Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage to millions of Americans aged 65 and older, as well as those with certain disabilities. While Medicare is a valuable resource for many, one question that often arises is how premiums are determined. Understanding the factors that go into determining Medicare premiums can help beneficiaries make informed decisions about their healthcare coverage and costs.

Medicare premiums are determined by a variety of factors, including income, eligibility, and the specific type of coverage selected. From Part A hospital insurance to Part D prescription drug coverage, each part of Medicare has its own premium structure. By taking the time to understand these factors, beneficiaries can make informed decisions about their healthcare coverage and costs, ensuring that they receive the care they need at a price they can afford.

Medicare premiums are determined based on a variety of factors, including income, age, and the type of coverage chosen. Most people pay the standard premium amount, but those with higher incomes may pay more. Medicare Advantage and prescription drug plans also have varying premiums depending on the plan chosen. It’s important to review and compare plans each year during open enrollment to ensure you are getting the best coverage at the most affordable price.

Contents

- How Are Medicare Premiums Determined?

- Frequently Asked Questions

- Q: How Are Medicare Premiums Determined?

- Q: What is the Medicare Part B Premium for 2021?

- Q: Can I Get Help Paying for My Medicare Premiums?

- Q: Can I Change My Medicare Coverage if I Cannot Afford the Premiums?

- Q: How Often Do Medicare Premiums Change?

- Giving You the Knowledge about Medicare Premium Payments

How Are Medicare Premiums Determined?

Medicare is an essential part of the healthcare system in the United States. It provides coverage for those who are 65 and older, as well as those with certain disabilities and illnesses. Medicare premiums are a crucial aspect of this program, as they help to fund the benefits that beneficiaries receive. In this article, we will discuss how Medicare premiums are determined and what factors can affect them.

1. Part A Premiums

Medicare Part A covers hospital stays, skilled nursing facility care, hospice care, and some home health care services. Most people do not have to pay a premium for Part A because they or their spouse paid Medicare taxes while working. However, if you do not qualify for premium-free Part A, you can purchase it for a monthly premium. The amount of the premium depends on how long you or your spouse worked and paid Medicare taxes.

If you have to pay a premium for Part A, the cost can vary based on how long you or your spouse worked and paid Medicare taxes. In 2021, the standard Part A premium is $471 per month if you worked and paid Medicare taxes for less than 30 quarters. If you worked and paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259 per month.

2. Part B Premiums

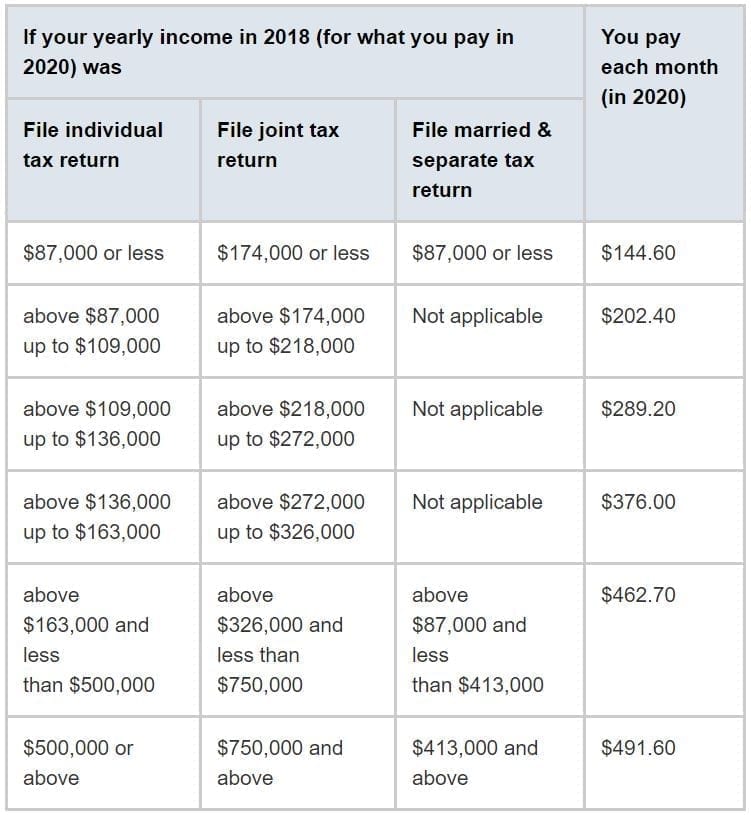

Medicare Part B covers doctor visits, outpatient care, and preventive services. Most beneficiaries must pay a monthly premium for Part B. The amount of the premium varies based on your income. In 2021, the standard Part B premium is $148.50 per month. However, if your income is above a certain threshold, you may have to pay a higher premium.

If you are a high-income earner, you may have to pay an Income-Related Monthly Adjustment Amount (IRMAA) in addition to your Part B premium. The IRMAA is an extra amount that you pay if your income is above a certain level. The amount of the IRMAA depends on your income level.

3. Part C Premiums

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare. It is offered by private insurance companies that are approved by Medicare. Medicare Advantage plans offer the same benefits as Original Medicare, but they may also offer additional benefits like prescription drug coverage, vision, dental, and hearing coverage.

The premiums for Medicare Advantage plans vary based on the plan you choose. Some plans may have no monthly premium, while others may have a premium in addition to the Part B premium.

4. Part D Premiums

Medicare Part D covers prescription drugs. Like Medicare Part B, most beneficiaries must pay a monthly premium for Part D. The amount of the premium varies based on the plan you choose. In 2021, the average monthly premium for a Part D plan is $33.06.

If you have a high income, you may have to pay an IRMAA in addition to your Part D premium. The amount of the IRMAA depends on your income level.

5. Factors That Can Affect Medicare Premiums

Several factors can affect your Medicare premiums. These include:

- Your income

- Your age

- Whether you have other insurance coverage

- Where you live

- The type of plan you choose

For example, if you have other insurance coverage, such as through an employer, your Medicare premiums may be lower. Similarly, if you live in an area with a high cost of living, your Medicare premiums may be higher.

6. Benefits of Medicare

Medicare provides essential health coverage to millions of Americans. It helps to cover the costs of hospital stays, doctor visits, prescription drugs, and more. Without Medicare, many seniors and people with disabilities would struggle to afford the healthcare services they need.

In addition to providing coverage for healthcare services, Medicare also offers several benefits to beneficiaries. These include access to preventive services like flu shots and cancer screenings, as well as coverage for certain health and wellness programs.

7. Medicare vs. Medicaid

Medicare and Medicaid are both government-run healthcare programs, but they serve different populations. Medicare is a federal program that provides health coverage to people who are 65 and older, as well as those with certain disabilities and illnesses. Medicaid, on the other hand, is a joint federal and state program that provides health coverage to people with low incomes.

While Medicare and Medicaid serve different populations, some people may be eligible for both programs. In this case, Medicare would be the primary payer for healthcare services, and Medicaid would provide additional coverage for certain services.

8. Medicare vs. Private Insurance

Medicare is a government-run healthcare program, while private insurance is offered by private insurance companies. While private insurance may offer more flexibility in terms of plan options and benefits, Medicare provides essential health coverage to millions of Americans.

One advantage of Medicare over private insurance is that it is standardized across the country. This means that all beneficiaries have access to the same benefits and services, regardless of where they live. Additionally, Medicare is required to cover certain services that private insurance may not cover.

9. Finding the Right Medicare Plan

When choosing a Medicare plan, it is essential to consider your healthcare needs and budget. You should compare the costs and benefits of different plans to find the one that best meets your needs.

You can use the Medicare Plan Finder tool on the Medicare website to compare plans in your area. You can also work with a licensed insurance agent who specializes in Medicare to help you find the right plan.

10. Conclusion

Medicare premiums are an essential part of the Medicare program. They help to fund the benefits that beneficiaries receive and ensure that the program remains sustainable. Understanding how Medicare premiums are determined can help you make informed decisions when choosing a Medicare plan. By comparing the costs and benefits of different plans, you can find the one that best meets your healthcare needs and budget.

Frequently Asked Questions

Q: How Are Medicare Premiums Determined?

Medicare premiums are determined by different factors, including the type of coverage you have and your income. Part A (hospital insurance) is usually free for most people who have worked and paid taxes for at least 10 years. However, if you do not qualify for premium-free Part A, you may have to pay a monthly premium.

Part B (medical insurance) has a standard monthly premium, which may vary depending on your income. In general, if your income is higher than a certain amount, you may have to pay an Income-Related Monthly Adjustment Amount (IRMAA) in addition to your Part B premium. The same applies to Part D (prescription drug coverage) premiums.

Q: What is the Medicare Part B Premium for 2021?

The standard Medicare Part B premium for 2021 is $148.50 per month. However, if your income is above a certain level, you may have to pay a higher premium through IRMAA. The Part B deductible for 2021 is $203.

It is important to note that the Part B premium can increase each year based on inflation and other factors. The government will announce any changes to the premiums in the fall of each year.

Q: Can I Get Help Paying for My Medicare Premiums?

Yes, there are several programs that can help you pay for your Medicare premiums. The most common program is the Medicare Savings Program (MSP), which is available to people with limited income and resources. The MSP can pay for some or all of your Part A and Part B premiums, as well as other Medicare costs.

Another program is the Extra Help program, which can help you pay for your Part D premiums and other drug costs. To qualify for Extra Help, you must have limited income and resources. You can apply for these programs through your state’s Medicaid office.

Q: Can I Change My Medicare Coverage if I Cannot Afford the Premiums?

Yes, you may be able to change your Medicare coverage if you cannot afford the premiums. One option is to switch to a Medicare Advantage plan, which may have lower premiums than Original Medicare. However, you may have to pay additional costs, such as copayments and deductibles.

Another option is to apply for financial assistance through the programs mentioned earlier. If you qualify for these programs, you may be able to get help paying for your Medicare premiums and other costs.

Q: How Often Do Medicare Premiums Change?

Medicare premiums can change each year based on inflation and other factors. The government announces any changes to the premiums in the fall of each year, and the new premiums take effect on January 1st of the following year.

In addition, your premiums may change if your income changes or if you enroll in a new Medicare plan. It is important to review your Medicare coverage and premiums each year during the Annual Enrollment Period (AEP) to make sure you have the best coverage for your needs.

Giving You the Knowledge about Medicare Premium Payments

In conclusion, understanding how Medicare premiums are determined is essential to making informed decisions about healthcare coverage. The government agencies responsible for setting these premiums consider a variety of factors, including the age and health status of beneficiaries, as well as the cost of providing healthcare services.

It is important to note that while Medicare premiums may seem overwhelming at first glance, there are a variety of resources available to help beneficiaries navigate the system and find affordable coverage options. From speaking with Medicare representatives to working with independent insurance agents, there are many resources available to help ensure that you are able to access the care you need without breaking the bank.

Ultimately, by taking the time to understand how Medicare premiums are determined and exploring all of your coverage options, you can make informed decisions about your healthcare that will help you stay healthy and financially secure for years to come.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts