Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare Part B is an essential component of the Medicare program that provides coverage for medically necessary services, including doctor visits, preventive care, and medical equipment. Understanding how it works is crucial for anyone who wants to make informed healthcare choices.

If you’re feeling overwhelmed by the complexities of Medicare Part B, don’t worry. In this article, we’ll break down the program’s key features, eligibility criteria, and coverage options, so you can confidently navigate the system and get the care you need.

Understanding Medicare Part B

Medicare Part B is a health insurance program offered by the federal government to cover medical expenses for individuals who are 65 years and older, as well as individuals with certain disabilities. Medicare Part B works in combination with Part A, which covers hospital stays. In this article, we will take a closer look at how Medicare Part B works.

Enrollment in Medicare Part B

In order to enroll in Medicare Part B, you must either be eligible for Medicare or have a disability. You will need to enroll in Part B during your initial enrollment period, which begins three months before your 65th birthday and ends three months after your birthday. Failure to enroll during this period may result in a late enrollment penalty. If you have a disability, you can enroll in Part B during a special enrollment period.

Once you are enrolled in Medicare Part B, you will need to pay a monthly premium. The premium amount is determined by your income and can change from year to year. If you are receiving Social Security benefits, your Part B premium will be deducted from your benefit payment.

Coverage under Medicare Part B

Medicare Part B covers a wide range of medical services and supplies, including doctor visits, outpatient care, preventive services, and medical equipment. This coverage includes medically necessary services and supplies that are needed to diagnose or treat a medical condition.

Some of the services covered under Medicare Part B include:

- Doctor visits

- Outpatient care

- Lab tests and X-rays

- Preventive services, such as flu shots and cancer screenings

- Medical equipment, such as wheelchairs and oxygen tanks

It is important to note that Medicare Part B does not cover all medical services and supplies. For example, it does not cover dental care, eyeglasses, or hearing aids.

Costs under Medicare Part B

In addition to the monthly premium, there are other costs associated with Medicare Part B. These include deductibles, coinsurance, and copayments. The deductible is the amount you must pay before Medicare begins to cover your medical expenses. The coinsurance is the percentage of the cost of a service that you are responsible for paying. The copayment is a fixed amount that you pay for a particular service.

It is important to understand these costs so that you can budget accordingly. You may also consider purchasing a Medicare Supplement plan to help cover some of these costs.

Benefits of Medicare Part B

One of the major benefits of Medicare Part B is that it provides coverage for a wide range of medical services and supplies. This can help individuals stay healthy and manage chronic conditions. Additionally, Medicare Part B provides access to preventive services that can help detect and prevent health problems before they become more serious.

Another benefit of Medicare Part B is that it allows individuals to choose their own doctors and healthcare providers. This can be especially important for individuals who have established relationships with their healthcare providers and want to continue receiving care from them.

Medicare Part B vs. Medicare Advantage

Medicare Advantage is an alternative to traditional Medicare, and it includes both Part A and Part B coverage. Medicare Advantage plans are offered by private insurance companies and may provide additional benefits, such as prescription drug coverage.

While Medicare Advantage plans may offer additional benefits, they may also have higher out-of-pocket costs and may limit the doctors and healthcare providers that individuals can see. Medicare Part B, on the other hand, allows individuals to choose their own doctors and healthcare providers and has a wider range of coverage.

Conclusion

Medicare Part B is an important program that provides healthcare coverage for individuals who are 65 years and older, as well as individuals with certain disabilities. It covers a wide range of medical services and supplies, and allows individuals to choose their own healthcare providers. Understanding how Medicare Part B works and the costs associated with it can help individuals make informed decisions about their healthcare coverage.

Contents

Frequently Asked Questions

What is Medicare Part B?

Medicare Part B is a government-run health insurance program that covers medically necessary services and supplies that are needed to diagnose or treat a health condition. This may include doctor visits, outpatient care, lab tests, preventive services, and durable medical equipment. Part B is optional and requires payment of a monthly premium.

If you enroll in Part B, you will typically pay 20% of the Medicare-approved amount for most services. The remaining 80% will be covered by Medicare. There is also an annual deductible that must be met before Medicare will begin covering your expenses.

Who is eligible for Medicare Part B?

Most people who are eligible for Medicare are also eligible for Part B. This includes individuals who are 65 years or older, those with certain disabilities, and those with end-stage renal disease. You must be a U.S. citizen or legal resident to qualify for Medicare.

It is important to note that there may be late enrollment penalties if you do not sign up for Part B when you are first eligible. To avoid these penalties, you should enroll in Part B during your initial enrollment period or during a special enrollment period if you qualify.

How do I enroll in Medicare Part B?

You can enroll in Medicare Part B during your initial enrollment period, which is the seven-month period that starts three months before your 65th birthday month and ends three months after that month. You can also enroll during a special enrollment period if you qualify.

To enroll in Part B, you will need to complete an application and submit it to the Social Security Administration. You can complete the application online, over the phone, or in person at a Social Security office. Once your application is processed, you will receive a Medicare card and your coverage will begin.

What does Medicare Part B not cover?

While Medicare Part B covers many medically necessary services and supplies, there are some things that it does not cover. This includes most prescription drugs, long-term care, dental care, and vision care.

There are also limits on certain services, such as physical therapy and occupational therapy. For example, Medicare may only cover a certain number of therapy sessions per year. If you need additional services, you may need to pay out of pocket or seek coverage from a different insurance plan.

Can I change my Medicare Part B coverage?

Yes, you can change your Medicare Part B coverage during certain enrollment periods. This includes during the annual open enrollment period, which runs from October 15th to December 7th each year, and during the Medicare Advantage open enrollment period, which runs from January 1st to March 31st each year.

During these enrollment periods, you can switch from Original Medicare to a Medicare Advantage plan, switch from one Medicare Advantage plan to another, or add or drop Part D prescription drug coverage. It is important to review your options carefully and choose the coverage that best meets your needs.

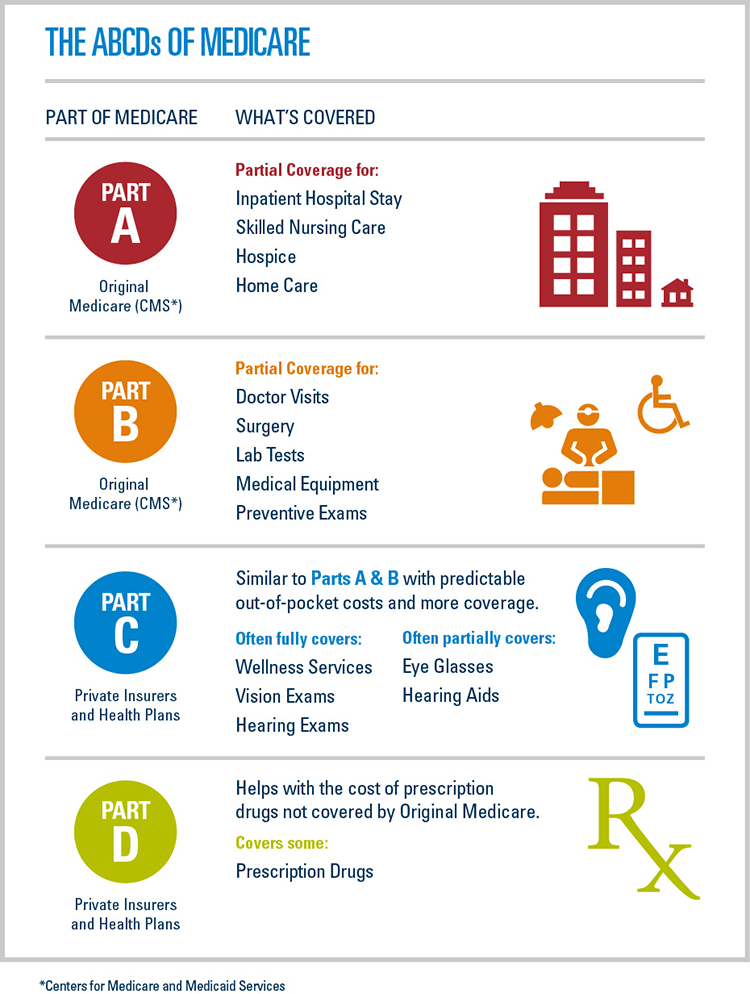

Medicare Basics: Parts A, B, C & D

In conclusion, Medicare Part B is a critical component of the Medicare program that provides essential medical services to individuals aged 65 and over. It covers a wide range of medical expenses, including doctor visits, outpatient care, and medical equipment.

While Part B premiums are based on an individual’s income, the program is designed to be affordable for all beneficiaries. Additionally, Medicare Part B offers a variety of benefits that can help seniors stay healthy and maintain their independence as they age.

Overall, Medicare Part B is an essential program that provides critical medical services to seniors. If you or a loved one are eligible for Medicare, be sure to explore your options and take advantage of this valuable program. With the right coverage, you can enjoy peace of mind and access to the care you need to stay healthy and happy in your golden years.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts