Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

The world of Medicare can be confusing, especially when it comes to understanding what is considered creditable coverage for Medicare Part D. With so many different options and rules to follow, it’s no wonder that many people feel overwhelmed and unsure of where to start.

Fortunately, understanding creditable coverage doesn’t have to be a daunting task. In this article, we’ll break down the basics of what creditable coverage is, why it matters, and how you can ensure that you have the right coverage to meet your needs. So let’s dive in and get started!

Creditable coverage for Medicare Part D refers to prescription drug coverage that is at least as good as the standard Medicare prescription drug coverage. This means that the coverage must meet or exceed the basic benefits offered by Medicare Part D. Examples of creditable coverage include employer-sponsored health plans, union plans, and TRICARE. If you have creditable coverage, you can avoid paying a late enrollment penalty if you decide to enroll in Medicare Part D later on.

Understanding Creditable Coverage for Medicare Part D

If you are enrolled in Medicare Part D, it’s important to understand what is considered creditable coverage. Creditable coverage is any prescription drug coverage that is at least as good as Medicare’s standard prescription drug coverage. If you have creditable coverage, you will not have to pay a late enrollment penalty if you later decide to enroll in Medicare Part D. Here’s what you need to know about creditable coverage for Medicare Part D.

What is Creditable Coverage?

Creditable coverage is any prescription drug coverage that meets or exceeds Medicare’s standard prescription drug coverage. This coverage can come from a variety of sources, including employer plans, union plans, TRICARE, and VA coverage. Creditable coverage must provide at least the same level of coverage as Medicare Part D and must be available to all members of the plan.

There are a few different ways to determine whether your coverage is creditable. Your plan should provide you with a notice each year that tells you whether your coverage is creditable. You can also ask your plan administrator whether your coverage is creditable. If your coverage is not creditable, you may want to consider enrolling in Medicare Part D to avoid a late enrollment penalty.

Benefits of Creditable Coverage

There are several benefits to having creditable coverage. First and foremost, having creditable coverage means that you will not have to pay a late enrollment penalty if you decide to enroll in Medicare Part D at a later date. This penalty can be significant, as it is calculated based on the number of months you went without creditable coverage.

In addition to avoiding a late enrollment penalty, having creditable coverage can also provide you with peace of mind. You will know that you have adequate prescription drug coverage and that you will not face high out-of-pocket costs for your medications. This can be especially important for people with chronic conditions who rely on expensive medications to manage their health.

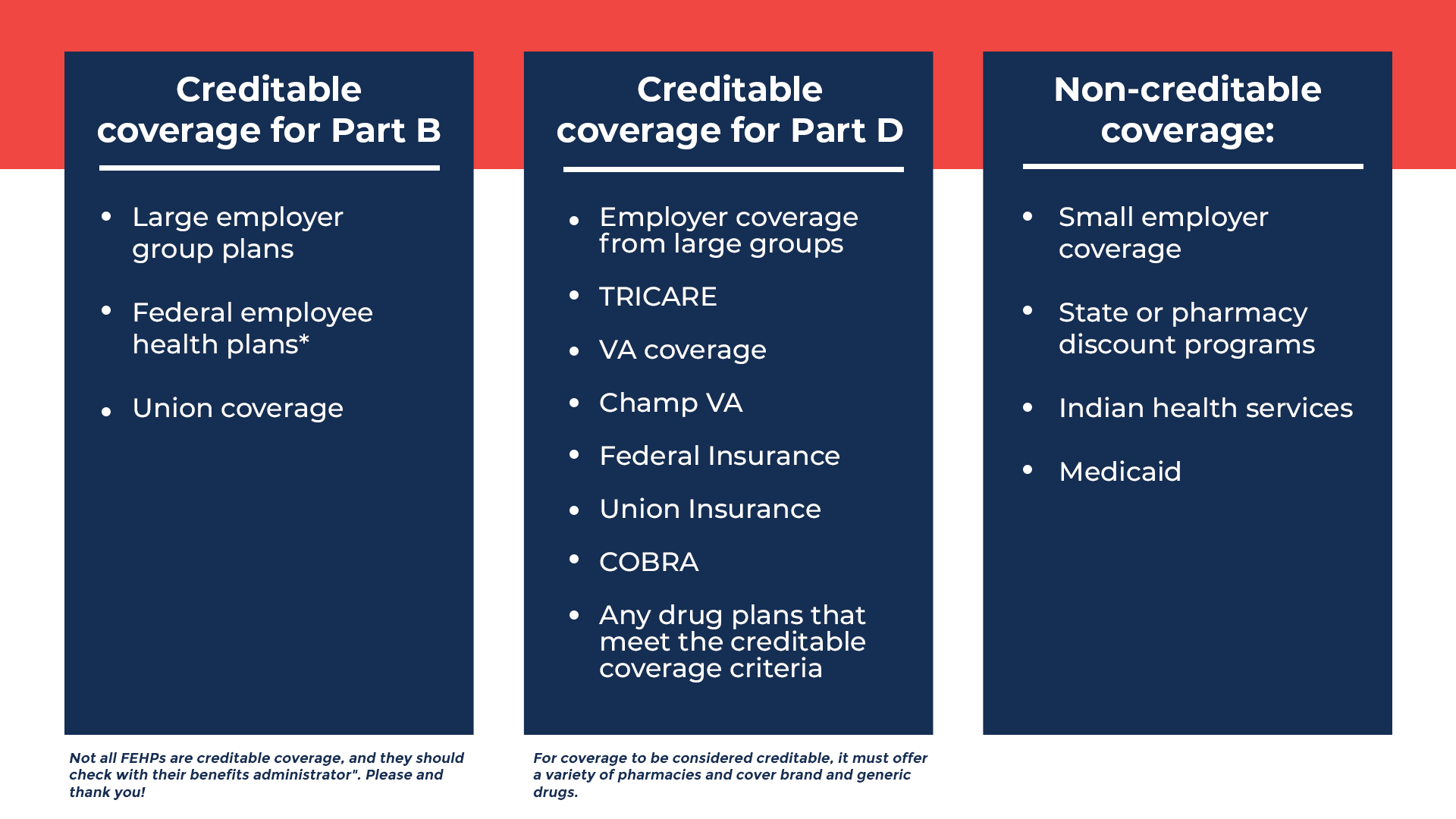

Creditable Coverage vs. Non-Creditable Coverage

If your coverage is not creditable, you may still be able to enroll in Medicare Part D, but you will face a late enrollment penalty. This penalty is calculated by multiplying 1% of the national base beneficiary premium by the number of full, uncovered months you were eligible but did not enroll in a Medicare drug plan and went without other creditable prescription drug coverage.

The penalty is added to your monthly premium for as long as you have Medicare Part D coverage. This can add up to a significant amount over time, so it’s important to enroll in creditable coverage if it is available to you.

Examples of Creditable Coverage

There are many types of coverage that may be considered creditable for Medicare Part D purposes. These include:

– Employer group health plans

– Union plans

– TRICARE

– VA coverage

– Indian Health Service coverage

– State Pharmaceutical Assistance Programs

– Medicare Advantage plans with prescription drug coverage

If you are unsure whether your coverage is creditable, you should check with your plan administrator or benefits coordinator.

How to Get Creditable Coverage

If you do not have creditable coverage, you may want to consider enrolling in a Medicare drug plan or other creditable coverage. You can enroll in a Medicare drug plan during the annual enrollment period, which runs from October 15 to December 7 each year.

If you have other creditable coverage, such as through your employer, you do not need to enroll in a Medicare drug plan. However, you should still make sure that your coverage is creditable and that you have the necessary documentation to prove it.

Conclusion

Understanding what is considered creditable coverage for Medicare Part D is important for anyone who is eligible for Medicare. By having creditable coverage, you can avoid a late enrollment penalty and ensure that you have adequate prescription drug coverage. If you are unsure whether your coverage is creditable, be sure to check with your plan administrator or benefits coordinator.

Contents

- Frequently Asked Questions

- What is considered creditable coverage for Medicare Part D?

- How do I know if my current prescription drug coverage is creditable for Medicare Part D?

- What happens if I do not have creditable coverage for Medicare Part D?

- Can I switch from a plan that is not creditable to one that is creditable for Medicare Part D?

- What if I qualify for Extra Help with my Medicare Part D costs?

- What is Creditable Prescription Drug Coverage?

Frequently Asked Questions

What is considered creditable coverage for Medicare Part D?

Creditable coverage refers to the prescription drug coverage you have that is expected to pay, on average, at least as much as standard Medicare prescription drug coverage. This coverage can come from an employer or union plan, a Medicare Advantage plan, or any other health insurance plan that provides prescription drug coverage.

It is important to have creditable coverage because if you go without coverage for 63 days or more, you may be subject to a late enrollment penalty when you do enroll in a Medicare Part D plan.

How do I know if my current prescription drug coverage is creditable for Medicare Part D?

If you have current prescription drug coverage, you should receive an annual notice from your plan letting you know if your coverage is creditable. This notice should be mailed to you every year before October 15th, which is the start of the Medicare Annual Enrollment Period.

If you do not receive a notice or are unsure if your coverage is creditable, you can contact your plan administrator or human resources department to ask.

What happens if I do not have creditable coverage for Medicare Part D?

If you do not have creditable coverage for Medicare Part D and go without coverage for 63 days or more, you may be subject to a late enrollment penalty when you do enroll in a Medicare Part D plan. The penalty is calculated by multiplying 1% of the national base beneficiary premium by the number of full, uncovered months you were eligible but did not enroll in a Medicare Part D plan.

The penalty is added to your monthly premium for as long as you have Medicare prescription drug coverage, so it is important to have creditable coverage to avoid this penalty.

Can I switch from a plan that is not creditable to one that is creditable for Medicare Part D?

Yes, you can switch from a plan that is not creditable to one that is creditable for Medicare Part D during the Annual Enrollment Period, which runs from October 15th to December 7th each year. You can also switch plans during the Medicare Advantage Open Enrollment Period, which runs from January 1st to March 31st each year.

It is important to compare plans and choose one that provides creditable coverage to avoid the late enrollment penalty.

What if I qualify for Extra Help with my Medicare Part D costs?

If you qualify for Extra Help with your Medicare Part D costs, you will not be subject to the late enrollment penalty even if you do not have creditable coverage. Extra Help is a program that helps people with limited income and resources pay for their Medicare prescription drug costs.

To see if you qualify for Extra Help, you can contact your local Social Security office or call 1-800-MEDICARE (1-800-633-4227).

What is Creditable Prescription Drug Coverage?

In conclusion, understanding what is considered creditable coverage for Medicare Part D is crucial for individuals who are eligible for this program. Creditable coverage refers to any prescription drug coverage that is at least as good as the standard Medicare Part D coverage. It is essential to enroll in creditable coverage to avoid late enrollment penalties and gaps in coverage.

By enrolling in creditable coverage, you can ensure that you have access to the medications you need at an affordable cost. You can also avoid the stress and financial burden of paying out-of-pocket for prescription drugs. It is important to review your coverage options each year during open enrollment to ensure that you are still enrolled in creditable coverage.

In summary, creditable coverage for Medicare Part D is any prescription drug coverage that is at least as good as the standard Medicare Part D coverage. Enrolling in creditable coverage is essential to avoid late enrollment penalties and gaps in coverage. Make sure to review your coverage options each year during open enrollment to ensure that you are still enrolled in creditable coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts