Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage for people who are 65 years and older or for those who have certain disabilities. One common question among Medicare beneficiaries is whether the program covers their primary insurance deductible. In this article, we will explore the answer to this question and provide some clarity on what Medicare does and does not cover when it comes to primary insurance deductibles.

Understanding the ins and outs of Medicare coverage can be overwhelming, especially when it comes to deductibles and out-of-pocket costs. If you’re curious about whether Medicare pays for your primary insurance deductible, you’re not alone. But don’t worry, we’ve got you covered. In the following paragraphs, we’ll break down the basics of Medicare coverage and help you navigate the confusing world of healthcare expenses.

Medicare does not cover the primary insurance deductible. However, if you have secondary insurance, it may cover some or all of the primary insurance deductible. It’s essential to understand your insurance coverage and how it works with Medicare to avoid unexpected expenses.

Does Medicare Pay Primary Insurance Deductible?

If you are a Medicare beneficiary, you may have been wondering whether Medicare pays your primary insurance deductible. The answer is not straightforward, as it depends on several factors. In this article, we will explore Medicare’s policy regarding primary insurance deductibles and help you understand how it may impact your healthcare expenses.

Understanding Primary Insurance Deductible

First, let’s define what a primary insurance deductible is. Your primary insurance is the insurance that pays first for your medical expenses. A deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. Once you reach your deductible, your insurance will start covering your medical expenses, subject to any copayments or coinsurance that may apply.

What is Medicare?

Medicare is a federal health insurance program for people aged 65 and older, people with certain disabilities, and people with end-stage renal disease. Medicare has different parts that cover various healthcare services, including hospital stays, doctor visits, prescription drugs, and more.

Does Medicare Cover Primary Insurance Deductible?

Medicare does not typically pay for primary insurance deductibles. If you have other insurance, such as employer-sponsored insurance or a private health insurance plan, you will need to pay your deductible out of pocket before your insurance coverage kicks in.

However, there are some exceptions to this rule. If you have Medicare and Medicaid, also known as dual eligibility, Medicaid may pay your primary insurance deductible. Additionally, if you have a Medicare Advantage plan, your plan may offer coverage for your primary insurance deductible. It’s important to check with your plan to understand what benefits are included.

Benefits of Having Medicare and Other Insurance

Having both Medicare and other insurance can provide you with additional healthcare coverage and potentially lower your out-of-pocket costs. For example, if you have employer-sponsored insurance, your employer may cover some of your healthcare expenses that Medicare does not cover. Additionally, if you have a Medicare Advantage plan, your plan may offer additional benefits, such as dental, vision, or hearing coverage.

Medicare vs. Other Insurance

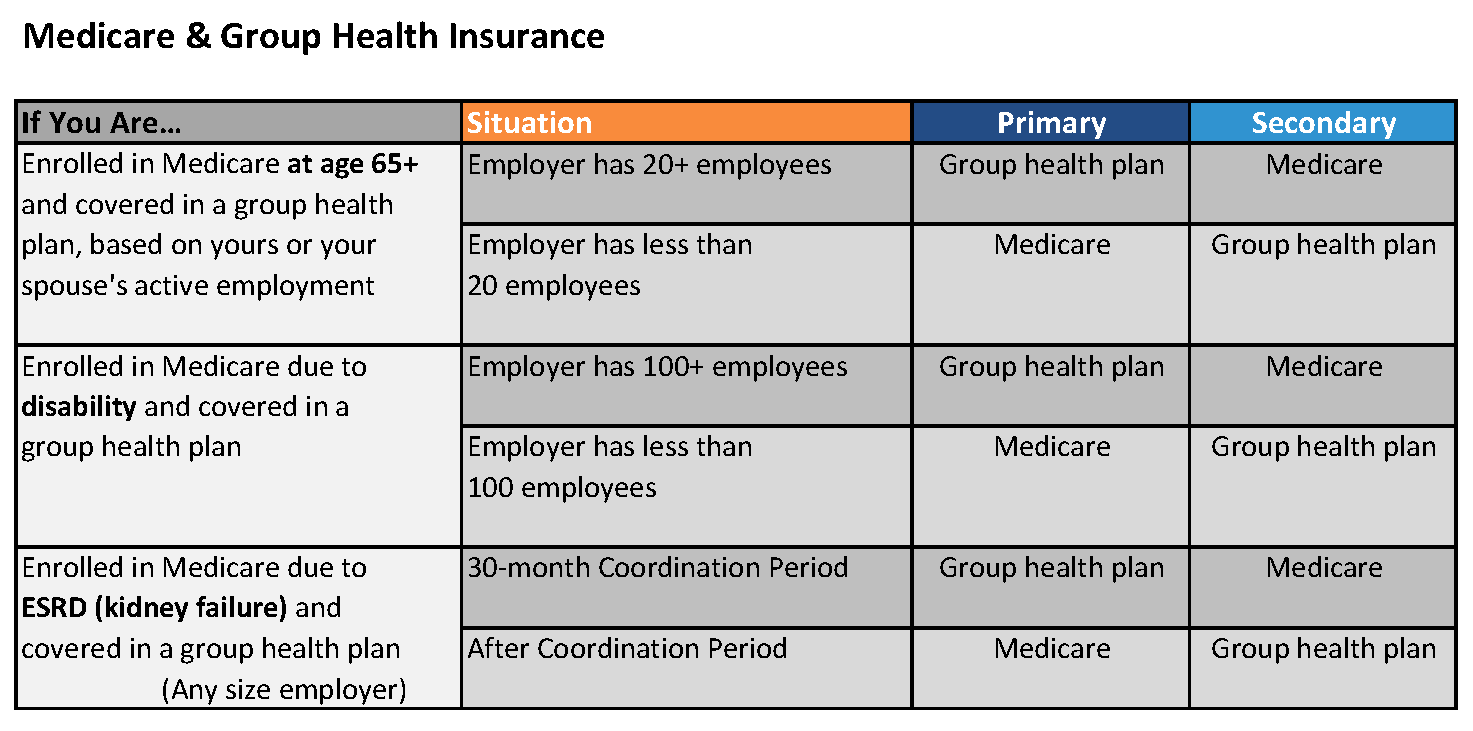

When you have both Medicare and other insurance, your primary insurance will pay first, and Medicare will pay second. This means that your out-of-pocket costs may be lower than if you only had one type of insurance. However, you will need to follow the rules of both insurance plans to make sure you are receiving the maximum benefits available.

How to Manage Your Healthcare Expenses

To manage your healthcare expenses effectively, it’s important to understand your insurance coverage and any deductibles, copayments, or coinsurance that may apply. You should also keep track of your medical expenses and any statements you receive from your insurance providers. If you have questions about your coverage or expenses, don’t hesitate to reach out to your insurance providers for clarification.

Conclusion

In conclusion, Medicare does not typically pay for primary insurance deductibles. If you have other insurance, you will need to pay your deductible out of pocket before your insurance coverage kicks in. However, if you have Medicare and Medicaid or a Medicare Advantage plan, you may be eligible for additional benefits that could help lower your healthcare expenses. Understanding your insurance coverage and managing your healthcare expenses can help you make informed decisions about your healthcare.

Contents

Frequently Asked Questions

Does Medicare pay primary insurance deductible?

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. It is always considered as the secondary payer, which means that it will only pay for healthcare services that are not covered by your primary insurance. Therefore, Medicare does not pay for your primary insurance deductible.

However, if you have a Medicare Supplement Insurance (Medigap) policy, it may cover some or all of your primary insurance deductible. Medigap policies are sold by private insurance companies to help pay for some of the healthcare costs that Medicare doesn’t cover, such as copayments, coinsurance, and deductibles. So, if you have a Medigap policy, you may be able to get some help with your primary insurance deductible.

What is primary insurance deductible?

Primary insurance deductible is the amount of money you have to pay out of your own pocket before your insurance company starts paying for your healthcare services. It is usually an annual amount and varies depending on your insurance plan. For example, if your primary insurance deductible is $1,000, you have to pay the first $1,000 of your healthcare costs before your insurance company pays anything.

It is important to note that your primary insurance deductible is separate from your Medicare deductible. Medicare deductible is the amount of money you have to pay out of your own pocket before Medicare starts paying for your healthcare services. It is also an annual amount and varies depending on the type of Medicare plan you have.

What is a Medigap policy?

A Medigap policy is a type of health insurance that is sold by private insurance companies to help pay for some of the healthcare costs that Medicare doesn’t cover, such as copayments, coinsurance, and deductibles. Medigap policies are also known as Medicare Supplement Insurance.

There are 10 standardized Medigap plans available in most states, labeled A, B, C, D, F, G, K, L, M, and N. Each plan offers a different set of benefits, but all plans with the same letter provide the same benefits. For example, Plan F offers the most comprehensive coverage, while Plan A offers the least coverage.

How do I know if I need a Medigap policy?

If you have Original Medicare (Part A and Part B) and want to limit your out-of-pocket costs, you may want to consider buying a Medigap policy. Medigap policies can help pay for some of the healthcare costs that Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

It is important to note that if you have a Medicare Advantage plan, you cannot buy a Medigap policy. Medicare Advantage plans are an alternative to Original Medicare and often have different rules, costs, and restrictions. If you have a Medicare Advantage plan, your healthcare costs are covered by the plan, not by Medicare and a Medigap policy.

How do I buy a Medigap policy?

To buy a Medigap policy, you must be enrolled in Medicare Part A and Part B. You can buy a Medigap policy from any insurance company that is licensed in your state to sell one. It is important to compare the benefits, costs, and restrictions of different Medigap policies before you buy one.

It is also important to note that insurance companies can charge different prices for the same Medigap policy. The cost of a Medigap policy may depend on your age, gender, location, and health status. You may be able to save money by buying a Medigap policy during your Medigap Open Enrollment Period, which lasts for six months and starts the month you turn 65 and enroll in Medicare Part B.

Will My Secondary Insurance Pay for my Medicare Deductible and/or 20% Coinsurance?

In conclusion, Medicare does not cover primary insurance deductibles. This means that beneficiaries are responsible for paying their own deductibles before Medicare begins to cover their medical expenses. However, Medicare does cover a wide range of medical services and treatments, which can help to reduce overall healthcare costs for seniors and those with disabilities.

It’s important for beneficiaries to understand their Medicare coverage and any out-of-pocket expenses they may be responsible for, including primary insurance deductibles. This can help them to plan for healthcare costs and make informed decisions about their medical care.

In summary, while Medicare does not cover primary insurance deductibles, it remains an essential resource for millions of Americans who rely on the program to access necessary medical care. By understanding their coverage and costs, beneficiaries can make the most of their Medicare benefits and ensure they receive the care they need to stay healthy and well.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts