Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching the age of 65 and wondering when you need to enroll in Medicare? Or maybe you have a disability and are unsure of when you should start receiving Medicare benefits. Understanding when to enroll in Medicare can be confusing, but it’s important to know the deadlines and avoid penalties.

Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and those with End-Stage Renal Disease. But when do you need to enroll in Medicare? Read on to learn about the different enrollment periods and deadlines, so you can make informed decisions about your healthcare coverage.

When Do I Have to Enroll in Medicare?

Medicare is a health insurance program that is offered to people 65 years and older, as well as to those with certain disabilities. It is important to know when to enroll in Medicare to avoid penalties and gaps in coverage. Here’s what you need to know:

Initial Enrollment Period

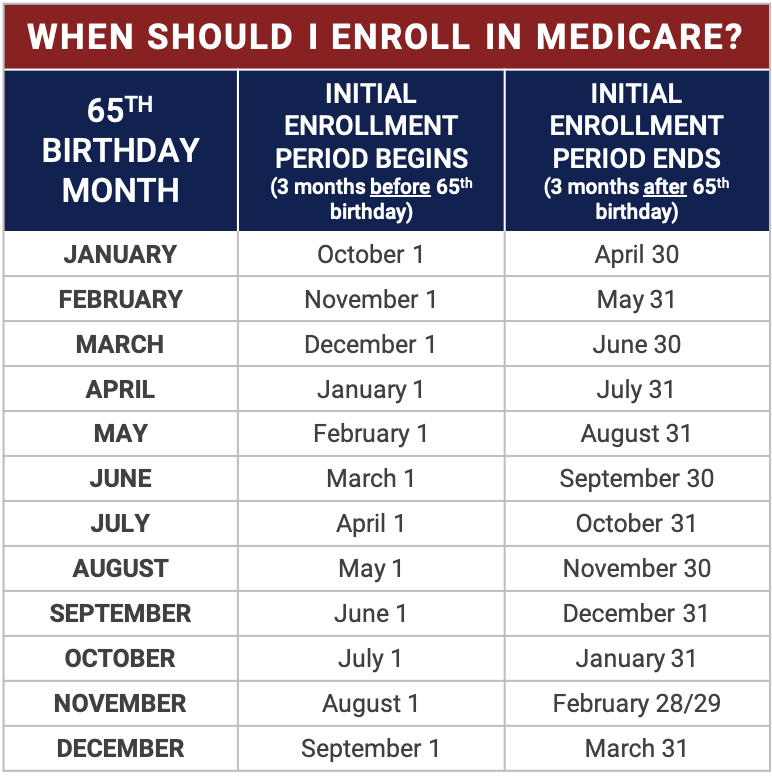

The initial enrollment period (IEP) is the first time you can enroll in Medicare. It starts three months before your 65th birthday and ends three months after. If you miss this window, you may have to pay a late enrollment penalty.

During your IEP, you can enroll in Part A (hospital insurance), Part B (medical insurance), or both. If you are already receiving Social Security benefits, you will be automatically enrolled in Parts A and B.

If you are still working and have employer-sponsored health coverage, you can delay enrollment in Part B without penalty until you retire or lose your coverage.

General Enrollment Period

If you missed your IEP, you can enroll during the general enrollment period (GEP). The GEP runs from January 1st to March 31st each year. Coverage will begin on July 1st of the same year.

However, if you delay enrolling in Part B when you are first eligible, you may have to pay a late enrollment penalty for as long as you have Part B coverage.

Special Enrollment Period

In some cases, you may be eligible for a special enrollment period (SEP) outside of the IEP or GEP. For example, if you or your spouse are still working and have employer-sponsored health coverage, you can enroll in Part B without penalty when you or your spouse retire or lose coverage.

Other circumstances that may qualify you for an SEP include moving to a new area that is not covered by your current plan, losing your current coverage due to divorce or death of a spouse, or qualifying for Extra Help with prescription drug costs.

Benefits of Enrolling in Medicare

Enrolling in Medicare provides many benefits, including:

– Access to a wide range of healthcare services and providers

– Protection against high healthcare costs

– Coverage for preventive care services, such as screenings and check-ups

– Coverage for prescription drugs (with Part D)

– Flexibility to choose how you receive your Medicare benefits (Original Medicare or Medicare Advantage)

Original Medicare vs. Medicare Advantage

Original Medicare includes Part A and Part B and is managed by the federal government. You can choose any doctor or hospital that accepts Medicare, but you may have to pay deductibles, coinsurance, and copayments.

Medicare Advantage (Part C) is an alternative to Original Medicare. It is offered by private insurance companies and includes all the benefits of Part A and Part B, as well as additional benefits like vision, dental, and hearing. Medicare Advantage plans usually have networks of providers that you must use to receive coverage.

Conclusion

Enrolling in Medicare is an important decision that should not be taken lightly. Knowing when to enroll can help you avoid penalties and gaps in coverage. Review your options and speak with a Medicare advisor to determine the best plan for your needs.

Contents

- Frequently Asked Questions

- 1. When am I eligible to enroll in Medicare?

- 2. What happens if I don’t enroll in Medicare when I’m first eligible?

- 3. Can I enroll in Medicare outside of my initial enrollment period?

- 4. Do I need to enroll in Medicare if I have other health insurance?

- 5. What are my options if I miss my initial enrollment period for Medicare?

- When to Enroll In Medicare | Tips to Avoid Penalties

Frequently Asked Questions

Enrolling in Medicare can be a confusing process, and it’s important to know when you need to enroll to avoid any late penalties or gaps in coverage. Here are 5 common questions and answers about when to enroll in Medicare.

1. When am I eligible to enroll in Medicare?

Most people become eligible for Medicare when they turn 65 years old. You can enroll in Medicare during the 7-month period that begins 3 months before the month of your 65th birthday and ends 3 months after the month of your 65th birthday.

If you are under 65 and have a disability or certain medical conditions, you may also be eligible for Medicare. In this case, you can enroll in Medicare during the 7-month period that begins 3 months before your 25th month of disability and ends 3 months after your 25th month of disability.

2. What happens if I don’t enroll in Medicare when I’m first eligible?

If you don’t enroll in Medicare when you are first eligible, you may face late enrollment penalties and gaps in coverage. The penalty for late enrollment in Medicare Part B is 10% of the premium for each 12-month period that you could have had Part B but didn’t enroll. This penalty continues for as long as you have Part B coverage.

If you miss your initial enrollment period for Medicare Part A and/or Part B, you may have to wait until the next general enrollment period to enroll. This period runs from January 1 to March 31 each year, with coverage beginning on July 1 of that year.

3. Can I enroll in Medicare outside of my initial enrollment period?

Yes, you can enroll in Medicare outside of your initial enrollment period during the annual open enrollment period from October 15 to December 7 each year. You can also enroll in Medicare during a special enrollment period if you experience certain life events, such as losing your employer-sponsored health coverage or moving to a new state.

Keep in mind that if you enroll in Medicare outside of your initial enrollment period, you may face late enrollment penalties and gaps in coverage.

4. Do I need to enroll in Medicare if I have other health insurance?

If you have other health insurance, such as through an employer or union, you may not need to enroll in Medicare right away. You should check with your employer or union to see if their insurance is primary or secondary to Medicare.

If your other insurance is primary, you may be able to delay enrolling in Medicare without facing penalties. If your other insurance is secondary, you may need to enroll in Medicare when you are first eligible to avoid gaps in coverage.

5. What are my options if I miss my initial enrollment period for Medicare?

If you miss your initial enrollment period for Medicare, you may be able to enroll during a special enrollment period if you experience certain life events, such as losing your employer-sponsored health coverage or moving to a new state. You may also be able to enroll during the general enrollment period from January 1 to March 31 each year, with coverage beginning on July 1 of that year.

If you miss your initial enrollment period and do not qualify for a special enrollment period, you may face late enrollment penalties and gaps in coverage. It’s important to enroll in Medicare as soon as possible to avoid these penalties and gaps in coverage.

When to Enroll In Medicare | Tips to Avoid Penalties

In conclusion, enrolling in Medicare can be a complex process. It’s important to understand when you are eligible to enroll and what type of coverage you need. If you miss your initial enrollment period, you may face penalties, so it’s best to stay on top of your enrollment deadlines. Remember that Medicare Part A is usually free, but Parts B and D come with monthly premiums.

It’s also important to note that if you have employer-sponsored coverage, you may be able to delay enrolling in Medicare without penalty. However, you should speak with your employer’s benefits administrator to determine your options.

Overall, the key takeaway is to be informed about your Medicare options and enrollment requirements. This will help you make the best decisions for your healthcare needs and avoid any penalties or coverage gaps.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts