Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare tax is a payroll tax that is automatically deducted from your paycheck. This tax is a part of the Federal Insurance Contributions Act (FICA) and is used to fund the Medicare program, which provides healthcare benefits to millions of Americans.

If you are employed, you will see Medicare tax listed as a deduction on your pay stub. It is important to understand how this tax works and how it is calculated, as it directly affects your take-home pay. In this article, we will explore the ins and outs of Medicare tax, including who pays it, how it is calculated, and what it funds.

What is Medicare Tax on My Paycheck?

Medicare tax is a payroll tax that funds the Medicare program, which provides health insurance for people over the age of 65 and those with disabilities. The Medicare tax rate is 1.45% of your gross wages, and your employer matches that amount. If you are self-employed, you pay both the employee and employer portions, which is a total of 2.9%.

Understanding Medicare Tax on Your Paycheck

Medicare tax is a payroll tax that is automatically deducted from your paycheck to fund the Medicare program. If you are an employee, you pay 1.45% of your wages, and your employer pays an additional 1.45%. If you are self-employed, you pay both the employee and employer portions, for a total of 2.9%. In this article, we will discuss everything you need to know about Medicare tax, including how it works, who pays it, and how it benefits you.

What is Medicare Tax?

Medicare tax is a payroll tax that is used to fund the Medicare program. The Medicare program provides health insurance for people who are 65 or older, as well as people with disabilities and those with end-stage renal disease. The program is funded by payroll taxes, premiums, and general revenue. The payroll taxes are collected from employees and employers, and the premiums are paid by beneficiaries.

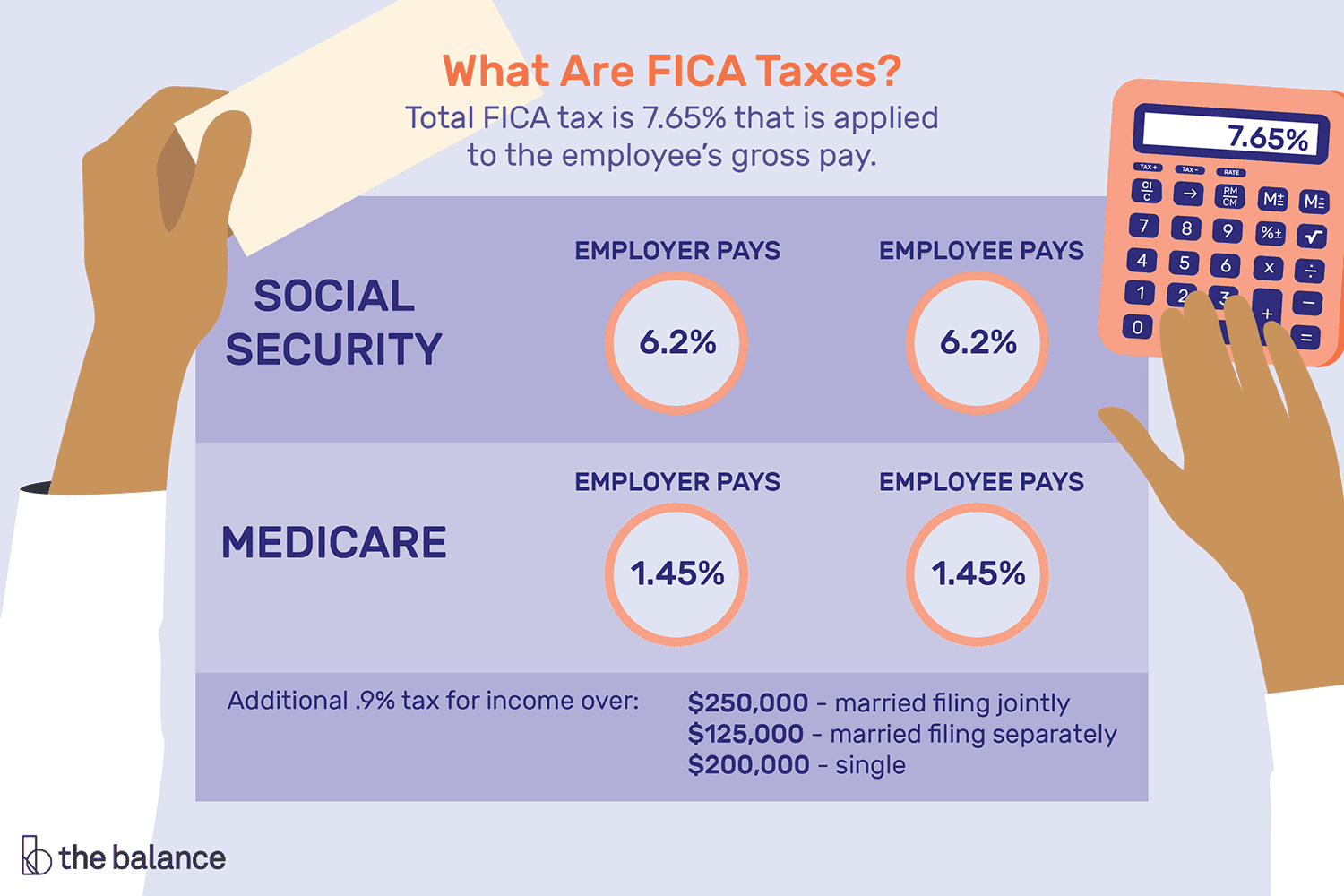

The Medicare tax is one part of the Federal Insurance Contributions Act (FICA) tax, which also includes Social Security tax. While Social Security tax funds retirement benefits, Medicare tax funds health insurance benefits. The Medicare tax rate is a flat percentage of your wages, regardless of how much you make.

Who Pays Medicare Tax?

Both employees and employers are responsible for paying Medicare tax. If you are an employee, your employer withholds 1.45% of your wages, and they pay an additional 1.45%. If you are self-employed, you are responsible for paying both the employee and employer portions, for a total of 2.9%.

It’s important to note that there is no income cap for Medicare tax. This means that even if you make millions of dollars a year, you will still pay the same percentage of your wages in Medicare tax as someone who makes minimum wage. However, there is an income cap for Social Security tax, which is $142,800 in 2021.

How is Medicare Tax Calculated?

Medicare tax is calculated as a percentage of your wages. If you are an employee, your employer withholds 1.45% of your wages, and they pay an additional 1.45%. If you are self-employed, you calculate your Medicare tax on your tax return. You will owe 2.9% of your net earnings from self-employment, which is your total self-employment income minus any deductions and credits you are eligible for.

If you make over $200,000 as an individual or $250,000 as a married couple filing jointly, you will be subject to an additional 0.9% Medicare tax. This is known as the Additional Medicare Tax. Employers are responsible for withholding this tax from their employees’ wages if they make over $200,000, but if you are self-employed, you will need to calculate and pay this tax on your own.

What are the Benefits of Medicare Tax?

The Medicare program provides health insurance to millions of Americans who would otherwise be unable to afford it. It covers a wide range of medical services, including hospital stays, doctor visits, and prescription drugs. Medicare also provides preventative care, such as screenings for cancer and other diseases, to help catch health issues early when they are more treatable.

By paying Medicare tax, you are contributing to a program that helps ensure that all Americans have access to quality health care, regardless of their income or health status. Even if you do not currently use Medicare, you may be eligible for it in the future, and your contributions will help fund the program for future generations.

Medicare Tax vs. Social Security Tax

While Medicare tax and Social Security tax are both payroll taxes, they serve different purposes. Social Security tax funds retirement benefits, while Medicare tax funds health insurance benefits. The Social Security tax rate is 6.2%, and it is also split between employees and employers. However, there is an income cap for Social Security tax, which is $142,800 in 2021.

It’s important to note that while the Medicare tax rate is a flat percentage of your wages, the Social Security tax rate is only applied to a certain amount of your wages. If you make over the income cap, you will not pay Social Security tax on that additional income.

Conclusion

Medicare tax is a payroll tax that is used to fund the Medicare program, which provides health insurance to millions of Americans. Both employees and employers are responsible for paying Medicare tax, and there is no income cap for it. By paying Medicare tax, you are contributing to a program that helps ensure that all Americans have access to quality health care, regardless of their income or health status.

It’s important to understand how payroll taxes work, including Medicare tax and Social Security tax, so that you can properly budget for your finances. If you have any questions or concerns about your payroll taxes, be sure to speak with your employer or a tax professional.

Frequently Asked Questions

What is Medicare Tax on My Paycheck?

Medicare tax is a payroll tax that is deducted from your paycheck by your employer. It is used to fund the Medicare program, which provides healthcare benefits to Americans who are 65 years of age or older, as well as people with certain disabilities. The Medicare tax is calculated as a percentage of your total wages, and the rate varies depending on your income.

When you start a new job, you will be asked to fill out a Form W-4, which tells your employer how much federal income tax and Medicare tax to withhold from your paycheck. Your employer will then deduct the appropriate amount of Medicare tax from your paycheck each pay period, and they will send the money to the government on your behalf.

How much Medicare Tax do I have to pay?

The amount of Medicare tax you have to pay depends on your income. Currently, the Medicare tax rate is 1.45% of your total wages, and your employer is required to match that amount. If you are self-employed, you are responsible for paying both the employee and employer portions of the Medicare tax, which is currently 2.9%.

However, if you earn more than $200,000 as an individual or $250,000 as a married couple filing jointly, you will be subject to an additional 0.9% Medicare tax. This is known as the Additional Medicare Tax, and it is designed to help fund the Affordable Care Act.

Can I get a refund on my Medicare tax?

No, you cannot get a refund on the Medicare tax that is deducted from your paycheck. Unlike federal income tax, which you may be able to get a refund on if you overpay, the Medicare tax is a payroll tax that is used to fund the Medicare program. Once the money is taken out of your paycheck, it is sent to the government to help pay for healthcare benefits for eligible Americans.

Who is eligible for Medicare?

Medicare is a federal health insurance program that provides coverage to Americans who are 65 years of age or older, as well as people with certain disabilities. To be eligible for Medicare, you must be a U.S. citizen or permanent legal resident who has lived in the United States for at least five years.

There are four parts to Medicare: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Each part of Medicare covers different healthcare services, and you may be eligible for some or all of them depending on your circumstances.

What happens if I don’t pay my Medicare tax?

If you don’t pay your Medicare tax, you may face penalties and interest charges from the government. Your employer is required by law to withhold Medicare tax from your paycheck, and if they fail to do so, they may face fines and legal action.

If you are self-employed and you fail to pay the Medicare tax, you may be subject to an IRS audit and could face additional penalties and interest charges. It is important to pay your Medicare tax on time to avoid any legal or financial consequences.

All you NEED to Know About your Paycheck Deductions in 4 Minutes

In conclusion, understanding Medicare tax is an essential part of managing your finances. By paying this tax, you are contributing to a system that provides healthcare benefits to millions of Americans. It’s important to note that Medicare tax is only one of several taxes that may be deducted from your paycheck, including Social Security tax and federal income tax.

While it may seem like a burden to have a portion of your paycheck go towards taxes, it’s important to remember the benefits that come with paying into Medicare. It provides peace of mind knowing that you and your loved ones have access to healthcare services when needed. Additionally, it’s important to review your paycheck regularly and ensure that the correct amount of Medicare tax is being deducted.

Lastly, if you have any questions or concerns about Medicare tax or any other taxes on your paycheck, seek guidance from a financial advisor or tax professional. They can provide valuable insight and help you navigate the complex world of taxes. In the end, understanding Medicare tax is just one small step in taking control of your financial future.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts