Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a vital healthcare program for millions of Americans. It provides access to affordable medical care and helps to cover the costs of necessary treatments. However, some beneficiaries may be wondering if they can drop Medicare Part B, one of the program’s four parts.

If you’re considering dropping Medicare Part B, it’s important to understand the potential consequences and what other options may be available to you. In this article, we’ll explore the reasons why someone might choose to drop Part B, the rules and restrictions around doing so, and some alternative healthcare coverage options you may want to consider.

Can You Drop Medicare Part B?

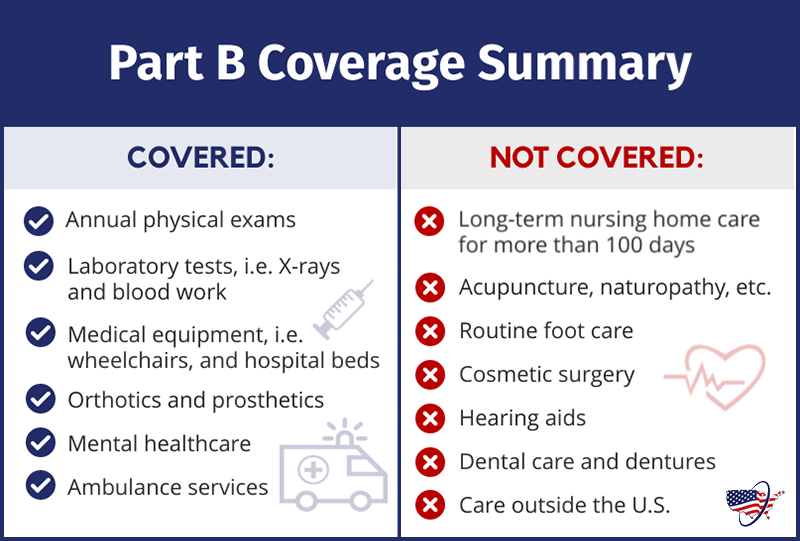

If you have Medicare, you might be wondering if it’s possible to drop Medicare Part B. Medicare Part B covers doctor visits, outpatient care, and preventive services, and it’s an important part of many people’s healthcare coverage. However, there are some circumstances where you might want to consider dropping Part B. Here’s what you need to know.

Reasons You Might Consider Dropping Medicare Part B

There are a few situations where you might want to drop Medicare Part B. One reason is if you’re still working and have coverage through your employer. If your employer has 20 or more employees, their coverage is considered primary and Medicare is secondary. In this case, you may not need Medicare Part B and can drop it to avoid paying the monthly premium.

Another reason you might consider dropping Part B is if you’re enrolled in a Medicare Advantage plan that includes all the benefits of Part A and Part B. These plans, also known as Medicare Part C, are offered by private insurance companies and can sometimes provide more comprehensive coverage at a lower cost than traditional Medicare.

Benefits of Dropping Medicare Part B

The main benefit of dropping Medicare Part B is that you’ll save money on premiums. In 2021, the standard monthly premium for Part B is $148.50, which can add up over time. If you don’t need the coverage, dropping Part B can be a smart financial decision.

Disadvantages of Dropping Medicare Part B

While there are some benefits to dropping Medicare Part B, there are also some disadvantages to consider. If you drop Part B, you’ll lose coverage for doctor visits, outpatient care, and preventive services. If you need these services in the future, you’ll have to pay for them out of pocket. Additionally, if you decide to re-enroll in Part B later, you may have to pay a late enrollment penalty.

How to Drop Medicare Part B

If you’ve decided that dropping Medicare Part B is the right choice for you, there are a few steps you’ll need to take. First, you’ll need to contact Social Security to let them know that you want to drop Part B. You can do this online, by phone, or in person at your local Social Security office.

It’s important to note that you can only drop Medicare Part B during certain times of the year. The general enrollment period runs from January 1 to March 31 each year, and the annual coordinated election period runs from October 15 to December 7. You may also be able to drop Part B outside of these periods if you have a qualifying event, such as losing your job-based coverage.

Steps to Take Before Dropping Medicare Part B

Before you make the decision to drop Medicare Part B, it’s important to carefully consider your healthcare needs and coverage options. Talk to your employer or insurance provider to understand your options for coverage. You may also want to speak with a licensed insurance agent to help you make the best decision for your situation.

Conclusion

Dropping Medicare Part B is possible in certain situations, but it’s important to carefully consider the benefits and disadvantages before making a decision. If you’re still working and have coverage through your employer, or if you’re enrolled in a Medicare Advantage plan that includes all the benefits of Part B, dropping Part B may be a smart financial decision. However, if you need coverage for doctor visits, outpatient care, and preventive services, it’s important to keep Part B to avoid paying for these services out of pocket.

Contents

Frequently Asked Questions

Can you drop Medicare Part B?

Yes, you can drop Medicare Part B. However, it’s important to understand the implications of doing so. Medicare Part B covers outpatient services such as doctor visits, lab tests, and medical equipment. If you drop Part B, you will no longer have coverage for these services.

It’s also important to note that if you drop Part B, you may face penalties if you decide to enroll again in the future. The penalty is a 10% increase in your monthly premium for each year you were eligible for Part B but didn’t enroll. So, if you waited three years to enroll, you would pay a 30% penalty on top of your regular monthly premium.

When can you drop Medicare Part B?

You can drop Medicare Part B during certain enrollment periods. The most common enrollment period is the annual open enrollment period, which runs from October 15th to December 7th each year. During this time, you can make changes to your Medicare coverage, including dropping Part B.

You can also drop Part B during the Medicare Advantage open enrollment period, which runs from January 1st to March 31st each year. If you have a Medicare Advantage plan, you can switch to a different plan or drop Part B and return to original Medicare.

How do you drop Medicare Part B?

To drop Medicare Part B, you need to contact the Social Security Administration. You can do this by calling their toll-free number or visiting your local Social Security office. You will need to fill out a request form and provide a written explanation of why you want to drop Part B.

It’s important to note that if you drop Part B, you may need to show proof of other health insurance coverage, such as through an employer or spouse, to avoid penalties.

What happens if you drop Medicare Part B?

If you drop Medicare Part B, you will no longer have coverage for outpatient services such as doctor visits, lab tests, and medical equipment. You may also face penalties if you decide to enroll again in the future.

It’s important to carefully consider your decision to drop Part B and explore all of your coverage options. You may be able to enroll in a Medicare Advantage plan or a supplemental insurance plan to help cover some of the costs that would have been covered by Part B.

Can you drop Medicare Part B and keep Part A?

Yes, you can drop Medicare Part B and keep Part A. Medicare Part A covers inpatient hospital services and is typically free for most people. If you drop Part B, you will still have coverage for hospital services but will no longer have coverage for outpatient services.

Medicare Part B Premium DROPPED in 2023! But THIS Will COST You More 😱

In conclusion, dropping Medicare Part B can be a complicated decision that requires careful consideration of various factors. While it may seem like a way to save money on premiums, it could also lead to significant out-of-pocket expenses in the long run. It is crucial to assess your healthcare needs, current coverage, and financial situation before making any decisions.

Furthermore, it is essential to understand that dropping Medicare Part B may come with consequences, such as late enrollment penalties and limited access to certain healthcare services. Therefore, it is advisable to consult with a trusted healthcare professional or a Medicare expert to help you make an informed decision.

Ultimately, the decision to drop Medicare Part B is a personal one that depends on individual circumstances. It is essential to weigh the pros and cons carefully and make a decision that aligns with your healthcare needs and financial goals. With the right information and guidance, you can make the best decision for your healthcare coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts