Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a government-funded health insurance program that provides medical coverage to millions of Americans. Medicare has four parts, and Part B is one of them. Part B covers a wide range of medical services, including doctor visits, lab tests, and outpatient care. However, Part B comes with a monthly premium, and the amount of that premium can vary from person to person. In this article, we will explore how Medicare calculates the Part B premium and what factors can affect the cost. Understanding how the Part B premium is calculated can help you make informed decisions about your healthcare coverage and budget. So, let’s dive in and learn more about this critical aspect of Medicare.

Understanding How Medicare Part B Premium is Calculated

What is Medicare Part B Premium?

Medicare Part B is a medical insurance program offered by the federal government for people aged 65 or older, those with certain disabilities, and people with End-Stage Renal Disease. Part B covers medically necessary services, including doctor visits, lab tests, and outpatient care. To enroll in Part B, you must pay a monthly premium. This premium is calculated based on your income, and there are different tiers that determine how much you will pay.

How is the Medicare Part B Premium Calculated?

The Medicare Part B premium is calculated based on your modified adjusted gross income (MAGI) from two years ago. This means that the premium you pay in 2021 is based on your income from 2019. The premium is calculated using a sliding scale.

If your MAGI is below $88,000 for individuals or $176,000 for married couples filing jointly, you will pay the standard monthly premium of $148.50 in 2021. However, if your income is above these thresholds, you will pay an income-related monthly adjustment amount (IRMAA) in addition to the standard premium.

The IRMAA is calculated based on your MAGI from two years ago and is added to the standard premium. The higher your income, the more you will pay. The IRMAA ranges from $207.90 to $504.90 per month in 2021.

What are the Different Tiers?

There are five different tiers that determine how much you will pay for Part B premiums. The tiers are based on your MAGI from two years ago, and each tier has a different premium amount.

The first tier is for individuals with a MAGI of $88,000 or less and married couples filing jointly with a MAGI of $176,000 or less. These individuals will pay the standard monthly premium.

The second tier is for individuals with a MAGI between $88,000 and $111,000 and married couples filing jointly with a MAGI between $176,000 and $222,000. These individuals will pay the standard premium plus an IRMAA of $59.40 per month in 2021.

The third tier is for individuals with a MAGI between $111,000 and $138,000 and married couples filing jointly with a MAGI between $222,000 and $276,000. These individuals will pay the standard premium plus an IRMAA of $148.50 per month in 2021.

The fourth tier is for individuals with a MAGI between $138,000 and $165,000 and married couples filing jointly with a MAGI between $276,000 and $330,000. These individuals will pay the standard premium plus an IRMAA of $237.60 per month in 2021.

The fifth tier is for individuals with a MAGI above $165,000 and married couples filing jointly with a MAGI above $330,000. These individuals will pay the standard premium plus an IRMAA of $326.70 per month in 2021.

What are the Benefits of Medicare Part B?

Medicare Part B covers a wide range of medically necessary services, including doctor visits, lab tests, and outpatient care. It also covers preventive services, such as flu shots and cancer screenings, and some home health services. Part B may also cover certain medical equipment, such as wheelchairs and walkers.

Medicare Part B vs. Medicare Advantage

Medicare Advantage plans are an alternative to traditional Medicare. These plans are offered by private insurance companies and provide all of the benefits of Medicare Part A and Part B, as well as additional benefits, such as dental and vision coverage.

One of the main differences between Medicare Part B and Medicare Advantage is that with Medicare Part B, you can go to any doctor or hospital that accepts Medicare. With Medicare Advantage, you must choose a plan that has a network of providers, and you may be limited in your choice of doctors and hospitals.

Another difference is the cost. With Medicare Part B, you pay a monthly premium, and there may be additional costs, such as deductibles and copays. With Medicare Advantage, you may pay a lower monthly premium, but there may be additional costs, such as copays for doctor visits and prescriptions.

Conclusion

In conclusion, the Medicare Part B premium is calculated based on your income, with higher earners paying more. There are five different tiers that determine how much you will pay, and the premium is based on your MAGI from two years ago. Medicare Part B offers a wide range of benefits, including coverage for medically necessary services and preventive care. If you are considering Medicare Advantage, be sure to compare the costs and benefits carefully before making a decision.

Contents

- Frequently Asked Questions

- How is Medicare Part B Premium Calculated?

- How often does the Medicare Part B Premium change?

- Can I get help paying for my Medicare Part B Premium?

- When do I need to start paying for my Medicare Part B Premium?

- What happens if I don’t pay my Medicare Part B Premium?

- Medicare Costs ✅- How to EASILY Calculate Part A and Part B Premiums

Frequently Asked Questions

How is Medicare Part B Premium Calculated?

Medicare Part B premium is calculated based on the beneficiary’s income. The government uses a sliding scale to determine how much each person will pay. The more you earn, the more you will pay. If you are single and your income is less than $85,000, you will pay the standard premium amount. However, if your income is above $85,000, you will pay an additional amount based on your income bracket.

The income brackets for Medicare Part B premiums are as follows:

– $85,000 to $107,000 for single filers

– $170,000 to $214,000 for married couples filing jointly

– $107,000 to $133,500 for single filers with a higher income

– $214,000 to $267,000 for married couples filing jointly with a higher income

How often does the Medicare Part B Premium change?

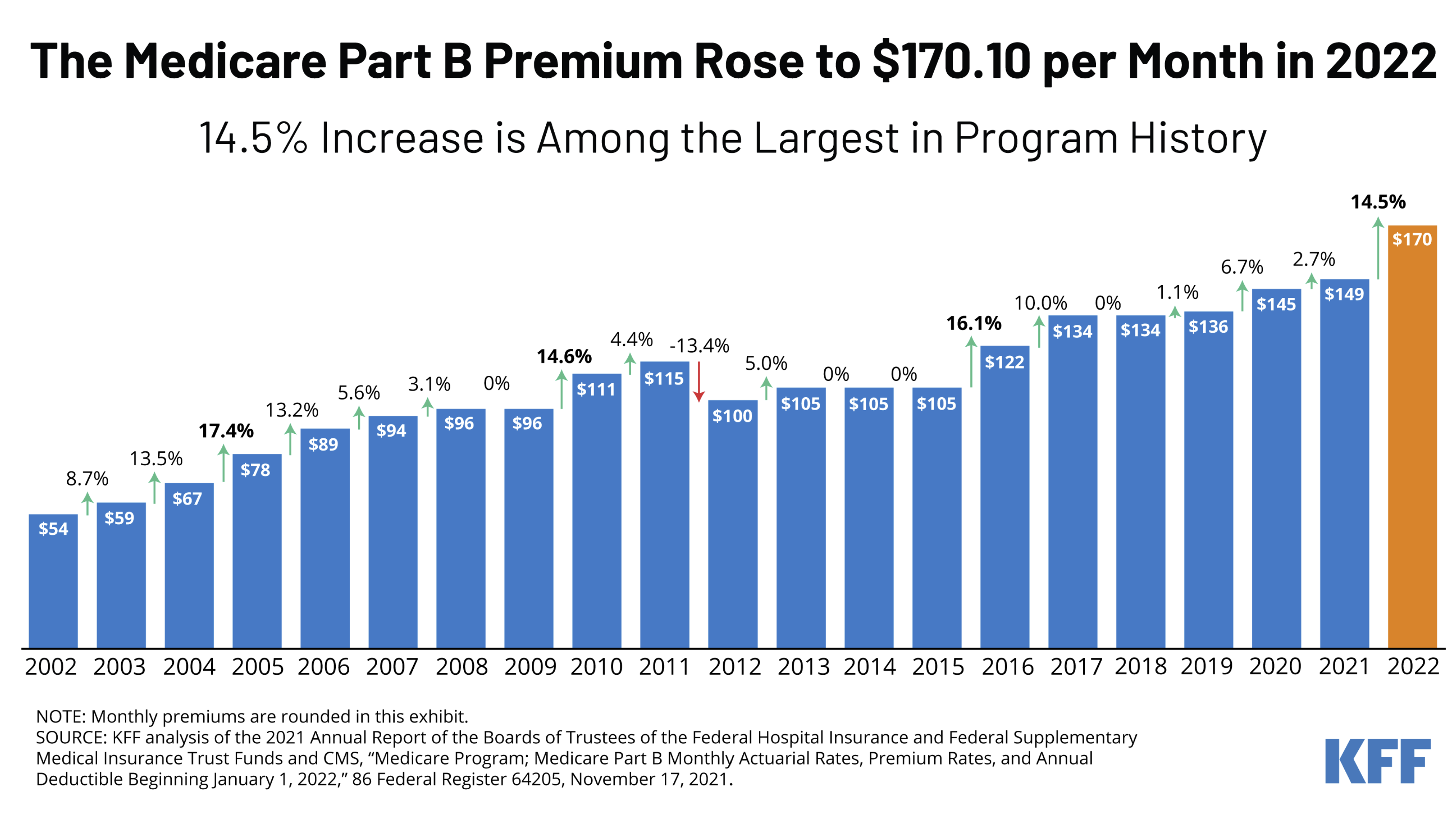

The Medicare Part B premium can change every year. The premium is reviewed annually and is subject to change based on inflation and other factors. The government usually announces any changes to the premium amount in the fall, before the start of the new year. It’s important to keep an eye out for any changes so you can plan accordingly.

It’s worth noting that not everyone pays the same amount for Medicare Part B premiums. As mentioned earlier, the premium is based on your income. So, if your income changes, your premium may also change.

Can I get help paying for my Medicare Part B Premium?

Yes, there are programs available to help you pay for your Medicare Part B premium if you meet certain income and asset requirements. The two main programs are the Medicare Savings Programs and Extra Help. The Medicare Savings Programs help pay for Medicare Part B premiums, deductibles, and other costs. Extra Help is a program that helps pay for prescription drug costs.

To qualify for these programs, you must meet certain income and asset requirements. The exact requirements vary depending on the program and your location. You can contact your local Medicaid office or the Social Security Administration to find out if you qualify.

When do I need to start paying for my Medicare Part B Premium?

Most people are automatically enrolled in Medicare Part B when they turn 65, or when they become eligible for Medicare due to a disability. If you’re automatically enrolled, you’ll receive a Medicare card in the mail three months before your 65th birthday or your 25th month of disability.

If you’re not automatically enrolled, you’ll need to sign up for Medicare Part B during your Initial Enrollment Period (IEP). Your IEP is a seven-month period that begins three months before your 65th birthday and ends three months after your birthday month.

You’ll need to start paying your Medicare Part B premium once coverage begins. If you’re automatically enrolled, your coverage will begin on the first day of the month you turn 65. If you sign up during your IEP, your coverage will begin on the first day of the month after you enroll.

What happens if I don’t pay my Medicare Part B Premium?

If you don’t pay your Medicare Part B premium, your coverage will be terminated. You’ll receive a notice in the mail letting you know that your coverage will end if you don’t pay the outstanding premium. If you still don’t pay, your coverage will end on the last day of the month in which the premium was due.

If your coverage is terminated due to non-payment, you’ll need to wait until the next General Enrollment Period (GEP) to enroll in Medicare Part B. The GEP occurs every year from January 1 to March 31. You’ll also be subject to a late enrollment penalty, which will increase your premium by 10% for each 12-month period you were eligible for Medicare Part B but didn’t enroll.

Medicare Costs ✅- How to EASILY Calculate Part A and Part B Premiums

In conclusion, Medicare Part B premium is calculated based on the beneficiary’s income. The higher the income, the higher the premium. However, the majority of beneficiaries will pay the standard premium amount which is set each year by the government.

It is important to note that there are ways to reduce your Medicare Part B premium. For example, if you have limited income and resources, you may qualify for a program called Extra Help. This program can help pay for your Medicare premiums, deductibles, and co-insurance.

In summary, understanding how your Medicare Part B premium is calculated is crucial in planning for your healthcare costs. By knowing the factors that influence your premium, you can make informed decisions that will help you get the coverage you need at a price you can afford.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts