Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage to people over the age of 65, as well as those with certain disabilities or medical conditions. While Medicare covers many healthcare costs, it does not cover everything. That’s where Medicare supplement plans come in. These plans, also known as Medigap plans, offer additional coverage to help fill in the gaps left by traditional Medicare. In this article, we will explore the different Medicare supplement plans available and what they cover, so you can make an informed decision about your healthcare coverage. Let’s dive in!

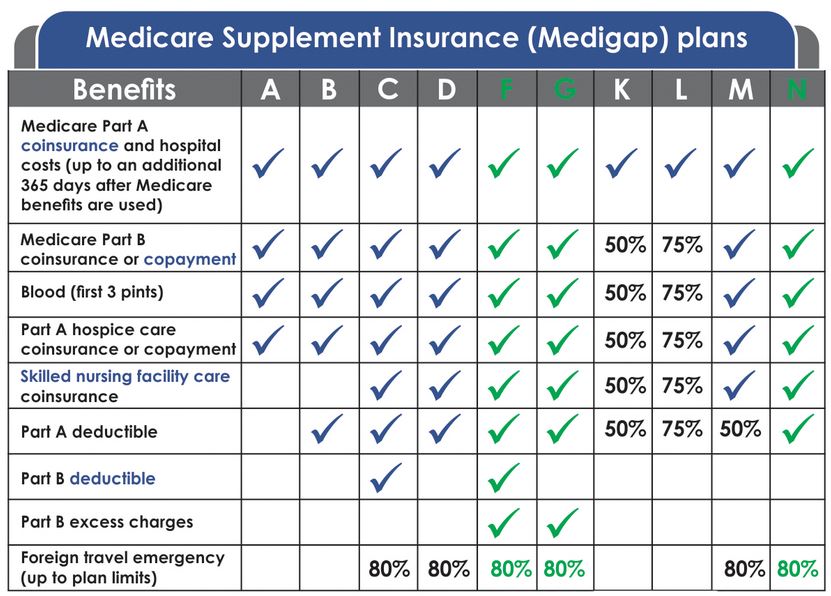

Explaining Different Medicare Supplement Plans

Medicare is a federal health insurance program for people over the age of 65, as well as for younger people with certain disabilities. While original Medicare covers many health care services, it does not cover everything. This is where Medicare supplement plans come into play. Medicare supplement plans, also known as Medigap plans, are designed to help fill in the gaps left by original Medicare. In this article, we’ll take a closer look at the different Medicare supplement plans available and what they cover.

Plan A

Plan A is the most basic Medicare supplement plan available. It covers the coinsurance and copayment amounts for Medicare Part A and B, as well as the first three pints of blood each year. Plan A does not cover any of the deductibles for either Part A or Part B.

Plan A can be a good option for those who are on a tight budget and want to keep their monthly premiums low. However, it may not be the best choice for those who anticipate needing more medical care and services in the future.

Plan B

Plan B covers everything that Plan A covers, as well as the Medicare Part A deductible. This deductible is the amount you must pay out of pocket before Medicare Part A will cover your hospital stay. Plan B does not cover the Medicare Part B deductible.

Plan B may be a good option for those who are looking for slightly more coverage than Plan A, but still want to keep their monthly premiums low.

Plan C

Plan C is a more comprehensive Medicare supplement plan. It covers everything that Plan B covers, as well as the Medicare Part B deductible. It also covers skilled nursing facility care, Medicare Part B excess charges, and foreign travel emergency care.

Plan C may be a good option for those who anticipate needing more medical care and services in the future, as well as those who travel frequently outside of the United States.

Plan D

Plan D covers everything that Plan B covers, as well as the Medicare Part B deductible. It also covers skilled nursing facility care, but does not cover Medicare Part B excess charges or foreign travel emergency care.

Plan D may be a good option for those who want coverage for skilled nursing facility care, but do not anticipate needing foreign travel emergency care or Medicare Part B excess charges.

Plan F

Plan F is one of the most comprehensive Medicare supplement plans available. It covers everything that Plan C covers, as well as the Medicare Part B deductible, Medicare Part B excess charges, and foreign travel emergency care.

Plan F may be a good option for those who want the most comprehensive coverage available and do not mind paying a higher monthly premium.

Plan G

Plan G is similar to Plan F, but it does not cover the Medicare Part B deductible. However, the monthly premiums for Plan G are typically lower than those for Plan F.

Plan G may be a good option for those who want comprehensive coverage, but are willing to pay the Medicare Part B deductible out of pocket.

Plan K

Plan K is a lower-cost Medicare supplement plan that covers 50% of the coinsurance and copayment amounts for Medicare Part A and B. It also covers the first three pints of blood each year, as well as hospice care coinsurance or copayments.

Plan K may be a good option for those who are on a tight budget and do not anticipate needing a lot of medical care and services in the future.

Plan L

Plan L is similar to Plan K, but it covers 75% of the coinsurance and copayment amounts for Medicare Part A and B, rather than 50%. It also covers the first three pints of blood each year, as well as hospice care coinsurance or copayments.

Plan L may be a good option for those who want slightly more coverage than Plan K, but still want to keep their monthly premiums low.

Plan M

Plan M is a newer Medicare supplement plan that covers everything that Plan D covers, as well as 50% of the Medicare Part A deductible. It does not cover the Medicare Part B deductible or Medicare Part B excess charges.

Plan M may be a good option for those who want coverage for the Medicare Part A deductible, but do not need coverage for the Medicare Part B deductible or excess charges.

Plan N

Plan N is similar to Plan D, but it requires you to pay a copayment for certain doctor visits and emergency room visits. It covers everything that Plan D covers, as well as the Medicare Part B deductible and skilled nursing facility care.

Plan N may be a good option for those who are willing to pay a copayment for certain medical services in exchange for lower monthly premiums.

In conclusion, choosing the right Medicare supplement plan can be a daunting task. It’s important to carefully consider your medical needs and budget when selecting a plan. By understanding the different Medicare supplement plans available and what they cover, you can make an informed decision that meets your unique needs.

Frequently Asked Questions

Medicare Supplement plans are designed to fill in the gaps left by Original Medicare. Each plan has its own set of benefits, costs, and coverage options. Here are some frequently asked questions about different Medicare Supplement plans.

What is Medicare Supplement Plan A?

Medicare Supplement Plan A is the most basic plan available. It covers the Medicare Part A coinsurance and hospital costs for up to an additional 365 days after Medicare benefits are exhausted. It also covers the Medicare Part B coinsurance or copayment, as well as the first three pints of blood each year.

Plan A does not cover any of the other Medicare gaps, such as the Medicare Part B deductible, excess charges, or skilled nursing facility care. It may be a good option for those who have lower healthcare needs and want to pay a lower premium.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is the most comprehensive plan available. It covers all of the gaps left by Original Medicare, including the Medicare Part A and Part B deductibles, coinsurance, and copayments. It also covers skilled nursing facility care, excess charges, and foreign travel emergencies.

Plan F has the highest premium out of all the Medicare Supplement plans but offers the most comprehensive coverage. It may be a good option for those who have higher healthcare needs and want to avoid unexpected out-of-pocket costs.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is similar to Plan F but does not cover the Medicare Part B deductible. It covers all of the other gaps left by Original Medicare, including the Medicare Part A and Part B coinsurance, copayments, and excess charges. It also covers skilled nursing facility care and foreign travel emergencies.

Plan G may be a good option for those who want comprehensive coverage but are willing to pay the Medicare Part B deductible out of pocket. It typically has a lower premium than Plan F.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N is a lower-cost option that covers many of the gaps left by Original Medicare but requires some cost-sharing. It covers the Medicare Part A coinsurance and hospital costs, as well as the Medicare Part B coinsurance or copayment. It also covers the first three pints of blood each year and skilled nursing facility care.

Plan N requires a copayment for some office visits and emergency room visits. It also does not cover the Medicare Part B deductible or excess charges. It may be a good option for those who want comprehensive coverage but are willing to share some of the costs.

What is Medicare Supplement Plan L?

Medicare Supplement Plan L is a plan that has lower premiums but higher out-of-pocket costs. It covers the Medicare Part A coinsurance and hospital costs, as well as 75% of the Medicare Part B coinsurance or copayment. It also covers the first three pints of blood each year and skilled nursing facility care.

Plan L has a higher out-of-pocket limit than other Medicare Supplement plans. Once the out-of-pocket limit is reached, the plan pays 100% of covered services for the rest of the year. It may be a good option for those who want lower premiums but are willing to take on more out-of-pocket costs.

Medicare Explained – Medicare Supplement Plans ✅

In conclusion, understanding the various Medicare supplement plans available can be a valuable tool in ensuring that you have the healthcare coverage you need. Each plan offers different benefits and levels of coverage, so it’s important to carefully consider your individual needs and budget before making a decision. Whether you opt for a comprehensive Plan F or a more affordable Plan N, having a Medicare supplement plan can provide peace of mind and help you stay on top of your healthcare costs.

Overall, Medicare supplement plans are an excellent way to fill in the gaps left by traditional Medicare coverage. With a range of options available, it’s easy to find a plan that meets your specific needs and budget. Whether you’re looking for comprehensive coverage or a more affordable option, there’s a Medicare supplement plan out there for you. So don’t wait – start exploring your options today and take control of your healthcare coverage.

In the end, it’s important to remember that Medicare supplement plans are designed to work alongside your existing Medicare coverage. By opting for a supplement plan, you can enjoy enhanced benefits and greater peace of mind, knowing that you’re covered in the event of unexpected healthcare costs. So whether you’re nearing retirement or just starting to think about your healthcare options, be sure to consider the benefits of a Medicare supplement plan and make an informed decision that meets your unique needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts