Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, our healthcare needs tend to increase, and Medicare becomes an essential part of our healthcare journey. However, navigating the Medicare system can be daunting, especially when it comes to filing a claim. In this step-by-step guide, we will walk you through the process of filing a claim with Medicare, making it easier for you to access the healthcare services you need.

Whether you are filing a claim for the first time or have filed one before, this guide will provide you with useful information on the documentation you need, the different types of claims, and the steps you need to take to ensure that your claim is processed efficiently. So, let’s get started on understanding how to file a claim with Medicare.

- Collect all the necessary documents, including your Medicare card and the itemized bill from your healthcare provider.

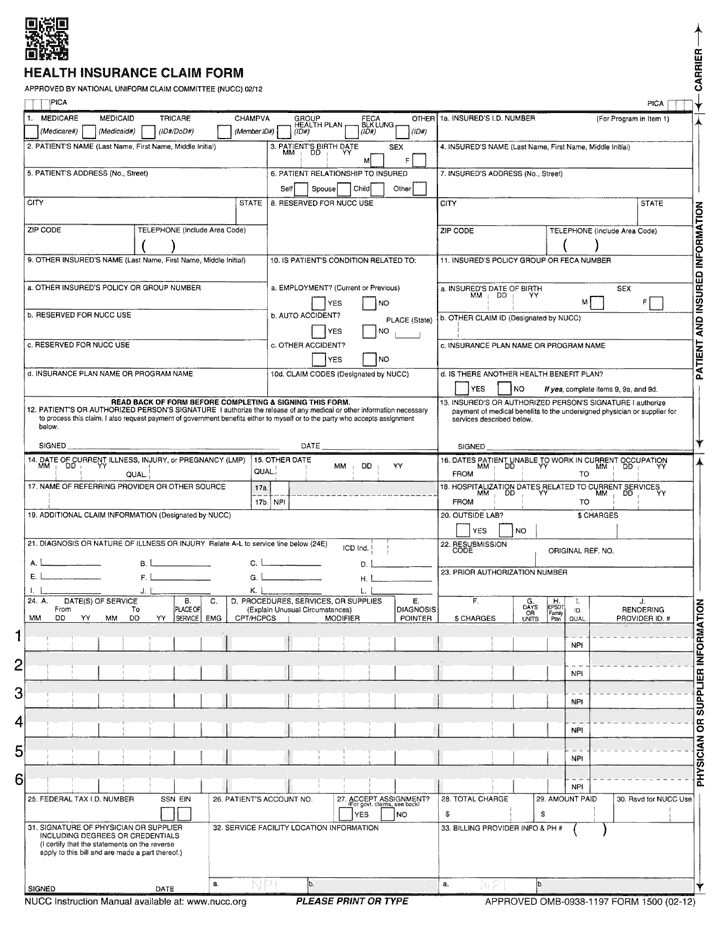

- Fill out a Medicare claim form, also known as Form CMS-1490S.

- Include the itemized bill and any supporting documentation with your claim form.

- Submit your claim form and supporting documents to Medicare by mail or electronically.

- Wait for Medicare to process your claim and notify you of the decision.

How to File a Claim With Medicare?

Filing a claim with Medicare can be a daunting task, especially if you are new to the program. However, it is essential to file your claim correctly to receive the benefits that you are entitled to. In this article, we will discuss how to file a claim with Medicare and provide you with helpful tips to ensure a smooth process.

Step 1: Understand Your Medicare Coverage

Before filing a claim with Medicare, it is crucial to understand your coverage. Medicare has several parts, including Part A, Part B, Part C, and Part D. Each part covers different services, and you may have different deductibles, copayments, and coinsurance for each part. You can review your Medicare coverage online or by calling Medicare.

Once you understand your coverage, you can determine which services are covered and which are not. If you receive a service that is not covered, you will be responsible for paying the full cost.

Benefits of Understanding Your Medicare Coverage

- Know which services are covered by Medicare

- Understand your deductibles, copayments, and coinsurance

- Avoid unexpected costs

- Make informed healthcare decisions

Medicare Coverage Vs. Private Insurance

| Medicare | Private Insurance |

|---|---|

| Covers most medical services | Covers specific services based on the plan |

| Has set deductibles, copayments, and coinsurance | Deductibles, copayments, and coinsurance vary by plan |

| No network restrictions | May have network restrictions |

Step 2: Obtain the Necessary Documents

To file a claim with Medicare, you will need to have the necessary documents. These documents include your Medicare card, a copy of the itemized bill from your healthcare provider, and any other relevant documents, such as an Explanation of Benefits (EOB) from your private insurance.

It is crucial to ensure that all the information on the documents is correct and matches your Medicare card. Any discrepancies can delay the processing of your claim.

Benefits of Obtaining the Necessary Documents

- Ensure that all information is correct

- Speed up the processing of your claim

- Provide proof of services received

- Help you keep track of your healthcare expenses

Medicare Claim Filing Deadline

It is essential to file your claim with Medicare within one year of receiving the service. If you do not file your claim within one year, Medicare may deny your claim.

Step 3: File Your Claim

After you have obtained the necessary documents and ensured that all the information is correct, you can file your claim with Medicare. You can file your claim online, by mail, or by calling Medicare.

When filing your claim, you will need to provide the following information:

- Your name and Medicare number

- The date you received the service

- The name and address of your healthcare provider

- The service provided

- The amount charged for the service

It is crucial to ensure that all the information is accurate and complete. Any errors can delay the processing of your claim.

Benefits of Filing Your Claim with Medicare

- Receive reimbursement for covered services

- Keep track of your healthcare expenses

- Appeal denied claims if necessary

- Ensure that your healthcare providers are paid correctly

Medicare Claim Denial

If Medicare denies your claim, you have the right to appeal the decision. You can request a redetermination, a reconsideration, and a hearing if necessary.

Step 4: Follow Up on Your Claim

After filing your claim with Medicare, it is essential to follow up on the status of your claim. You can check the status of your claim online or by calling Medicare.

If your claim is denied, you can appeal the decision. If your claim is approved, you will receive reimbursement for the covered services.

Benefits of Following Up on Your Claim

- Ensure that your claim is processed correctly

- Identify any errors or discrepancies

- Appeal denied claims if necessary

- Receive reimbursement for covered services

Medicare Claim Reimbursement

If your claim is approved, Medicare will reimburse you for the covered services. The reimbursement amount will depend on your coverage and any deductibles, copayments, and coinsurance that apply.

In conclusion, filing a claim with Medicare can seem overwhelming at first, but with the right information and documents, it can be a straightforward process. Understanding your Medicare coverage, obtaining the necessary documents, filing your claim accurately, and following up on your claim can ensure that you receive the benefits that you are entitled to.

Contents

Frequently Asked Questions

Medicare is a government-funded health insurance program in the United States for people aged 65 and older, as well as certain younger people with disabilities and those with End-Stage Renal Disease. If you need to file a claim with Medicare, here are some common questions and answers to help guide you through the process.

1. How do I file a claim with Medicare?

First, you need to make sure you have Original Medicare, which consists of Part A (hospital insurance) and Part B (medical insurance). Once you receive medical services or supplies, your healthcare provider or supplier should submit a claim to Medicare on your behalf. If they don’t, you can submit a claim yourself by completing a Patient Request for Medical Payment form (CMS-1490S).

Include all necessary information, such as your Medicare number, the date of service, and the total amount charged. Submit the form and any supporting documents to the Medicare Administrative Contractor (MAC) in your state. You can find your MAC’s contact information on the Medicare website.

2. When should I file a claim with Medicare?

You should file a claim with Medicare as soon as possible after receiving medical services or supplies. Medicare has strict deadlines for filing claims, and if you miss these deadlines, you may be responsible for paying the full cost of the services or supplies. In general, you should file a claim within one calendar year from the date of service.

However, if you’re filing a claim for durable medical equipment (DME), such as a wheelchair or oxygen equipment, you must file the claim within 15 months from the date of service. It’s important to keep track of your medical bills and receipts so you can file a claim in a timely manner.

3. What should I do if my claim is denied by Medicare?

If your claim is denied by Medicare, you have the right to appeal the decision. The first step is to request a redetermination from the MAC that denied your claim. You must do this within 120 days of receiving the denial notice. Include any additional documentation or information that supports your claim.

If the redetermination is still unfavorable, you can request a hearing by an administrative law judge. If the judge upholds the denial, you can appeal to the Medicare Appeals Council and then to federal court if necessary.

4. Can I file a claim with Medicare if I have other insurance?

Yes, you can file a claim with Medicare even if you have other insurance, such as a private insurance plan or Medicaid. Medicare is considered the primary payer, which means it pays first for your medical services or supplies. Your other insurance may pay some or all of the remaining costs.

You should still submit a claim to Medicare, and include information about your other insurance. Medicare will then send the claim to your other insurance for payment. If your other insurance pays more than Medicare would have paid, you may receive a refund from Medicare.

5. How long does it take to receive payment from Medicare?

It can take several weeks or even months to receive payment from Medicare. The processing time depends on the complexity of your claim and whether additional information or documentation is needed. If your claim is processed electronically, you may receive payment more quickly.

You can check the status of your claim on the Medicare website or by calling Medicare’s customer service line. If you haven’t received payment within 30 days of submitting your claim, contact your MAC to inquire about the status.

How to file a Medicare claim

In conclusion, filing a claim with Medicare can be a daunting task, but it is important to understand the process to ensure you receive the healthcare benefits you deserve. The first step is to gather all necessary information before submitting your claim. This includes your Medicare number, the date of service, and the cost of the medical service or item.

Secondly, it is crucial to follow the specific instructions for submitting your claim, whether it be through mail, online, or over the phone. Make sure to double-check all information before submitting to avoid any errors or delays in processing.

Lastly, be patient throughout the process. Medicare claims can take up to 30 days to process, so it is important to remain calm and trust the system. If you have any questions or concerns, do not hesitate to reach out to Medicare for assistance.

Overall, filing a claim with Medicare may seem overwhelming, but by following these steps and remaining patient, you can ensure that you receive the healthcare benefits you are entitled to.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts