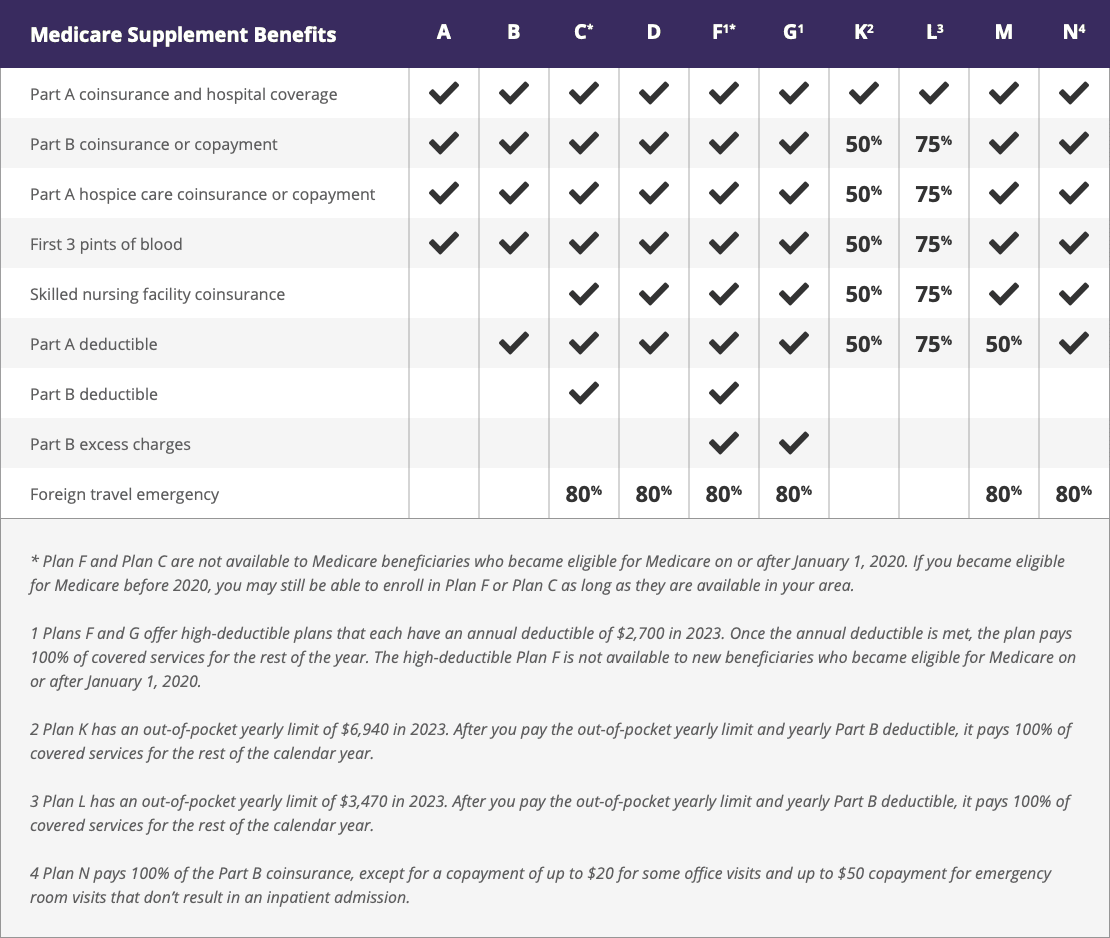

Yes, AARP offers Medicare Supplement Insurance plans that can help cover the Medicare Part A and Part B deductibles. AARP’s Medicare Supplement Insurance plans are sold by UnitedHealthcare Insurance Company, and they are designed to help pay for some of the out-of-pocket costs that Original Medicare doesn’t cover. It’s important to note that AARP Medicare Supplement plans are not the same as Medicare Advantage plans, which are offered by private insurance companies and often include additional benefits like prescription drug coverage.

Does AARP Cover Medicare Deductible?

If you’re a senior citizen, you’re probably aware of the benefits of Medicare. Medicare is a government program that provides health insurance coverage to people who are 65 years or older or those who have a disability. While Medicare is a great program, it doesn’t cover all of your healthcare costs. One of the costs that Medicare doesn’t cover is the Medicare deductible. The Medicare deductible is the amount you must pay out of pocket before your Medicare coverage kicks in. In this article, we’ll explore whether AARP covers Medicare deductible.

What is AARP?

Before we dive into whether AARP covers Medicare deductible, let’s first discuss what AARP is. AARP is a non-profit organization that advocates for the rights of senior citizens. It provides a range of services, including healthcare insurance, financial planning, and travel discounts. AARP has over 38 million members, making it one of the largest organizations in the United States.

What is Medicare Deductible?

As mentioned earlier, the Medicare deductible is the amount you must pay out of pocket before your Medicare coverage kicks in. The Medicare deductible changes every year, and it varies depending on the type of Medicare coverage you have. In 2021, the Medicare Part A deductible is $1,484, while the Medicare Part B deductible is $203.

Does AARP Cover Medicare Deductible?

Unfortunately, AARP does not cover Medicare deductible. However, AARP does offer a range of healthcare insurance plans that can help you reduce your healthcare costs. These plans include Medicare Advantage, Medicare Supplement, and Prescription Drug plans.

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare. It is provided by private insurance companies and offers additional benefits that are not covered by Original Medicare. Medicare Advantage plans often include prescription drug coverage, dental, and vision coverage.

What is Medicare Supplement?

Medicare Supplement, also known as Medigap, is a type of insurance that helps pay for the costs that Original Medicare does not cover. Medicare Supplement plans are provided by private insurance companies and cover things like deductibles, copayments, and coinsurance.

What is Prescription Drug Coverage?

Prescription Drug Coverage, also known as Part D, is a type of insurance that helps pay for prescription drugs. It is provided by private insurance companies and can be added to Original Medicare or some Medicare Advantage plans.

Benefits of AARP Healthcare Insurance Plans

While AARP does not cover Medicare deductible, its healthcare insurance plans offer a range of benefits. Some of the benefits of AARP’s healthcare insurance plans include:

- Lower healthcare costs

- Additional benefits not covered by Original Medicare

- Access to a network of healthcare providers

- Predictable healthcare costs

AARP Healthcare Insurance Plans vs. Original Medicare

While Original Medicare offers some coverage, it doesn’t cover everything. AARP’s healthcare insurance plans offer additional coverage that can help you save money on healthcare costs. Some of the differences between AARP’s healthcare insurance plans and Original Medicare include:

| AARP Healthcare Insurance Plans | Original Medicare |

|---|---|

| Additional benefits not covered by Original Medicare | No additional benefits |

| Lower healthcare costs | Higher healthcare costs |

| Predictable healthcare costs | Unpredictable healthcare costs |

Conclusion

In conclusion, AARP does not cover Medicare deductible. However, AARP’s healthcare insurance plans offer a range of benefits that can help you save money on healthcare costs. If you’re interested in learning more about AARP’s healthcare insurance plans, you can visit their website or speak to an AARP representative. Remember, it’s important to have healthcare coverage to protect yourself from unexpected healthcare costs.

Contents

Frequently Asked Questions

As a professional writer, I understand the importance of delivering accurate and informative content to my readers. In this article, I will be answering some common questions about whether AARP covers Medicare deductible. Read on to find out more.

Question 1: What is AARP?

AARP, or the American Association of Retired Persons, is a non-profit organization that aims to improve the quality of life for people over the age of 50. They offer a range of services and benefits, including health insurance plans, travel discounts, and financial planning advice.

One of the health insurance plans offered by AARP is Medicare Supplement Insurance, also known as Medigap. This type of insurance helps cover some of the costs that Original Medicare doesn’t, such as deductibles, copayments, and coinsurance.

Question 2: What is Medicare deductible?

Medicare deductible is the amount that you have to pay out of pocket before Medicare starts covering your healthcare costs. There are two types of Medicare deductible: Part A deductible, which applies to inpatient hospital stays, and Part B deductible, which applies to outpatient services like doctor visits and lab tests.

The amount of Medicare deductible can change each year, so it’s important to check the latest rates before choosing a health insurance plan.

Question 3: Does AARP cover Medicare deductible?

Yes, AARP’s Medigap plans can help cover some or all of the Medicare deductible. The exact amount of coverage will depend on the specific plan you choose. AARP offers several Medigap plans, including Plan F, Plan G, and Plan N, which all provide varying levels of coverage.

It’s important to note that Medigap plans are only available to people who are already enrolled in Original Medicare. If you have a Medicare Advantage plan, you won’t be eligible for a Medigap plan.

Question 4: How much does AARP’s Medigap plans cost?

The cost of AARP’s Medigap plans will depend on several factors, including your age, location, and health status. In general, the monthly premiums for Medigap plans can range from around $50 to $300, depending on the level of coverage you choose.

It’s important to shop around and compare different Medigap plans before making a decision. AARP offers a Medigap plan comparison tool that can help you find the best plan for your needs.

Question 5: How can I enroll in AARP’s Medigap plans?

To enroll in AARP’s Medigap plans, you must first be enrolled in Original Medicare. Once you are enrolled in Original Medicare, you can apply for a Medigap plan through AARP or any other insurance provider that offers Medigap plans in your area.

It’s important to enroll in a Medigap plan during the open enrollment period, which lasts for six months after you turn 65 and enroll in Original Medicare. During this time, insurance companies are required to offer you coverage without charging higher premiums or denying you coverage based on your health status.

5 Things Medicare Doesn’t Cover (and how to get them covered)

In conclusion, AARP does not directly cover Medicare deductibles. However, they offer various plans and services that can help offset the cost of deductibles and other healthcare expenses.

One option is to enroll in an AARP Medicare Supplement Insurance plan, which can cover some or all of your Medicare deductibles. Additionally, AARP offers resources and tools to help you better understand your Medicare benefits and options, so you can make informed decisions about your healthcare.

Overall, while AARP may not cover Medicare deductibles directly, their offerings can still be valuable for those looking to manage healthcare costs and optimize their coverage. It’s important to carefully review your options and choose the plan that best fits your individual needs and budget.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts